If I am in the Donut Hole and switch Medicare Part D plans during the year, will I still be in the Donut Hole?

Probably. If you use a Special Enrollment Period to change Medicare Part D drug plans during the year, your drug purchase history moves with you to your new Medicare plan. So if you are in the Donut Hole and then move to another Medicare Part D plan, most likely you will still be in the Donut Hole or Coverage Gap (assuming that your new Medicare plan has the same Initial Coverage Limit or ICL).

Changing Drug Plans? Your retail drug costs and out-of-pocket spending move with you.

Your drug purchase transactions will transfer to your new Medicare prescription drug plan when you change plans during the year - so the retail value of formulary drug purchases (gross covered drug costs*) and your total out-of-pocket spending (TrOOP) move with you if you join another Medicare Part D prescription drug plan (PDP) or Medicare Advantage plan that offers prescription drug coverage (MAPD).

For example, if you purchase a Tier 3 Brand Name Drug that has a retail cost of $500 and you have a $47 co-pay - and then change Medicare Part D plans, the $500 gross covered drug cost and the $47 out-of-pocket cost both transfer to the new plan.

The Centers for Medicare and Medicaid Services (CMS) notes that, "[when you change Medicare prescription drug plans during the year, a] record of your drug costs will transfer with you to your new drug plan..." And your total covered drug costs will help your new Medicare Part D plan determine where you are within the phases of your new plan.

The Initial Coverage Limit (ICL) and entering the Donut Hole

Please remember that you enter your Medicare Part D Donut Hole when your retail drug costs exceed your plan's Initial Coverage Limit (the standard ICL is $4,660 in 2023 and $5,030 in 2024) - not what you pay, but the actual retail value of your formulary drug purchases.

Changing Drug Plans? Your retail drug costs and out-of-pocket spending move with you.

Your drug purchase transactions will transfer to your new Medicare prescription drug plan when you change plans during the year - so the retail value of formulary drug purchases (gross covered drug costs*) and your total out-of-pocket spending (TrOOP) move with you if you join another Medicare Part D prescription drug plan (PDP) or Medicare Advantage plan that offers prescription drug coverage (MAPD).

For example, if you purchase a Tier 3 Brand Name Drug that has a retail cost of $500 and you have a $47 co-pay - and then change Medicare Part D plans, the $500 gross covered drug cost and the $47 out-of-pocket cost both transfer to the new plan.

The Centers for Medicare and Medicaid Services (CMS) notes that, "[when you change Medicare prescription drug plans during the year, a] record of your drug costs will transfer with you to your new drug plan..." And your total covered drug costs will help your new Medicare Part D plan determine where you are within the phases of your new plan.

The Initial Coverage Limit (ICL) and entering the Donut Hole

Please remember that you enter your Medicare Part D Donut Hole when your retail drug costs exceed your plan's Initial Coverage Limit (the standard ICL is $4,660 in 2023 and $5,030 in 2024) - not what you pay, but the actual retail value of your formulary drug purchases.

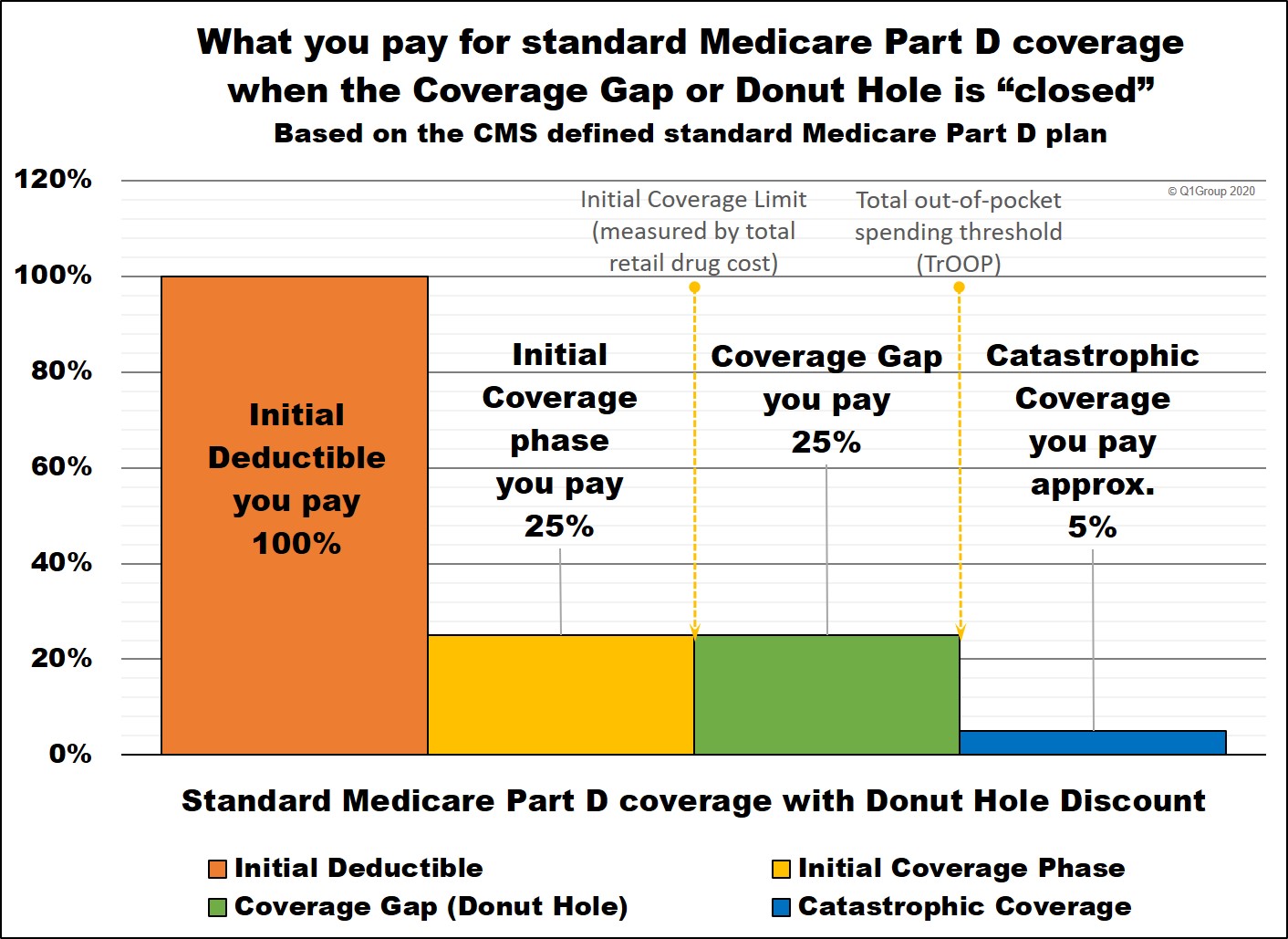

Question: But isn't the Donut Hole closed?

Not exactly. Although we say that the Donut Hole "closed" in

2020 since you receive a 75% discount on all formulary drugs, you will

still leave your Medicare Part D plan's Initial Coverage Phase once your

retail drug costs exceed the Initial Coverage Limit. And when you

leave your Initial Coverage Phase, you will enter the Coverage Gap

(Donut Hole) where the cost of your formulary medications can increase, decrease, or stay the same - depending on your Medicare drug plan, your cost-sharing, and the drug's retail price. You can click on our FAQ "Did the Coverage Gap or Donut Hole just close up and go away?" to read more.

Example of when you may not be in the Donut Hole when transferring to a Medicare Advantage plan

Since Medicare drug plans (Part D and Medicare Advantage plans) are allowed to have an Initial Coverage Limit that is different from the standard ICL, it is possible to be in a plan with a low ICL (for example, $4,355), have retail drug spending of $4,400 and be in your drug plan's Donut Hole. So when you may move to a Medicare drug plan with the standard ICL (for example, $4,660), your new Medicare plan will look at your gross covered drug purchases ($4,400) and place you back into the plan's Initial Coverage phase since your gross retail drug purchases are under the new Medicare drug plan's ICL of $4,660.

A New Year starts a new Donut Hole or Coverage Gap

The good news is that each January 1st starts a new Medicare Part D plan year and you will begin your annual Medicare Part D plan coverage all over again (with new Part D drug plan parameters). So if you were in the Donut Hole on December 31st, you will no longer be in the Donut Hole on January 1st of the new plan year.

* Gross covered drug costs (GCDC) amount to the retail value of the formulary medications you purchase or "the total cost of drugs (including dispensing fee and sales tax) regardless of payer" and include "certain dispensing fees, but not including administrative costs." The beneficiary’s accumulated gross covered drug costs determine" whether the "beneficiary is in the Deductible or the Initial Coverage Phase or has entered the Coverage Gap".

Additional CMS Source

PDE Manual p. 9-18, https://oig.hhs.gov/oei/ reports/oei-05-07-00610.pdf, and 42 CFR 423.308)

Medicare Prescription Drug Benefit Manual, Chapter 14 - Coordination of Benefits, (Rev. 18, 09-17-18) (https://www.cms.gov/ medicare/coverage/ prescription-drug-coverage-contracting/ prescription-drug-benefit-manual)

Browse FAQ Categories

Find Your Prescription Discount

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service