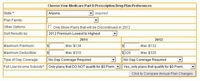

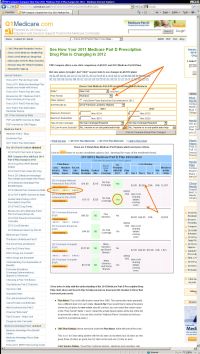

- Plan Name: This is the official plan name from the Centers for Medicare and Medicaid Services (CMS). The same plan name generally has a different plan id in each state. (Search Tip: If you would like to reduce the plans shown to just plans for one or two specific carriers, you can select the carrier name in the "Plan Family" fields 1 and 2. Select the empty (blank) option at the top of the list to remove the criteria. You can also click the "National Plans" checkbox to limit your search to just national plans.)

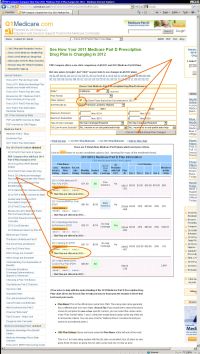

- CMS Plan Ratings: these are found under the Plan Name at the left side of the chart.

This is a 1 to 5 star rating system with five (5) stars as excellent, four (4) stars as very good, three (3) stars as good, two (2) stars as fair and one (1) star as poor.

- Cust. Service Rating - Drug Plan Customer Service - Medicare and members rate the drug plan and how well a drug plan provides customer service.

This category includes measures of how drug plans rate on the following areas:

- Time on Hold When Customer and Pharmacist Calls Drug Plan.

- Calls Disconnected When Customer and Pharmacist Calls Drug Plan.

- Drug Plan’s Timeliness in Giving a Decision for Members Who Make an Appeal.

- Fairness of Drug Plan’s Denials to a Member’s Appeal, Based on an Independent Reviewer.

- Member Plan Exper. - Member Experience with Drug Plan - This category shows how well drug plans make prescription drugs available to their members.

This category includes measures of how drug plans rate on the following areas:

- Drug Plan Provides Information or Help When Members Need It.

- Members’ Overall Rating of Drug Plan.

- Members’ Ability to Get Prescriptions Filled Easily When Using the Drug Plan.

- RxCost Info Rating - This category shows how well drug plans are doing with pricing prescriptions and providing information on the Medicare website.

This category includes measures of how drug plans rate on the following areas:- Completeness of the Drug Plan’s Information on Members Who Need Extra Help.

- Drug Plan Provides Current Information on Costs and Coverage for Medicare’s Website (the same data is used on this Q1Medicare.com).

- Drug Plan’s Prices that Did Not Increase More Than Expected During the Year.

- Drug Plan’s Prices on Medicare’s Website (and this website) Are Similar to the Prices Members Pay at the Pharmacy.

- Drug Plan’s Members 65 and Older Who Received Prescriptions for Certain Drugs with a High Risk of Side Effects, when There May Be Safer Drug Choices.

- Cust. Service Rating - Drug Plan Customer Service - Medicare and members rate the drug plan and how well a drug plan provides customer service.

- Monthly Premium: This is the amount you must pay each month to use the plan. This monthly premium must be paid even if you are in the initial deductible phase or the coverage gap (donut hole) phase. (Search Tip: If you would like to reduce the plans shown to just plans under a certain premium, enter this value in the "Maximum Premium" field.)

(Search Tip: If you have selected an amount in the "LIS Subsidy Amount" filed, the premium shown is the premium based on your Low-Income Subsidy selection. - Deductible: The standard CMS plan

initial deductible is $. Many Medicare plans do not have a deductible; however their plan premium may be higher. (Search Tip: If you would like to reduce the plans shown to just plans with a deductible under a certain value, enter this value in the "Maximum Deductible" field.) Some plans that have an annual deductible

exempt certain drug tiers from the deductible. For example, "Tier 1 exempt" may be shown. This would mean that

Tier 1 drugs purchased during the Deductible phase, would not fall into the deductible and would be charged the

Initial Coverage Phase tier 1 cost-sharing.

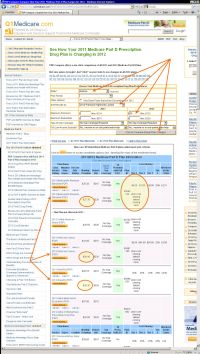

- Gap Coverage: In the CMS Standard Plan,

the beneficiary, or others on their behalf (e.g. the brand-name drug manufacturer discount), pay(s)

up to $0 in drug costs,

depending on your mix of generics and brand-name drugs.

The Healthcare Reform provides that for plan year ,

all formulary drugs will have at least a 0% discount in

the coverage gap (Donut Hole).

The Gap Coverage Types discussed in this section are

supplemental coverage your plan pays in addition to the Healthcare Reform mandated discounts. In our chart, you will see one of the following:

- No Gap Coverage: You receive the 0% Donut Hole Discount and pay up to $0 depending on your mix of generics and brand-name drugs, before exiting into Catastrophic Coverage. Read more...

- Yes: This plan offers some supplemental gap coverage in addition to the 0% Donut Hole Discount. See plan details for a description of the gap coverage. The description may read similar to: Under this plan you may pay even less for the brand and generic drugs on the formulary. Your cost varies by tier. You will need to use your formulary to locate your drug's tier. See the chart that follows to find out how much it will cost you.

- $0 Premium with Full LIS - Does the plan qualify for $0 premium with full Low-Income Subsidy?: If Yes is in the field, then you would pay a $0 premium if you have a Full Low-Income Subsidy (LIS). If No is in the field, then you would be responsible for the difference between what the state provides as the Full Low-Income Subsidy and the actual cost of the plan even if you have a Full Low-Income Subsidy. (Search Tip: If you would like to reduce the plans shown to just plans that qualify for the $0 premium (Benchmark plans), select "Yes..." in the "Full Low-Income Subsidy?" field.)

- Plan ID: This is the unique id for this particular plan.

- Copay / Coinsurance - Cost Sharing -

This is what you will pay for formulary drugs in the

Initial Coverage Phase

of your plan. This is the phase after the initial deductible has been met and before you

reach the Coverage Gap (Donut Hole). Plans often cover drugs in "tiers". Tiers are specific

to the list of drugs covered by the plan. Plans may have several tiers, and the copay for a

drug depends on the drug’s tier. Plans can form their own tiers, so you should contact

the plan or reference their summary of benefits to find out what copays and limitations are

associated with each tier. These cost sharing figures DO NOT necessarily apply to the

Coverage Gap. The plan may have a separate copay/coinsurance for the same drug while in the

Coverage Gap. (Search Tip: If you would like to reduce the plans shown to just plans

that have a tier 1 (Generics) co-pay of up to a certain value (ex: $0 co-pay), enter the

value (ex: 0) in the "Max. Co-pay Tier 1 (Generics)" field.)

Additional Information Fields:

You can select one of the following additional pieces of plan information to display (Search Tip: to change the type of information shown in the last column of the chart, select the data to be shown in the "Additional Info" field.)

(Chart Source: various files provided by the Centers for Medicare and Medicaid Services along with data from the Medicare.gov website plan finder.)

Please note: The above plan information comes from CMS. We make every attempt to keep our information up-to-date with plan/premium changes. However, we cannot guarantee the accuracy of this information. You should always verify cost and coverage information with your Medicare plan provider.