Pre-2010 Medicare.gov - Find and Enter Your Drug Information

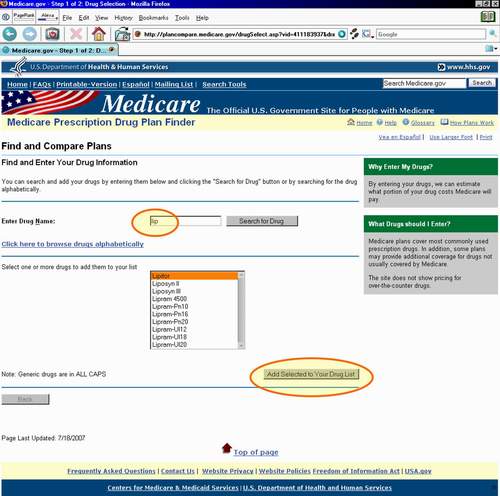

***Archive: Below is the Pre-2010 Medicare.gov Tutorial***The next Medicare.gov screen allows the user to enter their prescription medications — one at a time — and add them to their Drug List.

You may recall that, in general, Medicare Part D plans exclude certain medications. So if you are finding that one of your medications is never found in the medication database, it might not be covered by the Medicare Part D program. Alternatively, if you have been prescribed a very new medication that has just been released, it is possible that the medication database has not yet been updated and you should save your partial medication list and come back at another time and check again.

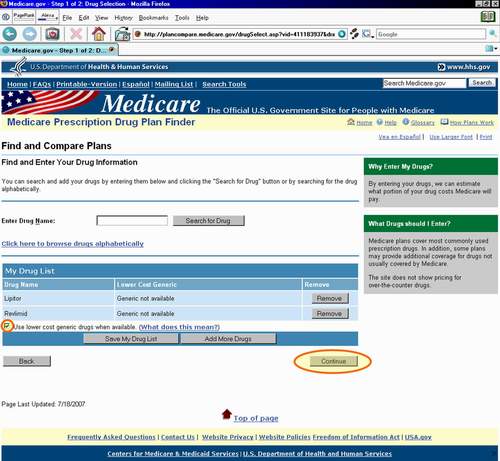

Now we see how "My Drug List" (graphic below) looks after adding two of our medications. We did not even have to choose the drug Revlimid from a list of similar drugs since the system found the only possible match and put it directly into list.

Find Your Prescription Discount

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service