What is a Medicare Part D PDP?

A Medicare Part D PDP is a stand-alone Medicare Part D prescription drug plan that provides

insurance coverage for your out-patient prescription drugs. (Prescription drugs you receive in the hospital or a doctor's office may

be covered by your Medicare Part A or Medicare Part B.)

So like any insurance, you will pay a monthly premium (unless you join a plan with a $0 premium), pay an initial deductible (unless you join a plan with a $0 deductible or have a plan that excludes low-costing generics from the deductible), and receive some form of coverage for any drugs that are on your plans drug list or formulary at participating pharmacies (or pharmacies within the plans network).

Note: Low-income Medicare beneficiaries may qualify for the Medicare Part D Extra Help program and have lower (or no) monthly premiums and pay very low costs for formulary drugs throughout the year.

Every Medicare Part D or Medicare Advantage plan is a little different with different premiums, initial deductibles, drug coverage (plans do not cover the same drugs), and cost-sharing (what you pay for your drugs). For more information, please see our popular Frequently Asked Question, "What is a Medicare Part D plan?" found at: Q1FAQ.com/563

So like any insurance, you will pay a monthly premium (unless you join a plan with a $0 premium), pay an initial deductible (unless you join a plan with a $0 deductible or have a plan that excludes low-costing generics from the deductible), and receive some form of coverage for any drugs that are on your plans drug list or formulary at participating pharmacies (or pharmacies within the plans network).

Note: Low-income Medicare beneficiaries may qualify for the Medicare Part D Extra Help program and have lower (or no) monthly premiums and pay very low costs for formulary drugs throughout the year.

Every Medicare Part D or Medicare Advantage plan is a little different with different premiums, initial deductibles, drug coverage (plans do not cover the same drugs), and cost-sharing (what you pay for your drugs). For more information, please see our popular Frequently Asked Question, "What is a Medicare Part D plan?" found at: Q1FAQ.com/563

Question: How to choose a Medicare Part D PDP?

In general, you want a Medicare Part D plan that provides the most economical drug coverage at the pharmacies you usually visit. To learn more:

(1) Which PDPs are available to you?

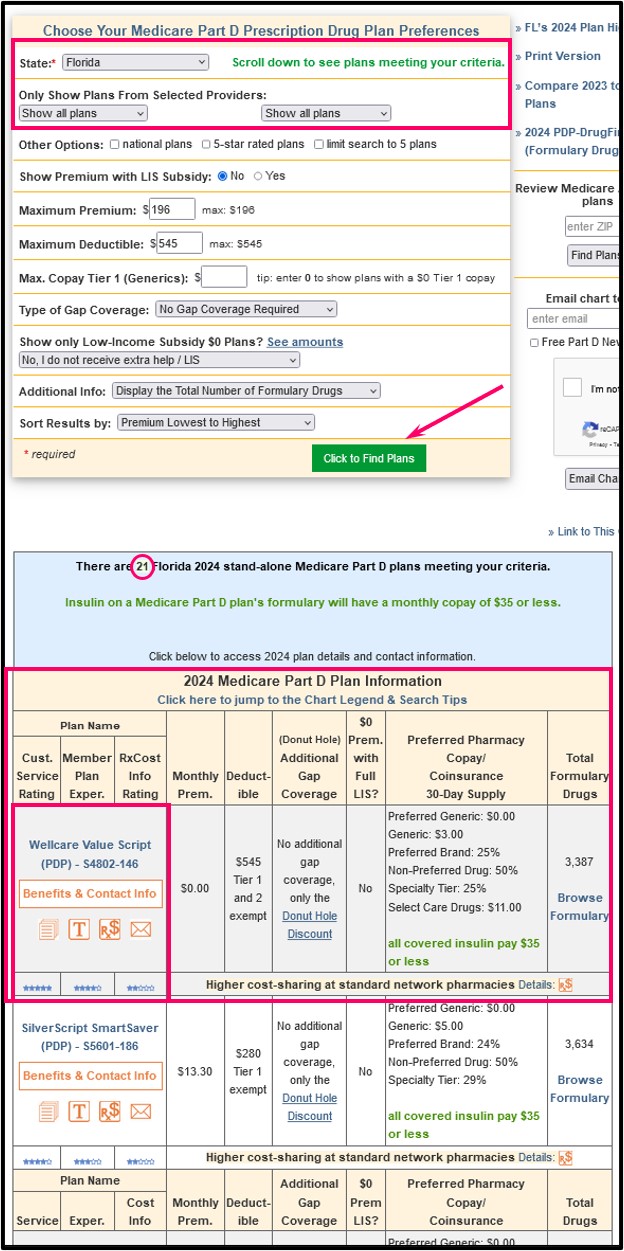

You can begin by reviewing the Medicare plans that are available in your area (see our Medicare Part D Plan Finder at PDP-Finder.com - you can click here for an overview of our PDP Finder or just choose your state to get started). You will see that each stand-alone Medicare Part D PDP provides unique coverage with different monthly premiums, deductibles, coverage cost, and drug coverage.

(2) Which drugs are covered by the Medicare Part D PDP?

Be sure to review the PDPs Formulary (drug list) and cost-sharing and usage management restrictions to learn more about how your PDP will cover your prescriptions.

Important: Medicare Part D drug plans cover thousands of drugs(2,000 to 4,000), but drug plans are not required to cover all known prescription drugs - and all drugs are not covered at the same cost - and some drugs have additional coverage restrictions. Instead drug are only required to cover a fixed number of drugs in certain drug classes to be sure that all drug plans have a well-rounded offering of prescriptions.

You can also use our Formulary Browser to see the drugs covered by any plan (and at what cost and with what restrictions): see Formulary-Browser.com.

The medications covered by a Medicare Part D plan are organized in a formulary or drug list and you need to check the formulary to ensure your drugs are covered - or you can ask your Medicare plan to make an exception and cover a non-formulary drug - but a drug plan is not required to grant your request. Some drugs are also excluded by law from Medicare Part D coverage, but may be covered by your plan as supplemental drugs.

(3) Ready to enroll or need additional assistance?

If you are ready to choose a Medicare Part D plan that most economically covers your medications at your chosen pharmacy - call a Medicare representative at 1-800-633-4227 for enrollment assistance or a Medicare representative can offer help finding a plan and enrolling into a plan.

(4) What happens after enrollment?

Once you are enrolled in the Part D PDP, you will pay a monthly premium (like any other insurance), then you may pay an initial deductible before your plan coverage begins (although some drug plans have a $0 deductible). You and your Part D plan will then each share a portion of the drug's coverage costs (for example, your Part D plan may pay 75% of retail drug prices and you pay the 25% balance - or you may pay a $2 copay for your generic drugs and a $47 copay for brand-name drugs).

Question: Are there any alternative ways to get Medicare Part D coverage?

Yes: Your Medicare Part D prescription drug coverage can be provided in several ways:

Yes: Your Medicare Part D prescription drug coverage can be provided in several ways:

- A "stand-alone" Medicare Part D prescription drug plan (PDP)

A PDP only provides prescription coverage - and perhaps some supplemental or over-the-counter drug coverage (in limited cases).

- A Medicare Advantage plan that includes prescription coverage (MAPD)

A MAPD includes your Medicare Part D prescription drug coverage (like a PDP) - plus an MAPD includes Medicare Part A coverage (for in-patient and hospital care) - plus Medicare Part B coverage (for out-patient and physician care) - and often other benefits such as basic dental coverage, optical coverage, hearing aid coverage, and fitness coverage (maybe even transportation coverage, home healthcare, and other supplemental benefits) - all for one monthly premium.

Medicare Advantage plans are also called Medicare Part C.

- Your employer or union drug coverage. Your current or past

employer (or spouse's employer) may provide coverage of your

prescription drugs that is as good as Medicare Part D coverage (or

"creditable" drug coverage). If you have creditable employer or union

drug coverage you do not need to join a Medicare Part D drug plan (PDP

or MAPD).

Important: If you are receiving prescription drug coverage from your employer, the key is to ensure that any Employer Health Plan provides "creditable" prescription drug coverage so that you avoid any Late-Enrollment penalties.

- Finally, you can also receive "creditable" prescription drug coverage from

other sources such as your Union, Employer Health Plan, TRICARE for

Life, or the Veterans Affairs (VA).

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service