If I receive Medicare Part D Extra Help, will I enter the Donut Hole?

No. If you qualify for the Medicare Part D Extra Help

program or Low-Income Subsidy (LIS), then you will never enter the Donut

Hole or Coverage Gap -- and the cost of your prescriptions will remain constant through most of your drug plan coverage. In fact, your coverage cost for formulary drugs will only change if you

reach the Catastrophic Coverage portion of your Medicare Part D plan.

And you will only reach the Catastrophic Coverage phase when your total out-of-pocket drug spending exceeds the annual threshold (for example, $8,000 in 2024). In Catastrophic Coverage, all Medicare beneficiaries pay nothing ($0) for formulary drug purchases.

Note: 2024 and 2025 changes to your Medicare Part D drug coverage.

Starting with plan year 2024, the Catastrophic Coverage phase maximum 5% coinsurance (or any cost-sharing) is eliminated with the establishment of a maximum out-of-pocket prescription drug spending limit (RxMOOP) capping formulary drug costs at the annual 2024 total out-of-pocket cost threshold or TrOOP threshold ($8,000 in 2024 - equating to Part D formulary drugs with an estimated retail value of $12,447). And, as noted below, in 2024 full-Extra Help will be expanded to 150% of FPL and there will no longer be partial-Extra Help.

This means that all Medicare beneficiaries will not pay any additional costs for formulary drugs once the reach the 2024 out-of-pocket spending limit (TrOOP or RxMOOP) of $8,000.

In 2025, the Donut Hole or Coverage Gap will no longer exist and will be replaced with a $2,000 out-of-pocket spending limit. When a person reaches the $2,000 maximum cap or Part D maximum out-of-pocket spending limit (RxMOOP) - they will not pay any additional costs for formulary drugs for the remainder of the year. In 2025, the $2,000 RxMOOP should be reached when a person purchases Medicare Part D formulary drugs with a retail value totaling about $6,230. (The $2,000 RxMOOP can change each year like other Medicare Part D parameters.)

This means that all Medicare beneficiaries will not pay any additional costs for formulary drugs once the reach the 2025 out-of-pocket spending limit (RxMOOP) of $2,000.

And you will only reach the Catastrophic Coverage phase when your total out-of-pocket drug spending exceeds the annual threshold (for example, $8,000 in 2024). In Catastrophic Coverage, all Medicare beneficiaries pay nothing ($0) for formulary drug purchases.

Note: 2024 and 2025 changes to your Medicare Part D drug coverage.

Starting with plan year 2024, the Catastrophic Coverage phase maximum 5% coinsurance (or any cost-sharing) is eliminated with the establishment of a maximum out-of-pocket prescription drug spending limit (RxMOOP) capping formulary drug costs at the annual 2024 total out-of-pocket cost threshold or TrOOP threshold ($8,000 in 2024 - equating to Part D formulary drugs with an estimated retail value of $12,447). And, as noted below, in 2024 full-Extra Help will be expanded to 150% of FPL and there will no longer be partial-Extra Help.

This means that all Medicare beneficiaries will not pay any additional costs for formulary drugs once the reach the 2024 out-of-pocket spending limit (TrOOP or RxMOOP) of $8,000.

In 2025, the Donut Hole or Coverage Gap will no longer exist and will be replaced with a $2,000 out-of-pocket spending limit. When a person reaches the $2,000 maximum cap or Part D maximum out-of-pocket spending limit (RxMOOP) - they will not pay any additional costs for formulary drugs for the remainder of the year. In 2025, the $2,000 RxMOOP should be reached when a person purchases Medicare Part D formulary drugs with a retail value totaling about $6,230. (The $2,000 RxMOOP can change each year like other Medicare Part D parameters.)

This means that all Medicare beneficiaries will not pay any additional costs for formulary drugs once the reach the 2025 out-of-pocket spending limit (RxMOOP) of $2,000.

Question: If I am eligible for Extra Help, will I also receive a 75% Donut Hole discount on my prescriptions?

No. Qualifying for Extra Help = No Donut Hole = No 75% Donut Hole discount.

Since a person who qualifies for Extra Help never has a Coverage Gap in their Medicare Part D plan, they also will not receive the 75% Donut Hole discount, but instead will continue to pay low prices for their formulary brand and generic prescription drugs throughout the year.

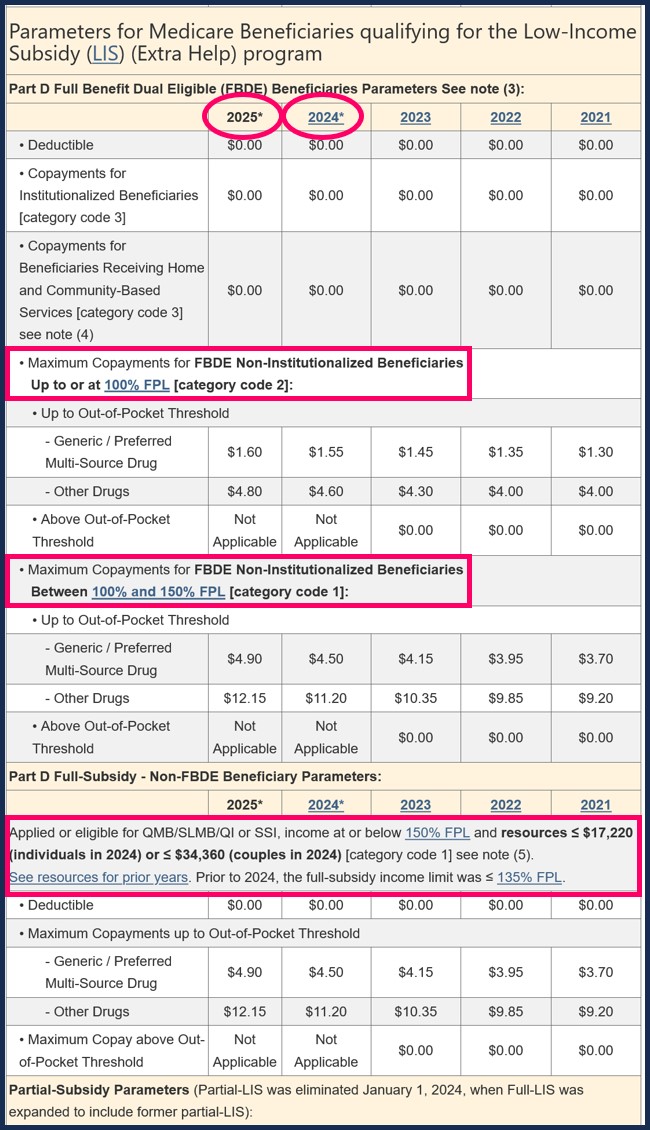

For more details on Extra Help drug copayments during the first phases of coverage, see the chart for Extra Help drug costs for: 2024 and 2025.

Reminder: 2023 was the last year for partial-Extra Help benefits as full-Extra Help limits were expanded in 2024 to 150% of FPL.

(or Federal Poverty Level).

See: 2024 Federal Poverty Level Guidelines (FPL): 2024/2025 LIS Qualifications and Benefits

Important: You can apply for Medicare Part D Extra Help at any time!

Remember, if you have limited income and financial resources, you can apply for the Medicare Part D Extra Help program (or Low-Income Subsidy) and receive help paying for your prescription drugs. And since the annual income and resource limits for the Medicare Part D “Extra Help” program change every year, you may now qualify for the Medicare Part D Extra Help program even when you have not qualified in past years.

You can apply for Extra Help at any time of the year by visiting your local state Medicaid office, going to the Social Security website (www.socialsecurity.gov), or calling Social Security at 1-800-772-1213 (TTY users 1-800-325-0778).

Remember, if you have limited income and financial resources, you can apply for the Medicare Part D Extra Help program (or Low-Income Subsidy) and receive help paying for your prescription drugs. And since the annual income and resource limits for the Medicare Part D “Extra Help” program change every year, you may now qualify for the Medicare Part D Extra Help program even when you have not qualified in past years.

You can apply for Extra Help at any time of the year by visiting your local state Medicaid office, going to the Social Security website (www.socialsecurity.gov), or calling Social Security at 1-800-772-1213 (TTY users 1-800-325-0778).

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service