What are some of the Supplemental Benefits provided by Medicare Advantage plans?

Medicare Advantage plans provide coverage for Medicare Part A (in-patient, hospitalization), Medicare Part B (out-patient, doctor visits), and can include Medicare Part D prescription drug coverage (an MAPD). Medicare Advantage plan may also include supplemental benefits not normally offered by Original Medicare that can fall into several categories:

(1) optional Supplemental Benefits (you pay an additional fee for benefits such as supplemental dental coverage that is beyond the plan's routine dental coverage). You can learn more about this coverage by calling your Medicare Advantage plan (using the toll-free number on your Member ID card) or by reviewing your plan's Evidence of Coverage (EOC) document where you may read:

(3) health-related Supplemental Benefits available to only a select portion of plan members such as supplemental benefits tailored for a specific need (or each clinically-targeted enrollee ) - but, not uniformly available to all members)

(4) non-health-related benefits for people who have specific chronic conditions such air cleansers, pest control, non-medical transportation or meal (food) service. This category is also known as Special Supplemental Benefits for the Chronically Ill (SSBCI). To learn more about SSBCI, you can telephone your plan or review your plan's Evidence of Coverage (EOC) document where you may read:

(1) optional Supplemental Benefits (you pay an additional fee for benefits such as supplemental dental coverage that is beyond the plan's routine dental coverage). You can learn more about this coverage by calling your Medicare Advantage plan (using the toll-free number on your Member ID card) or by reviewing your plan's Evidence of Coverage (EOC) document where you may read:

"Optional Supplemental Benefits – Non-Medicare-covered benefits that can be purchased for an additional premium and are not included in your package of benefits. If you choose to have optional supplemental benefits, you may have to pay an additional premium. You must voluntarily elect Optional Supplemental Benefits in order to get them."(2) primarily health-related Supplemental Benefits uniformly available to all plan members such as optical, dental, hearing, or fitness center coverage

(3) health-related Supplemental Benefits available to only a select portion of plan members such as supplemental benefits tailored for a specific need (or each clinically-targeted enrollee ) - but, not uniformly available to all members)

(4) non-health-related benefits for people who have specific chronic conditions such air cleansers, pest control, non-medical transportation or meal (food) service. This category is also known as Special Supplemental Benefits for the Chronically Ill (SSBCI). To learn more about SSBCI, you can telephone your plan or review your plan's Evidence of Coverage (EOC) document where you may read:

"If you are diagnosed with the following chronic condition(s) identified below [--- a condition or list of conditions will follow] and meet certain criteria, you may be eligible for special supplemental benefits for the chronically ill."Now, health-related and non-health-related supplemental benefits offered by some Medicare Advantage plans may include:

- fitness center or gym memberships

- routine vision care (exams, eye glasses)

- routing hearing care (exams hearing aids)

- dental services (cleanings, extractions, dentures)

- chiropractic service

- acupuncture

- telemedicine (expanded with the outbreak of COVID-19)

- OTC or allowance for over-the-counter items

- transportation for medical and non-medical related reasons

- pest control

- home cleaning services

- home meal delivery (and other nutritional services)

- adult day health services

- caregiver support services

- in-home support services

- therapeutic massage

- home-based palliative care

Important: Supplemental Benefits (health-related or non-health-related) are usually not unlimited. For example, you may not receive free meals delivered for an entire year, but rather have some limitations on the amount of the specific benefit.

Where to find Supplemental Benefits beyond your plan documentation?

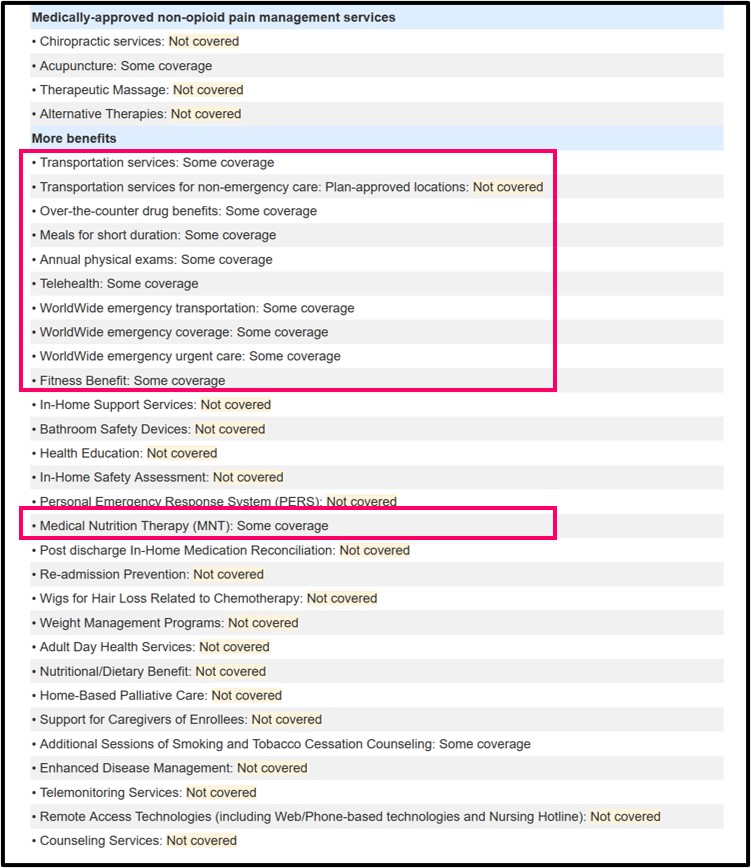

We show many of the Medicare Advantage plan supplemental benefits in our Medicare Advantage plan finder coverage details (MA-Finder.com) and this information can be found down toward the bottom of the coverage detail pages.

Here is an example showing the additional or supplemental benefits provided by the St. Johns County, Florida (32084) 2020 Humana Gold Plus - Diabetes (HMO C-SNP) (designed for Medicare beneficiaries with Diabetes Mellitus):

In 2019, the Centers for Medicare and Medicaid Services (CMS) expanded supplemental benefits to include both health related and non-health related benefits (for the chronically ill). Special Supplemental Benefits for the Chronically Ill or non-primarily health related Supplemental Benefits are an additional type of coverage that Medicare Advantage plans can offer plan members with chronic illness, "if these benefits have a reasonable expectation of improving or maintaining the health or overall function of the patient as it relates to their chronic condition or illness."

More background on the Medicare Advantage plan Supplemental Benefits

As noted by the Centers for Medicare and Medicaid Services (CMS) in the April 1, 2019, Fact Sheet (released with the 2020 Final Call Letter), starting in 2020, Medicare Advantage plans "will have greater flexibility to offer chronically ill patients a broader range of supplemental benefits that are tailored to their specific needs, such as providing meals beyond a limited basis, transportation for non-medical needs, and home environment services."

In the Call Letter, CMS notes that Medicare Advantage plans will be responsible for determining which of their plan members are identified as "chronically ill" and thus able to receive the Supplemental Benefits (Special Supplemental Benefits for the Chronically Ill or SSBCI). Such Supplemental Benefits should be well received as CMS notes that about 73% of current Medicare Advantage plan members have one or more chronic conditions (as defined or listed by CMS).

Medicare Advantage plans also will be responsible for determining whether "the non-primarily health related benefit will have a reasonable expectation of improving the chronic disease or maintaining the health or overall function of the enrollee receiving the benefit".

Examples of non-primarily health related Supplemental Benefits (as provide by CMS) include:

As noted by the Centers for Medicare and Medicaid Services (CMS) in the April 1, 2019, Fact Sheet (released with the 2020 Final Call Letter), starting in 2020, Medicare Advantage plans "will have greater flexibility to offer chronically ill patients a broader range of supplemental benefits that are tailored to their specific needs, such as providing meals beyond a limited basis, transportation for non-medical needs, and home environment services."

In the Call Letter, CMS notes that Medicare Advantage plans will be responsible for determining which of their plan members are identified as "chronically ill" and thus able to receive the Supplemental Benefits (Special Supplemental Benefits for the Chronically Ill or SSBCI). Such Supplemental Benefits should be well received as CMS notes that about 73% of current Medicare Advantage plan members have one or more chronic conditions (as defined or listed by CMS).

Medicare Advantage plans also will be responsible for determining whether "the non-primarily health related benefit will have a reasonable expectation of improving the chronic disease or maintaining the health or overall function of the enrollee receiving the benefit".

Examples of non-primarily health related Supplemental Benefits (as provide by CMS) include:

- A

Medicare Advantage plan could provide a plan member with asthma

coverage for "home air cleaners and carpet shampooing to reduce

irritants that may trigger asthma attacks".

- A Medicare Advantage plan could provide a plan member with heart disease coverage for "heart healthy food or produce".

- A

Medicare Advantage plan "may offer items and services that include

capital or structural improvements (e.g., permanent ramps, and widening

hallways or doorways) if those items and services have a reasonable

expectation of improving or maintaining the health or overall function

of the enrollee as it relates to the chronic condition or illness".

CMS added to the description of healthcare and non-healthcare related supplemental benefits that are offered by Medicare Advantage plans in the press release announcing 2021 Medicare Part D and Medicare Advantage plans:When considering Supplemental Benefits, CMS reminded Medicare Advantage plans that, "SSBCI are supplemental benefits and, therefore, must not be items or services covered by original Medicare." In addition, CMS reminded Medicare Advantage plans that a member's request for Supplemental Benefits was to be treated as any other benefit request and subject to the appeals process.

[In 2021, there will be m]ore opportunities for seniors to choose from Medicare Advantage plans that provide extra healthcare benefits to keep people healthy. In 2021, about 730 plans will provide about 3 million Medicare Advantage enrollees with these additional types of supplemental benefits, such as

- adult day health services,

- caregiver support services,

- in-home support services,

- therapeutic massage, or

- home-based palliative care, that are primarily health related under a new interpretation adopted beginning with 2019. [formatting added]

. . . About 920 [2021 Medicare Advantage] plans reaching 4.3 million beneficiaries will offer non-primarily health related benefits tailored to people with chronic conditions that may help them better manage their disease(s). Examples of these benefits includeReferences:

- pest control,

- home cleaning services,

- meal home delivery, and

- transportation for non-medical reasons such as trips to the grocery store. [formatting added]

https://www.cms.gov/newsroom/fact-sheets/2020-medicare-advantage-and-part-d-advance-notice-part-ii-and-draft-call-letter

https://www.cms.gov/newsroom/fact-sheets/2020-medicare-advantage- and-part-d-rate-announcement-and- final-call-letter-fact-sheet, and

https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Announcements-and-Documents-Items/ 2020Announcement.html

https://www.cms.gov/newsroom/press-releases/trump-administration-announces-historically-low-medicare-advantage-premiums-and-new-payment-model

https://www.cms.gov/newsroom/fact-sheets/2020-medicare-advantage- and-part-d-rate-announcement-and- final-call-letter-fact-sheet, and

https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Announcements-and-Documents-Items/ 2020Announcement.html

https://www.cms.gov/newsroom/press-releases/trump-administration-announces-historically-low-medicare-advantage-premiums-and-new-payment-model

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service