2021 Medicare Part D Outlook

- Chart comparing 2017 through 2021 defined standard Medicare Part D prescription drug plan parameters

2021 Tools and Links

» PDP-Facts: 2021 Part D Plan Statistics» PDP-Facts: 2021 Beyond the Numbers

» Browse Any 2021 Part D Plan Formulary

» 2021 Part D Formulary Search By Drug Letter

» 2021 Part D Drug Finder

» 2021 Quick Plan facts

» 2021 PDP-Finder: Stand-Alone Prescription Drug Plan Finder

» 2021 MA-Finder: Medicare Advantage Plan Finder

» Guided Help Searching 2021 Prescription Drug Plans

» PDP-Compare: How did each 2020 Part D Plan Change in 2021?

» MA-Compare: Review Changes in each 2020 Medicare Advantage Plan for 2021

» Search for 2021 Medicare Plans by Plan ID

» Search for 2021 Medicare Plans by Formulary ID

» 2021 Plan Overview by State

» 2021 Overview by CMS Region

» 2021 PDP-Planner & Donut Hole Calculator

Latest News on Medicare for 2021

2021 defined standard Medicare Part D prescription drug plan coverage parameters

Each year, the Centers for Medicare and Medicaid Services (CMS) releases the Part D benefit parameters for the "Defined Standard Benefit" plan and the Low-Income Subsidy benefits. Medicare Part D plans use these benefit parameters to determine drug plan coverage for the next plan year. CMS releases the "preliminary" benefit parameters in February and the "finalized" benefit parameters in April. The finalized benefit parameters drive the plan designs that you will see in the fall annual Open Enrollment Period (AEP).You can use these parameters as a possible preview of how your Medicare Part D plan coverage may change in January, 2021. Actual plan options and benefit details will be available for your review beginning October 1, 2020.

Here are a few highlights of the defined standard Medicare Part D plan changes from 2020 to 2021. And the chart below shows the changes in defined standard Medicare Part D design for plan years 2017, 2018, 2019, 2020 and 2021. The CMS "Part D Benefit Parameters for Defined Standard Benefit" is the minimum allowable Medicare Part D plan coverage. However, CMS does allow Medicare Part D plans to offer a variation on the defined standard benefits (for example, a Medicare Part D plan can offer a $0 Initial Deductible).

- Initial Deductible:

will be increased by $10 to $445 in 2021. - Initial Coverage Limit

(ICL):

will increase from $4,020 in 2020 to $4,130 in 2021. - Out-of-Pocket Threshold

(or TrOOP):

will increase from $6,350 in 2020 to $6,550 in 2021. - Coverage Gap (Donut Hole):

begins once you reach your Medicare Part D plan’s initial coverage limit ($4,130 in 2021) and ends when you spend a total of $6,550 out-of-pocket in 2021. See: But isn’t the Coverage Gap (Donut Hole) closed?

- 2021 Donut Hole Discount:

Part D enrollees will receive a 75% Donut Hole discount on the total cost of their brand-name drugs purchased while in the Donut Hole. The discount includes, a 70% discount paid by the brand-name drug manufacturer and a 5% discount paid by your Medicare Part D plan. The 70% paid by the drug manufacturer combined with the 25% you pay, count toward your TrOOP or Donut Hole exit point.

For example: If you reach the Donut Hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your 2021 total out-of-pocket spending limit.

Medicare Part D beneficiaries who reach the Donut Hole will also pay a maximum of 25% coinsurance on generic drugs purchased while in the Coverage Gap (receiving a 75% discount).

For example: If you reach the 2021 Donut Hole, and your generic medication has a retail cost of $100, you will pay $25. The $25 that you spend will count toward your TrOOP or Donut Hole exit point. - Minimum Cost-sharing in the Catastrophic Coverage Portion of the Benefit**:

beneficiaries will be charged $3.70 for those generic or preferred multisource drugs with a retail price under $74 and 5% for those with a retail price greater than $74. For brand-name drugs, beneficiaries would pay $9.20 for those drugs with a retail price under $184 and 5% for those with a retail price over $184. - Maximum Copayments below the Out-of-Pocket Threshold for certain Low Income Full Subsidy Eligible Enrollees:

will increase to $3.70 for generic or preferred drug that is a multi-source drug and $9.20 for all other drugs in 2021.

Chart comparing 2017 through 2021 defined standard Medicare Part D prescription drug plan parameters

Click here to see a comparison of plan parameters for all years since 2006

| Medicare Part D Benefit Parameters for Defined Standard Benefit 2017 through 2021 Comparison |

||||||||||||||||

| Part D Standard Benefit Design Parameters: | 2021 | 2020 | 2019 | 2018 | 2017 | |||||||||||

| Deductible - After the Deductible is met, Beneficiary pays 25% of covered costs up to total prescription costs meeting the Initial Coverage Limit. | $445 | $435 | $415 | $405 | $400 | |||||||||||

| Initial Coverage Limit - Coverage Gap (Donut Hole) begins at this point. (The Beneficiary pays 100% of their prescription costs up to the Out-of-Pocket Threshold) | $4,130 | $4,020 | $3,820 | $3,750 | $3,700 | |||||||||||

| Out-of-Pocket Threshold - This is the Total Out-of-Pocket Costs including the Donut Hole. | $6,550 | $6,350 | $5,100 | $5,000 | $4,950 | |||||||||||

| Total Covered Part D Drug Out-of-Pocket Spending including the Coverage Gap - Catastrophic Coverage starts after this point. See note (1) below. |

$9,313.75 (1) | $9,038.75 (1) | $7,653.75 (1) | $7,508.75 (1) | $7,425.00 (1) | |||||||||||

| Total Estimated Covered Part D Drug Out-of-Pocket Spending including the Coverage Gap Discount (NON-LIS) See note (2). | $10,048.39 plus a 75% discount on all formulary drugs |

$9,719.38 plus a 75% discount on all formulary drugs |

$8,139.54 plus a 75% brand discount |

$8,417.60 plus a 65% brand discount |

$8,071.16 plus a 60% brand discount |

|||||||||||

| Catastrophic Coverage Benefit: | ||||||||||||||||

| Generic/Preferred Multi-Source Drug (3) | $3.70 (3) | $3.60 (3) | $3.40 (3) | $3.35 (3) | $3.30 (3) | |||||||||||

| Other Drugs (3) | $9.20 (3) | $8.95 (3) | $8.50 (3) | $8.35 (3) | $8.25 (3) | |||||||||||

| Part D Full Benefit Dual Eligible (FBDE) Parameters: | 2021 | 2020 | 2019 | 2018 | 2017 | |||||||||||

| • Deductible | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |||||||||||

| • Copayments for Institutionalized Beneficiaries | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |||||||||||

| Maximum Copayments for Non-Institutionalized Beneficiaries | ||||||||||||||||

| Up to or at 100% FPL: | ||||||||||||||||

| • Up to Out-of-Pocket Threshold | ||||||||||||||||

| - Generic / Preferred Multi-Source Drug | $1.30 | $1.30 | $1.25 | $1.25 | $1.20 | |||||||||||

| - Other Drugs | $4.00 | $3.90 | $3.80 | $3.70 | $3.70 | |||||||||||

| • Above Out-of-Pocket Threshold | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |||||||||||

| Over 100% FPL: | ||||||||||||||||

| • Up to Out-of-Pocket Threshold | ||||||||||||||||

| - Generic / Preferred Multi-Source Drug | $3.70 | $3.60 | $3.40 | $3.35 | $3.30 | |||||||||||

| - Other Drugs | $9.20 | $8.95 | $8.50 | $8.35 | $8.25 | |||||||||||

| • Above Out-of-Pocket Threshold | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |||||||||||

| Part D Full Subsidy - Non Full Benefit Dual Eligible Full Subsidy Parameters: | 2021 | 2020 | 2019 | 2018 | 2017 | |||||||||||

| Eligible for QMB/SLMB/QI, SSI or applied and income at or below 135% FPL and resources ≤ $9,470 (individuals in 2021) or ≤ $14,960 (couples, 2021) (4) | ||||||||||||||||

| • Deductible | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |||||||||||

| • Maximum Copayments up to Out-of-Pocket Threshold | ||||||||||||||||

| - Generic / Preferred Multi-Source Drug | $3.70 | $3.60 | $3.40 | $3.35 | $3.30 | |||||||||||

| - Other Drugs | $9.20 | $8.95 | $8.50 | $8.35 | $8.25 | |||||||||||

| • Maximum Copay above Out-of-Pocket Threshold | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |||||||||||

| Partial Subsidy Parameters: | 2021 | 2020 | 2019 | 2018 | 2017 | |||||||||||

| Applied and income below 150% FPL and resources between $14,790 (individual, 2021) or $29,520 (couples, 2021) (category code 4) (4) | ||||||||||||||||

| • Deductible | $92.00 | $89.00 | $85.00 | $83.00 | $82.00 | |||||||||||

| • Coinsurance up to Out-of-Pocket Threshold | 15% | 15% | 15% | 15% | 15% | |||||||||||

| • Maximum Copayments above Out-of-Pocket Threshold | ||||||||||||||||

| - Generic / Preferred Multi-Source Drug | $3.70 | $3.60 | $3.40 | $3.35 | $3.30 | |||||||||||

| - Other Drugs | $9.20 | $8.95 | $8.50 | $8.35 | $8.25 | |||||||||||

| (1) Total Covered Part D Spending at Out-of-Pocket Threshold for Non-Applicable Beneficiaries - Beneficiaries who ARE entitled to an income-related subsidy under section 1860D-14(a) (LIS) | ||||||||||||||||

| (2) Total Covered Part D Spending at Out-of-Pocket Threshold for Applicable Beneficiaries - Beneficiaries who are NOT entitled to an income-related subsidy under section 1860D-14(a) (NON-LIS) and do receive the coverage gap discount. For 2021, the weighted gap coinsurance factor is 87.5872%. This is based on the 2019 PDEs (89.50% Brands & 10.50% Generics) | ||||||||||||||||

| (3) The Catastrophic Coverage is the greater of 5% or the values shown in the chart above. In 2021, beneficiaries will be charged $3.70 for those generic or preferred multisource drugs with a retail price under $74 and 5% for those with a retail price greater than $74. For brand-name drugs, beneficiaries would pay $9.20 for those drugs with a retail price under $184 and 5% for those with a retail price over $184. | ||||||||||||||||

| (4) This amount includes the $1,500 per person burial allowance. The resource limit may be updated during contract year 2021. | ||||||||||||||||

Click here to see a comparison of plan parameters for all years since 2006

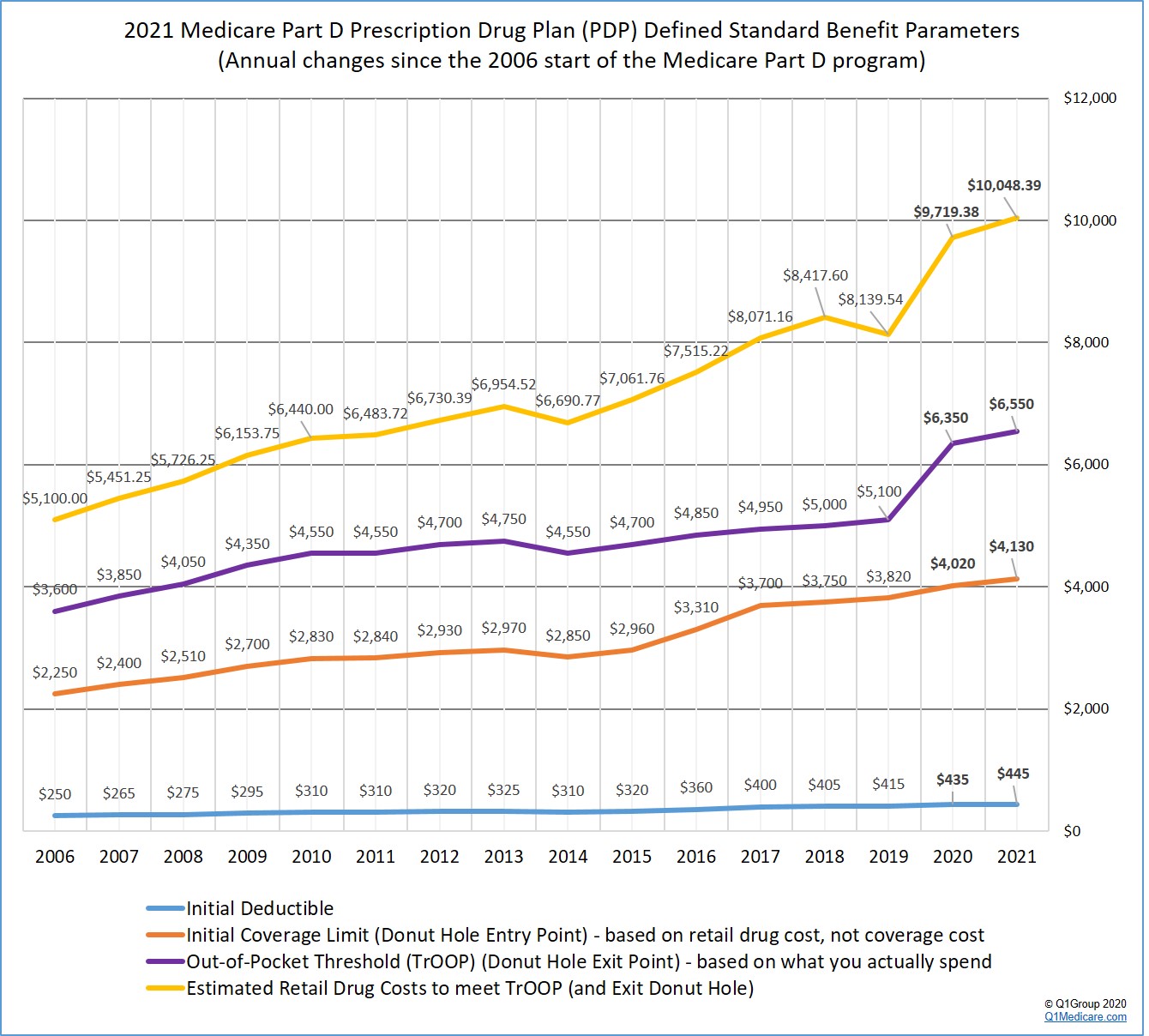

Medicare Part D standard benefit trends 2006 to 2021

The graph below shows the finalized Medicare Part D defined standard benefit parameters.

Click here to see a comparison of plan parameters for all years since 2006

Federal Poverty Level Guidelines: LIS Qualifications

The LIS qualifications using the 2021 Federal Poverty Level (FPL) guidelines are shown below. The 2021 FPL guidelines will be used for determining LIS qualifications during the 2021 plan year and at the beginning of the 2022 plan year.If your income is below 135% of the FPL ($17,388 if you are single or $23,517 for married couples), you could qualify for the full Low-Income Subsidy (resource limits also apply - see chart above). Even if you don’t qualify for full LIS benefits, you could be eligible for partial LIS benefits if your income level is at or below 150% FPL (resource limits also apply - see chart above). Remember, the LIS subsidy helps to pay both your monthly plan premiums and drug costs.

Learn more in our article, 2021 Federal Poverty Level Guidelines (FPL): 2021/2022 LIS Qualifications and Benefits.

| 2021 Full Low-Income Subsidy Income Requirements (135% of FPL) | |||

| Persons in Family | 48 Contiguous States & D.C. | Alaska | Hawaii |

| 1 | $17,388 | $21,722 | $20,007 |

| 2 | $23,517 | $29,390 | $27,054 |

| 3 | $29,646 | $37,058 | $34,101 |

| 4 | $35,775 | $44,726 | $41,148 |

| 5 | $41,904 | $52,394 | $48,195 |

| 6 | $48,033 | $60,062 | $55,242 |

Click here for additional family member figures and for partial-LIS figures. Learn more about the Extra-Help program.

Sign-up for our 2025 Reminder Service

2025 Medicare Part D Plan Reminder Service

If you would like for us to send you an email as the 2025 Medicare Part D plan information becomes available, as it is updated and when enrollment begins (October 15th), please complete the form below. We will NOT share your information with any third-parties.

8am to 5pm MST

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service