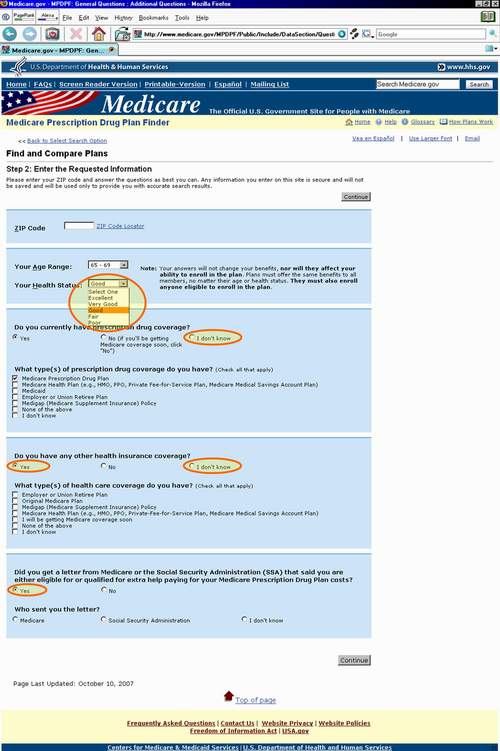

Pre-2010 Medicare.gov - Enter the Requested Information

Medicare would like some information about you to help with the Part D prescription drug plan process. The zip code that you enter and the questions regarding "extra help" will directly affect your plan search — see below. The other information is for Medicare’s benefit. Try to answer the questions accurately as it may provide CMS with some feedback on how they can improve their site and to also help guide you to the best Part D plan. When in doubt, choose "I don’t know."

These two questions are simple "yes/ no" questions when you first enter the screen. If you select "yes", the window will expand and you will be asked for more specific information. Depending on your answers, you will be shown some disclaimers regarding possible loss of coverage (as mentioned above).

Answer: If you did not enroll into a Medicare Part D plan during your initial eligibility and you did not have any other "creditable" prescription drug coverage, you may pay a higher monthly premium based on the number of months you were without prescription drug coverage. This penalty will be calculated by CMS and reported to your selected Part D plan and they will, in turn, contact you about the additional costs. In 2008, you will pay $0.28 or 1% more of $27.93 for each month you were without creditable prescription coverage. This value will change every year based on the average monthly Part D premium.

(See: What you pay for a Medicare Prescription Drug Plan in 2008 - Part D

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service