Does Q1Medicare have online tools to learn more about Medicare Part D or Medicare Advantage plan coverage?

Yes. Q1Medicare offers a number of online tools designed to help you learn more about your Medicare Part D and Medicare Advantage plan options and coverage.

You can use the following links to go directly to the Q1Medicare.com features that are important to you:

You can use the following links to go directly to the Q1Medicare.com features that are important to you:

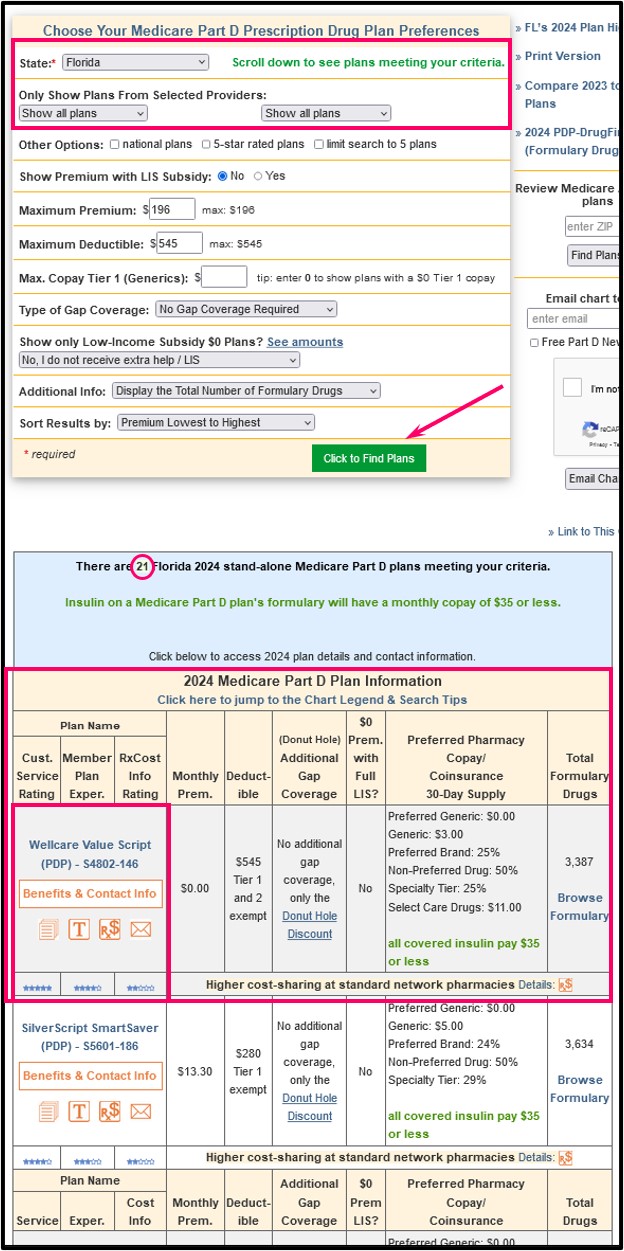

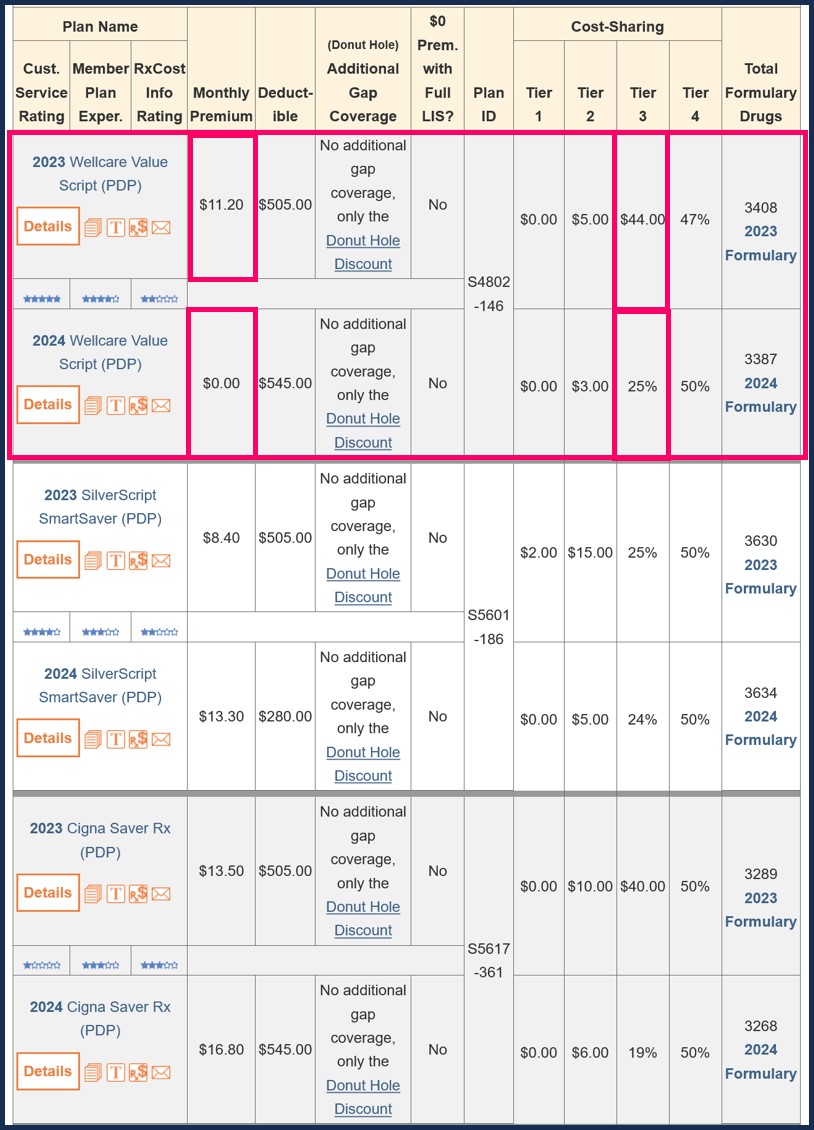

- PDP-Finder.com - Our stand-alone Medicare Part D prescription drug plan (PDP) search tool or Plan Finder was designed to help people get a quick overview of all stand-alone Medicare Part D plans in their service area with key PDP information along with links to additional plan details and our Formulary Browser.

The PDP-Finder provides a unique collection of prescription drug plan details including: drug tier copayments, initial deductibles, monthly premiums, Part D plan IDs, Initial Coverage Limits, supplemental Donut Hole or Gap coverage, formulary size, and Medicare plan quality star ratings.

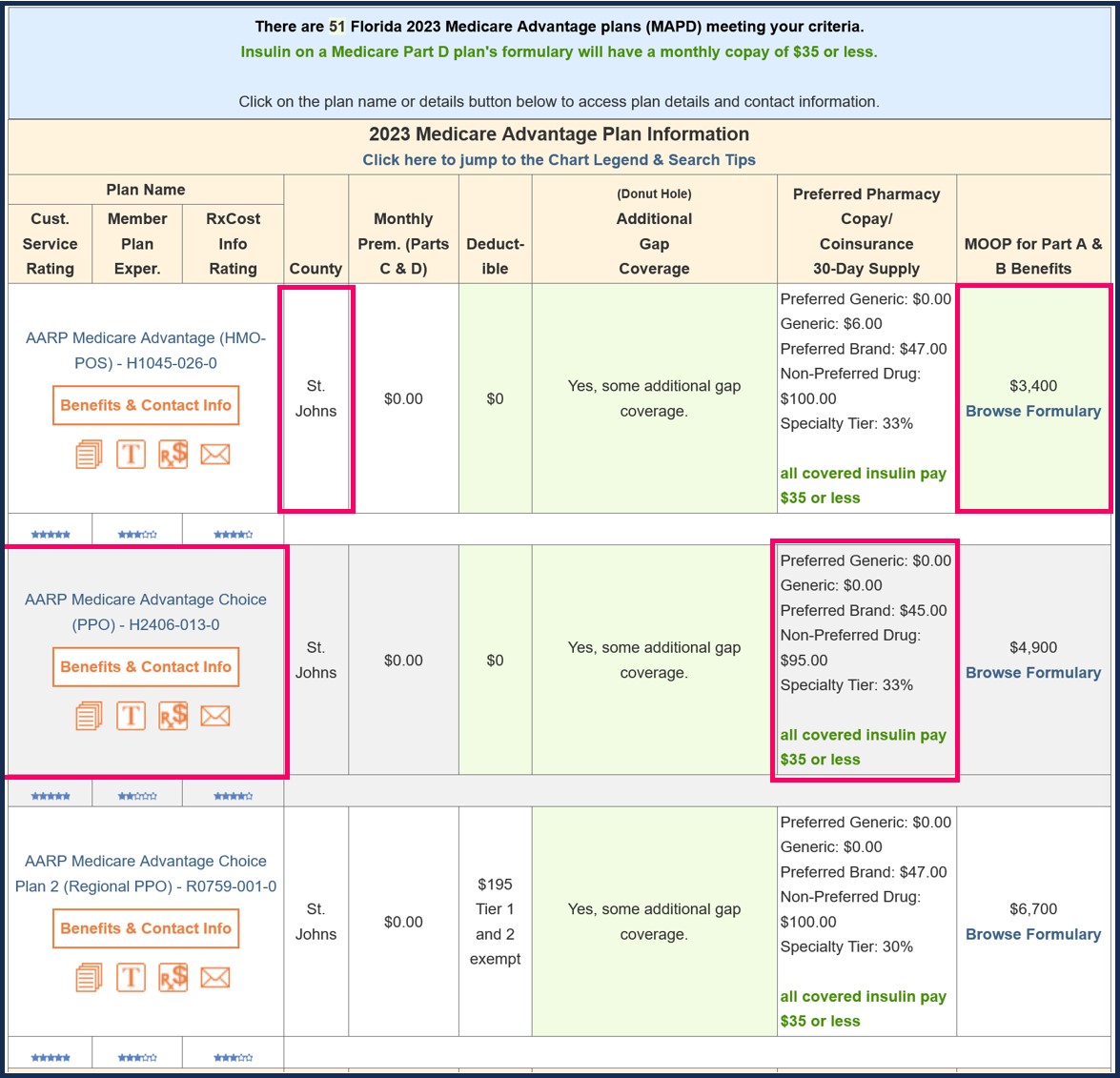

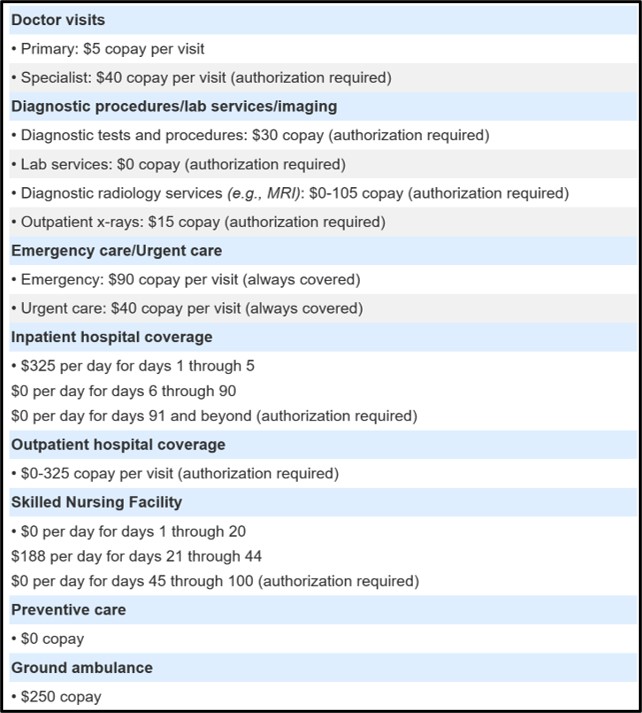

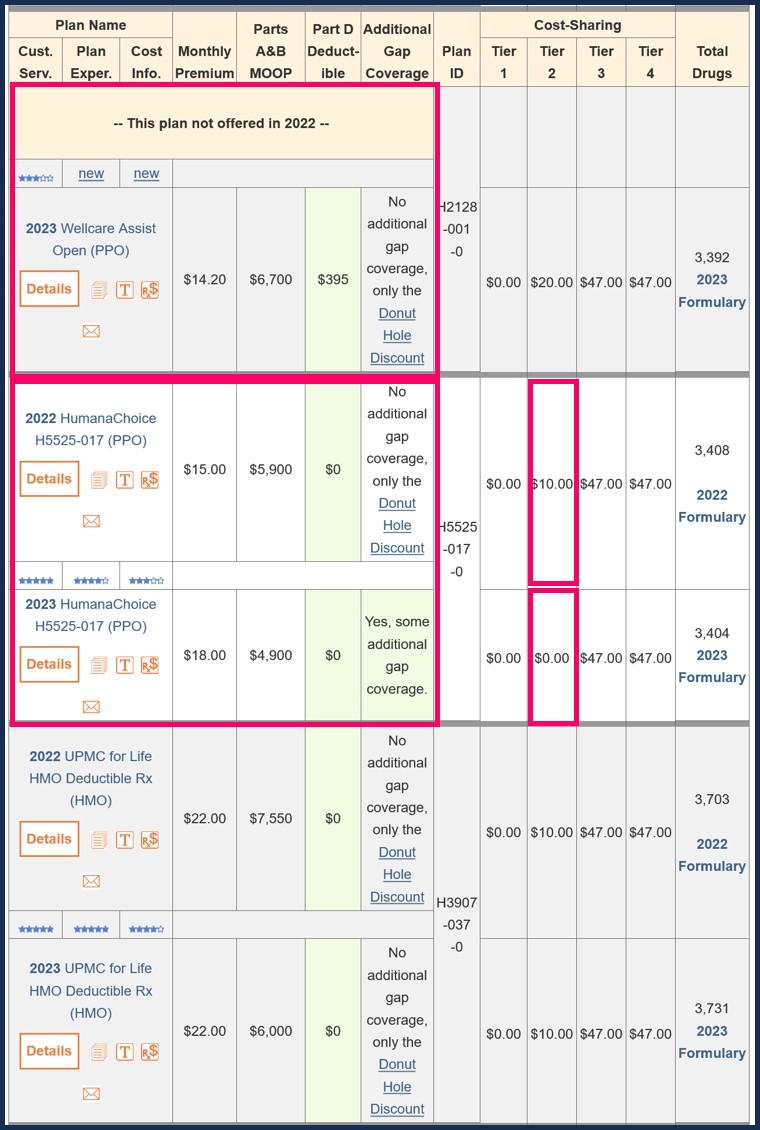

You can click on the plan name or “Benefits & Contact Info” for more information about the specific Medicare PDP (including the plan's toll-free telephone number). - MA-Finder.com - Our Medicare Advantage plan finder allows you to review all Medicare Advantage plans (MA, MAPD, and SNP) in your service area (county or Zip Code area).

Medicare Advantage plans combine your Medicare hospitalization coverage (Medicare Part A), out-patient coverage (Medicare Part B) - and may provide your Medicare prescription drug coverage (Medicare Part D), dental, vision, fitness center coverage, and other supplemental benefits.

In some areas, Medicare Advantage plans with prescription drug coverage are offered with a $0 monthly premium and a $0 initial deductible (or a Medicare Advantage plan may even have a $0 premium and "give back" or rebate a portion of your Medicare Part B premium).

You can use our MA-Finder for searching and comparing all Medicare Advantage plans across the country by plan features. Since Medicare Advantage plans are offered on a county-by-county basis, begin by entering your ZIP code. You can click here for an example of $0 premium Medicare Advantage plans that include prescription drug coverage (MAPDs) in New York, NY – just change the ZIP code to see the plans in your area.

You may wish to telephone the Medicare Advantage plan (using the toll-free number provided on the same page) to confirm or clarify any cost-sharing details that you find unclear. (For example, "What will I pay if I visit an out-of-network healthcare provider without a referral from my primary care physician?")

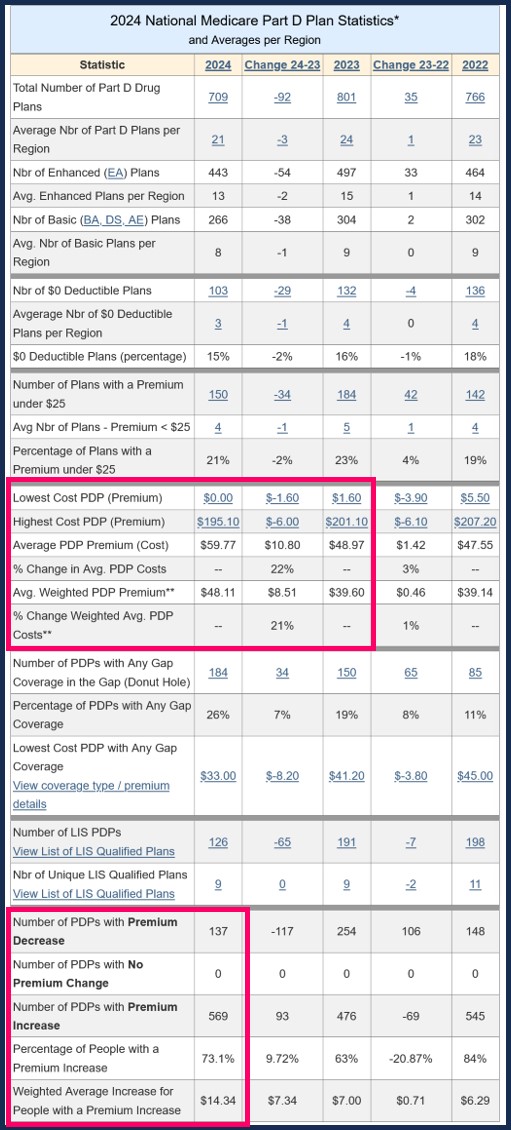

- PDP-Facts.com - For an overview of the current Medicare Part D prescription drug plan (PDP) landscape, we have our PDP-Facts section online and you can see our analysis of the Medicare Part D plan landscape on a national and state-by-state basis.

- PDP-Compare.com - Our PDP-Compare shows you how your current Medicare Part D plan or Medicare Advantage plan is changing next year. Changes to your existing Medicare Part D prescription drug plan coverage were explained in your Annual Notice of Change (ANOC) letter that you should have received from your current Medicare plan.

However, if you would like a quick overview of how any current Medicare plan is changing in next year, please use our Medicare Part D plan comparison tool, PDP-Compare You will also see the Medicare Part D plans merged, discontinued, or introduced next year. - MA-Compare.com - Our MA-Compare shows you how your current Medicare Advantage plan is changing next year. Changes to your existing Medicare Advantage plan coverage were explained in your Annual Notice of Change (ANOC) letter that you should have received from your current Medicare plan.

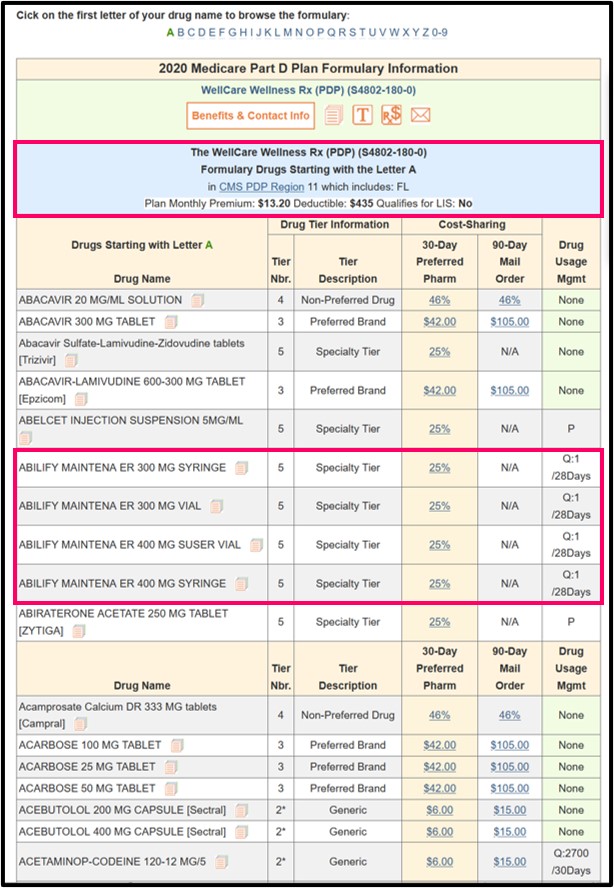

However, if you would like a quick overview of how any current Medicare plan is changing next year, please use our Medicare Advantage plan comparison tool, MA-Compare. You will also see the Medicare Advantage plans merged, discontinued, or introduced in next year. - Q1Rx.com - Our Q1Rx® Drug Finder allows you to quickly see how all Medicare Part D or Medicare Advantage plans in your service area are covering a particular prescription drug. Our Drug Finder details include average negotiated retail drug prices and usage management restrictions (such as Quantity Limits or Prior Authorization requirements).

- Formulary-Browser.com - Our Formulary Browser allows you to browse through all Medicare prescription drug plan formularies or drug lists. You can click on the cost-sharing values of any medication to see the costs difference between using a preferred network pharmacy or a standard (non-preferred) network pharmacy. (Please note, we do not show formulary information for sanctioned Medicare Part D plans. We update our Formulary Browser when CMS releases the plan sanctions and publishes the formulary information.

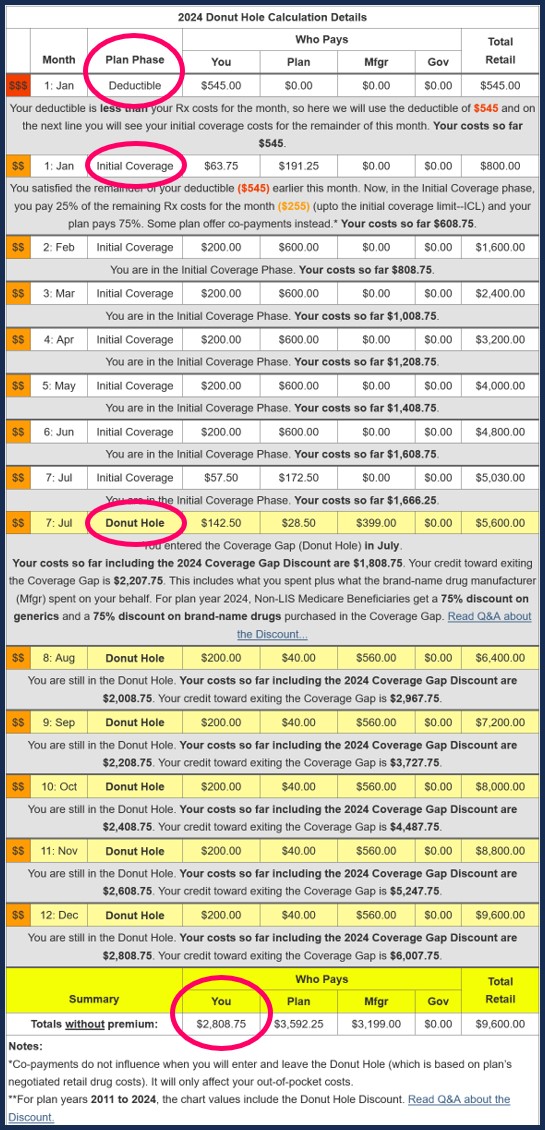

- PDP-Planner.com or Donut Hole cost estimator - Our Donut Hole Calculator helps you estimate when you will enter the Coverage Gap and provides an idea of your monthly and annual Medicare Part D prescription drug spending. You can begin by entering your monthly retail drug costs and choose the variables that apply to your Medicare drug plan, then you can see how you move through the different phases of your Part D plan coverage.

Still have questions or a suggestion for a new online Medicare plan tool ?

If you are looking for answers to your Medicare Part D or Medicare Advantage plan questions, browse our online Frequently Asked Questions or click here for our Help Desk and send us your questions or suggestions.

Browse FAQ Categories

Check Local Pharmacy Prices Using a Drug Discount Card

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service