How to compare annual Medicare drug plan changes with the Q1Medicare Medicare Part D PDP-Compare tool

Our Q1Medicare® PDP-Compare

and MA-Compare

tools allow you to compare annual Medicare changes in all

stand-alone Medicare Part D prescription drug plans (PDPs) or Medicare

Advantage plans (MAs or MAPDs) across the country - showing changes in

monthly premiums and plan design changes, as well as changes in

co-payments or co-insurance rates for different drug tiers along with

the most recent Medicare quality star ratings.

Reminder: Medicare Part D plans can (and usually do) change every year and you should be aware that your current Medicare Part D plan may have the same name next year, but the plan can have changed many coverage features.

How can your Medicare plan change in a year?

Unfortunately, the Annual Notice of Change letter can be pretty difficult for some people to read (or just easy to ignore) and that is why we launched our PDP-Compare tool so we can stress the importance of knowing your annual plan changes.

Our Q1Medicare PDP-Compare and MA-Compare tools provide a side-by-side comparison of basic plan costs and design changes between all individual Medicare Part D plans as we move from one year to the next.

Reminder: Medicare Part D plans can (and usually do) change every year and you should be aware that your current Medicare Part D plan may have the same name next year, but the plan can have changed many coverage features.

How can your Medicare plan change in a year?

- Your Medicare Part D or Medicare Advantage plan may not be offered next year.

- You may be automatically moved or "crosswalked" to another Medicare plan.

- Your Medicare plan's name may change.

- Your monthly premiums may increase.

- Your plan's Initial Deductible may change.

- Your plan will probably change the Initial Coverage Limit (when you go into the Donut Hole).

- Your plan may offer supplemental Donut Hole or Coverage Gap Coverage.

- Your Medicare drug plan's Formulary or Drug List will probably change.

- Your drug cost sharing amounts (what you pay for co-pays or co-insurance) may change.

- Usage Management restrictions may be added to your drugs (whether your drug requires prior authorization or step-therapy or quantify limits)

- ... and more

Unfortunately, the Annual Notice of Change letter can be pretty difficult for some people to read (or just easy to ignore) and that is why we launched our PDP-Compare tool so we can stress the importance of knowing your annual plan changes.

Our Q1Medicare PDP-Compare and MA-Compare tools provide a side-by-side comparison of basic plan costs and design changes between all individual Medicare Part D plans as we move from one year to the next.

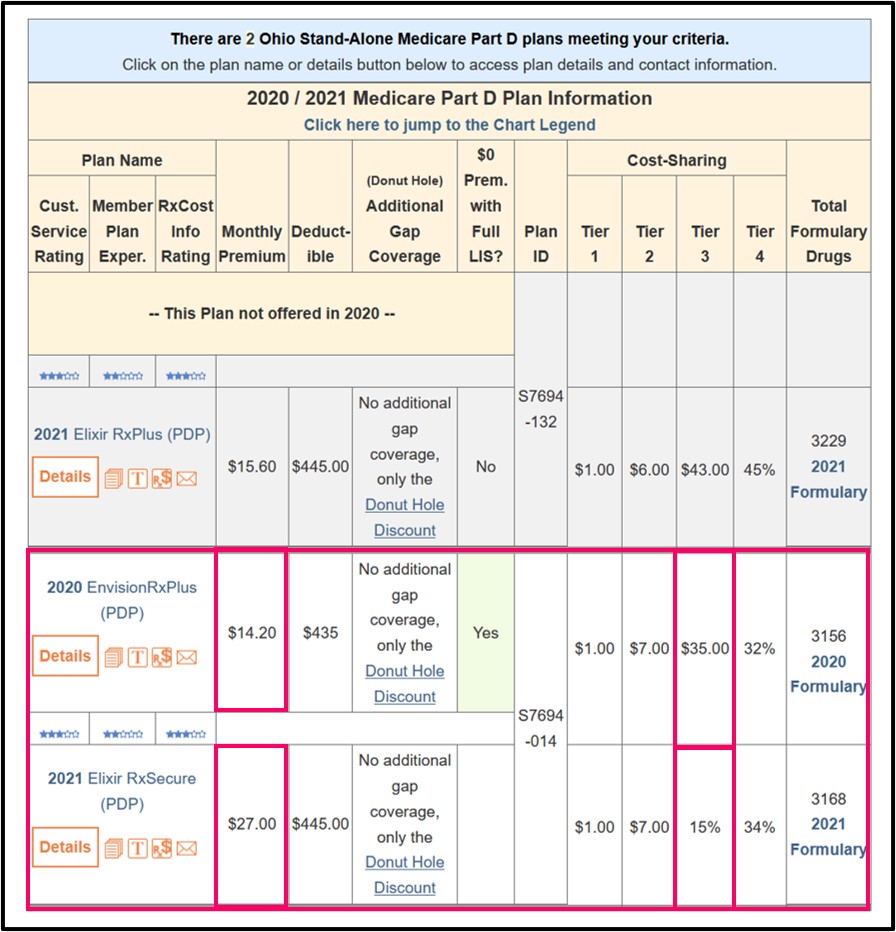

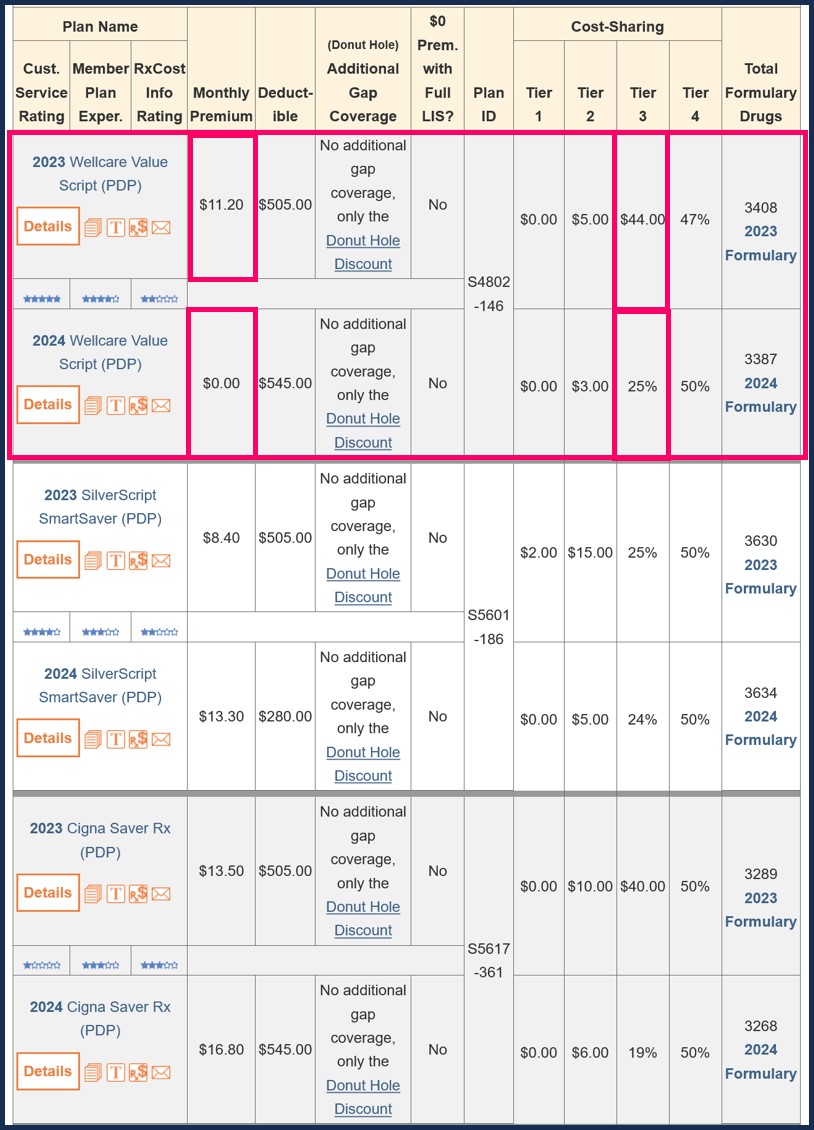

As an example, below shows how a Medicare Part D plan in Ohio will change the plan name, increase monthly premiums, increase the deductible, and change drug cost-sharing for the next plan year.

From the graphic you can see that people enrolled in the 2020 Ohio EnvisionRxPlus plan (who took no action during the annual Open Enrollment Period (October 15 through December 7)) found themselves enrolled in the 2021 Elixer RxSecure plan on January 1st, 2021.

On the positive side, the new 2020 plan had a larger formulary as compared to the previous year's 2019 drug list.

You can click on the plan names for the plan's coverage details and you can click on the "formulary" text to browse the plan's formulary or drug list using our Formulary Browser.

All Medicare Part D prescription drug plans in all states (and US territories) are represented with the PDP-Compare tool and here is an example link to how all stand-alone Medicare Part D plans will change from one year to the next within the state of New Jersey: PDPCompare.com/NJ.

Our MA-Compare tool

You can use our PDP-Compare/FL to review coverage changes in stand-alone Part D drug plans and use our MA-Compare.com/15238 for annual changes in Medicare Advantage plans.

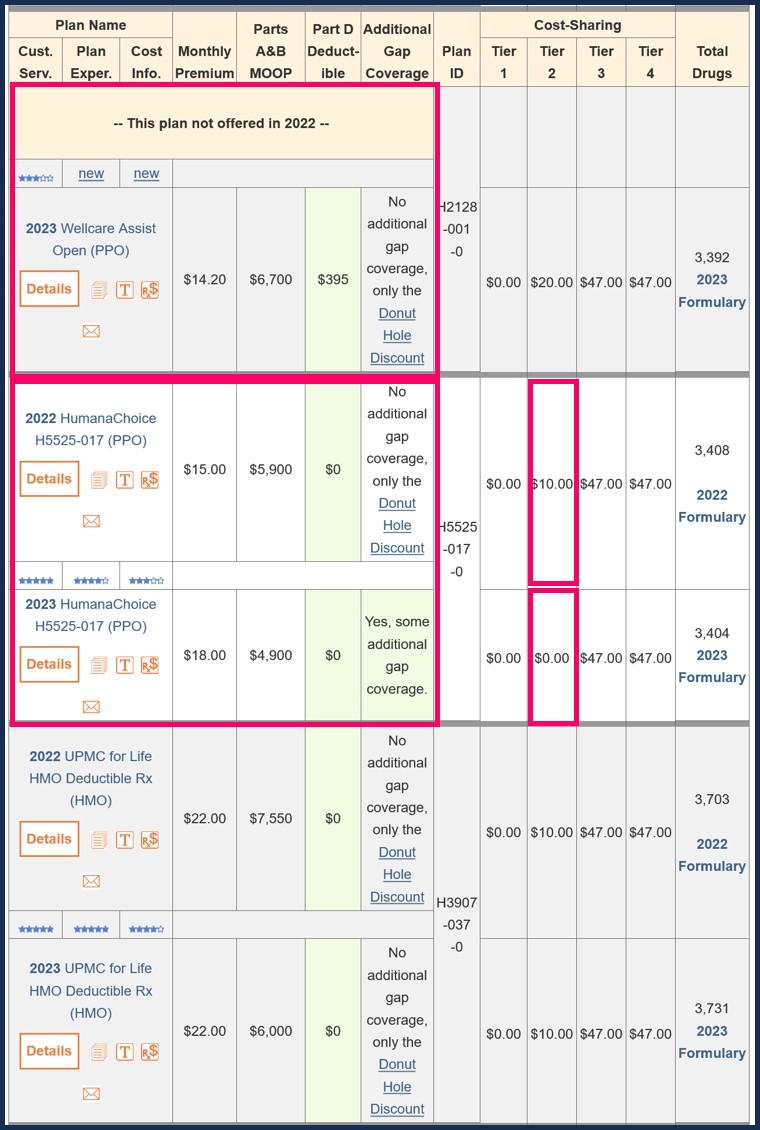

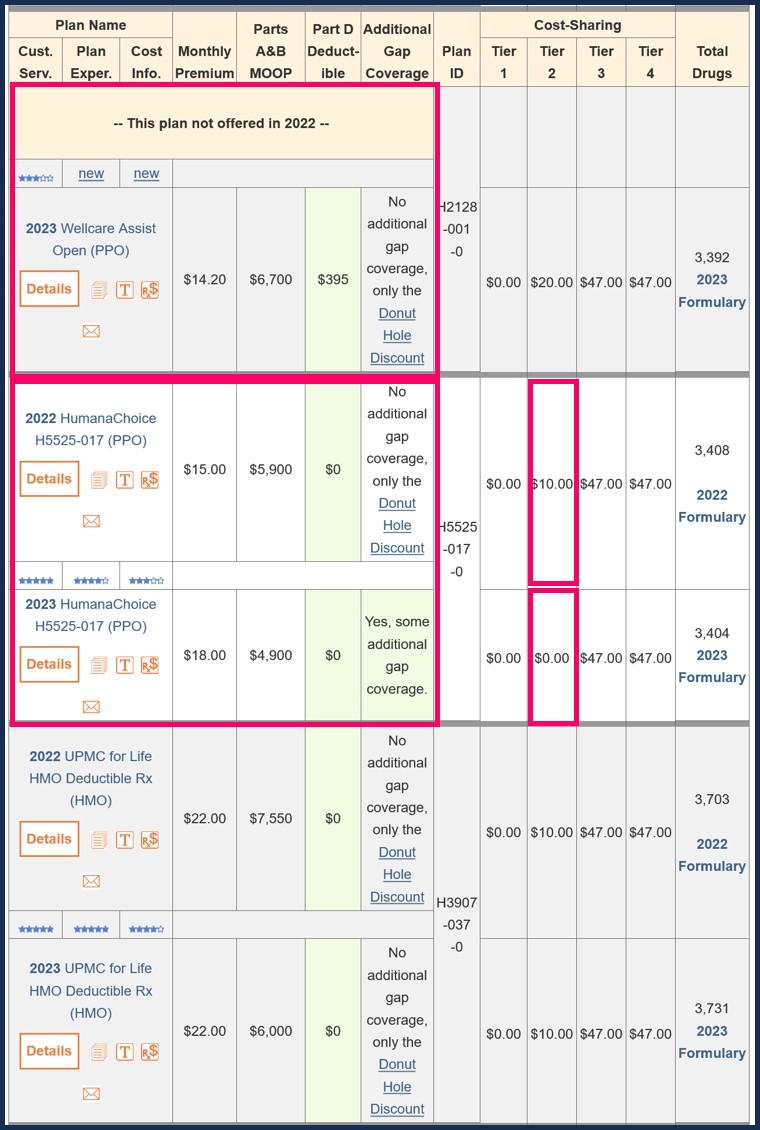

Like our PDP-Compare tool, you can find similar information for annual changes to Medicare Advantage plans using the Q1Medicare MA-Compare or Medicare Advantage plan annual comparison tool.

As an example, using Zip Code 90001 (Los Angeles, California), you can see that there were 195 different 2020/2021 Medicare Advantage plans changes year-to-year. That is, Medicare Advantage plans in this Los Angeles county are changing healthcare and drug coverage, changing plan names, leaving the Service Area, or entering the Service Area.

Like Medicare Part D plans, each year, Medicare Advantage plans can be changing:

Again, as with our PDP-Compare tool, we make every effort to show changes in all Medicare Advantage plans (with and without drug coverage, Special Needs Plans, and MSAs) in all states and US territories. MA-Compare.com/15238 - please note that we also show Medicare plans "sanctioned" by the Centers for Medicare and Medicaid Services (CMS).

Again, as with our PDP-Compare tool, we make every effort to show changes in all Medicare Advantage plans (with and without drug coverage, Special Needs Plans, and MSAs) in all states and US territories. MA-Compare.com/15238 - please note that we also show Medicare plans "sanctioned" by the Centers for Medicare and Medicaid Services (CMS).

You can use our PDP-Compare/FL to review coverage changes in stand-alone Part D drug plans and use our MA-Compare.com/15238 for annual changes in Medicare Advantage plans.

Like our PDP-Compare tool, you can find similar information for annual changes to Medicare Advantage plans using the Q1Medicare MA-Compare or Medicare Advantage plan annual comparison tool.

As an example, using Zip Code 90001 (Los Angeles, California), you can see that there were 195 different 2020/2021 Medicare Advantage plans changes year-to-year. That is, Medicare Advantage plans in this Los Angeles county are changing healthcare and drug coverage, changing plan names, leaving the Service Area, or entering the Service Area.

Like Medicare Part D plans, each year, Medicare Advantage plans can be changing:

- Plan availability - Your Medicare Advantage plan may not be offered next year.

- New Medicare Advantage plan options may be available to you next year.

- Plan mergers and consolidations - You may be automatically moved or "crosswalked" to another Medicare plan.

- Your Medicare plan's name may change.

- Your monthly premiums may increase.

- Your plan's maximum out-of-pocket limit or MOOP may change.

- Your Medicare drug plan's Formulary or Drug Lists may change.

- Your drug cost sharing amounts (what you pay for co-payments or co-insurance) may change.

- ... and more

Browse FAQ Categories

Pets are Family Too!

Use your drug discount card to save on medications for the entire family ‐ including your pets.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service