What is the 5-star Special Enrollment Period?

The 5-Star Special Enrollment Period (SEP) is a once-a-year opportunity

to switch from your current Medicare Part D prescription drug plan (PDP) or Medicare Advantage plan (MA or MAPD) to another Medicare Part D or Medicare Advantage plan with a

"5-Star" quality rating -- as long as a 5-Star plan is available in your area.

The 5-Star SEP can be used at any time starting December 8 and continuing through November 30 with your new Medicare plan coverage beginning the first day of the month after your enrollment.

Unfortunately, 5-Star Medicare plans are usually only found in limited geographic areas (although this still amounts to millions of people who can use the 5-Star SEP to change plans mid-year) - and the number of plans with a 5-Star quality rating changes from year-to-year.

For example, in 2023, we saw the largest number of 5-Star rated Medicare Advantage plans to date, with about 31 million Medicare beneficiaries having access to one or more 5-Star rated Medicare Advantage plans. Unfortunately, no 5-Star rated 2023 stand-alone Medicare Part D plans (PDPs) are available to the general public (there are only 5-Star rated employer/union plans).

And, in 2024, we will see fewer 5-Star rated Medicare Advantage plans; however, about 28 million Medicare beneficiaries will still have access to one or more 5-Star rated Medicare Advantage plans. Once again, no 5-Star rated 2024 stand-alone Medicare Part D plans (PDPs) are available to the general public (there are only 5-Star rated employer/union plans).

More about the Medicare plan Star Ratings

Each year, the Centers for Medicare and Medicaid Services (CMS) rates the quality of Medicare Part D and Medicare Advantage plans using various measures. In the end, an overall Star Rating is calculated for each Medicare plan. A summary rating of prescription drug plan quality and a separate summary rating of health plan quality are calculated where appropriate.

The data used to calculate the Star Ratings is gathered from several different sources: surveys of Plan Members, or reviews of billing or self-reporting information submitted by Medicare plans to CMS (as part of Medicare’s regular monitoring activities).

Star Ratings are also awarded for various discrete aspects of Medicare Part D and Medicare Advantage plans. As a note, newly-introduced Medicare Part D or Medicare Advantage plans do not have any historical information, so they will not have any Star or quality ratings for the first year. For more information, please see: q1medicare.com/PartD-StarRatingsMedicareQualityRating.php

Question: What are Special Enrollment Periods?

Special Enrollment Periods (or SEPs) allow you to change to another Medicare Part D or Medicare Advantage plan outside of the annual Open Enrollment Period (AEP) that runs each year from October 15th through December 7th. If you use a SEP to change Medicare plans outside of the AEP, your coverage with the new plan will begin the first day of the month after enrollment.

SEPs are only granted for specific reasons (such as when you move outside of your plan’s service area or enter a long-term care facility). You can click here to read more about the Special Enrollment Periods that may be available to you.

Remember, if you are eligible for the Medicare Part D Extra Help program, you are granted a quarterly Special Enrollment Period and can change Medicare plans once per quarter during the first nine months of the year.

And a little background on the 5-Star SEP

In 2012, the Centers for Medicare and Medicaid Services (CMS) established a Special Enrollment Period (SEP) allowing Medicare beneficiaries eligible for Medicare Part D prescription drug plans (PDP) or Medicare Advantage plans (MA and MAPD) to switch to a 5-Star plan at any point during the year.

The 5-Star SEP can be used at any time starting December 8 and continuing through November 30 with your new Medicare plan coverage beginning the first day of the month after your enrollment.

Unfortunately, 5-Star Medicare plans are usually only found in limited geographic areas (although this still amounts to millions of people who can use the 5-Star SEP to change plans mid-year) - and the number of plans with a 5-Star quality rating changes from year-to-year.

For example, in 2023, we saw the largest number of 5-Star rated Medicare Advantage plans to date, with about 31 million Medicare beneficiaries having access to one or more 5-Star rated Medicare Advantage plans. Unfortunately, no 5-Star rated 2023 stand-alone Medicare Part D plans (PDPs) are available to the general public (there are only 5-Star rated employer/union plans).

And, in 2024, we will see fewer 5-Star rated Medicare Advantage plans; however, about 28 million Medicare beneficiaries will still have access to one or more 5-Star rated Medicare Advantage plans. Once again, no 5-Star rated 2024 stand-alone Medicare Part D plans (PDPs) are available to the general public (there are only 5-Star rated employer/union plans).

More about the Medicare plan Star Ratings

Each year, the Centers for Medicare and Medicaid Services (CMS) rates the quality of Medicare Part D and Medicare Advantage plans using various measures. In the end, an overall Star Rating is calculated for each Medicare plan. A summary rating of prescription drug plan quality and a separate summary rating of health plan quality are calculated where appropriate.

The data used to calculate the Star Ratings is gathered from several different sources: surveys of Plan Members, or reviews of billing or self-reporting information submitted by Medicare plans to CMS (as part of Medicare’s regular monitoring activities).

Star Ratings are also awarded for various discrete aspects of Medicare Part D and Medicare Advantage plans. As a note, newly-introduced Medicare Part D or Medicare Advantage plans do not have any historical information, so they will not have any Star or quality ratings for the first year. For more information, please see: q1medicare.com/PartD-StarRatingsMedicareQualityRating.php

Question: What are Special Enrollment Periods?

Special Enrollment Periods (or SEPs) allow you to change to another Medicare Part D or Medicare Advantage plan outside of the annual Open Enrollment Period (AEP) that runs each year from October 15th through December 7th. If you use a SEP to change Medicare plans outside of the AEP, your coverage with the new plan will begin the first day of the month after enrollment.

SEPs are only granted for specific reasons (such as when you move outside of your plan’s service area or enter a long-term care facility). You can click here to read more about the Special Enrollment Periods that may be available to you.

Remember, if you are eligible for the Medicare Part D Extra Help program, you are granted a quarterly Special Enrollment Period and can change Medicare plans once per quarter during the first nine months of the year.

And a little background on the 5-Star SEP

In 2012, the Centers for Medicare and Medicaid Services (CMS) established a Special Enrollment Period (SEP) allowing Medicare beneficiaries eligible for Medicare Part D prescription drug plans (PDP) or Medicare Advantage plans (MA and MAPD) to switch to a 5-Star plan at any point during the year.

Question: Where can I see the 5-Star Medicare Part D or Medicare Advantage plans in my area?

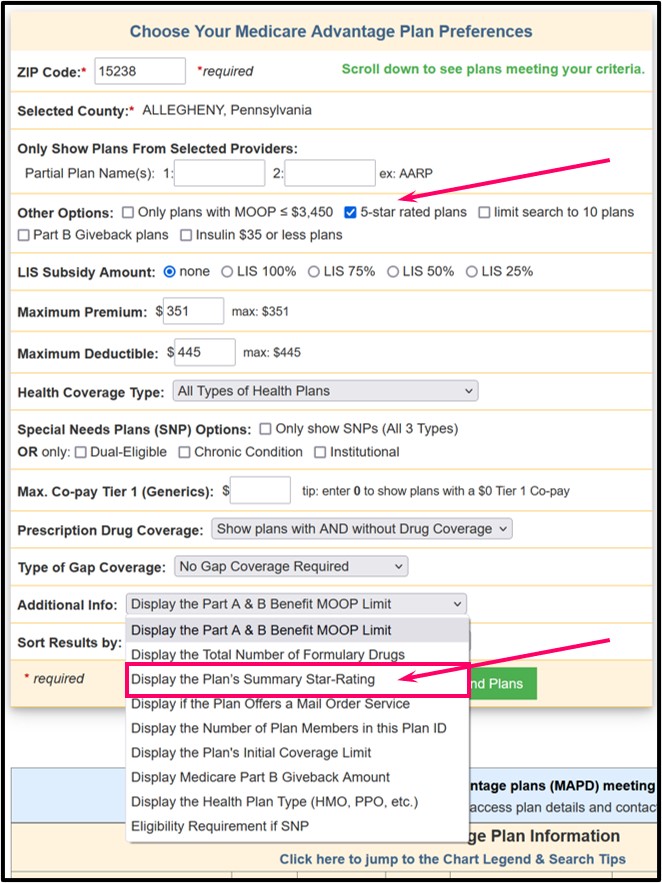

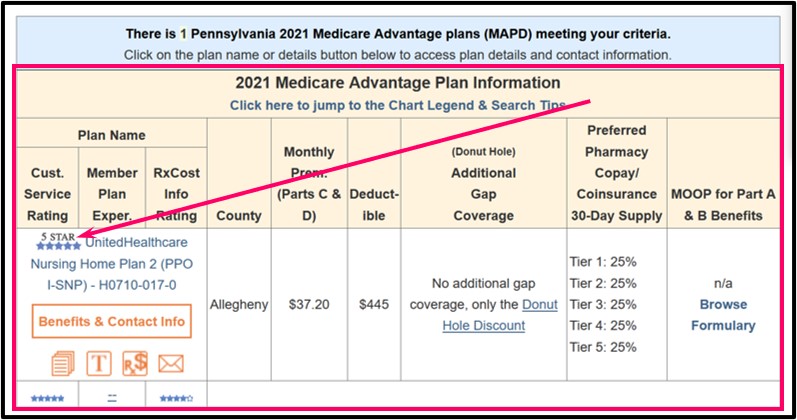

We highlight Medicare plans with a 5-Star rating in our Medicare Part D Plan Finder (PDP-Finder.com/OH) and our Medicare Advantage Plan Finder (MA-Finder.com/15238) using a special 5-Star icon (the following graphic shows the only 5-Star 2021 Medicare Advantage plan found in Allegheny County, Pennsylvania).

The top of the Medicare Advantage Plan Finder allows you to choose to only see 5-Star plans in your chosen area and the "Additional Information" field will show more information about Star Ratings in the right-hand column.

The results of the Plan Finder search will show any Medicare plans with the 5-Star rating sorted by premiums (no plans will be shown if no 5-Star rated plans area found within your chosen ZIP code, county, or state (for Medicare Part D plans)). The 5-Star rating icon will be shown near the name of the Medicare plan.

Examples of the 5-Star Medicare Part D and Medicare Advantage plans available during different plan years can be found below:

CMS exercised statutory authority under Section 1851(e)(4)(D) of the Social Security Act to establish the 5-star Special Election Period as part of CMS’ overall quality effort, combined with the quality bonus payment demonstration, to give plans greater incentive to achieve 5-Star status.

Question: What data is used to create the 5-Star quality rating?

CMS uses the quality rating information gathered from the previous year to determine a Medicare Part D or Medicare Advantage plan's quality rating and the summary quality star rating is awarded on a calendar year basis. For example, Medicare plan ratings for the 2024 plan year were published in the fall of 2023 using data collected prior to the 2024 annual Open Enrollment Period (AEP).

Again, the summary quality star rating is provided by CMS prior to each Annual Coordinated Election Period (AEP) or annual Open Enrollment Period and star ratings are effective for the following contract year (January through December).

Question: Who is eligible for this SEP?

Effective dates for enrollments made under the 5-Star SEP will be the first of the month following the month when the enrollment request is received. Once an individual enrolls in a 5-Star plan using this SEP, the individual's SEP ends for that plan year and the individual will be limited to making changes only during other applicable election periods.

Question: How many times can I use the 5-Star SEP?

Just once. As a reminder, the 5-Star SEP can only be used one time during the plan year -- between December 8th through November of the following year.

Please also see our Star Rating Frequently Asked Questions, including: Is there any risk associated with using the 5-Star Special Enrollment Period?

For more history of the 5-Star SEP please see the category: Star Ratings & Plan Quality

- 2024 Medicare Advantage Plans with a CMS 5-Star Quality Rating.

- 2023 Medicare Advantage Plans with a CMS 5-Star Quality Rating.

- 2022 Medicare Advantage Plans with a CMS 5-Star Quality Rating

- 2020 Medicare Part D and Medicare Advantage Plans with a CMS 5-Star Quality Rating.

- 2019 Medicare Part D and Medicare Advantage Plans with a CMS 5-Star Quality Rating.

- 2018 Medicare Part D and Medicare Advantage Plans with a CMS 5-Star Quality Rating.

- 2017 Medicare Part D and Medicare Advantage Plans with a CMS 5-Star Quality Rating.

- 2015 Medicare Part D and Medicare Advantage Plans with a CMS 5-Star Quality Rating.

- 2014 CMS 5-Star Quality Rated Medicare Part D & Medicare Advantage Plans.

- 2013 Medicare Advantage Plans with a CMS 5-Star Quality Rating.

- 2012 Medicare Advantage Plans with a CMS 5-Star Quality Rating.

CMS exercised statutory authority under Section 1851(e)(4)(D) of the Social Security Act to establish the 5-star Special Election Period as part of CMS’ overall quality effort, combined with the quality bonus payment demonstration, to give plans greater incentive to achieve 5-Star status.

Question: What data is used to create the 5-Star quality rating?

CMS uses the quality rating information gathered from the previous year to determine a Medicare Part D or Medicare Advantage plan's quality rating and the summary quality star rating is awarded on a calendar year basis. For example, Medicare plan ratings for the 2024 plan year were published in the fall of 2023 using data collected prior to the 2024 annual Open Enrollment Period (AEP).

Again, the summary quality star rating is provided by CMS prior to each Annual Coordinated Election Period (AEP) or annual Open Enrollment Period and star ratings are effective for the following contract year (January through December).

Question: Who is eligible for this SEP?

- Beneficiaries currently enrolled any MA, MAPD or PDP plan (including those that already have a 5-Star rating)

- Beneficiaries who are enrolled in Original Medicare and meet the eligibility requirements for Medicare Advantage

Effective dates for enrollments made under the 5-Star SEP will be the first of the month following the month when the enrollment request is received. Once an individual enrolls in a 5-Star plan using this SEP, the individual's SEP ends for that plan year and the individual will be limited to making changes only during other applicable election periods.

Question: How many times can I use the 5-Star SEP?

Just once. As a reminder, the 5-Star SEP can only be used one time during the plan year -- between December 8th through November of the following year.

Please also see our Star Rating Frequently Asked Questions, including: Is there any risk associated with using the 5-Star Special Enrollment Period?

For more history of the 5-Star SEP please see the category: Star Ratings & Plan Quality

Browse FAQ Categories

Find Prescription Discounts

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service