What is the Medicare Part D RxMOOP?

The Inflation Reduction Act

establishes a maximum out-of-pocket limit - or RxMOOP - that a person will pay each year for Medicare Part D prescription drugs covered by their Part D drug plan (either a stand-alone Medicare

Part D prescription drug plan, PDP or Medicare Advantage plan that includes drug coverage, MAPD).

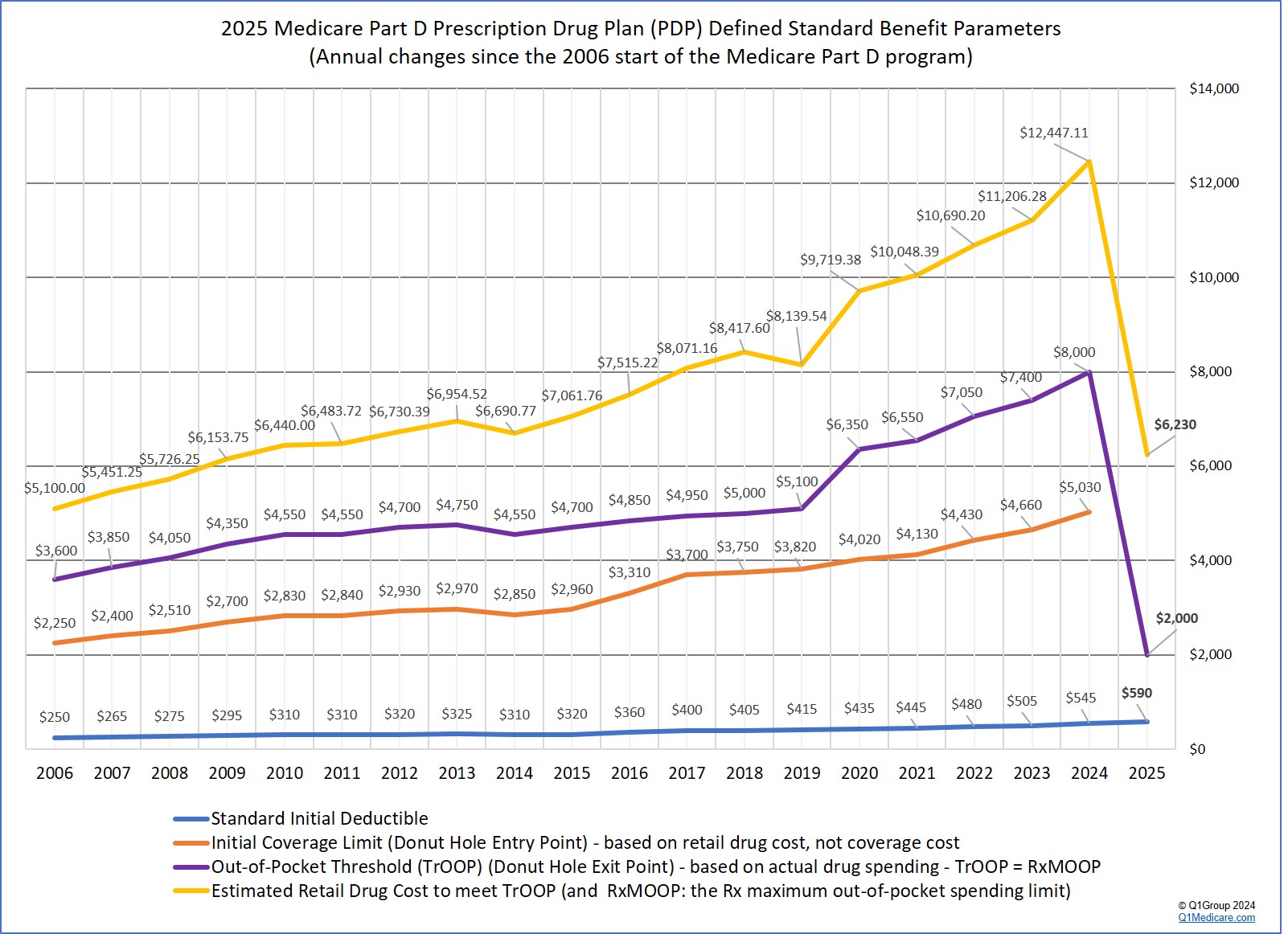

The Medicare Part D RxMOOP will begin first in 2024 and be equivalent to the 2024 Medicare Part D total out-of-pocket spending (TrOOP) threshold of $8,000.

Then in 2025, the annual maximum out-of-pocket spending limit for formulary drugs (RxMOOP) will be reduced to $2,000 and be equivalent to both the 2025 TrOOP threshold (replacing what was the Medicare Part D Initial Coverage Limit (ICL)). Each year thereafter, the RxMOOP will be adjusted (increase or decrease) based on inflation or economic changes. After reaching the RxMOOP, a person will not have additional costs for Part D drugs covered by their Medicare Part D plan. A drug plan member who will exceed the $2,000 RxMOOP will have the option of spreading their prescription drug spending over the entire year to assist with the stabilization of the person's monthly budgeting.

In summary:

(1) 2024 RxMOOP = $8,000 = 2024 TrOOP threshold

In 2024, a Medicare Part D beneficiary will not have any costs after reaching the annual total annual out-of-pocket (TrOOP) threshold of $8,000 (equating to formulary drug purchases with an estimated total retail value of $12,447.11). In other words, after a person reaches the $8,000 TrOOP threshold, instead of entering the Catastrophic Coverage phase, the 5% coinsurance or standard copay will be eliminated for formulary drugs and the person's 2024 maximum out-of-pocket drug cost (RxMOOP) will be capped at the TrOOP threshold.

(2) 2025 RxMOOP = $2,000 = 2025 TrOOP threshold

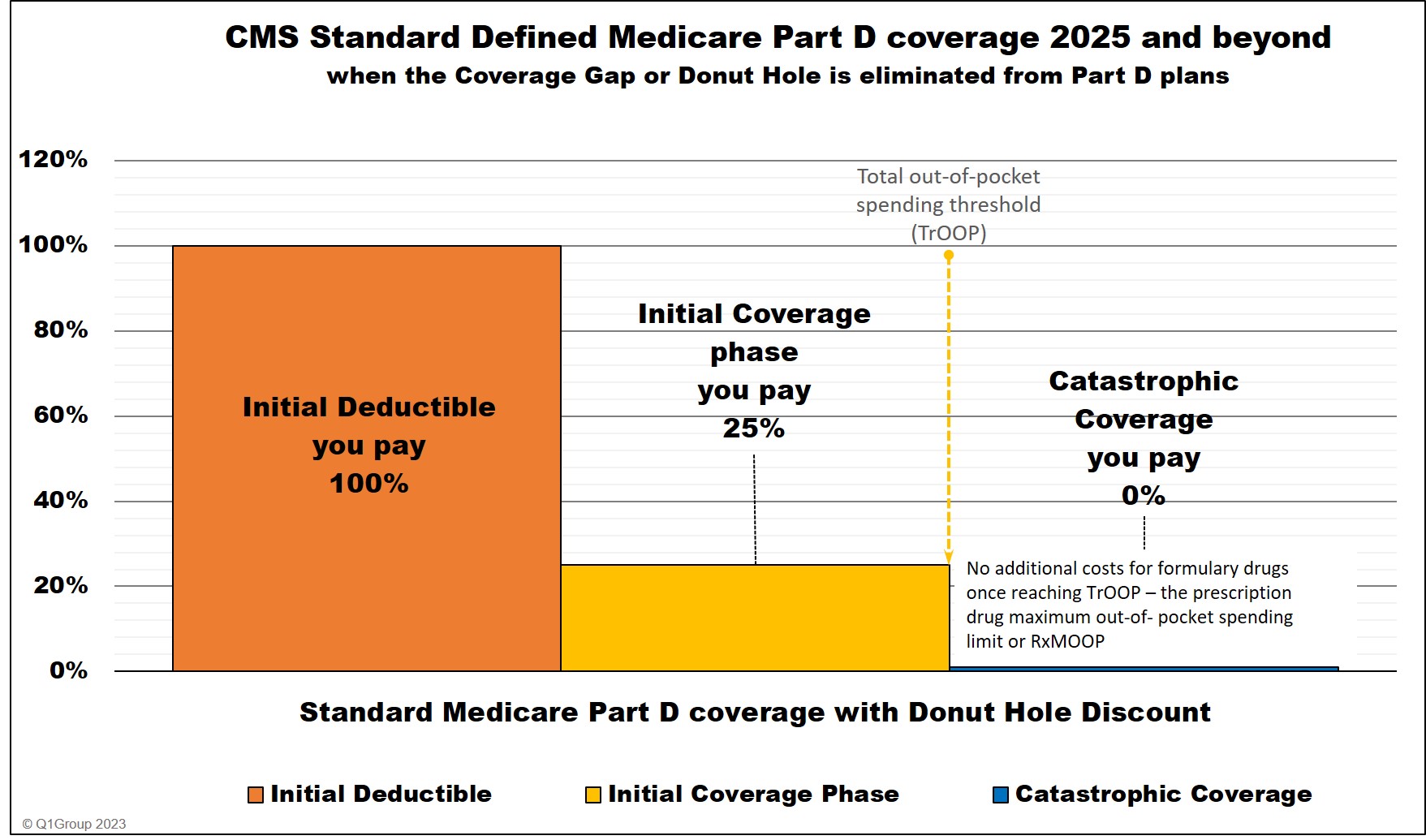

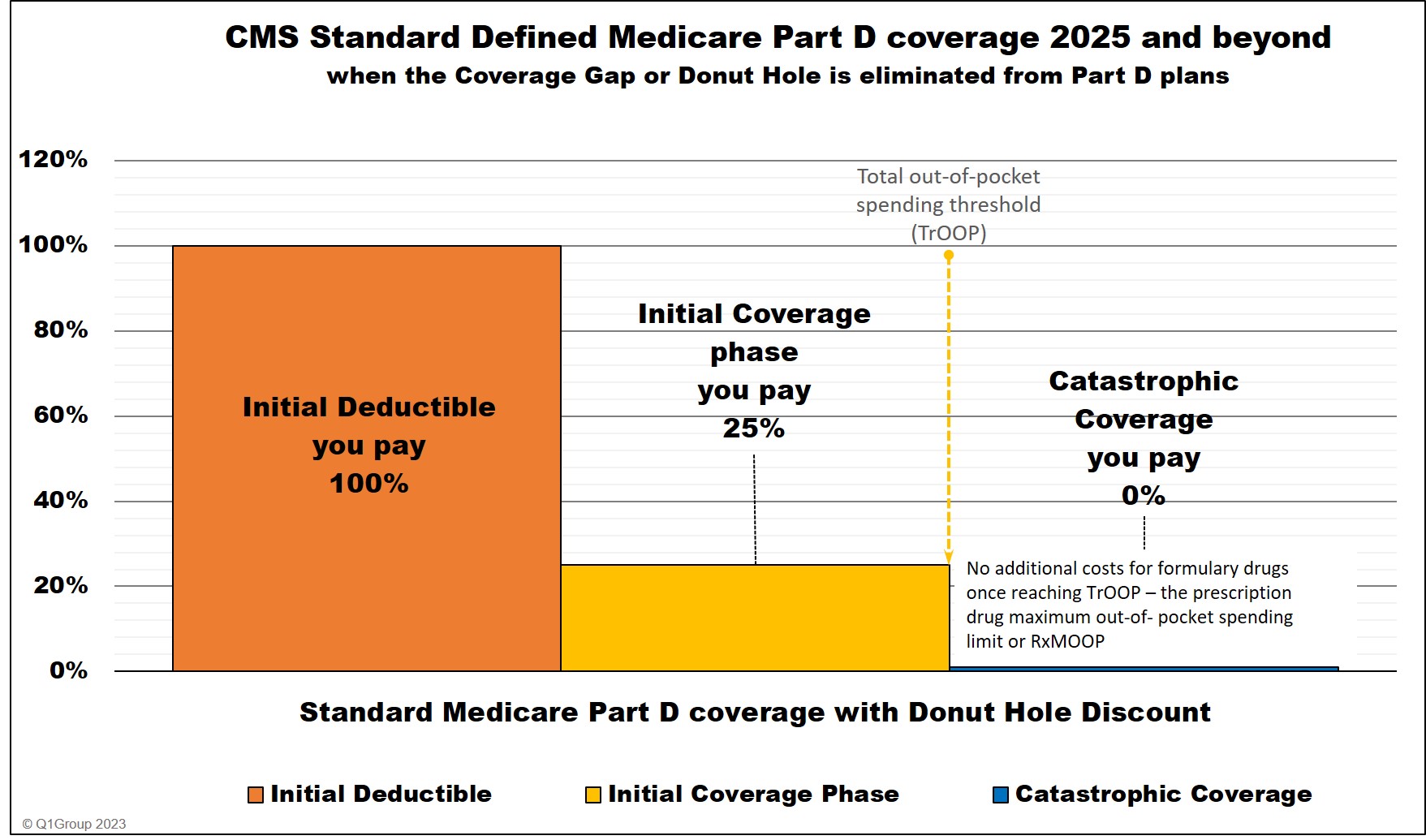

Beginning in 2025, a new Medicare Part D plan design will be established where Medicare Part D plans will have no more than two phases or parts: (1) the initial deductible (if the plan includes a deductible) and (2) an Initial Coverage phase that will continue until the end of the plan year (December 31st) or until the Medicare Part D beneficiary reaches the $2,000 maximum cap on out-of-pocket prescription drug spending (RxMOOP). Again, after reaching the RxMOOP (also known as the TrOOP threshold), the plan member will enter the Catastrophic Coverage phase and have no additional costs for formulary drugs for the remainder of the year.

(3) 2026 and beyond RxMOOP can be more - or less - than $2,000*

Like other Medicare Part D plan parameters, the annual $2,000 RxMOOP can (and probably will) change every year*. Currently, the Catastrophic Coverage threshold (or RxMOOP) is predicted as:

The Medicare Part D RxMOOP will begin first in 2024 and be equivalent to the 2024 Medicare Part D total out-of-pocket spending (TrOOP) threshold of $8,000.

Then in 2025, the annual maximum out-of-pocket spending limit for formulary drugs (RxMOOP) will be reduced to $2,000 and be equivalent to both the 2025 TrOOP threshold (replacing what was the Medicare Part D Initial Coverage Limit (ICL)). Each year thereafter, the RxMOOP will be adjusted (increase or decrease) based on inflation or economic changes. After reaching the RxMOOP, a person will not have additional costs for Part D drugs covered by their Medicare Part D plan. A drug plan member who will exceed the $2,000 RxMOOP will have the option of spreading their prescription drug spending over the entire year to assist with the stabilization of the person's monthly budgeting.

In summary:

(1) 2024 RxMOOP = $8,000 = 2024 TrOOP threshold

In 2024, a Medicare Part D beneficiary will not have any costs after reaching the annual total annual out-of-pocket (TrOOP) threshold of $8,000 (equating to formulary drug purchases with an estimated total retail value of $12,447.11). In other words, after a person reaches the $8,000 TrOOP threshold, instead of entering the Catastrophic Coverage phase, the 5% coinsurance or standard copay will be eliminated for formulary drugs and the person's 2024 maximum out-of-pocket drug cost (RxMOOP) will be capped at the TrOOP threshold.

(2) 2025 RxMOOP = $2,000 = 2025 TrOOP threshold

Beginning in 2025, a new Medicare Part D plan design will be established where Medicare Part D plans will have no more than two phases or parts: (1) the initial deductible (if the plan includes a deductible) and (2) an Initial Coverage phase that will continue until the end of the plan year (December 31st) or until the Medicare Part D beneficiary reaches the $2,000 maximum cap on out-of-pocket prescription drug spending (RxMOOP). Again, after reaching the RxMOOP (also known as the TrOOP threshold), the plan member will enter the Catastrophic Coverage phase and have no additional costs for formulary drugs for the remainder of the year.

(3) 2026 and beyond RxMOOP can be more - or less - than $2,000*

Like other Medicare Part D plan parameters, the annual $2,000 RxMOOP can (and probably will) change every year*. Currently, the Catastrophic Coverage threshold (or RxMOOP) is predicted as:

| Year | Catastrophic Coverage phase threshold (RxMOOP = TrOOP threshold) |

| 2024 | $8,000 |

| 2025 | $2,000 |

| 2026 | $2,000 |

| 2027 | $1,950 |

| 2028 | $1,850 |

| 2029 | $1,800 |

Question: What would be the retail value of the formulary prescriptions needed to reach the 2025 RxMOOP?

The total retail value of formulary drugs that you can purchase before you no longer have any 2025 formulary drug costs will vary with your Medicare drug plan's initial deductible and here are two possibilities:

(1) Retail value of formulary medications of about $6,230 when the drug plan has an standard deductible of $590.

The 2025 Medicare Part D deductible is $590 and a Medicare Part D plan member would need to purchase medication with a retail value of around $6,230 before reaching the $2,000 RxMOOP (assuming a standard 25% coinsurance cost-sharing for all formulary drugs). So a person with a standard $590 deductible using Part D formulary medications with a retail value of over $520 per month would reach the RxMOOP at some time during 2025 and have no additional costs for Part D formulary drugs for the remainder of 2025.

(2) Retail value of formulary medications of about $8,000 for drug plans with a $0 deductible.

If a 2025 Medicare Part D plan (PDP or MAPD) has a $0 deductible and standard 25% coinsurance, a Medicare Part D plan member would need to purchase medication with a retail value of around $8,000 before reaching the annual $2,000 RxMOOP. So a person with a $0 Rx deductible using Part D formulary medications with a retail value of over $667 per month would reach the annual RxMOOP at some time during 2025 and have no additional costs for Part D formulary drugs for the remainder of 2025.

*Section 1860D-2(b)(6) of the Social Security Act notes:

"Annual percentage increase - The annual percentage increase [for Medicare Part D plan parameters] specified in this paragraph for a year is equal to the annual percentage increase in average per capita aggregate expenditures for covered part D drugs in the United States for part D eligible individuals, as determined by the Secretary for the 12-month period ending in July of the previous year using such methods as the [HHS] Secretary shall specify."And the 2023 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, predicts that the Catastrophic Coverage threshold (or RxMOOP) will decline starting 2027 and notes:

"As required by the provisions of the Inflation Reduction Act 2022 (IRA), the initial benefit limit will end at the catastrophic threshold beginning in 2025, and the catastrophic threshold will be reduced to $2,000 in that year. Thereafter, the catastrophic threshold will be indexed by program growth."

Question: Who pays formulary drug costs after RxMOOP is reached?

As noted in our Frequently Asked Question, "Who pays for Medicare Part D Catastrophic Coverage?", starting in 2024, the Inflation Reduction Act (IRA) eliminates beneficiary cost-sharing in the Catastrophic Coverage phase. A Medicare Part D plan member will not have any out-of-pocket costs after reaching the plan's total out-of-pocket (TrOOP) threshold of $8,000. Therefore, 2024 TrOOP threshold will become the prescription drug maximum out-of-pocket spending threshold (RxMOOP).

Below is a chart showing how example formulary drug purchases are paid throughout your Medicare Part D plan coverage -- using the CMS defined standard benefit Medicare Part D plan with a fixed 25% coinsurance for calculating cost-sharing.

* 25% coinsurance

** 75% Brand-name Discount

*** 75% Generic Discount

**** In 2024, the Catastrophic Coverage phase will still exist, but a plan member will not have any out-of-pocket costs for formulary drugs after reaching the plan's $8,000 total out-of-pocket threshold (TrOOP).

_____________________________________

* Important changes coming January 1, 2025:

In 2025, the IRA eliminates the Coverage Gap (Donut Hole) and extends the initial benefit limit until a person has spent $2,000 out-of-pocket for Part D formulary drugs.

The $2,000 will represent the prescription drug maximum out-of-pocket spending limit (RxMOOP). When a person reaches the RxMOOP (that can change from the $2,000 each year), the plan member will not have any additional costs for Part D formulary drugs for the remainder of the year.

At this same time, the IRA will also change the percentage of the drug costs allocated to the brand-name drug manufacturer, Medicare Part D plan, and the federal government.

* 25% coinsurance until you reach the $2,000 RxMOOP, then your Part D formulary drug costs are $0 for the remainder of the year.

** The 10% brand-name drug manufacturer discount applied in the 2025 Initial Coverage Phase (after the standard deductible) does not apply toward the $2,000 TrOOP threshold (https://www.cms.gov/files/document/manufacturer-discount-program-final-guidance.pdf).

**** Starting in 2025, the Coverage Gap (or Donut Hole) will no longer exist for plan members. A plan member will stay in the Initial Coverage phase until exceeding the plan's $2,000 out-of-pocket spending (TrOOP) threshold and enter Catastrophic Coverage where, for the remainder of the year, the person will not have any out-of-pocket costs for formulary drugs. As noted above, the $2,000 out-of-pocket threshold or RxMOOP can change every year.

_____________________________________

See:

https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_of_2022.pdf

https://www.congress.gov/bill/117th-congress/house-bill/5376/text

https://www.cms.gov/files/document/2024-announcement-pdf.pdf

https://www.cms.gov/oact/tr/2023

** https://www.cms.gov/files/document/manufacturer-discount-program-final-guidance.pdf

As noted in our Frequently Asked Question, "Who pays for Medicare Part D Catastrophic Coverage?", starting in 2024, the Inflation Reduction Act (IRA) eliminates beneficiary cost-sharing in the Catastrophic Coverage phase. A Medicare Part D plan member will not have any out-of-pocket costs after reaching the plan's total out-of-pocket (TrOOP) threshold of $8,000. Therefore, 2024 TrOOP threshold will become the prescription drug maximum out-of-pocket spending threshold (RxMOOP).

Below is a chart showing how example formulary drug purchases are paid throughout your Medicare Part D plan coverage -- using the CMS defined standard benefit Medicare Part D plan with a fixed 25% coinsurance for calculating cost-sharing.

|

Beginning January 1, 2024 When you purchase a Part D formulary medication with a $100 retail cost |

||||||

| Retail Cost | You Pay | Your Medicare drug plan pays |

Pharma Mfgr. pays |

Federal Govern. pays |

Amount counted toward your TrOOP Threshold |

|

| Initial Deductible | $100 | $100 | $0 | $0 | $0 | $100 |

| Initial Coverage phase * | $100 | $25 | $75 | $0 | $0 | $25 |

| Coverage Gap - brand-name ** | $100 | $25 | $5 | $70 | $0 | $95 |

| Coverage Gap - generic *** | $100 | $25 | $75 | $0 | $0 | $25 |

| Catastrophic Coverage (brand drug) **** | $100 | $0 | $20 | $0 | $80 | n/a |

| Catastrophic Coverage (generic drug) **** | $100 | $0 | $20 | $0 | $80 | n/a |

* 25% coinsurance

** 75% Brand-name Discount

*** 75% Generic Discount

**** In 2024, the Catastrophic Coverage phase will still exist, but a plan member will not have any out-of-pocket costs for formulary drugs after reaching the plan's $8,000 total out-of-pocket threshold (TrOOP).

_____________________________________

* Important changes coming January 1, 2025:

In 2025, the IRA eliminates the Coverage Gap (Donut Hole) and extends the initial benefit limit until a person has spent $2,000 out-of-pocket for Part D formulary drugs.

The $2,000 will represent the prescription drug maximum out-of-pocket spending limit (RxMOOP). When a person reaches the RxMOOP (that can change from the $2,000 each year), the plan member will not have any additional costs for Part D formulary drugs for the remainder of the year.

At this same time, the IRA will also change the percentage of the drug costs allocated to the brand-name drug manufacturer, Medicare Part D plan, and the federal government.

| Beginning January 1, 2025 When you purchase a Part D formulary medication with a $100 retail cost |

||||||

| Brand-name Drug Retail Cost |

You Pay | Your Medicare drug plan pays |

Pharma Mfgr. pays |

Federal Govern. pays |

Amount counted toward your RxMOOP Threshold |

|

| Initial Deductible (if any) |

$100 | $100 | $0 | $0 | $0 | $100 |

| Initial Coverage phase - brand-drugs * | $100 | $25 | $65 | $10** | $0 | $25 |

| Initial Coverage phase - generic-drugs * | $100 | $25 | $75 | $0 | $0 | $25 |

| Catastrophic Coverage (brand drug) **** | $100 | $0 | $60 | $20 | $20 | n/a |

| Catastrophic Coverage (generic drug) **** | $100 | $0 | $60 | $0 | $40 | n/a |

* 25% coinsurance until you reach the $2,000 RxMOOP, then your Part D formulary drug costs are $0 for the remainder of the year.

** The 10% brand-name drug manufacturer discount applied in the 2025 Initial Coverage Phase (after the standard deductible) does not apply toward the $2,000 TrOOP threshold (https://www.cms.gov/files/document/manufacturer-discount-program-final-guidance.pdf).

**** Starting in 2025, the Coverage Gap (or Donut Hole) will no longer exist for plan members. A plan member will stay in the Initial Coverage phase until exceeding the plan's $2,000 out-of-pocket spending (TrOOP) threshold and enter Catastrophic Coverage where, for the remainder of the year, the person will not have any out-of-pocket costs for formulary drugs. As noted above, the $2,000 out-of-pocket threshold or RxMOOP can change every year.

_____________________________________

See:

https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_of_2022.pdf

https://www.congress.gov/bill/117th-congress/house-bill/5376/text

https://www.cms.gov/files/document/2024-announcement-pdf.pdf

https://www.cms.gov/oact/tr/2023

** https://www.cms.gov/files/document/manufacturer-discount-program-final-guidance.pdf

Browse FAQ Categories

Pets are Family Too!

Use your drug discount card to save on medications for the entire family ‐ including your pets.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service