Who pays for Medicare Part D Catastrophic Coverage?

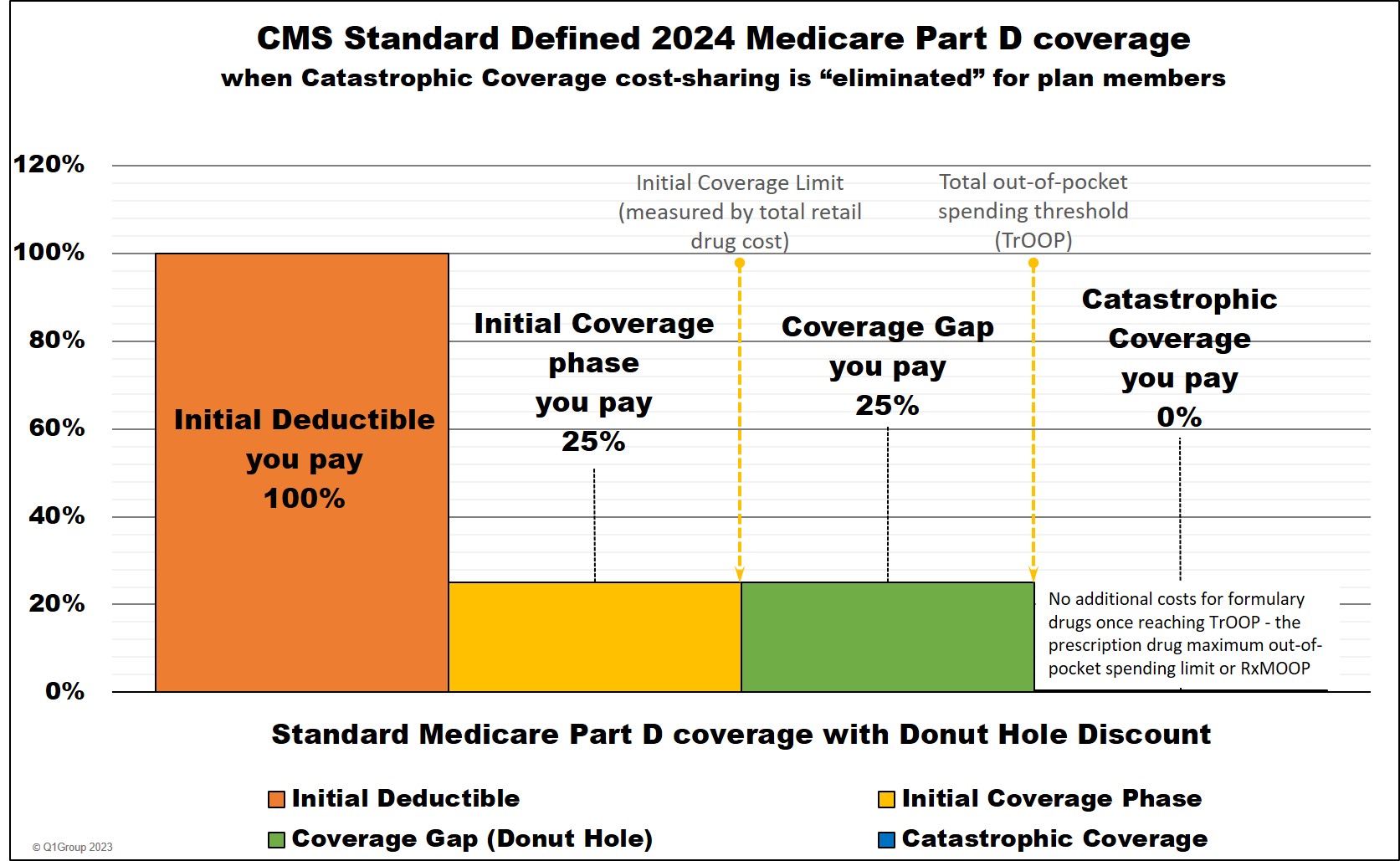

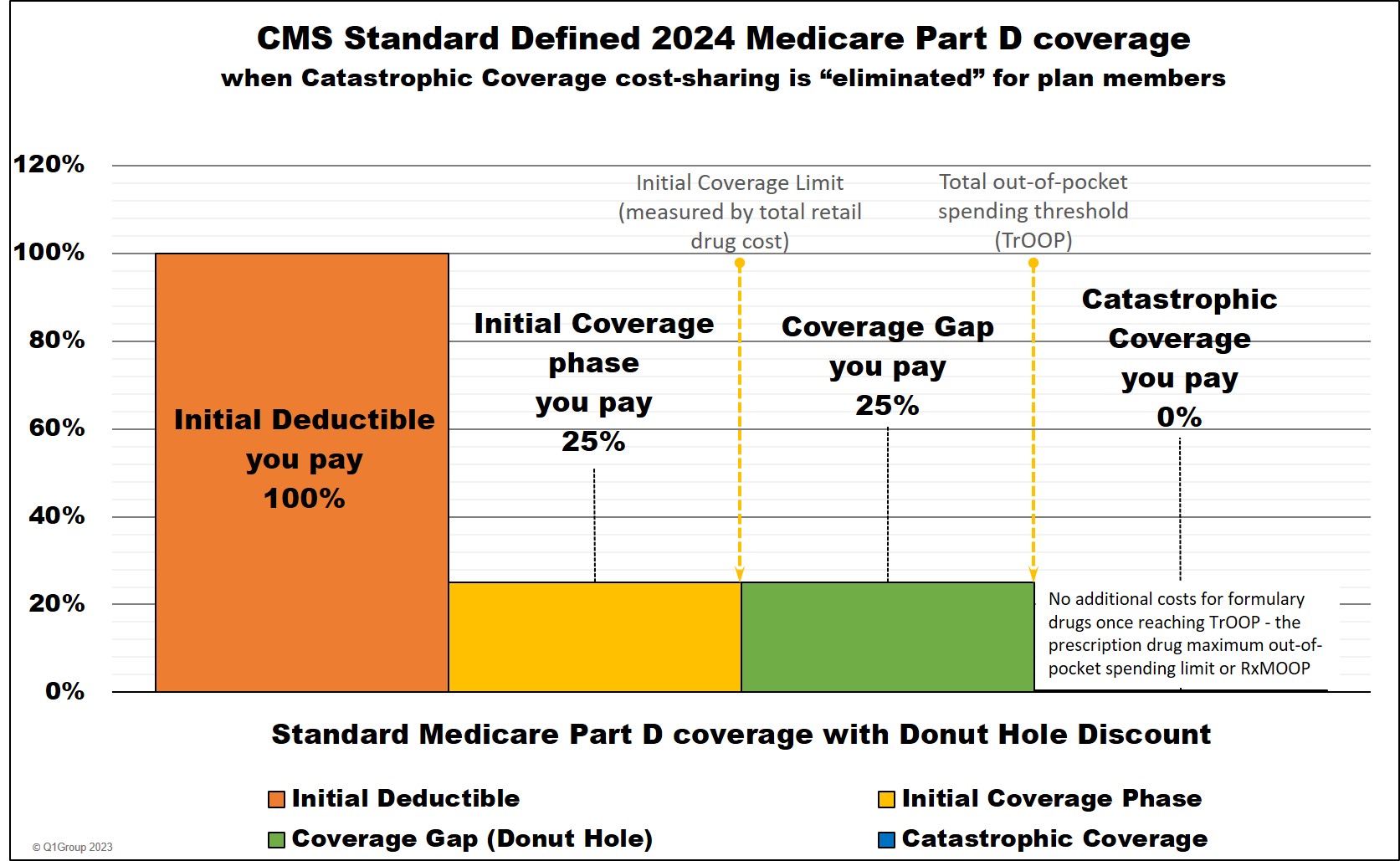

In 2024, the Inflation Reduction Act (IRA) eliminates beneficiary cost-sharing in the Catastrophic Coverage phase.

A Medicare Part D plan member will not have any out-of-pocket costs after reaching the plan's total out-of-pocket threshold (TrOOP) of $8,000. Therefore, 2024 TrOOP will become the prescription drug maximum out-of-pocket spending threshold (RxMOOP).

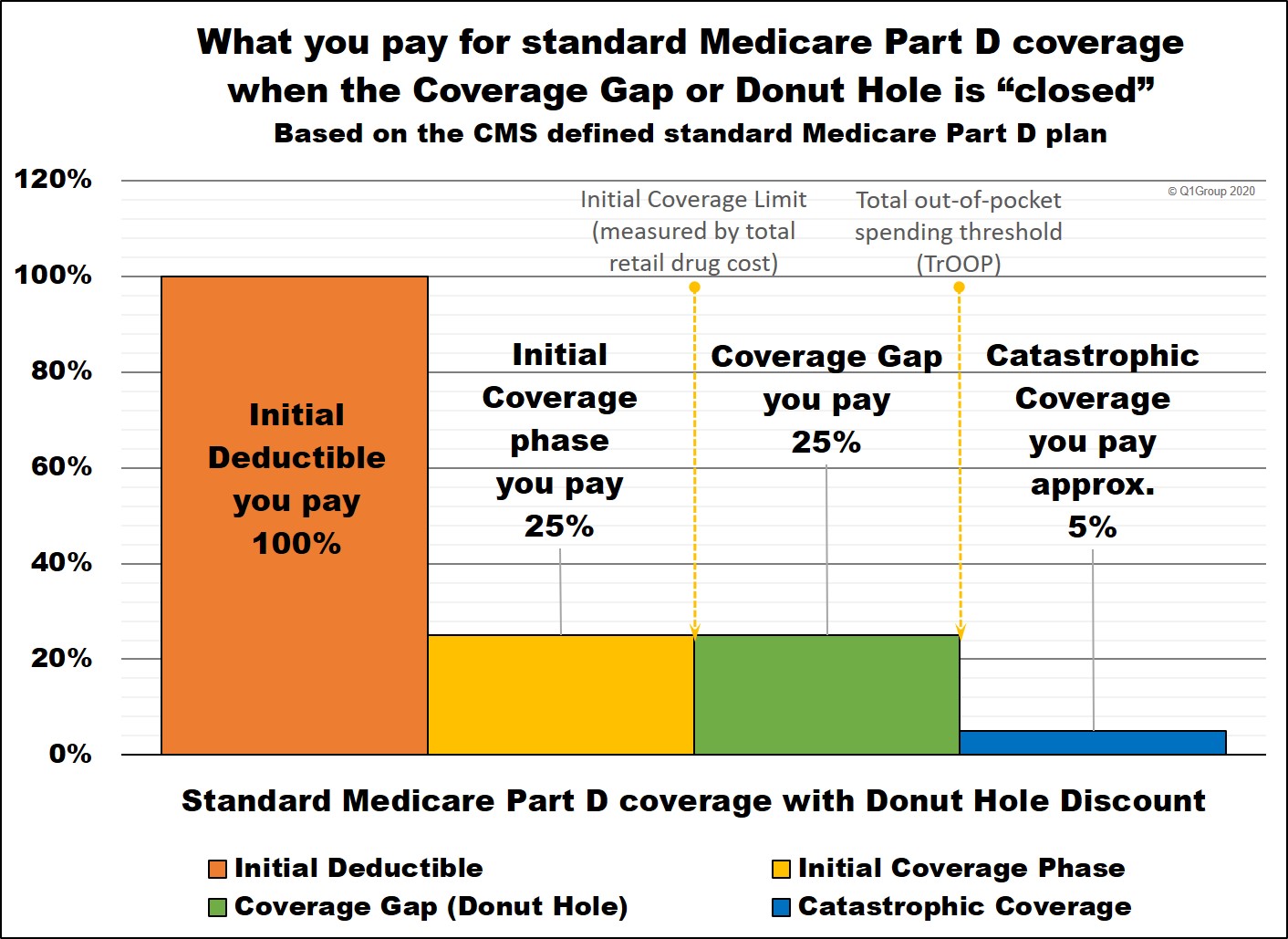

Below is a chart showing how example formulary drug purchases are paid throughout your Medicare Part D plan coverage -- using the CMS defined standard benefit Medicare Part D plan with a fixed 25% coinsurance for calculating cost-sharing.

* 25% coinsurance or cost-sharing

** 75% Brand-name Discount

*** 75% Generic Discount

**** In 2024, the Catastrophic Coverage phase will still exist, but plan members will not have any out-of-pocket costs for formulary drugs after reaching the plan's $8,000 total out-of-pocket threshold (TrOOP).

2024 Medicare Part D coverage

_____________________________________

* Important changes coming January 1, 2025:

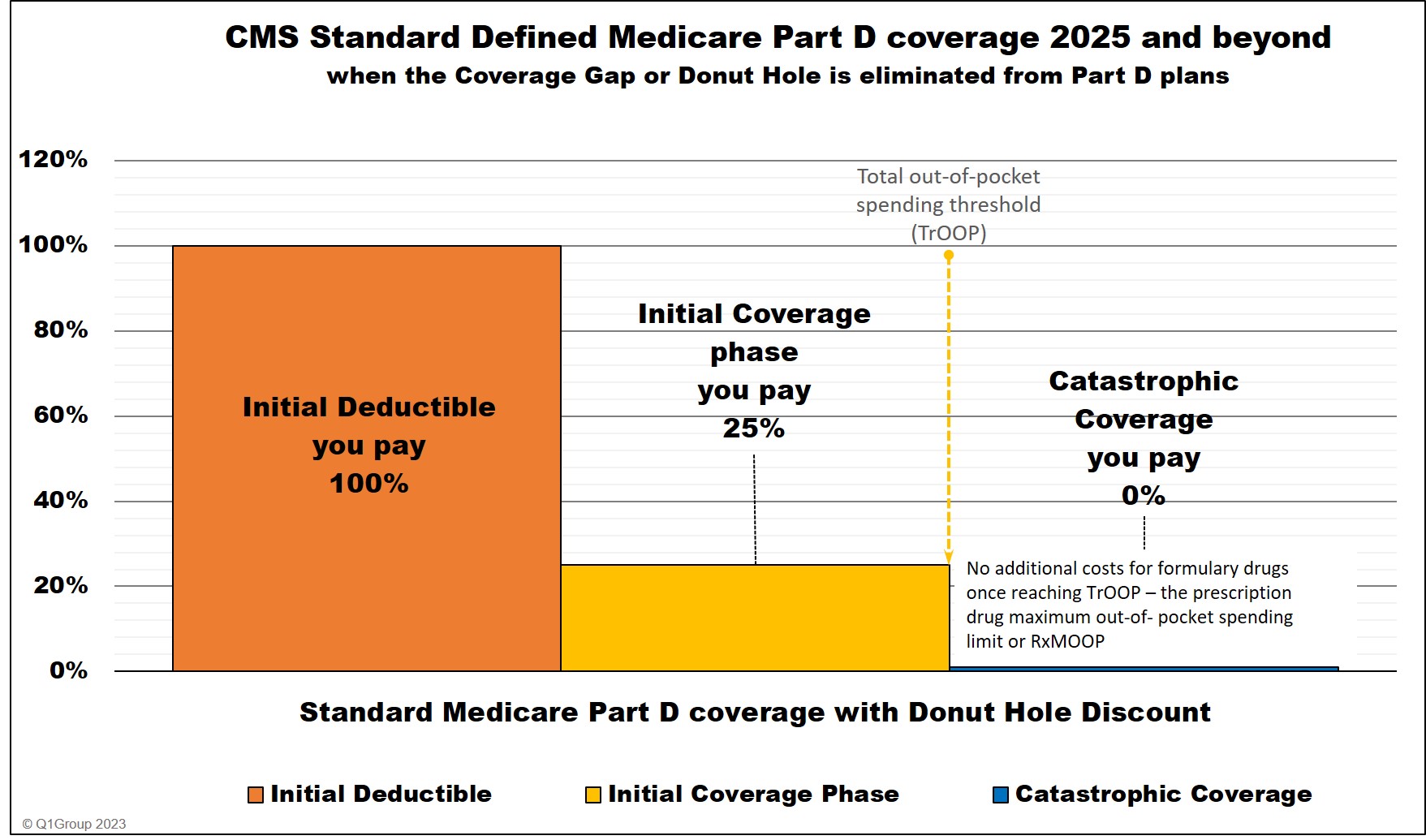

In 2025, the IRA eliminates the Coverage Gap and extends the Initial Coverage phase until a person has spent $2,000 out-of-pocket for Part D formulary drugs.

The $2,000 will represent the prescription drug maximum out-of-pocket spending limit (RxMOOP). When a person reaches the RxMOOP (this amount can change each year), the plan member will not have any additional costs for Part D formulary drugs for the remainder of the year.

Also in 2025, the IRA will change the percentage of the drug costs allocated to the brand-name drug manufacturer, Medicare Part D plan, and the federal government, see example table below.

* 25% coinsurance or cost-sharing until you reach the $2,000 RxMOOP, then your Part D formulary drug costs are $0 for the remainder of the year.

** The 10% brand-name drug manufacturer portion paid in the 2025 Initial Coverage phase (after the standard deductible) does not apply toward the $2,000 TrOOP threshold (https://www.cms.gov/files/document/manufacturer-discount-program-final-guidance.pdf).

**** Starting in 2025, the Coverage Gap (or Donut Hole) will no longer exist for plan members. A plan member will stay in the Initial Coverage phase until exceeding the plan's $2,000 out-of-pocket spending threshold and enter Catastrophic Coverage where for the remainder of the year, the person will not have any out-of-pocket costs for formulary drugs. As noted below, the $2,000 out-of-pocket threshold or RxMOOP can change every year.

Medicare Part D coverage 2025 and beyond

Question: Can the $2,000 RxMOOP change every year?

Yes. Like other Medicare Part D plan parameters, the annual $2,000 RxMOOP can (and probably will) change every year. Currently, the Catastrophic Coverage threshold (or RxMOOP) is predicted to decrease over time.

A Medicare Part D plan member will not have any out-of-pocket costs after reaching the plan's total out-of-pocket threshold (TrOOP) of $8,000. Therefore, 2024 TrOOP will become the prescription drug maximum out-of-pocket spending threshold (RxMOOP).

Below is a chart showing how example formulary drug purchases are paid throughout your Medicare Part D plan coverage -- using the CMS defined standard benefit Medicare Part D plan with a fixed 25% coinsurance for calculating cost-sharing.

|

Beginning January 1, 2024 When you purchase a Part D formulary medication with a $100 retail cost |

||||||

| Retail Cost | You Pay | Your Medicare drug plan pays |

Pharma Mfgr. pays |

Federal Govern. pays |

Amount counted toward your TrOOP Threshold |

|

| Initial Deductible | $100 | $100 | $0 | $0 | $0 | $100 |

| Initial Coverage phase * | $100 | $25 | $75 | $0 | $0 | $25 |

| Coverage Gap - brand-name ** | $100 | $25 | $5 | $70 | $0 | $95 |

| Coverage Gap - generic *** | $100 | $25 | $75 | $0 | $0 | $25 |

| Catastrophic Coverage (brand drug) **** | $100 | $0 | $20 | $0 | $80 | n/a |

| Catastrophic Coverage (generic drug) **** | $100 | $0 | $20 | $0 | $80 | n/a |

* 25% coinsurance or cost-sharing

** 75% Brand-name Discount

*** 75% Generic Discount

**** In 2024, the Catastrophic Coverage phase will still exist, but plan members will not have any out-of-pocket costs for formulary drugs after reaching the plan's $8,000 total out-of-pocket threshold (TrOOP).

2024 Medicare Part D coverage

_____________________________________

* Important changes coming January 1, 2025:

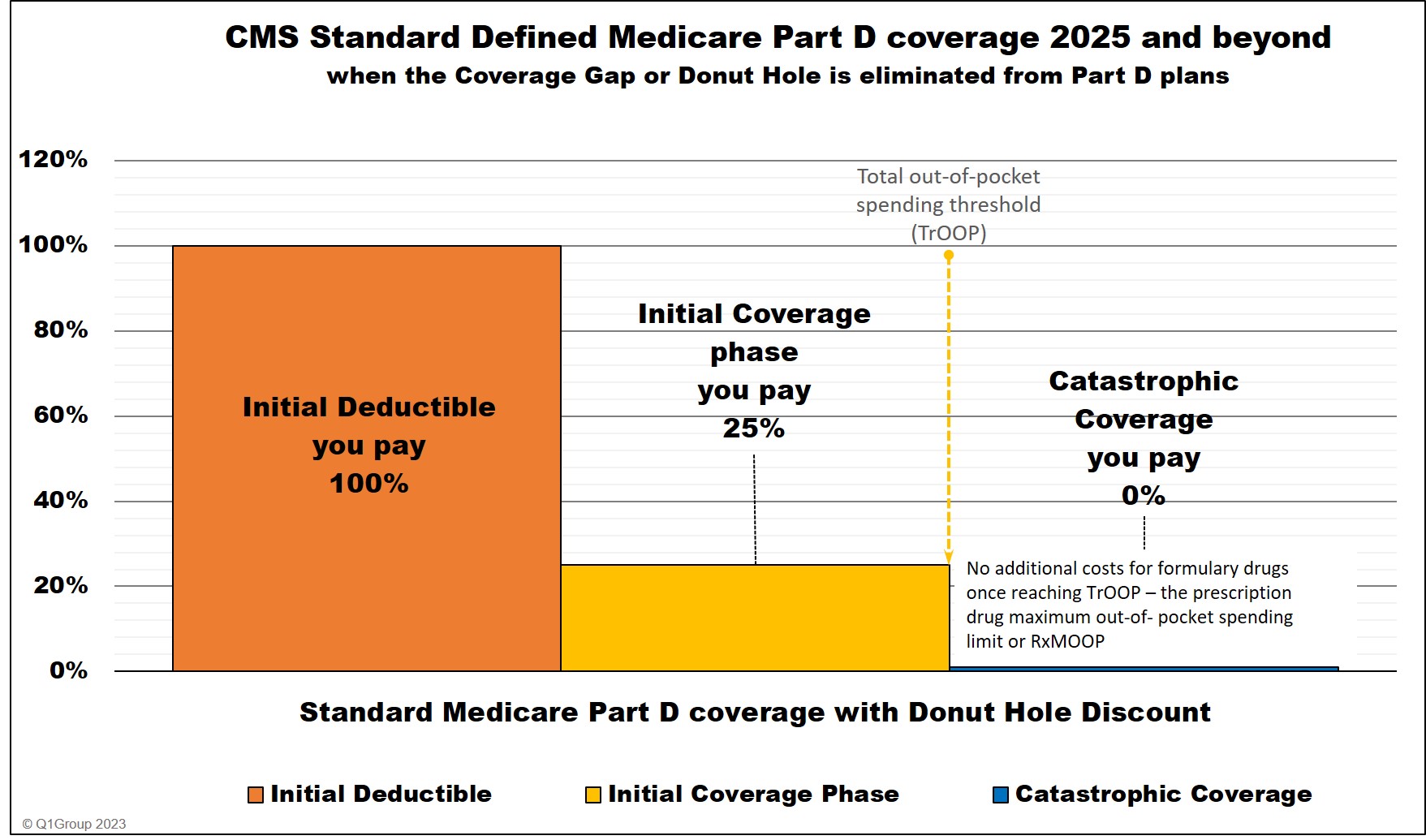

In 2025, the IRA eliminates the Coverage Gap and extends the Initial Coverage phase until a person has spent $2,000 out-of-pocket for Part D formulary drugs.

The $2,000 will represent the prescription drug maximum out-of-pocket spending limit (RxMOOP). When a person reaches the RxMOOP (this amount can change each year), the plan member will not have any additional costs for Part D formulary drugs for the remainder of the year.

Also in 2025, the IRA will change the percentage of the drug costs allocated to the brand-name drug manufacturer, Medicare Part D plan, and the federal government, see example table below.

| Beginning January 1, 2025 When you purchase a Part D formulary medication with a $100 retail cost |

||||||

| Brand-name Drug Retail Cost |

You Pay | Your Medicare drug plan pays |

Pharma Mfgr. pays |

Federal Govern. pays |

Amount counted toward your RxMOOP Threshold |

|

| Initial Deductible (if any) |

$100 | $100 | $0 | $0 | $0 | $100 |

| Initial Coverage phase - brand-drugs * | $100 | $25 | $65 | $10** | $0 | $25 |

| Initial Coverage phase - generic-drugs * | $100 | $25 | $75 | $0 | $0 | $25 |

| Catastrophic Coverage (brand drug) **** | $100 | $0 | $60 | $20 | $20 | n/a |

| Catastrophic Coverage (generic drug) **** | $100 | $0 | $60 | $0 | $40 | n/a |

* 25% coinsurance or cost-sharing until you reach the $2,000 RxMOOP, then your Part D formulary drug costs are $0 for the remainder of the year.

** The 10% brand-name drug manufacturer portion paid in the 2025 Initial Coverage phase (after the standard deductible) does not apply toward the $2,000 TrOOP threshold (https://www.cms.gov/files/document/manufacturer-discount-program-final-guidance.pdf).

**** Starting in 2025, the Coverage Gap (or Donut Hole) will no longer exist for plan members. A plan member will stay in the Initial Coverage phase until exceeding the plan's $2,000 out-of-pocket spending threshold and enter Catastrophic Coverage where for the remainder of the year, the person will not have any out-of-pocket costs for formulary drugs. As noted below, the $2,000 out-of-pocket threshold or RxMOOP can change every year.

Medicare Part D coverage 2025 and beyond

Question: Can the $2,000 RxMOOP change every year?

Yes. Like other Medicare Part D plan parameters, the annual $2,000 RxMOOP can (and probably will) change every year. Currently, the Catastrophic Coverage threshold (or RxMOOP) is predicted to decrease over time.

| Year | Catastrophic threshold (RxMOOP) |

| 2024 |

$8,000 |

| 2025 |

$2,000 |

| 2026 | $2,000 |

| 2027 | $1,950 |

| 2028 | $1,850 |

| 2029 | $1,800 |

Tip: Need some help planning your spending throughout the phases of your Medicare drug coverage?

To help you visualize the phases of your Medicare Part D prescription drug plan coverage, we have a Donut Hole Calculator or PDP-Planner.com online illustrating the changes in your monthly estimated costs based on the established annual standard Medicare Part D plan limits mentioned above.

A bit of history...

To help you visualize the phases of your Medicare Part D prescription drug plan coverage, we have a Donut Hole Calculator or PDP-Planner.com online illustrating the changes in your monthly estimated costs based on the established annual standard Medicare Part D plan limits mentioned above.

A bit of history...

Prior to plan year 2024, Medicare Part D plan members who had high medication costs would pay roughly 5% of the formulary drug's retail cost during the Catastrophic Coverage phase.

Of the remaining 95% of the total retail drug cost, 80% of the cost was paid by the federal government or Medicare’s reinsurance subsidy, 15% of the retail drug cost was

paid by the Medicare prescription drug plan (Medicare Part D plan or Medicare Advantage plan).

So, as illustrated in the example below, if you reached the 2023 Catastrophic Coverage phase and buy a brand-name formulary drug with a $300 retail cost, you paid $15 for the drug, the federal government paid $240, and the Medicare Part D prescription drug plan paid $45.

Medicare Part D Catastrophic Coverage was and still is the final part of your Medicare Part D prescription drug plan coverage. You reached Catastrophic Coverage after you spent a certain amount of money on your prescription drugs during the year. That is, after you spent more than your Medicare drug plan's total out-of-pocket spending limit (TrOOP), you exited the Coverage Gap or Donut Hole phase of your Medicare drug plan and entered the Catastrophic Coverage phase.

Prior to 2024, in the Catastrophic Coverage phase, you paid either a flat copay fee (set annually) or 5% of the plan's negotiated retail drug cost (whichever was greater) for your formulary medications, depending on the type of drug -- generics or preferred brand drugs that are multi-source drugs vs. all other drugs.

For example, in 2023, you paid the higher of either 5% of the drug's retail price or $10.35 for brand name drugs or $4.15 for generic drugs in Catastrophic Coverage.

So in 2023, if you purchased a brand-name drug with a retail price of $100 in the Catastrophic Coverage phase, you paid $10.35 for the prescription fill since the fixed $10.35 brand-name drug copay is higher than 5% of the $100 retail drug price (or $5). But, if you purchased a brand-name formulary drug with a retail cost of $300, you paid $15 in the 2023 Catastrophic Coverage phase since 5% of $300 ($15) is more than the 2023 fixed copay of $10.35.

2023 Medicare Part D coverage

Simple example of 2023 Medicare Part D plan coverage costs

Here is how example formulary drug purchases are calculated throughout your 2023 Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide).

* 25% coinsurance or cost-sharing

** 75% Brand-name Donut Hole Discount

*** 75% Generic Donut Hole Discount

**** In 2023, you paid 5% of retail or $10.35 for brand drugs whatever is higher or 5% of retail or $4.15 for generic or multi-source drugs whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

See:

https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_of_2022.pdf

https://www.congress.gov/bill/117th-congress/house-bill/5376/text

https://www.cms.gov/files/document/2024-announcement-pdf.pdf

https://www.cms.gov/oact/tr/2023

Here is how example formulary drug purchases are calculated throughout your 2023 Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide).

| When you purchase a formulary medication during your 2023 Medicare Part D prescription drug coverage - assuming a $100 retail drug cost (or $300 retail drug cost in our brand-name drug Catastrophic Coverage example) | ||||||

| Retail Cost | You Pay | Your Medicare drug plan pays |

Pharma Mfgr. pays |

Federal Govern. pays |

Amount counting toward your TrOOP Threshold |

|

| Initial Deductible | $100 | $100 | $0 | $0 | $0 | $100 |

| Initial Coverage phase * | $100 | $25 | $75 | $0 | $0 | $25 |

| Coverage Gap - brand-name ** | $100 | $25 | $5 | $70 | $0 | $95 |

| Coverage Gap - generic *** | $100 | $25 | $75 | $0 | $0 | $25 |

| Catastrophic Coverage (brand drug) **** | $300 | $15 | $45 | $0 | $240 | n/a |

| Catastrophic Coverage (generic drug) **** | $100 | $5 | $15 | $0 | $80 | n/a |

* 25% coinsurance or cost-sharing

** 75% Brand-name Donut Hole Discount

*** 75% Generic Donut Hole Discount

**** In 2023, you paid 5% of retail or $10.35 for brand drugs whatever is higher or 5% of retail or $4.15 for generic or multi-source drugs whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

See:

https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_of_2022.pdf

https://www.congress.gov/bill/117th-congress/house-bill/5376/text

https://www.cms.gov/files/document/2024-announcement-pdf.pdf

https://www.cms.gov/oact/tr/2023

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service