Is a Drug Discount Card always cheaper than my Medicare Part D coverage?

Not always. It is always worth checking Drug Discount Card prices, but be sure to compare these discount prices to your Medicare plan's coverage cost or negotiated retail drug price and you may find your Medicare drug plan's price are lower than the drug prices offered with a drug discount card.

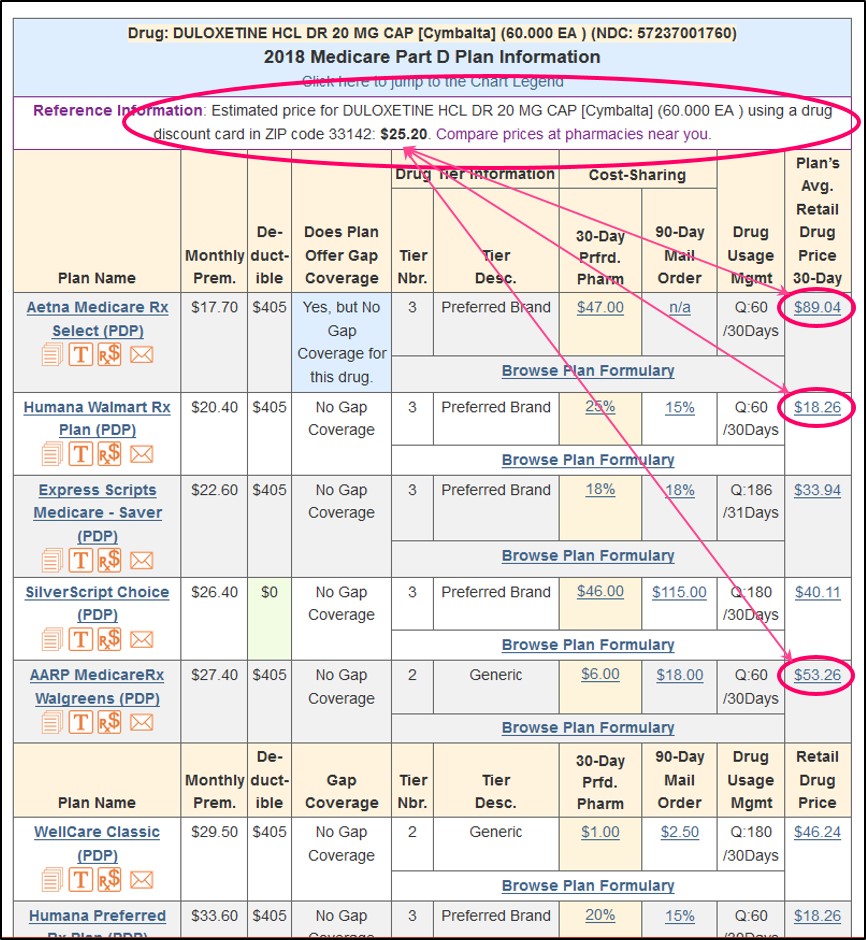

Bottom Line: You will often pay less for a drug when using your Medicare Part D plan coverage - even if you are paying 100% of the cost in the Initial Deductible (because your drug plan's negotiated retail price can be less than a Drug Discount Card's "discounted" or coupon price - see the example graphic below). You can view our Q1Rx.com Drug Finder for an overview of your Medicare plan's average retail drug pricing.

As an example: Using the generic drug 20 mg Duloxetine HCL, you can see in our Q1Rx.com Drug Finder example below that some Medicare Part D plan prices are less than the estimated drug discount card and some average Medicare Part D plan prices are far greater than the price using a drug discount card (- and don't forget: retail drug prices can change throughout the year).

Bottom Line: You will often pay less for a drug when using your Medicare Part D plan coverage - even if you are paying 100% of the cost in the Initial Deductible (because your drug plan's negotiated retail price can be less than a Drug Discount Card's "discounted" or coupon price - see the example graphic below). You can view our Q1Rx.com Drug Finder for an overview of your Medicare plan's average retail drug pricing.

As an example: Using the generic drug 20 mg Duloxetine HCL, you can see in our Q1Rx.com Drug Finder example below that some Medicare Part D plan prices are less than the estimated drug discount card and some average Medicare Part D plan prices are far greater than the price using a drug discount card (- and don't forget: retail drug prices can change throughout the year).

So, as noted above, even if you are in your Initial Deductible and responsible for 100% of the drug cost, your full drug cost with your Part D plan (for example, $18.26) is less than the estimated drug discount card price when using a Discount Card ($25.20). And naturally, if you were out of your Initial Deduction using this same example (from 2018), you would only pay 25% of the $18.26 for a prescription fill.

Question: Can I still get credit for my drug purchases even when not using my Part D drug plan?

Usually yes. After making a purchase, you can ask your Medicare Part D plan about submitting the receipts toward your annual out-of-pocket (TrOOP) spending records. In that way, if your medication needs change, and you need to purchase more expensive medications, your previous formulary prescription drug purchases will count toward exiting the Initial Deductible.

Please note, in most cases, your Medicare Part D plan will not reimburse you for drug purchases made outside of the Medicare Part D plan, but you can ask that the value (what you spent) for the formulary drugs is recorded by your plan. (There are exceptional cases when your Part D plan may reimburse you for non-Part D drug purchases such as when you cannot find a network pharmacy to fill a prescription.)

For more information about submitting your receipts for formulary drug purchased without your Medicare Part D plan, please contact your Medicare Part D plan's Member Services using the toll-free telephone number found on your Member ID card.

Usually yes. After making a purchase, you can ask your Medicare Part D plan about submitting the receipts toward your annual out-of-pocket (TrOOP) spending records. In that way, if your medication needs change, and you need to purchase more expensive medications, your previous formulary prescription drug purchases will count toward exiting the Initial Deductible.

Please note, in most cases, your Medicare Part D plan will not reimburse you for drug purchases made outside of the Medicare Part D plan, but you can ask that the value (what you spent) for the formulary drugs is recorded by your plan. (There are exceptional cases when your Part D plan may reimburse you for non-Part D drug purchases such as when you cannot find a network pharmacy to fill a prescription.)

For more information about submitting your receipts for formulary drug purchased without your Medicare Part D plan, please contact your Medicare Part D plan's Member Services using the toll-free telephone number found on your Member ID card.

Browse FAQ Categories

Compare Discounted Prescription Prices

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service