PDP-Compare Tutorial

This is archive material for research purposes. Please see

PDPFinder.com or

MAFinder.com for current plans.

This tutorial explains how to search and compare Medicare Part D plans using PDP-Compare.One-Click Comparison

PDP-Compare offers what we call a One-Click Comparison of Medicare Part D Plans. By simply selecting your state and clicking on the Search button, you can compare:- Plan Quality Ratings,

- Premium,

- Deductible,

- Type of Coverage during the Doughnut Hole,

- $0 Qualification for Low-Income Subsidy (LIS) Recipients

- Cost Sharing - Copayments, Coinsurance, and

- Popularity (Past Enrollment Figures)

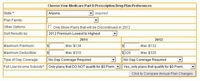

PDP-Compare Search Criteria

Each State offers 50 or more Medicare Part D plans. Sometimes it helps to reduce the number of plans that you want to compare. This section explains the search and sort options in PDP-Compare. The Search Criteria are divided into three areas:- Those applying to the plan independent of the plan year

- Criteria to be used against the 2007 plans

- Criteria to be used against the 2008 plans

Criteria that are used independent of the plan year include:

- State - this is a required field. You must select a state.

- Partial Plan Name - If you are only interested in certain plans, ex: AARP, enter the any part of the plan name in this field examples: AA or AARP, AR would not only include the AARP plans but would also include Aetna Medicare Rx plans and many others.

- Sort Results by - Premiums, Plan name, Plan rating, Popularity (Enrollment)

Criteria that apply to a particular plan year must be entered in the appropriate column for the year (2007 or 2008) the search criteria include:

- Maximum Premium - Which plans under $20 in 2007 are still under $20 in 2008? - enter 20 in the 2007 column and 20 in the 2008 column (Answer: in Arizona, only 4 of the 6 plans under $20 in 2007 are still under $20 in 2008

- Maximum Deductible - is used just as maximum premium is above.

- Type of Gap Coverage - 2007 offered different levels of coverage in the Coverage Gap (Doughnut Hole) than 2008 select an option in the appropriate column 2007 or 2008.

- Full Low-Income Subsidy? - Choose one of the three options: Yes, show only plans that qualify, No, I receive no or only partial extra help, or Only show Plans that DO NOT qualify for $0 Premium. This option is used if you would like to see only plans which changed their qualification status. Example: select Yes... in the 2007 column and Only show Plans that DO NOT qualify ... in the 2008 column. You will see that in Arizona, 3 plans no longer qualify for the LIS $0 Premium status. Switch the 2007 and 2008 criteria to see that one plan qualifies in 2008 that did not qualify in 2007.

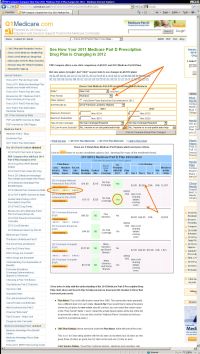

Example 1: Changes in Current Plan

In this example our New York beneficiary wants to see what changes they can expect in their current plan. We have selected New York as our state. Note that State is the only field that must be entered prior to a search. Since the beneficiary is only interested in Humana Plans, we can narrow down the comparison by entering Humana or even Hum in the Partial Plan Name field. We have left the Full Low-Income Subsidy (LIS) field set to No... so that we will see plans which qualify and also those that do not qualify. Then click on SearchThe comparison of the three Humana plans (Standard, Enhanced, and Complete) is shown and is shown for both 2007 and 2008. Our beneficiary can quickly see that the 2007 Humana Standard plan which qualified for the LIS $0 premium last year no longer qualifies in 2008. They can also see that the 2008 Enhanced plan is less expensive than its 2007 counterpart. Also, they can see that in 2007, 110,347 people enrolled in the Standard plan in New York and only 20,931 enrolled in the Enhanced plan. Note that the CMS Quality Ratings are the same for all three plans. The CMS Ratings are reported by company, not plan.

Example 2: 2007 Plan no longer offered in 2008

This California beneficiary wants to see the changes in their Sierra Plus plan. They enter California in the State field (which is a required field) and since they only want to see Sierra plans, they enter Sierra in the Partial Plan Name field. They can leave the rest of the search fields empty and then click on Search.The comparison of the three Sierra plans is shown for both 2007 and 2008. Our beneficiary can quickly see that the 2007 SierraRx plan and SierraRx Basic plan have not changed drastically for 2008. The SierraRx Plus plan from 2007 which had All Formulary Drugs covered, is no longer offered in 2008. Members of this plan will be automatically enrolled in a different Sierra plan unless they choose a new plan for themselves.

Our California beneficiary can see the CMS Quality Rating for the Sierra along with plan features and cost sharing information. Also, they can see that in 2007, 144,443 people across the country enrolled in the SierraRx plan in 2007 with 111,549 people California.

Example 3: Change in Plan Coverage from 2007 to 2008

In this example our New York beneficiary wants to see what changes they can expect in their current plan. We have selected New York as our state. Note that State is the only field that must be entered prior to a search. Since the beneficiary is only interested in UnitedHealth Rx Plans, we can narrow down the comparison by entering United in the Partial Plan Name field. We have left all other criterien fields empty. Then click on SearchThe comparison of the two UnitedHealth Rx plans is shown for both 2007 and 2008. Our beneficiary can see that the 2007 UnitedHealth Rx Extended plan is now the UnitedHealth Value plan in 2008. They can see that if the stay with their plan for 2008, they will now have a $275 deductible (in 2007 the Extended plan had a $0 deductible). and their premium will be reduced. The UnitedHealth Rx CMS Ratings are shown. Also shown is the Plan ID (a code that uniquely identifies the plan) and the 2007 enrollment figures for each plan.

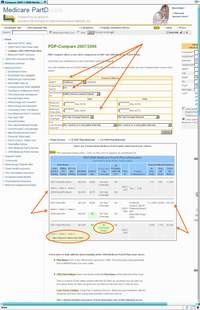

Example 4: Advanced Search - Comparing Plans from Different Companies.

Our Arizona beneficiary wants to find a medium priced Medicare Part D plan and wishes to compare plans across different companies. Since there are 58 plans in Arizona, this comparison list could be a bit cumbersome. Our beneficiary does not want to spend more than $28 per month and does not want to pay a deductible.This type of search is done by first selecting the State Arizona, and then entering our value 28 in the Maximum Premium field in the 2008 column and 0 in the Maximum Deductible field in the 2008 column. Since we and a medium priced plan and have entered our max, lets let the low priced plan fall to the bottom of the list by selecting 2008 Premium Highest to Lowest in the Sort Results by field. Then click on Search

Our comparison is reduced to only 9 plans rather than 58.

We can quickly compare the CMS Quality Rating, Premiums, Copays and Coinsurance, and even Plan Popularity across these plans. We can even see the individual plan changes from 2007 to 2008.

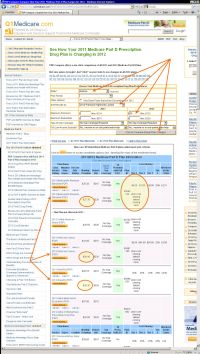

Example 5: Advanced Search - Premium increases in California

In this example our California beneficiary wants to see the changes in the most inexpensive Medicare Part D plans. We enter California in the State field, 10 in the 2007 Maximum Premium field, 265 in the 2007 Maximum Deductible field (or leave it blank since 265 is the 2007 maximum deductible. We entered 28 in the 2008 Maximum Premium field, 275 in the 2008Maximum Deductible field (or leave it blank since 275 is the 2008 maximum deductible. We changed the Sort Results by field to 2008 Premium Highest to Lowest.Our comparison show two plans that meet our search criteria. The AARP plan increased $11.20 and no longer qualifies for the LIS $0 premium. The WellCare plan increased $9.30, still qualifies for the LIS $0 premium and for non-LIS recipients, the Deductible was decreased $15. The copayments/coinsurance for both plans can quickly be compared to determine which plan best matches the prescription purchase patterns for the beneficiary.

Chart Key: What do all of the Chart Fields Mean?

Below is a key or legend for the PDP-Compare Comparison Chart. The same key is shown just after the PDP-Compare Chart once you click on the Search button.

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service