A little background on retail drug pricing

Medicare Part D plans (or their pharmaceutical benefit manager, PBM) set the retail prices for your formulary drugs at each standard and preferred network pharmacy.

So retail drug prices can vary plan-to-plan, week-to-week, between preferred and standard pharmacies, between preferred network pharmacies, and between standard network pharmacies - and certainly at non-network pharmacies.

As a note: In our Q1Rx® Drug Finder (Q1Rx.com), we show all Medicare Part D plans or Medicare Advantage plans in a Service Area (state or ZIP code area) that provide coverage for a particular formulary drug, and when available, we also show the Medicare plan's "average negotiated retail drug price" and this "average" price means that the retail drug prices are the average retail drug price across all network pharmacies (standard and preferred) in the plan’s Service Area. In many cases, we find that the average negotiated retail price we show in our Drug Finder accurately reflects what you may find at your chosen network pharmacy.

However, even though we update this drug pricing data on a regular basis, your actual retail drug price depends on how your Medicare prescription drug plan (PDP or MAPD) has negotiated with the standard and preferred network pharmacies in your area - and how that retail price has changed over the past weeks.

Question: Why should we care about retail drug pricing?

Your formulary drug's retail price is what determines when you enter your plan's Coverage Gap or Donut Hole. When the total retail cost of your formulary drugs (not what you paid, but the retail value), exceeds your plan's Initial Coverage Limit (for example, $4,660 in 2023 and $5,030 in 2024), you enter the Coverage Gap or Donut Hole phase of your Medicare Part D plan (where you pay 25% of the retail drug cost). So, the higher the retail drug cost, the faster you enter the Coverage Gap where you may pay more, less, or the same as what you spent before entering the Gap (depending on your drug plan).

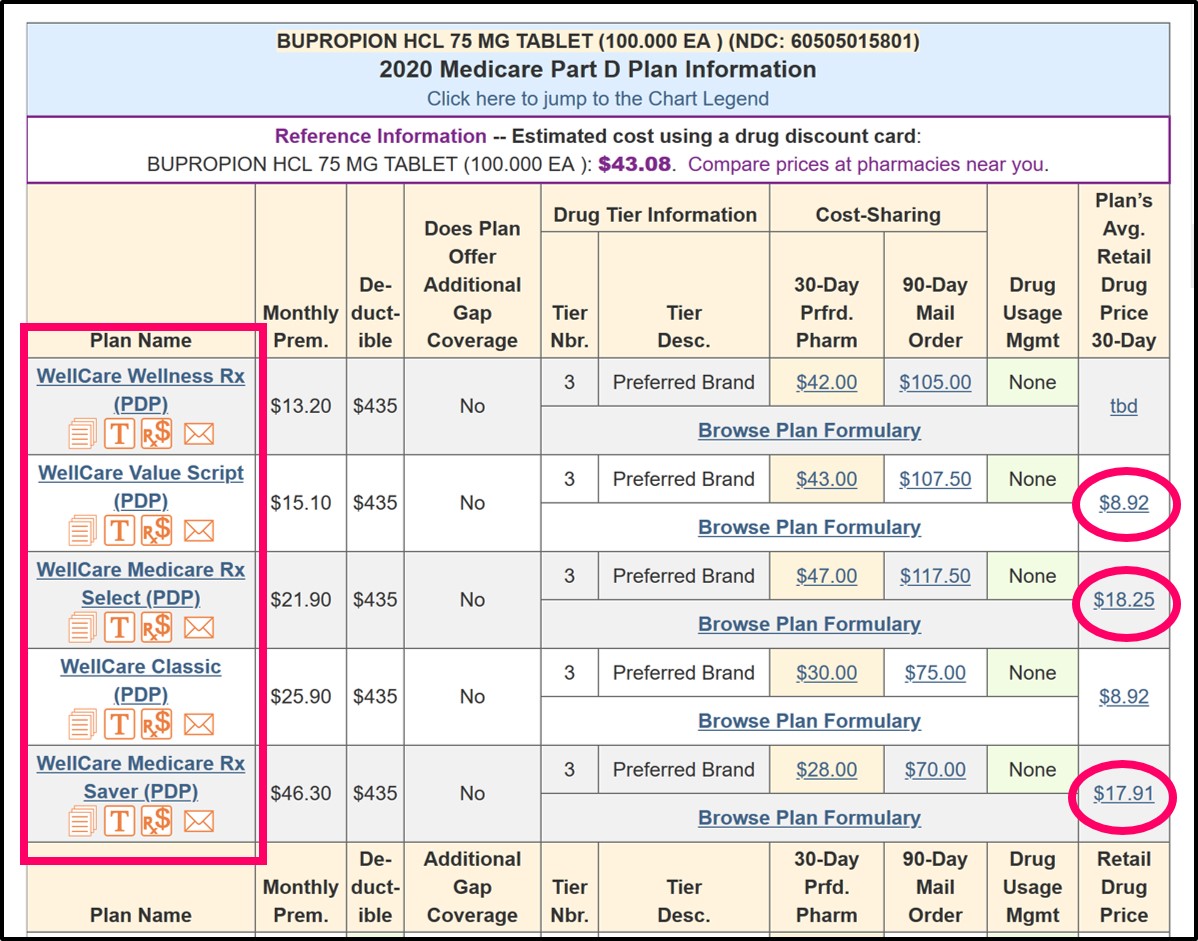

Example of how retail drug prices can vary between Medicare plan's offered by the same company

From the chart below (Q1Rx.com/2020/FL/60505015801), you can see that several Medicare Part D plans offered by the same company have different negotiated retail drug prices for the same drug (BUPROPION HCL 75 MG TABLET (100.000 EA) (NDC: 60505015801)).

Question: What happens when the drug's retail cost is less than the plans coverage costs?

You always pay the lower cost - either retail cost or the cost-sharing. So, in the examples above, you would not pay a $43 co-pay for a drug that has a retail cost of $8.92. Instead, you would pay the lower retail price of $8.92, even though this is a Tier 3 generic drug. This is called the "lessor of" rule (you pay retail or your co-pay, whichever is less) and you can read more about this rule in our Frequently Asked Question here: Q1FAQ.com/494

Question: How does the quantity of my prescription affect my coverage cost and retail drug cost?The quantity of your prescription may not impact your coverage cost, but will impact the retail cost based on the number of drugs

So if your Medicare Part D provides a specific Quantity Limit (say, 30 pills for 30 days) for your formulary drug, and your Medicare Part D plan grants you a Formulary Exception for 120 pills for 30 days - the 2019 Medicare.gov Plan Finder shows no impact of Quantity Limits on cost-sharing - however, you will note that the retail cost of the prescription drug is affected by the quantity of the prescription.

For example, the retail cost for a quantity of 120 tablets is approximately 4x the retail cost of the 30 tablet prescription. And since you enter the Coverage Gap or Donut Hole based on the retail value of your formulary drug purchases, you should move more quickly toward the Donut Hole when you increase the quantity of your prescription.

- Example 1 Higher Retail at Preferred Pharmacy. But, Higher Co-Pay at Standard Pharmacy

This actual example shows that you can have a higher negotiated retail price at a preferred pharmacy. But, you will pay a significantly higher co-pay at a standard pharmacy, but you never pay more than retail when your higher co-pay is more than your plan's retail drug price, the plan's Quantity Limit (QL) for this drug affects the total retail drug cost - but not your co-pay.

Notice that the Catastrophic Coverage price is often the actual low retail drug price since the retail price is more than 5% of the retail price, but still less than the minimum $3.40 price for generics in the 2019 Catastrophic Coverage phase - and, again, you will not pay more than retail.

- Example 2 - Retail Prices vary between Preferred Pharmacies

This example also shows that retail drug prices can even vary between two preferred network pharmacies, although the co-pays are consistent across all preferred pharmacies.

- Example 3 - Higher prescription quantities result in higher retail cost, but the same co-pay or cost-sharing

As noted above, without the Quantity Limit (QL) usage management restriction, the retail cost calculation provided by the 2019 Medicare.gov site (pre-2019 change) shows the same multiple of 4 x 30-day retail drug costs (as we saw with plans having a QL).

And, as expected, negotiated retail drug price can vary between standard network pharmacies, although fixed co-pays remain the same between standard pharmacies.

- Example 4 - How preferred pharmacy retail prices compare to much-higher non-network pharmacy prices

This last example shows pricing at a preferred network pharmacy as compared to the retail drug costs at an out-of-network pharmacy, although we doubt anyone would pay the prices showing in this example (over 10x the preferred pharmacy prices), but people would instead probably not use their Medicare Part D plan and simply pay the pharmacy's everyday low prices or use a Discount Drug Card prices for these low-costing generics.

How are Initial Deductible, Donut Hole, and Catastrophic Coverage Costs calculated in these examples?

Initial Deductible costs

All four of our chosen example 2019 Medicare Part D plans exclude low-costing Tier 1 and Tier 2 drugs from the ($415) initial deductible - so in all of the examples, the Medicare Part D prescription drug plan provides immediate coverage even before the standard initial deductible is met.

The chosen medication is a generic drug and will receive the 75% Donut Hole discount. The four example Medicare plans do not offer any additional coverage in the Donut Hole, so you would pay 25% of the retail drug cost.

Catastrophic Coverage costs

If you exited the 2019 Donut Hole or Coverage Gap, you would have paid the higher of either 5% of the drug's retail price or $3.40 for generic or preferred drug that is a multi-source drug and $8.50 for all other drugs (such as brand name drugs. In our examples, you can see that the Medicare.gov site shows Catastrophic Coverage costs for this generic as $3.40 - or the actual retail price is paid in Catastrophic Coverage when the actual retail price is less than the standard $3.40 co-pay for generics, but still greater than 5% of the retail drug price.

Keep in mind that 2023 is the last year that Medicare Part D beneficiaries will pay cost-sharing in the Catastrophic Coverage phase. For plan year 2024 and beyond, the Inflation Reduction Act (IRA) of 2022 eliminates beneficiary cost-sharing in the Catastrophic Coverage phase, so plan members will not have any out-of-pocket costs for formulary drugs after reaching the plan's 2024 $8,000 total out-of-pocket threshold (TrOOP); therefore, TrOOP becomes the RxMOOP in 2024.

Example 1 - higher retail cost at preferred pharmacy

Please notice that the retail drug price at the Preferred Network Pharmacy is actually higher than the retail drug price at the standard network pharmacy. However, the cost-sharing for this Tier 1 Preferred Generic is $1 at a preferred pharmacy and $10 at a standard network pharmacy. You can see that the retail cost at the standard retail pharmacy is significantly lower than the $10 co-pay, and since you never pay more than the negotiated retail price, you pay the retail price - and not the $10 co-pay.

This Medicare Part D plan also has the usage management restriction of a 30 tablet / 30 days Quantity Limit (QL). If the QL can be exceeded (for example, if the plan allows120 tablets / 30 days), the retail price increases by a factor of the QL, but the coverage cost, even for the excess amount of medication, does not change.

|

Comparison of Drug Cost-Sharing Across Quantities, Phases of Coverage, and Pharmacies

2019 Express Scripts Medicare - Saver (PDP) (S5660-227-0)with Quantity Limit (QL) of 30 tablets per 30 days |

||||||||||

| Walgreens #11481 - Standard Retail Cost Sharing | Walmart Pharmacy 10-2727 - Preferred Retail Cost Sharing | |||||||||

| Full Retail | Deduct- ible | Initial Coverage Phase | Cover-age Gap | Cata- strophic Coverage | Full Retail | Deduct- ible | Initial Coverage Phase | Cover- age Gap | Cata- strophic Coverage | |

| Atorvastatin Calcium TAB 10MG - 30 tablets | $2.44 | $2.44 | $2.44 | $0.90 | $2.44 | $2.93 | $1.00 | $1.00 | $1.08 | $2.93 |

| Atorvastatin Calcium TAB 10MG - 120 tablets | $8.08 | $8.08 | $8.08 | $2.99 | $3.40 | $8.57 | $1.00 | $1.00 | $3.17 | $3.40 |

| Atorvastatin Calcium TAB 20MG - 30 tablets | $5.65 | $5.65 | $5.65 | $2.09 | $3.40 | $6.14 | $1.00 | $1.00 | $2.27 | $3.40 |

| Atorvastatin Calcium TAB 20MG - 120 tablets | $20.92 | $10.00 | $10.00 | $7.74 | $3.40 | $21.41 | $1.00 | $1.00 | $7.92 | $3.40 |

Example 2 - different retail prices at different preferred pharmacies

In this example, we see that two preferred network pharmacies can also have different retail prices, although the cost-sharing for this Tier 2 (Generic) is the same at all preferred pharmacies.

|

Comparison of Drug Cost-Sharing Across Quantities, Phases of Coverage, and Pharmacies

Cigna-HealthSpring Rx Secure-Essential (PDP) (S5617-290-0)with Quantity Limit of 30 tablets per 30 days |

||||||||||

| Walgreens #11481 - Preferred Retail Cost Sharing | Walmart Pharmacy 10-2727 - Preferred Retail Cost Sharing | |||||||||

| Full Retail | Deduct- ible | Initial Coverage Phase | Cover-age Gap | Cata- strophic Coverage | Full Retail | Deduct- ible | Initial Coverage Phase | Cover- age Gap | Cata- strophic Coverage | |

| Atorvastatin Calcium TAB 10MG - 30 tablets | $3.38 | $3.00 | $3.00 | $1.25 | $3.38 | $3.00 | $3.00 | $3.00 | $1.11 | $3.00 |

| Atorvastatin Calcium TAB 10MG - 120 tablets | $11.53 | $3.00 | $3.00 | $4.27 | $3.40 | $8.55 | $3.00 | $3.00 | $3.16 | $3.40 |

| Atorvastatin Calcium TAB 20MG - 30 tablets | $3.00 | $3.00 | $3.00 | $1.11 | $3.00 | $3.00 | $3.00 | $3.00 | $1.11 | $3.00 |

| Atorvastatin Calcium TAB 20MG - 120 tablets | $9.99 | $3.00 | $3.00 | $3.70 | $3.40 | $8.55 | $3.00 | $3.00 | $3.16 | $3.40 |

Example 3 - retail drug prices vary between standard (non-preferred) network pharmacies

In this example, we do not have the usage management restriction of a Quantity Limit. So the plan member with a larger prescription (120 tablets / 30 days) would not need to file a formulary exception to receive this additional amount. The retail cost calculation provided by Medicare.gov shows the same multiple of 4 x 30-day costs.

|

Comparison of Drug Cost-Sharing Across Quantities, Phases of Coverage, and Pharmacies

WellCare Value Script (PDP) (S4802-146-0)with No Quantity Limit |

||||||||||

| Walgreens #11481 - Standard Retail Cost Sharing | Walmart Pharmacy 10-2727 - Standard Retail Cost Sharing | |||||||||

| Full Retail | Deduct- ible | Initial Coverage Phase | Cover-age Gap | Cata- strophic Coverage | Full Retail | Deduct- ible | Initial Coverage Phase | Cover- age Gap | Cata- strophic Coverage | |

| Atorvastatin Calcium TAB 10MG - 30 tablets | $4.61 | $3.00 | $3.00 | $1.71 | $3.40 | $6.60 | $3.00 | $3.00 | $2.44 | $3.40 |

| Atorvastatin Calcium TAB 10MG - 120 tablets | $16.93 | $3.00 | $3.00 | $6.26 | $3.40 | $24.90 | $3.00 | $3.00 | $9.21 | $3.40 |

| Atorvastatin Calcium TAB 20MG - 30 tablets | $6.46 | $3.00 | $3.00 | $2.39 | $3.40 | $9.36 | $3.00 | $3.00 | $3.46 | $3.40 |

| Atorvastatin Calcium TAB 20MG - 120 tablets | $24.63 | $3.00 | $3.00 | $9.01 | $3.40 | $35.92 | $3.00 | $3.00 | $13.29 | $3.40 |

Example 4 - higher retail prices at a preferred pharmacy, but much less than non-network pharmacies

In this example, you can see that at the preferred network pharmacy, there is a higher retail drug price, even when compared to standard pharmacies in our other examples. We also can see that the Out-of-Network retail costs are over 10x the preferred pharmacy prices. In most cases, people would not pay such high prices, and would instead pay the pharmacies "everyday low prices" without using their Medicare Part D coverage - or people could use a pharmacy Drug Discount card at this non-network pharmacy. Please note that the Medicare.gov site shows no coverage at a non-network pharmacy, except for the 37% Donut Hole discount. (This may be considering the requirement that "Part D sponsors shall provide the applicable discount for out-of-network paper claims submitted by Part D enrollees.").

|

Comparison of Drug Cost-Sharing Across Quantities, Phases of Coverage, and Pharmacies

AARP MedicareRx Walgreens (PDP) (S5921-383-0)with Quantity Limit of 30 tablets per 30 days |

||||||||||

| Walgreens #11481 - Preferred Retail Cost Sharing | Walmart Pharmacy 10-2727 - Out-of-Network Pharmacy Retail Cost Sharing | |||||||||

| Full Retail | Deduct- ible | Initial Coverage Phase | Cover-age Gap | Cata- strophic Coverage | Full Retail | Deduct- ible | Initial Coverage Phase | Cover- age Gap | Cata- strophic Coverage | |

| Atorvastatin Calcium TAB 10MG - 30 tablets | $9.57 | $0.00 | $0.00 | $3.54 | $3.40 | $106.40 | $106.40 | $106.40 | $39.37 | $106.40 |

| Atorvastatin Calcium TAB 10MG - 120 tablets | $34.67 | $0.00 | $0.00 | $12.83 | $3.40 | $425.59 | $425.59 | $425.59 | $157.47 | $425.59 |

| Atorvastatin Calcium TAB 20MG - 30 tablets | $13.86 | $0.00 | $0.00 | $5.13 | $3.40 | $152.30 | $152.30 | $152.30 | $56.35 | $152.30 |

| Atorvastatin Calcium TAB 20MG - 120 tablets | $51.85 | $0.00 | $0.00 | $19.18 | $3.40 | $609.20 | $609.20 | $609.20 | $225.40 | $609.20 |

8am to 5pm MST

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service