I enrolled last month and I have not received my membership card. How can I get my card?

First, you can contact your chosen Medicare plan's Member Services department and check that your address was entered correctly and that your Member ID card (and plan information) was sent. While you have Member Services on the phone, verify the effective date of your coverage (just to make sure there is no misunderstanding). Ask Member Services for your membership numbers including your Member ID number, Group number, BIN and PCN.

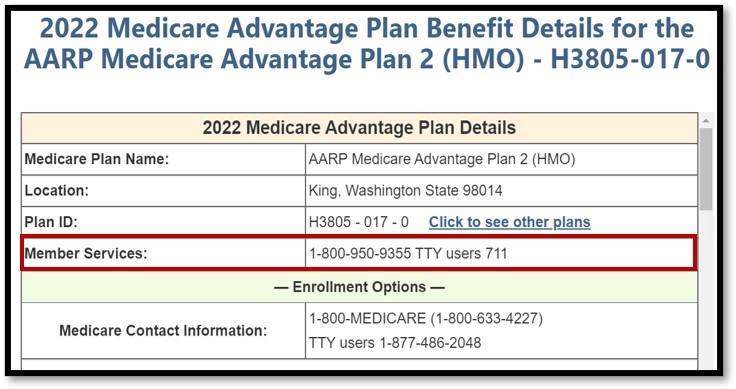

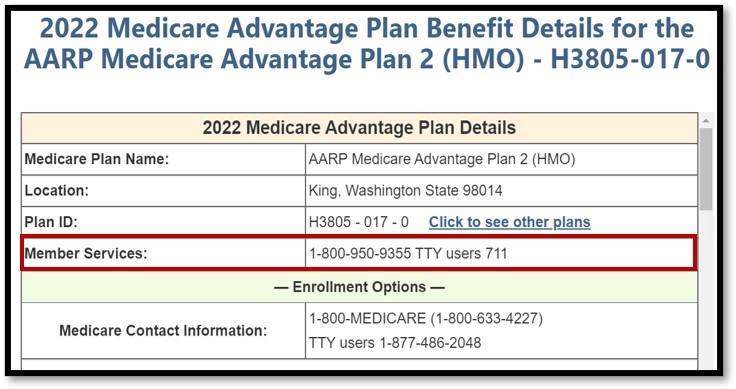

If you cannot find the telephone number for your Medicare plan, we have most Medicare plan Member Services numbers available through our PDP-Finder.com/FL and MA-Finder.com/15202 tools. You can just look up your Medicare plan name, click on the plan name or the "Benefits and Contact Info" button to see the Member or Customer Services number for your plan.

You can also telephone Medicare at 1-800-633-4227 (1-800-MEDICARE) and ask a Medicare representative how you can contact your Medicare plan (and you can ask the Medicare representative to verify your enrollment and effective date).

Once you confirm your plan enrollment and are sure that your coverage is active, you can work with your local pharmacy to obtain your prescriptions while you are waiting for your Medicare plan Member ID card to arrive.

If you did not already get your membership numbers, your local pharmacy can telephone your Medicare plan to get the numbers necessary to process your prescription:

As another option, if your enrollment in the Medicare Part D plan is verified and your coverage is effective, you can purchase your formulary medications at full-pharmacy pricing and then contact your plan's Member Services department regarding the reimbursement procedure. Please make sure you save your receipts and have patience. Reimbursement can take some time.

If you cannot find the telephone number for your Medicare plan, we have most Medicare plan Member Services numbers available through our PDP-Finder.com/FL and MA-Finder.com/15202 tools. You can just look up your Medicare plan name, click on the plan name or the "Benefits and Contact Info" button to see the Member or Customer Services number for your plan.

You can also telephone Medicare at 1-800-633-4227 (1-800-MEDICARE) and ask a Medicare representative how you can contact your Medicare plan (and you can ask the Medicare representative to verify your enrollment and effective date).

Once you confirm your plan enrollment and are sure that your coverage is active, you can work with your local pharmacy to obtain your prescriptions while you are waiting for your Medicare plan Member ID card to arrive.

If you did not already get your membership numbers, your local pharmacy can telephone your Medicare plan to get the numbers necessary to process your prescription:

- your Member ID number,

- your Group number,

- your BIN, and

- your PCN.

As another option, if your enrollment in the Medicare Part D plan is verified and your coverage is effective, you can purchase your formulary medications at full-pharmacy pricing and then contact your plan's Member Services department regarding the reimbursement procedure. Please make sure you save your receipts and have patience. Reimbursement can take some time.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service