Archive: If the total cost of one formulary drug purchase takes me into the Medicare Part D Donut Hole, will I pay the copay for my drug plus the discounted cost that is over the coverage limit?

Yes, you are responsible for the copayment of the formulary drug purchase in the Initial Coverage phase - plus - the cost-sharing on the amount of the purchase price that exceeds your Medicare Part D plan's Initial Coverage Limit ($5,030 in 2024) and extends over into the Coverage Gap (where the balance of your formulary drug purchase will receive the Donut Hole discount).

As background, this question is an example of a "Straddle Claim" - where a single Part D prescription purchase straddles (or overlaps) two or more phases of your Medicare Part D prescription drug coverage. for example, here is what you might pay for your $400 Tier 3 Part D drug (with a $35 copay) throughout different parts of your Medicare drug coverage: (1) Initial Deductible, (2) Initial Coverage, (3) Coverage Gap, and (4) a Straddle Claim:

When you have a Part D drug purchase that crosses two (or more phases) of your Part D plan coverage, both the amount of your copayment or cost-sharing for your medication purchase and how close you were to reaching your drug plan's Initial Coverage Limit will be important in the actual drug cost-sharing calculation - or what you actually pay at the pharmacy.

When you have a Part D drug purchase that crosses two (or more phases) of your Part D plan coverage, both the amount of your copayment or cost-sharing for your medication purchase and how close you were to reaching your drug plan's Initial Coverage Limit will be important in the actual drug cost-sharing calculation - or what you actually pay at the pharmacy.

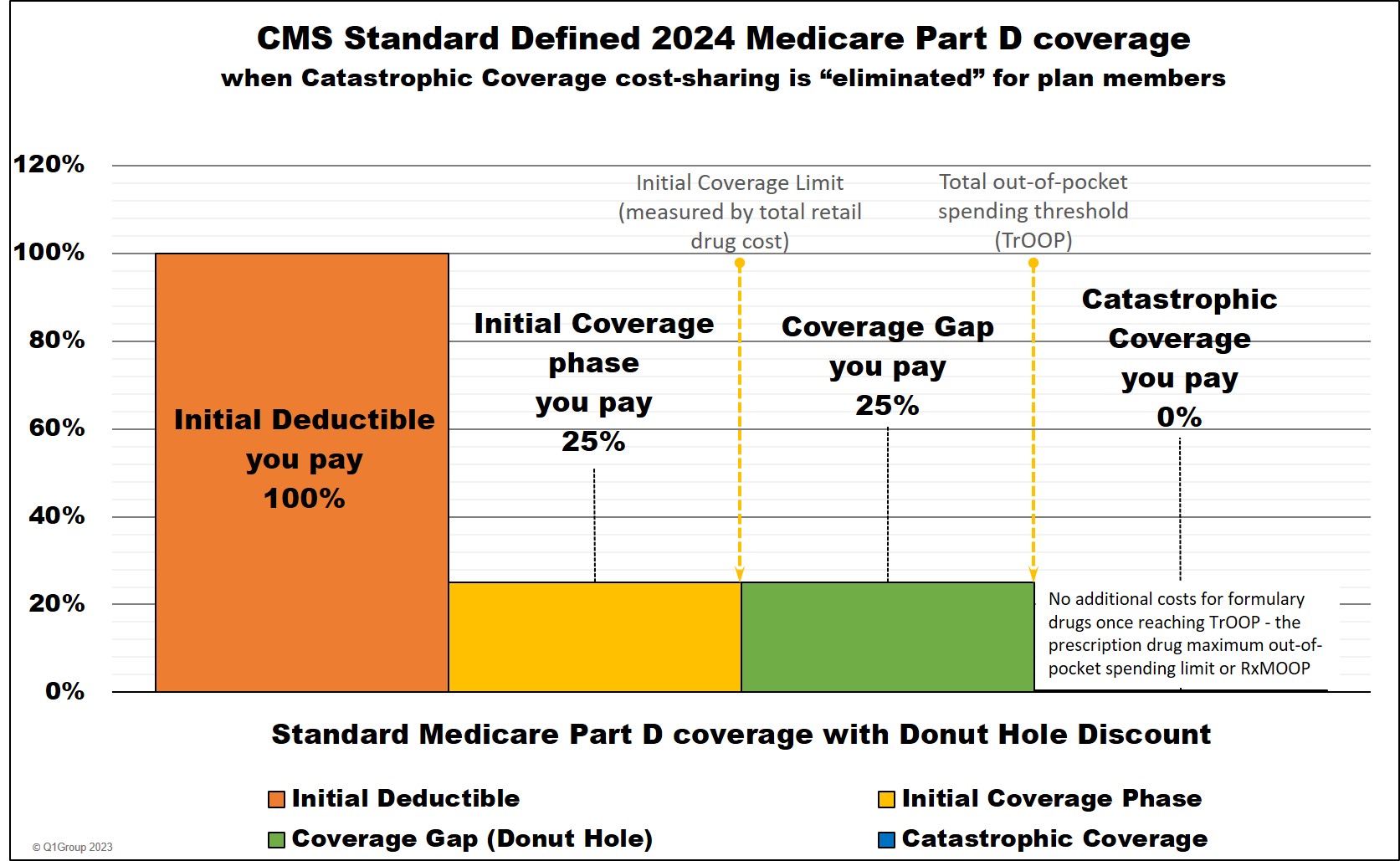

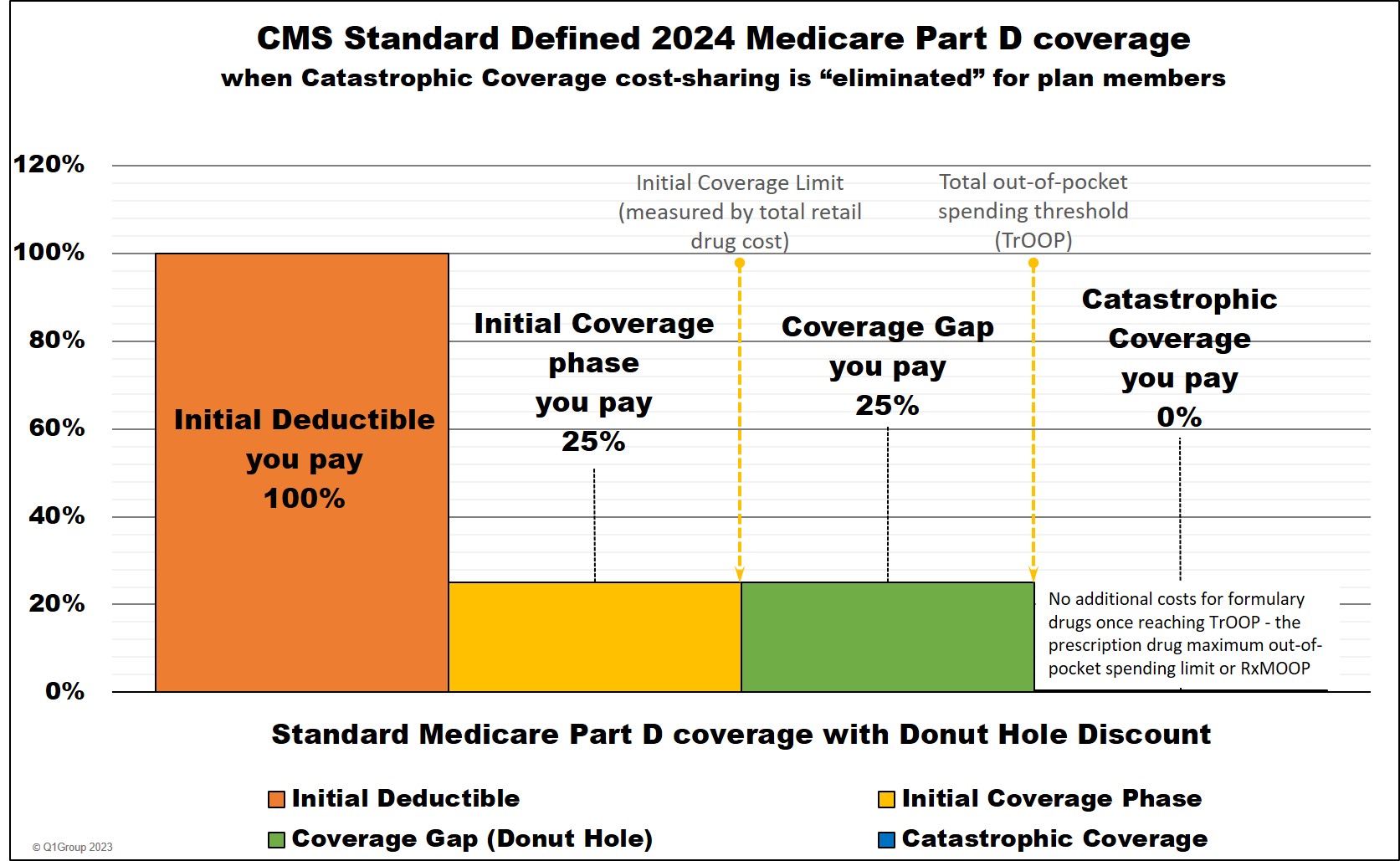

2024 Medicare Part D coverage

Example #1 - 2024:

If you purchased a tier 3 brand-name formulary drug with a $135 copay (the drug has a $700 retail cost) – and in 2024, you already purchased formulary Part D drugs with retail costs totaling $4,730, then you only need $300 more to reach the 2024 initial Coverage Limit of $5,030. (Click here to read more about the 2024 Initial Coverage Limits.)

This means you have only $300 in retail cost until reaching the Coverage Gap or Donut Hole – your cost-sharing will be calculated by adding your Initial Coverage Limit copay ($135 in our example) to the 25% of the drug’s retail cost that carried over into the Coverage Gap (in this example, $400).

So, in our example, $300 of the drug’s $700 retail price will meet your plan’s $5,030 Initial Coverage Limit with the remaining retail cost of $400 ($700 - $300) carrying over into the Coverage Gap where you automatically received the 75% Donut Hole discount on the remaining $400 retail-cost balance for an added cost of $100 (25% of $400).

This means that your total drug cost-sharing for this 2024 straddle claim is $135 + $100 = $235. Your next purchase of this same drug will no longer be a straddle claim and will fall only in the Coverage Gap where you will pay 25% of the full retail price of $700 or $175 ($700 x 25%).

In summary, your cost for this drug will change as you move through your 2024 Part D coverage phases:

- Cost-sharing of purchase solely in the Initial Coverage Phase: $135

- Cost-sharing of this example straddle claim: $235 ($135 + $100)

- Cost-sharing of purchase solely in the Coverage Gap: $175

(Note: If you reach the 2024 Catastrophic Coverage phase, the final phase of your Part D coverage, your cost will be $0 for all formulary drugs through the remainder of the year.)

Bottom Line: The cost of your covered Medicare Part D drugs could change as you moved through the different phases of your 2024 Medicare Part D plan coverage.

Question: Can the cost of my "straddle claim" actually be greater than my plan's retail drug cost?

No. Behind the scenes of your prescription purchase, your Medicare drug plan checks to make sure you will never pay more for your medications than the negotiated retail drug price by using the "lesser of" logic - meaning, you will always pay the "lessor of" either the retail drug price or your plan's cost-sharing - you will never be charged more than retail for your medication.

Since, in this example, you would pay $235 ($135 + $100) and this cost is less than the retail cost of $700 - then the lesser-of rule is satisfied. However, if the total cost-sharing (copay plus what you pay with the Donut Hole discount) exceeded the retail drug cost, you only will pay the retail drug cost.

To see another straddle claim example, please see our Frequently Asked Question: "How does the Medicare Donut Hole Discount apply to a drug purchases that crosses from the Initial Coverage Phase into the Coverage Gap?" (this FAQ also includes CMS support of the straddle claim calculations).

Click here if you would like to see another FAQ example and explanation of what happens when you buy a medication and the cost moves you into the Donut Hole portion of your Medicare Part D plan.

Important Update: 2024 is the last year for the Coverage Gap or Donut Hole - and straddle claims will change.

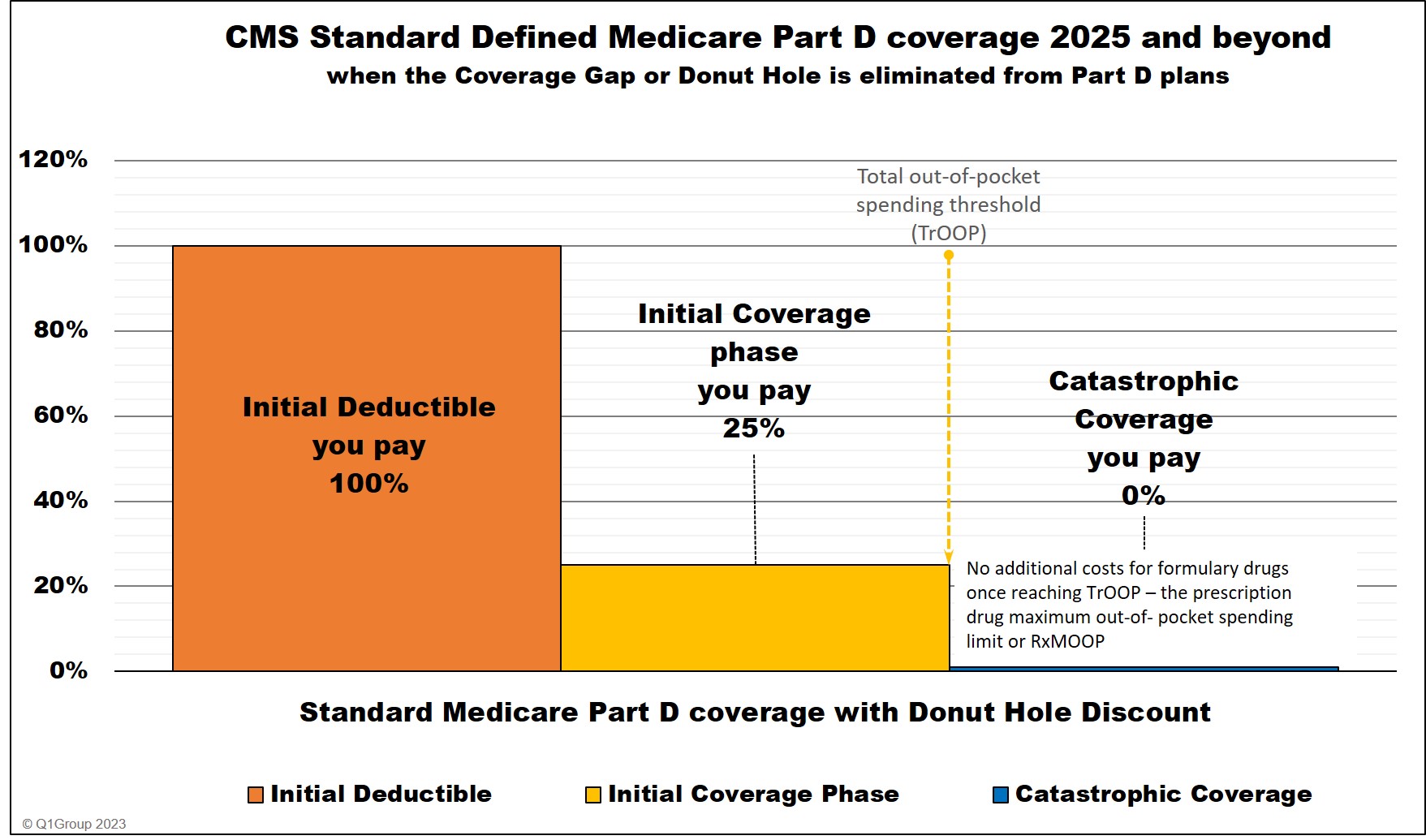

Starting in 2025, the Inflation Reduction Act (IRA) eliminates the Coverage Gap (Donut Hole). In 2025 and beyond, Medicare Part D beneficiaries will stay in the Initial Coverage phase until their out-of-pocket spending for Part D formulary drugs (TrOOP) reaches the maximum out-of-pocket spending limit for Part D formulary drugs (RxMOOP) - which is set at $2,000 for 2025.

After reaching RxMOOP, Medicare Part D beneficiaries will enter Catastrophic Coverage and have a $0 copay (no additional costs) for all formulary Medicare Part D drugs through the remainder of the year.

See the next section for how a similar transaction in 2025 is calculated.

As background, this question is an example of a "Straddle Claim" - where a single Part D prescription purchase straddles (or overlaps) two or more phases of your Medicare Part D prescription drug coverage. for example, here is what you might pay for your $400 Tier 3 Part D drug (with a $35 copay) throughout different parts of your Medicare drug coverage: (1) Initial Deductible, (2) Initial Coverage, (3) Coverage Gap, and (4) a Straddle Claim:

2024 Medicare Part D coverage

Example #1 - 2024:

If you purchased a tier 3 brand-name formulary drug with a $135 copay (the drug has a $700 retail cost) – and in 2024, you already purchased formulary Part D drugs with retail costs totaling $4,730, then you only need $300 more to reach the 2024 initial Coverage Limit of $5,030. (Click here to read more about the 2024 Initial Coverage Limits.)

This means you have only $300 in retail cost until reaching the Coverage Gap or Donut Hole – your cost-sharing will be calculated by adding your Initial Coverage Limit copay ($135 in our example) to the 25% of the drug’s retail cost that carried over into the Coverage Gap (in this example, $400).

So, in our example, $300 of the drug’s $700 retail price will meet your plan’s $5,030 Initial Coverage Limit with the remaining retail cost of $400 ($700 - $300) carrying over into the Coverage Gap where you automatically received the 75% Donut Hole discount on the remaining $400 retail-cost balance for an added cost of $100 (25% of $400).

This means that your total drug cost-sharing for this 2024 straddle claim is $135 + $100 = $235. Your next purchase of this same drug will no longer be a straddle claim and will fall only in the Coverage Gap where you will pay 25% of the full retail price of $700 or $175 ($700 x 25%).

In summary, your cost for this drug will change as you move through your 2024 Part D coverage phases:

- Cost-sharing of purchase solely in the Initial Coverage Phase: $135

- Cost-sharing of this example straddle claim: $235 ($135 + $100)

- Cost-sharing of purchase solely in the Coverage Gap: $175

(Note: If you reach the 2024 Catastrophic Coverage phase, the final phase of your Part D coverage, your cost will be $0 for all formulary drugs through the remainder of the year.)

Bottom Line: The cost of your covered Medicare Part D drugs could change as you moved through the different phases of your 2024 Medicare Part D plan coverage.

Question: Can the cost of my "straddle claim" actually be greater than my plan's retail drug cost?

No. Behind the scenes of your prescription purchase, your Medicare drug plan checks to make sure you will never pay more for your medications than the negotiated retail drug price by using the "lesser of" logic - meaning, you will always pay the "lessor of" either the retail drug price or your plan's cost-sharing - you will never be charged more than retail for your medication.

Since, in this example, you would pay $235 ($135 + $100) and this cost is less than the retail cost of $700 - then the lesser-of rule is satisfied. However, if the total cost-sharing (copay plus what you pay with the Donut Hole discount) exceeded the retail drug cost, you only will pay the retail drug cost.

To see another straddle claim example, please see our Frequently Asked Question: "How does the Medicare Donut Hole Discount apply to a drug purchases that crosses from the Initial Coverage Phase into the Coverage Gap?" (this FAQ also includes CMS support of the straddle claim calculations).

Click here if you would like to see another FAQ example and explanation of what happens when you buy a medication and the cost moves you into the Donut Hole portion of your Medicare Part D plan.

Important Update: 2024 is the last year for the Coverage Gap or Donut Hole - and straddle claims will change.

Starting in 2025, the Inflation Reduction Act (IRA) eliminates the Coverage Gap (Donut Hole). In 2025 and beyond, Medicare Part D beneficiaries will stay in the Initial Coverage phase until their out-of-pocket spending for Part D formulary drugs (TrOOP) reaches the maximum out-of-pocket spending limit for Part D formulary drugs (RxMOOP) - which is set at $2,000 for 2025.

After reaching RxMOOP, Medicare Part D beneficiaries will enter Catastrophic Coverage and have a $0 copay (no additional costs) for all formulary Medicare Part D drugs through the remainder of the year.

See the next section for how a similar transaction in 2025 is calculated.

2025 Medicare Part D coverage

Example #2 - Medicare Part D coverage starting in 2025:

If you purchased a tier 3 brand-name formulary drug with a $135 copay (the drug has a $700 retail cost) – and in 2025, you have already spent $1,900 out-of-pocket for your Medicare Part D drugs – you have only $100 of out-of-pocket spending before reaching the $2,000 maximum Part D drug out-of-pocket spending limit or (RxMOOP).

So, in our example, $100 of the drug’s $135 copay will meet your plan’s $2,000 out-of-pocket spending limit - and you will have no additional costs for 2025 Medicare Part D formulary drugs after reaching the $2,000 out-of-pocket spending limit.

This means that your total drug cost-sharing for this $700 drug purchase would be $100 instead of the $135 copay.

In summary, your cost for this drug could change as you move through your 2025 Part D coverage phases:

- Cost-sharing of purchase solely in the Initial Coverage Phase: $135

- Cost-sharing of this example : $100 ($2,000 - $1,900)

Bottom Line: The cost of your covered Medicare Part D drugs could change as you moved through the two phases of your 2025 Medicare Part D plan coverage - however, in 2025, Medicare will allow people to "smooth out" their formulary drug payments so that your cost for formulary drugs will be more consistent (but maybe not entirely consistent) throughout the year.

Medicare Part D History: Medicare Part D coverage 2023

Example #3 - Looking back at 2023:

If you purchased a tier 3 brand-name formulary drug with a $135 copay (the drug had a $700 retail cost) – and in 2023 you had already purchased drugs with a retail cost totaling $4,360 – and your plan’s 2023 Initial Coverage Limit is $4,660 (you have only $300 until reaching the Coverage Gap or Donut Hole) – your cost-sharing will be calculated by adding your Initial Coverage Limit copay ($135 in our example) and 25% of the drug’s retail cost that carried over into the Coverage Gap.

So, in our example, $300 of the drug’s $700 retail price will meet your plan’s $4,660 Initial Coverage Limit with the remaining retail cost of $400 ($700 - $300) carrying over into the Coverage Gap where you automatically received the 75% Donut Hole discount on this retail-cost balance for an added cost of $100 (25% of $400).

This means that your total drug cost-sharing for this straddle claim is $135 + $100 = $235. Your next purchase will no longer be a straddle claim and will fall only in the Coverage Gap where you will pay 25% of the full retail price of $700 or $175 ($700 x 25%).

In summary, your cost for this drug will change as you move through your 2023 Part D coverage phases:

- Cost-sharing of purchase solely in the Initial Coverage Phase: $135

- Cost-sharing of this example Straddle Claim: $235 ($135 + $100)

- Cost-sharing of purchase solely in the Coverage Gap: $175

Bottom Line: The cost of your covered Medicare Part D drugs could change as you moved through the different phases of your 2023 Medicare Part D plan coverage.

Example #3 - Looking back at 2023:

If you purchased a tier 3 brand-name formulary drug with a $135 copay (the drug had a $700 retail cost) – and in 2023 you had already purchased drugs with a retail cost totaling $4,360 – and your plan’s 2023 Initial Coverage Limit is $4,660 (you have only $300 until reaching the Coverage Gap or Donut Hole) – your cost-sharing will be calculated by adding your Initial Coverage Limit copay ($135 in our example) and 25% of the drug’s retail cost that carried over into the Coverage Gap.

So, in our example, $300 of the drug’s $700 retail price will meet your plan’s $4,660 Initial Coverage Limit with the remaining retail cost of $400 ($700 - $300) carrying over into the Coverage Gap where you automatically received the 75% Donut Hole discount on this retail-cost balance for an added cost of $100 (25% of $400).

This means that your total drug cost-sharing for this straddle claim is $135 + $100 = $235. Your next purchase will no longer be a straddle claim and will fall only in the Coverage Gap where you will pay 25% of the full retail price of $700 or $175 ($700 x 25%).

In summary, your cost for this drug will change as you move through your 2023 Part D coverage phases:

- Cost-sharing of purchase solely in the Initial Coverage Phase: $135

- Cost-sharing of this example Straddle Claim: $235 ($135 + $100)

- Cost-sharing of purchase solely in the Coverage Gap: $175

Bottom Line: The cost of your covered Medicare Part D drugs could change as you moved through the different phases of your 2023 Medicare Part D plan coverage.

Browse FAQ Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2025 Medicare Part D plan Facts & Figures

- 2025 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2024/2025 Medicare Part D plan changes

- 2025 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2024 to 2025

- Drug Finder: 2025 Medicare Part D drug search

- Formulary Browser: View any 2025 Medicare plan's drug list

- 2025 Browse Drugs By Letter

- Guide to Consumer Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2026 Medicare Part D Reminder Service