Where can I find the Medicare Part D prescription drug plan formularies or drug lists?

Our Q1Medicare® Formulary Browser includes formularies for all Medicare Part D prescription drug plans (PDPs) and Medicare Advantage plans (MAPDs) - and is packed with valuable information about your drug coverage such as drug tier, cost-sharing, and drug usage management restrictions for each formulary drug.

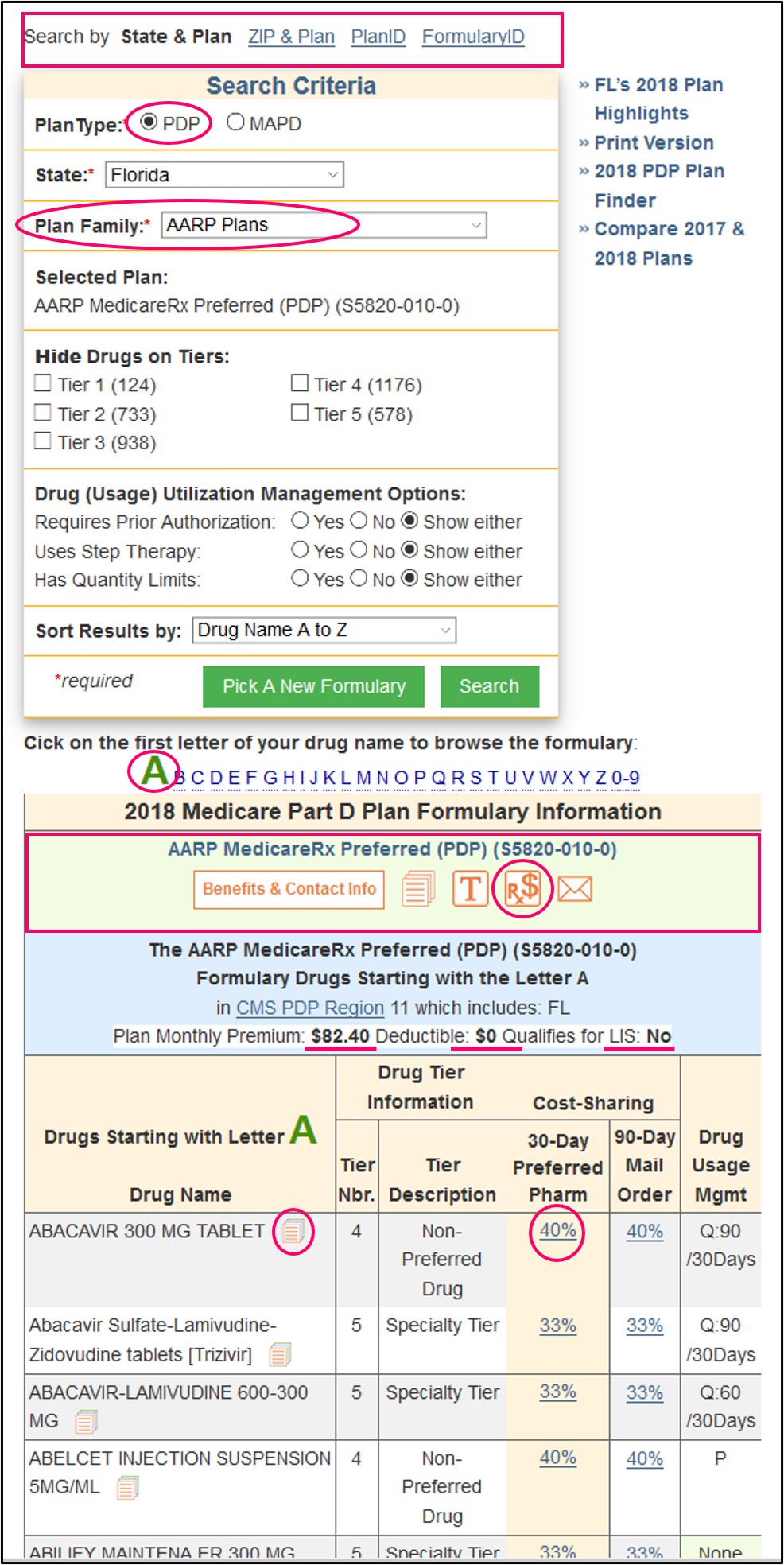

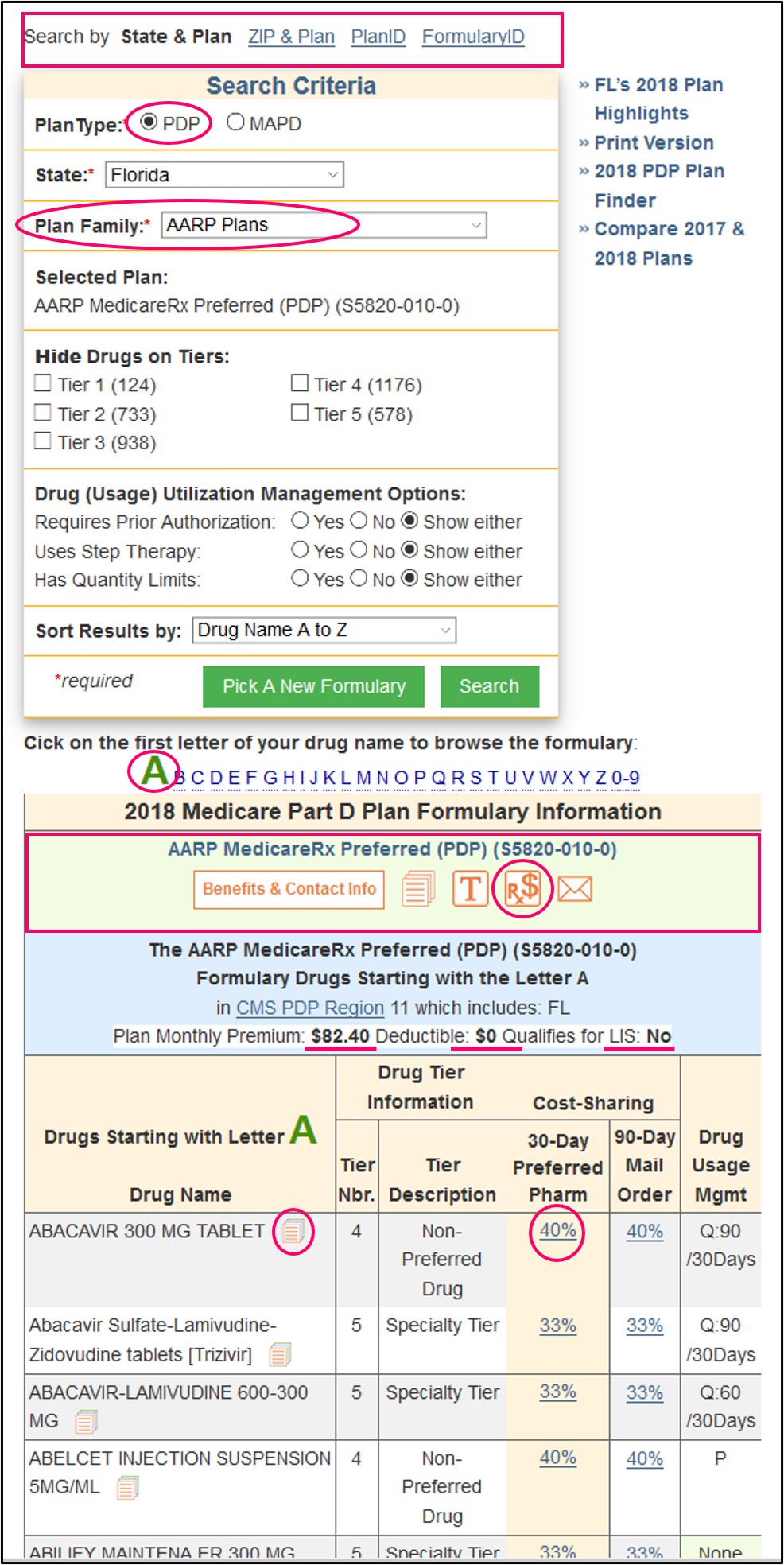

You can access our Formulary Browser directly at: FormularyBrowser.com and to get started select your state or entering your ZIP code (if you selected "MAPD") and select a Medicare plan carrier (such as AARP or Aetna).

Our Formulary Browser allows you to browse through any plan’s drug list alphabetically to review drug tier, cost-sharing details, and drug usage management for each covered drug.

When browsing the formulary, you will see a small icon (like a stack of paper) next to the drug name - and this icon is a link to our Q1Rx® Drug Finder (Q1Rx.com). Our Drug Finder allows you to look at coverage for a specific drug across all stand-alone Medicare Part D plans (PDPs) or Medicare Advantage plans that offer drug coverage (MAPD) plans in your service area.

You can access our Formulary Browser directly at: FormularyBrowser.com and to get started select your state or entering your ZIP code (if you selected "MAPD") and select a Medicare plan carrier (such as AARP or Aetna).

Our Formulary Browser allows you to browse through any plan’s drug list alphabetically to review drug tier, cost-sharing details, and drug usage management for each covered drug.

When browsing the formulary, you will see a small icon (like a stack of paper) next to the drug name - and this icon is a link to our Q1Rx® Drug Finder (Q1Rx.com). Our Drug Finder allows you to look at coverage for a specific drug across all stand-alone Medicare Part D plans (PDPs) or Medicare Advantage plans that offer drug coverage (MAPD) plans in your service area.

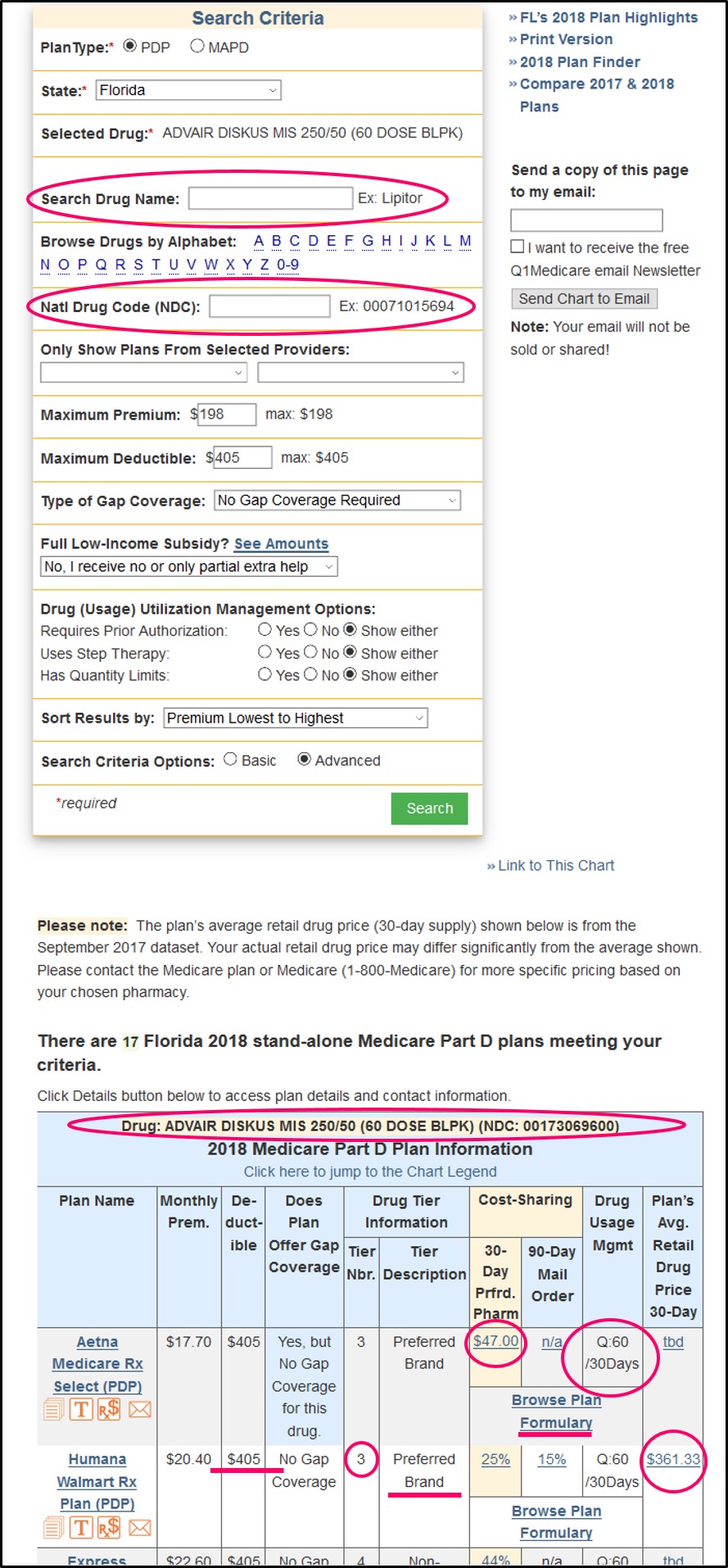

Using the Q1Rx Drug Finder, you can review plan features, drug tier, cost-sharing details (with estimated cost and explanation), drug usage management, and each plan’s average negotiated retail drug price (when available - otherwise we will show "tbd" meaning the drug price has not yet been released to us). You click on the cost-sharing (for instance, 40% or $47) for more about drug costs and the medication's pricing history (click on cost-sharing value or the retail average negotiated retail drug price).

You can access our Drug Finder directly at: Q1Rx.com.

Please notice the drug's average negotiated retail price for each Medicare prescription drug plan is shown in the right column. The actual retail price that you will see at a pharmacy can vary depending on your chosen pharmacy and recent changes in retail pricing. If we show "tbd" then the retail price information is "to be determined" when the data is released to us.

You can use the “Rx$” icon found on our Formulary Browser and Drug Finder to see any cost-sharing differences between a Medicare prescription drug plan’s preferred and standard network pharmacies.

You can also contact your Medicare plan provider and ask them to send you a printed comprehensive formulary or ask the plan where to find their online formulary.

If you do not know the plan’s Member Services telephone number, you can click on the Medicare plan name on our PDP-Finder.com or MA-Finder.com tools to see the plan’s Member Services telephone number or you can call Medicare at 1-800-633-4227 for more information about a particular Medicare plan.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service