What are the Medicare Part D Base and Supplemental premiums?

Your monthly Medicare Part D premium can be broken into two parts: the Basic and Supplemental Premiums. And Medicare provides the technical definitions of Total Premium, Basic Premium, and Supplemental Premium:

“Part D Total Premium: The Part D Total Premium is the sum of the Basic and Supplemental Premiums. Note the Part D Total Premium is net of any Part A/B rebates applied to "buy down" the drug premium for Medicare Advantage plans; for some plans the total premium may be lower than the sum of the basic and supplemental premiums due to negative basic or supplemental premiums.Although only the “total premium” is important to most people considering a Medicare Advantage plan (MAPD) or Medicare Part D plan (PDP), we also provide the Part D Base Premium and Supplemental Premium information within our Medicare Part D Plan Finder (PDP-Finder.com) and Medicare Advantage Plan Finder (MA-Finder.com) since this information can be used by Medicare beneficiaries to understand how much they will pay per month for a Medicare Part D plan if they are eligible for the full 100% Low-Income Subsidy (LIS).

Part D Basic Premium: The Part D Basic Premium covers the basic prescription benefit only and does not cover enhanced drug benefits, medical benefits, or hospital benefits. Note: the Part D Basic Premium is net of any Part A/B rebates applied to "buy down" the drug premium for Medicare Advantage plans. Beneficiaries are also responsible for their Part B premium and any premiums for Medigap coverage to meet their individual needs.

Part D Supplemental Premium: The Part D Supplemental Premium covers any enhanced benefits that may be offered by a plan above and beyond the basic (standard) Part D benefit. These benefits may include extra coverage in the coverage gap, lower copayments than the standard benefit, coverage of non-Part D drugs. Note: the Part D Supplemental Premium is net of any Part A/B rebates applied to "buy down" the drug premium for Medicare Advantage plans.”

Likewise, the Q1Medicare plan finders show a table listing the monthly premiums for people who are qualified for only 75% or 50% or 25% of the Low-Income Subsidy or Extra Help (based on their income or financial resources).

Starting with the 2024 plan year, partial LIS benefits will be eliminated and the full LIS benefits will be extended to include those persons who previously only qualified for partial benefits.

The Base and Supplemental Medicare Part D Premium and Medicare Part D Extra Help

A person who is qualified for full Extra Help or 100% LIS benefits will pay either no Medicare plan premium ($0 depending on the plan) or the person will pay only a portion of the “full premium” that is approximately above the state's Benchmark $0 LIS Premium.

You can see more about a state’s 2024 benchmark premium in our article "2024 State Low-Income Subsidy Benchmark Premium Amounts - with a comparison of benchmark changes since 2006" here: Q1News.com/1006.

Example: Your Medicare Part D premium when you are qualified for 100% LIS or full Extra Help

If you qualify for 100% of the LIS subsidy, and you have chosen to enroll into a Medicare Part D prescription drug plan that does not qualify for your state's Low-Income Subsidy $0 monthly premium, then you are responsible for a portion of your monthly premium that is above the state's benchmark premium.

For example, the 2023 Florida $0 LIS Benchmark Premium is $35.92 and if you are qualified for full Extra Help and enrolled in a "basic" Medicare Part D plan with a premium below (or even slightly over) the state benchmark premium, you would pay a $0 premium.

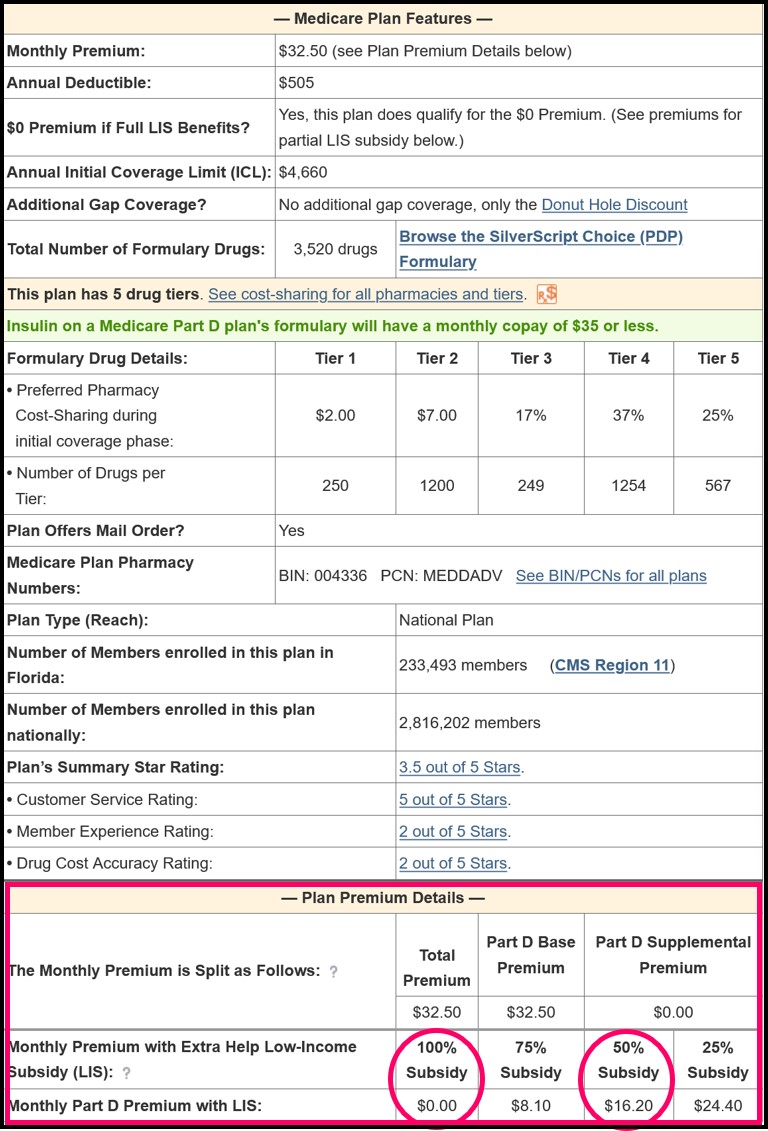

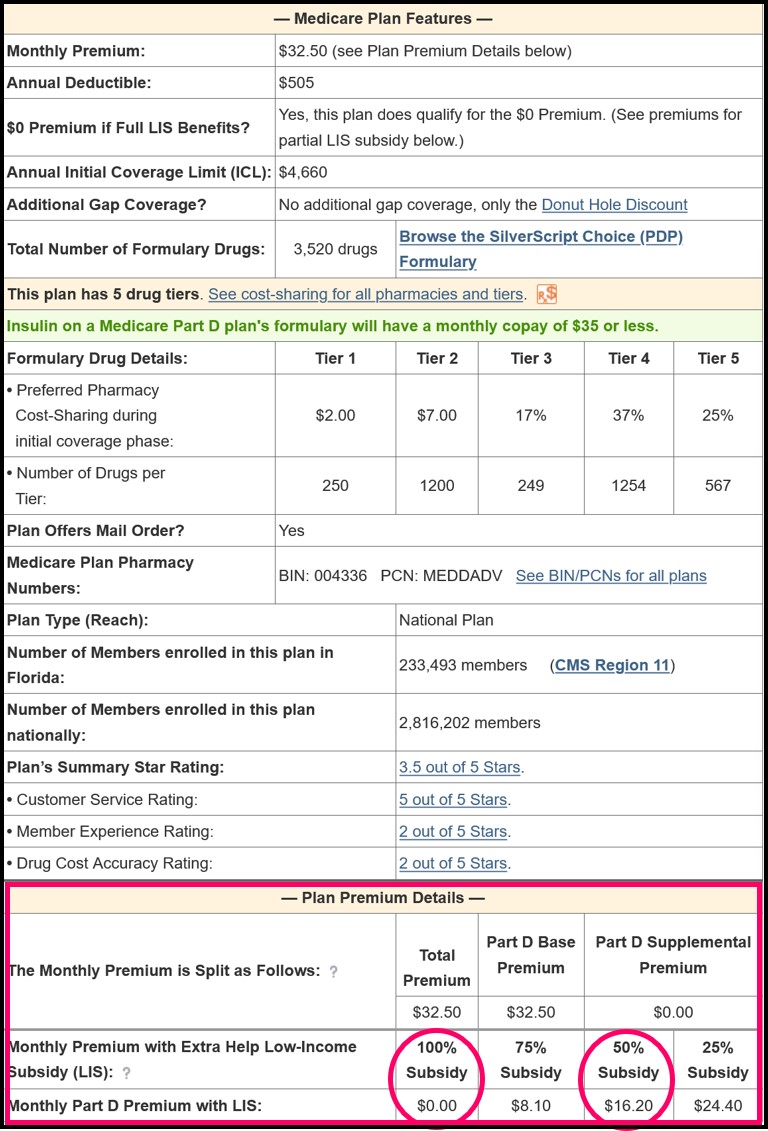

So, if you chose to enroll in the 2023 SilverScript Choice (PDP) Medicare Part D plan that has a $32.50 premium, you would pay a $0 premium.

However, in the same situation, if you enrolled into the 2023 Humana Basic Rx Plan (PDP) that has a $64.30 premium, you would pay $28.40 per month premium (the $64.30 premium - the $35.92 state benchmark premium rounded).

Example: Your Medicare Part D premium when you are qualified for less than 100% LIS

If you no longer qualify for full Extra Help Benefits (less than 100%), you may be paying a higher portion of your Medicare Part D plan's premium - even when the Medicare Part D prescription drug plan qualifies for the $0 monthly Low-Income Subsidy premium.

Using the same above example of the Florida 2023 SilverScript Choice (PDP) Medicare Part D plan that has a $32.50 premium, you would pay a $0 premium with full (100%) Extra Help benefits.

But, if you were eligible for only partial Extra Help benefits, you would pay a higher premium (although still less than the full $32.50 premium). In our example, if you qualified for 50% Extra Help, you would pay a premium of $16.20.

Example: Paying the premium balance when you are qualified for full Extra Help, but you have chosen a Medicare Part D plan with a premium well above the state benchmark premium.

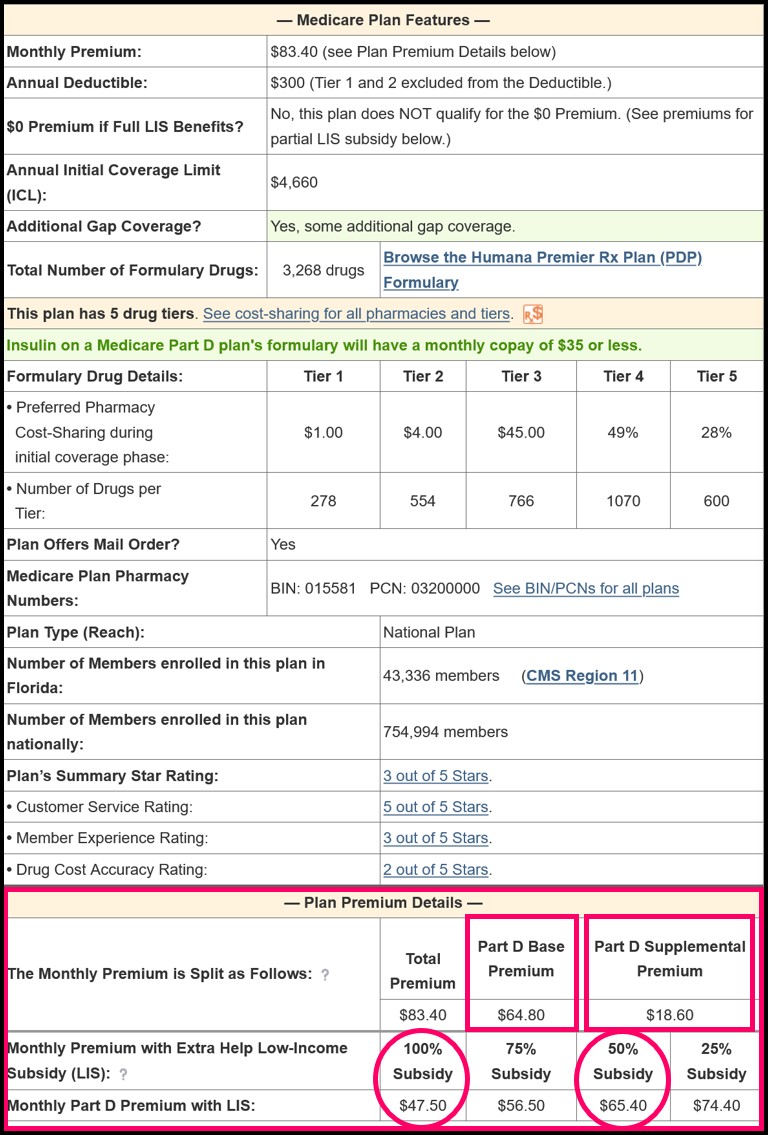

In this example, if you qualify for full Extra Help benefits, and your state has a LIS $0 premium benchmark of $35.92, - and you wish to join a Medicare Part D plan with a premium of $83.40 – you will not pay the full $83.40 premium with your LIS status, but instead, you will pay only a portion of the total premium.

In this example, of the $83.40 total premium, $64.80 is the base premium and this base premium is over the state’s $35.92 benchmark premium . . .

So if you receive 100% Extra Help (or are dual Medicare/Medicaid eligible), you will pay the portion of the Base Premium over the benchmark plus the Supplemental premium. That is, the amount of the base premium that is not covered by the state benchmark premium + the supplemental premium, in this example $47.50, as shown in the graphic.

If you no longer qualify for full Extra Help Benefits (less than 100%), you may be paying a higher portion of your Medicare Part D plan's premium - even when the Medicare Part D prescription drug plan qualifies for the $0 monthly Low-Income Subsidy premium.

Using the same above example of the Florida 2023 SilverScript Choice (PDP) Medicare Part D plan that has a $32.50 premium, you would pay a $0 premium with full (100%) Extra Help benefits.

But, if you were eligible for only partial Extra Help benefits, you would pay a higher premium (although still less than the full $32.50 premium). In our example, if you qualified for 50% Extra Help, you would pay a premium of $16.20.

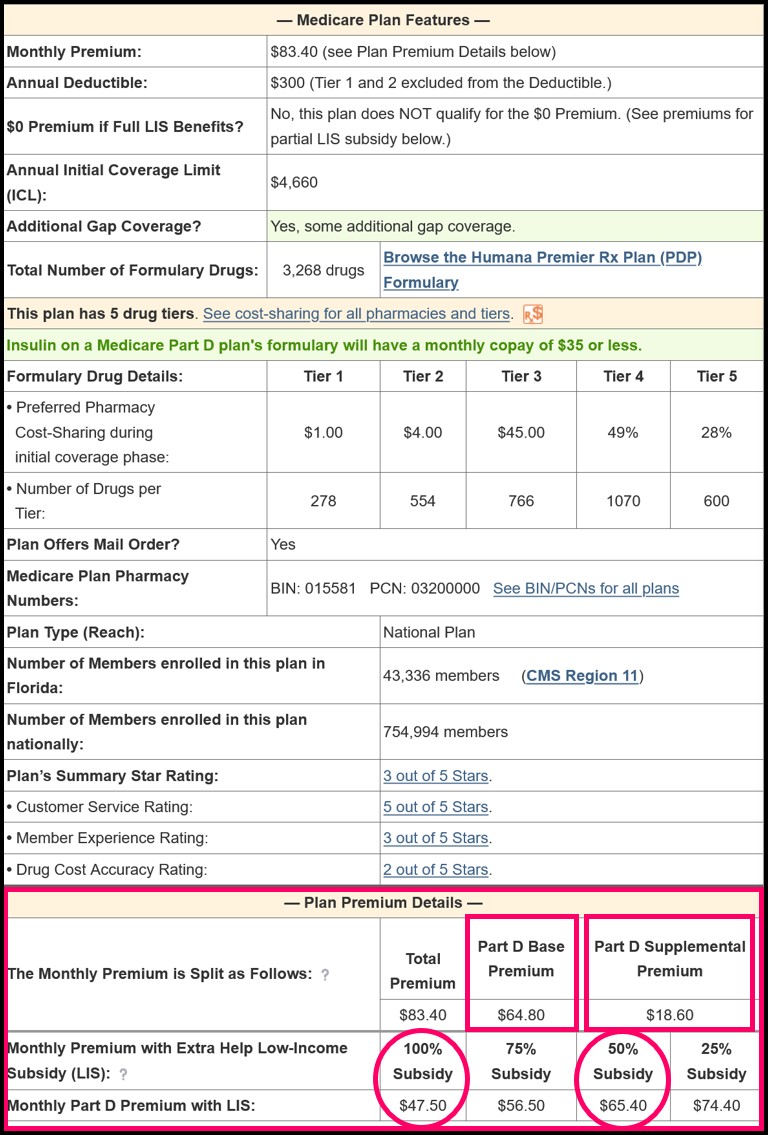

Example: Paying the premium balance when you are qualified for full Extra Help, but you have chosen a Medicare Part D plan with a premium well above the state benchmark premium.

In this example, if you qualify for full Extra Help benefits, and your state has a LIS $0 premium benchmark of $35.92, - and you wish to join a Medicare Part D plan with a premium of $83.40 – you will not pay the full $83.40 premium with your LIS status, but instead, you will pay only a portion of the total premium.

In this example, of the $83.40 total premium, $64.80 is the base premium and this base premium is over the state’s $35.92 benchmark premium . . .

So if you receive 100% Extra Help (or are dual Medicare/Medicaid eligible), you will pay the portion of the Base Premium over the benchmark plus the Supplemental premium. That is, the amount of the base premium that is not covered by the state benchmark premium + the supplemental premium, in this example $47.50, as shown in the graphic.

$64.80 Base Premium - $35.92 Benchmark Premium

+ $18.60 Supplemental Premium

------------------------------------------------------------------

= $47.48 (rounded to $47.50)

Browse FAQ Categories

Compare Discounted Medication Prices

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service