Pre-2010 Medicare.gov - Tutorial - Compare Plans in Your List (Plan Details)

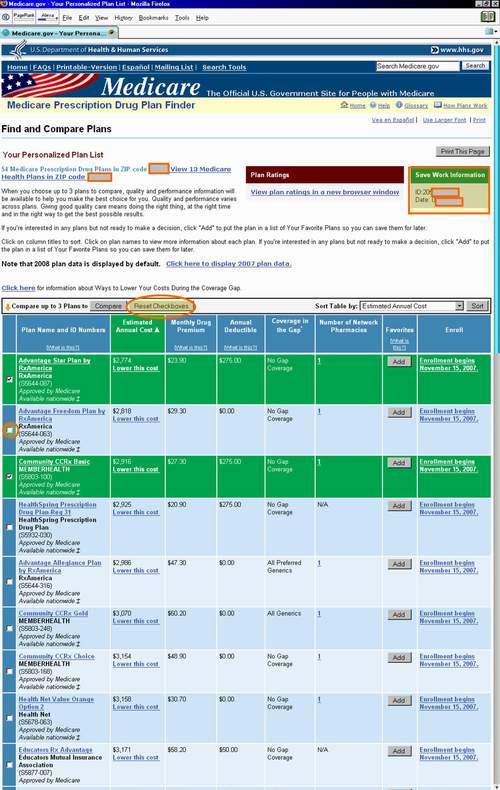

If you wish to compare one Medicare Part D plan to another, the Medicare.gov website allows you to select three Medicare Part D plans to analyze in more detail. "Check" three of the plans and then click on "Compare" and the site will lay the three plans side-by-side.

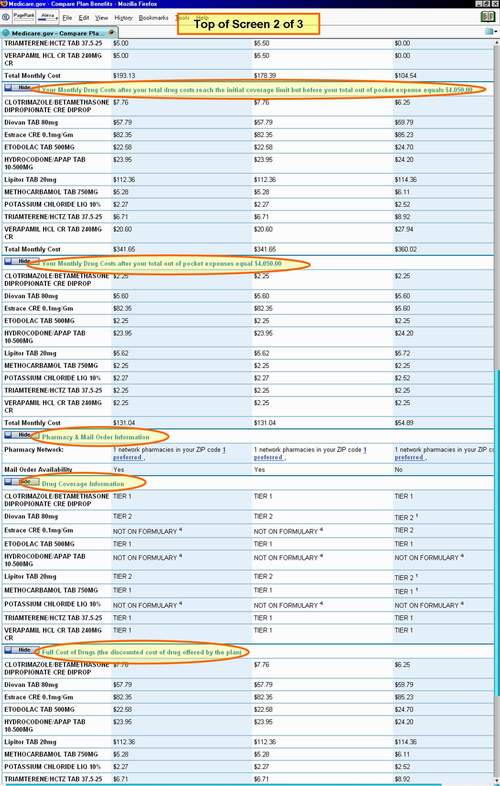

We have also found that at times, the prescription retail cost data is wrong!

In one example the drug ETODOLAC TAB 500MG was shown as having a retail cost of $22.58, $24.70 and for the third plan $77.34! When we went to the plan's website and checked the drug in their rx calculator, it showed a price of $27.35. This can greatly skew the accuracy of your plan comparison. So, if you see a retail cost that seems drastically inconsistent with the other plans, you may wish to save your drug list and try your comparison again in a few days or a week to compare the accuracy.

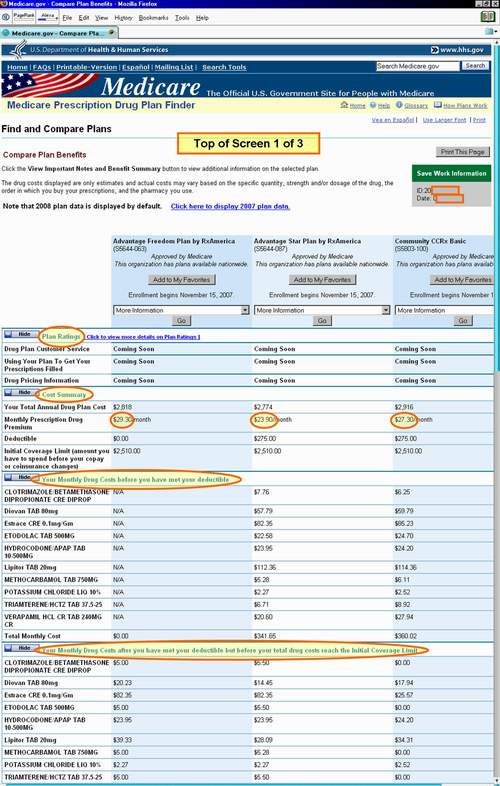

When we compare the three Part D plans, we see that the Medicare.gov site breaks the entire form into many sections (see graphic below):

"Plan Ratings"

One of interesting feature that Medicare.gov provides is a Plan Rating based on a number of factors. The ratings come from a sampling of experiences and, like any sample of events, these Medicare findings may or may not correspond with your own experiences.

"Cost Summary"

We consider the Total Annual Drug Plan Cost to be one of the most important factors that folks should consider when choosing a Medicare Part D plan. This figure is the total amount that you can be expected to pay for the whole year, including monthly premiums and deductibles.

"Your Monthly Drug Cost before you have met your deductible"

This first coverage area shows what will happen as you begin to use your plan in 2008. Note that the first plan does not have an initial deductible so this area does not apply and the fields are filed with "N/A" for Not Applicable.

One of the interesting things that people will note from the beginning is that the initial deductible for two of the plans is $275, but the total Monthly cost for this first coverage area is way over this amount. There are two reasons for this Total Cost figure that is over the initial deductible value: (1) there are some medications that are on the My Drug List that are not included in the Part D plan formularies — and since they are not in the formulary the cost is not included toward the initial deductibles or the Initial Coverage Limit (before the doughnut hole). (2) The Medicare.gov website is not programmed to break coverage periods within a month (This is a bug and may be fixed, however it was the same in 2007). In our Q1Medicare.com Doughnut Hole Calculator, we break the initial deductible into smaller portions and allow a person to go through multiple phases of coverage in a single month. In other words, in this example beneficiary would meet their initial deductible in about 25 days with the Community CCRx plan — well before the end of the first month $275/(Retail Drug Costs — Non-Formulary Drug Costs). If the RxAmerica plan is selected, the example beneficiary would spend $233.08 on covered drug in the first month and an additional $108.57 on non covered drugs, thus reaching the initial deductible $275 in the second month of coverage.

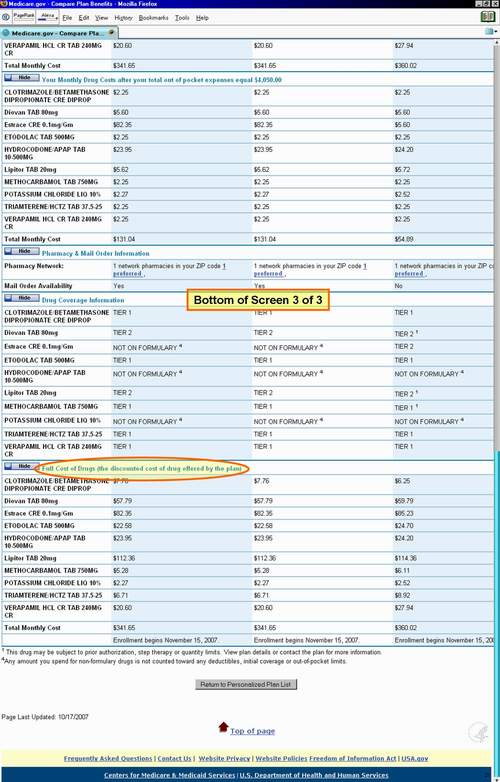

"Your Monthly Drug Cost after you have met your deductible but before your total drug costs reach the Initial Coverage Limit [beginning of the Doughnut Hole]"

The next coverage phase takes our example up to the Doughnut Hole. In 2008, the Doughnut Hole is reached when the total retail cost of covered prescription drugs reaches $2,510. This beneficiary should reach the doughnut hole in $2,510/$233.08 = 10.76 months or late November with the RxAmerica plans. This same beneficiary would reach the doughnut hole in 7.53 months or mid-August with Community CCRx plan (because more medications are included in the total covered retail costs). Our example beneficiary would not leave the doughnut hole or coverage gap in 2008 — no matter which of the three Part D plans would be chosen.

"Your Monthly Drug Costs after your total drug costs reach the initial coverage limit but before your total out of pocket expense equals $4,050.00" [What you pay in the Doughnut Hole or Coverage Gap]

This Part D coverage area shows the user what they will be paying in the Coverage Gap or Doughnut Hole. This is the full retail cost of the medications (less any discounts negotiated by your Part D provider). (See graphic below.)

Your Monthly Drug Costs after your total out of pocket expenses equal $4,050.00. [After your leave the Doughnut Hole and enter catastrophic portion of your Part D coverage].

When you reach the catastrophic portion of your Part D coverage, your covered prescription drug costs full dramatically. Please note that non-covered medications are still shown as retail cost because they are outside of the Part D plan. In order to exit the Doughnut Hole and enter the 2008 catastrophic portion of Medicare Part D coverage, the Medicare Part D beneficiary will have covered retail prescription costs of over $477 per month.

The next section shows the number of pharmacies located in your ZIP Code area and whether the Medicare Part D plan offers a mail order service.

Nearing the bottom of the page is the "Drug Coverage Information" which shows the medications from the My Drug List that are covered under the Part D plan formularies. Notice also that some medications are subject to usage management such as prior authorization, step therapy or quantity limits. (See graphic below.)

Finally, the last section on the page shows the "Full Cost of Drugs" or the Part D plan’s negotiated retail cost which is the same as the cost shown above in the Doughnut Hole coverage phase.

Check for Savings Using a Drug Discount Card

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service