Standard Medicare Part D coverage 2006 to 2023

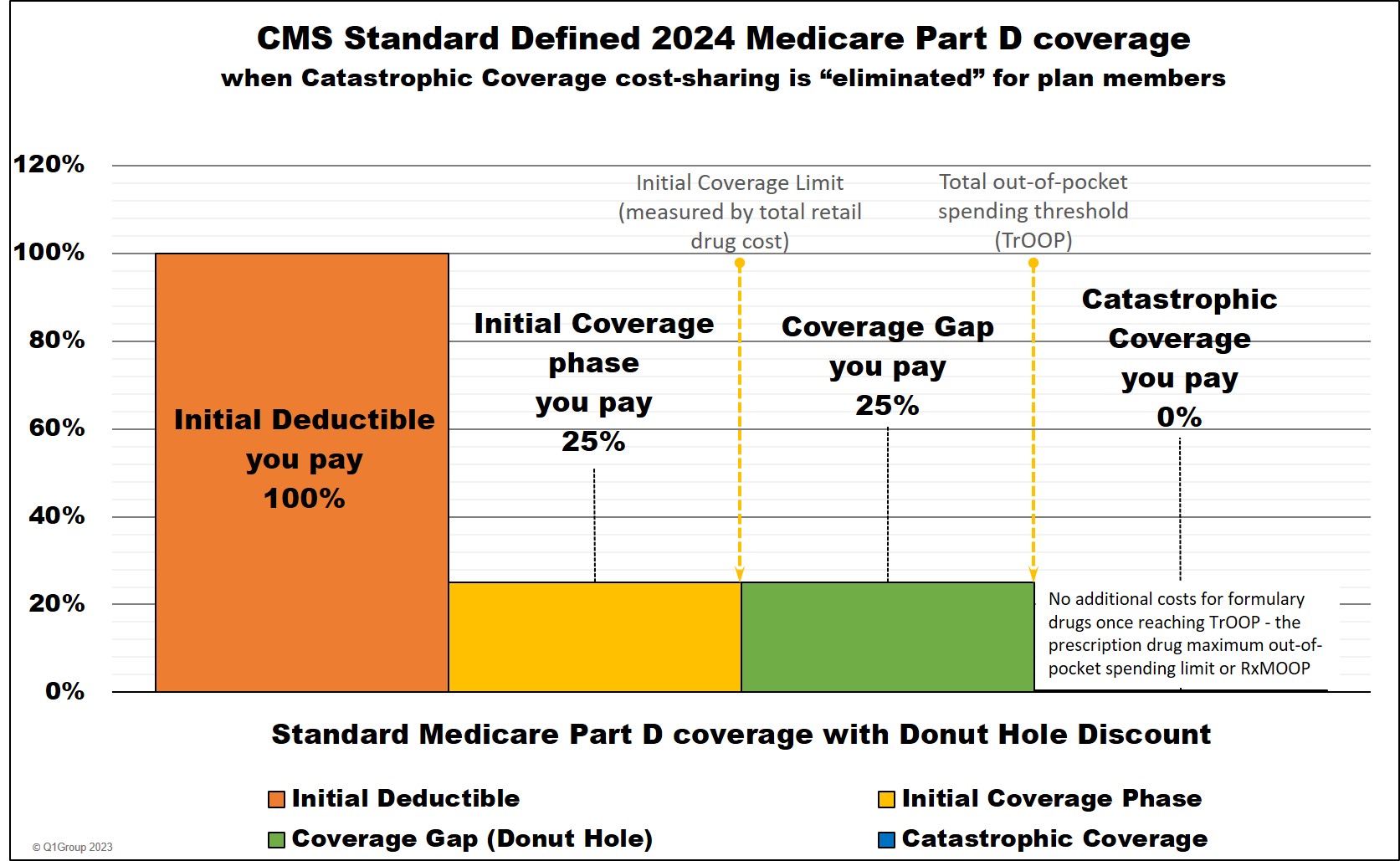

Standard 2024 Medicare Part D coverage

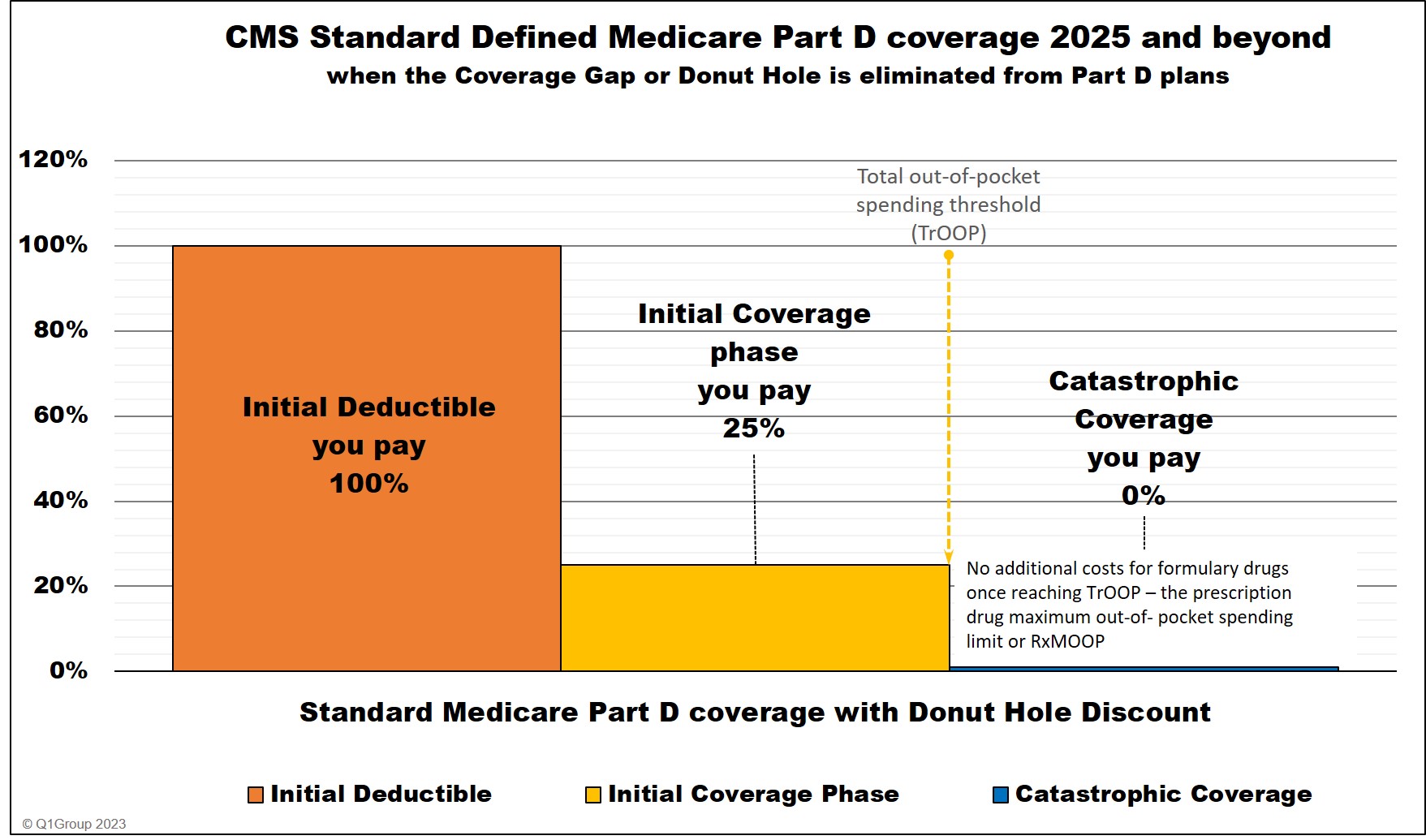

Standard Medicare Part D coverage 2025 and beyond

As noted by the Centers for Medicare and Medicaid Services (CMS), a plan with creditable prescription drug coverage meets the following requirements:

1) Provides coverage for brand and generic prescriptions;Sources include:

2) Provides reasonable access to retail providers;

3) The plan is designed to pay on average at least 60% of participants’ prescription drug expenses; and

4) Satisfies at least one of the following:

a) The prescription drug coverage has no annual benefit maximum benefit or a maximum annual benefit payable by the plan of at least $25,000, or

b) The prescription drug coverage has an a expectation that the amount payable by the plan will be at least $2,000 annually per Medicare eligible individual.

c) [Health plans with integrated healthcare features, such as dental and medical] For entities that have integrated health coverage, the integrated health plan has no more than a $250 deductible per year, has no annual benefit maximum or a maximum annual benefit payable by the plan of at least $25,000 and has no less than a $1,000,000 lifetime combined benefit maximum.

(An integrated plan is any plan of benefits that is offered to a Medicare eligible in where the prescription drug benefit is combined with other coverage offered by the entity (i.e., medic dental, vision, etc.) and the plan has all of the following plan provisions:

1) a combined plan year deductible for all benefits under the plan,

2) a combined annual benefit maximum for all benefits under the plan, and

3) a combined lifetime benefit maximum for all benefits under the plan.

A prescription drug plan that meets the above parameters is considered an integrated plan for the purpose of using the simplified method and would have to meet steps 1, 2, 3 and 4(c) of the simplified method If it does not meet all of the criteria, then it is not considered to be an integrated plan and would have to meet steps 1, 2, 3 and either 4(a) or 4(b).)"

CMS, Creditable Coverage Simplified Determination (September 18, 2009)

https://www.cms.gov/ medicare/ prescription-drug-coverage/ creditablecoverage/ cownloads/ ccsimplified091809.pdf

https://www.cms.gov/medicare/prescription-drug-coverage/creditablecoverage/ downloads/whatiscreditablecoverage.pdf

If your Employer drug Plan meets minimum requirements . . .

If your current employer/union coverage is at least as good as the standard Medicare drug coverage (this is called creditable):

- You can keep the employer drug coverage - as long as it is still offered.

-

You won't have to pay a penalty if you drop or lose your coverage.

But ... if you involuntarily lose the coverage, you must join a Medicare drug plan with an effective date that is within 60 days of the coverage end date. If you chose to drop the coverage, you must join a Medicare drug plan within 3 months of dropping the coverage. However, if you do not enroll in a Medicare drug plan and have a period of 63 days or longer without coverage that is as good as Medicare's coverage, you may have to pay a late-enrollment penalty when you do enroll.

Important: Keep a copy of the "creditable coverage" notice

from your employer that specifically states that you have creditable

drug coverage.

If you join a Medicare drug plan after you are first eligible, you'll

need to provide this letter of creditable coverage as proof - or

otherwise face the late-enrollment penalty.

Even if you provide the letter of creditable coverage, your newly-chosen

Medicare Part D drug plan may contact you for additional information.

The Medicare Part D plan will determine whether you have had continuous

creditable drug coverage and send this information to Medicare.

If your Employer drug Plan does not meets minimum Part D requirements . . .

If your current employer/union coverage is not at least as good as the standard Medicare drug coverage (non-creditable), you may be able to:

-

Keep your current employer/union drug plan and join a Medicare drug plan that gives you more complete coverage - or

-

Keep only your current employer/union drug plan and not enroll in a Medicare Part D plan. But ... if you decide to join a Medicare drug plan at a later date, after you are first eligible, you will have to pay a late-enrollment penalty.

-

Drop your current coverage and join a Medicare drug plan or a Medicare Advantage drug plan.

Important: If you drop your employer/union coverage, you may not be able to get it back. You may not be able to drop your employer/union drug coverage without also dropping your employer/union health coverage.

In some cases, employers or unions have rules that say you cannot have both a Medicare drug plan and your employer/union plan. Your current coverage may end for you and your dependents. You should talk to your employer/union and/or the benefits administrator about all of your options.

If you are covered under COBRA, you should check with your former employer/union or the benefits administrator to see if the drug coverage is creditable.

Please note that Workers' Compensation is not considered creditable coverage.Sources include:

CMS, "Your Guide to Medicare Drug Coverage" (Revised July 2022)

https://www.medicare.gov/publications/ 11109-Medicare-Drug-Coverage-Guide.pdf

If you didn't receive a creditable coverage notice about your drug plan:

You must request in writing a copy of the creditable coverage notice

from your employer/union. You must send it by certified/registered mail.

Keep a copy of your letter for your records.

As noted by the Centers for Medicare and Medicaid Services (CMS):

"The Medicare Modernization Act (MMA) requires entities (whose policies include prescription drug coverage) to notify Medicare eligible policyholders whether their prescription drug coverage is creditable coverage, which means that the coverage is expected to pay on average as much as the standard Medicare prescription drug coverage.Additional Sources include:

For these entities, there are two disclosure requirements:

1. The first disclosure requirement is to provide a written disclosure notice to all Medicare eligible individuals annually who are covered under its prescription drug plan, prior to October 15th each year and at various times as stated in the regulations, including to a Medicare eligible individual when he/she joins the plan. This disclosure must be provided to Medicare eligible active working individuals and their dependents, Medicare eligible COBRA individuals and their dependents, Medicare eligible disabled individuals covered under your prescription drug plan and any retirees and their dependents. The MMA imposes a late enrollment penalty on individuals who do not maintain creditable coverage for a period of 63 days or longer following their initial enrollment period for the Medicare prescription drug benefit. Accordingly, this information is essential to an individual's decision whether to enroll in a Medicare Part D prescription drug plan.

2. The second disclosure requirement is for entities to complete the Online Disclosure to CMS Form to report the creditable coverage status of their prescription drug plan. The Disclosure should be completed annually no later than 60 days from the beginning of a plan year (contract year, renewal year), within 30 days after termination of a prescription drug plan, or within 30 days after any change in creditable coverage status. -- This requirement does not pertain to the Medicare beneficiaries for whom entities are receiving the Retiree Drug Subsidy (RDS)."

Quick Facts about Medicare’s New Coverage for Prescription Drugs for People who have Prescription Coverage from an Employer or

Union (May 2005) - http://www.medicare.gov/Publications/ pubs/pdf/11107.pdf (no longer online)

https://www.cms.gov/ Medicare/ Prescription-Drug-Coverage /CreditableCoverage

[The Medicare Prescription Drug, Improvement, and Modernization Act of 2003]

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2025 Medicare Part D plan Facts & Figures

- 2025 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2024/2025 Medicare Part D plan changes

- 2025 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2024 to 2025

- Drug Finder: 2025 Medicare Part D drug search

- Formulary Browser: View any 2025 Medicare plan's drug list

- 2025 Browse Drugs By Letter

- Guide to Consumer Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2026 Medicare Part D Reminder Service