Where can I find the size of the Medicare Part D prescription drug plan formularies?

We include the size of all Medicare Part D prescription drug plan formularies in our stand-alone Medicare Part D Plan Finder (PDP-Finder.com) and our Medicare Advantage Plan Finder (MA-Finder.com).

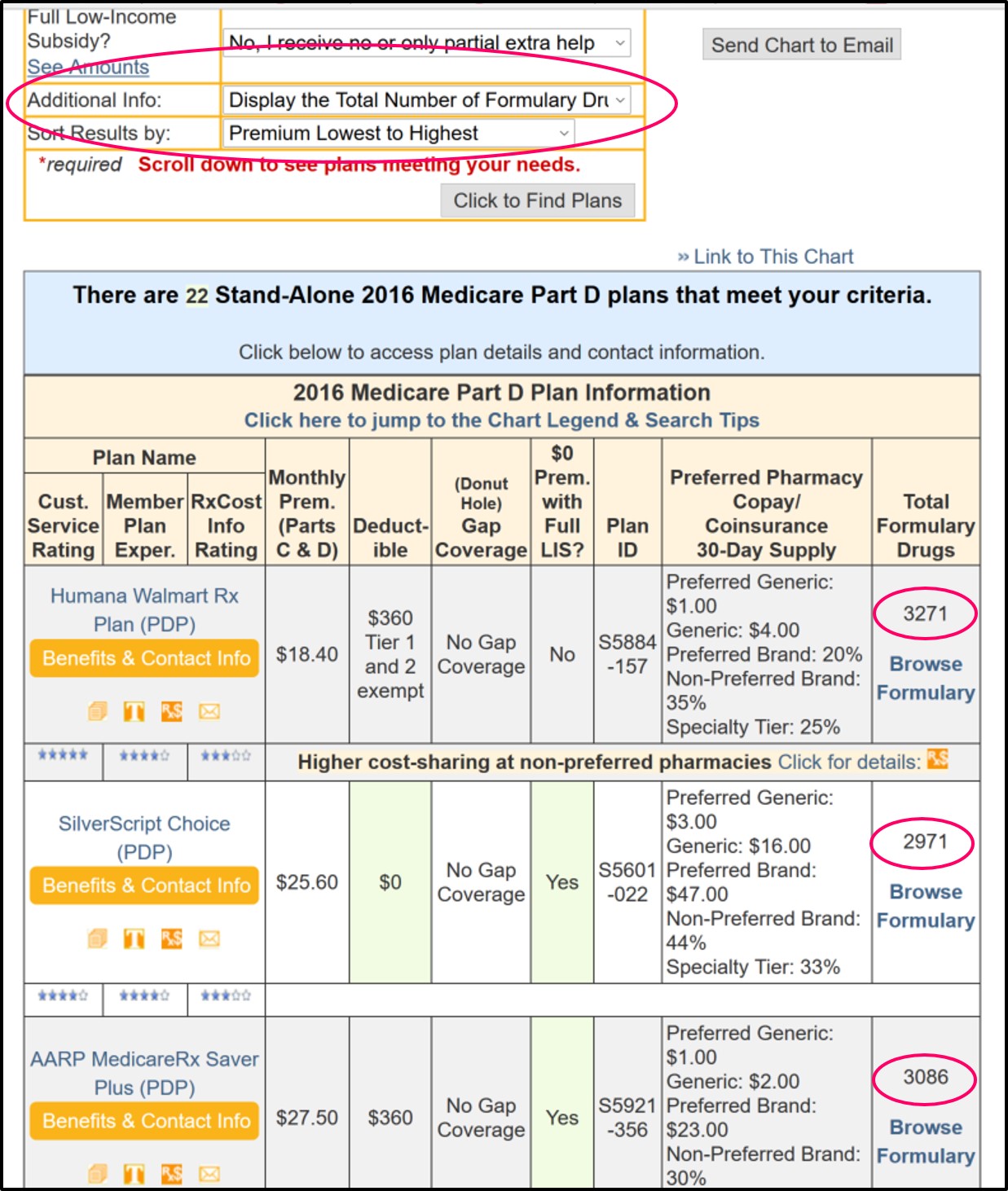

In our PDP-Finder tool we show the number of drugs on a stand-alone Medicare Part D drug plan's formulary by default in the right-most column of our Plan Finder tools ("Total Formulary Drugs").

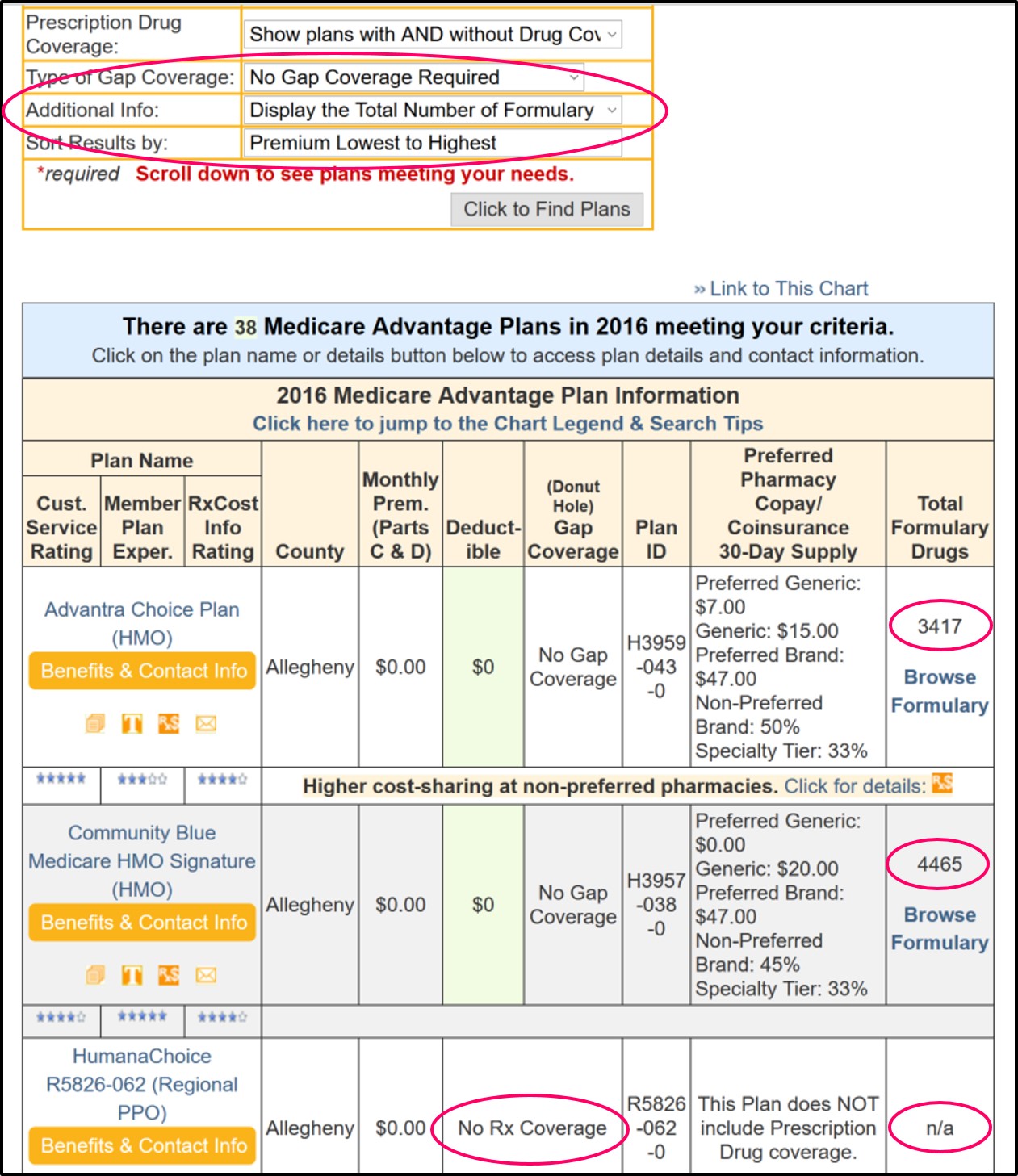

In our MA-Finder tool, we show "MOOP for Part A & B Benefits" for Medicare Advantage plans by default in the right-most column and you will need to choose "Display the Total Number of Formulary Drugs" from the search box "Additional Info:".

Question: What exactly is meant by the "total" number of formulary drugs?

The number that we show under the "Total Formulary Drugs" column is the number of National Drug Codes that are covered by a Medicare drug plan (PDP or MAPD).

National Drug Codes distinctly identify the medication, the medication strength, the medication's packaging, and the manufacturer of the medication. This means that a Medicare drug plan may cover a common drug such as "atorvastatin" in multiple formats and we count every variation of the drug as another medication on the plan's formulary.

So you may see a drug plan will cover "atorvastatin", but we will count multiple entries for the same drug name with multiple strengths, forms, or packaging. As an example, we count four (4) unique drug entries for "atorvastatin" since the Medicare drug plan actually covers:

In our PDP-Finder tool we show the number of drugs on a stand-alone Medicare Part D drug plan's formulary by default in the right-most column of our Plan Finder tools ("Total Formulary Drugs").

In our MA-Finder tool, we show "MOOP for Part A & B Benefits" for Medicare Advantage plans by default in the right-most column and you will need to choose "Display the Total Number of Formulary Drugs" from the search box "Additional Info:".

Question: What exactly is meant by the "total" number of formulary drugs?

The number that we show under the "Total Formulary Drugs" column is the number of National Drug Codes that are covered by a Medicare drug plan (PDP or MAPD).

National Drug Codes distinctly identify the medication, the medication strength, the medication's packaging, and the manufacturer of the medication. This means that a Medicare drug plan may cover a common drug such as "atorvastatin" in multiple formats and we count every variation of the drug as another medication on the plan's formulary.

So you may see a drug plan will cover "atorvastatin", but we will count multiple entries for the same drug name with multiple strengths, forms, or packaging. As an example, we count four (4) unique drug entries for "atorvastatin" since the Medicare drug plan actually covers:

- ATORVASTATIN 10 MG TABLET

- ATORVASTATIN 20 MG TABLET

- ATORVASTATIN 40 MG TABLET

- ATORVASTATIN 80 MG TABLET

Example of number of formulary drugs on a Medicare Part D prescription drug plan (PDP).

You can see the size of all formularies for the stand-alone Medicare Part D plans available in Florida here:

PDP-Finder.com/FL.

Not a Florida resident? You can choose your state at the top of the page or change the URL to your state abbreviation such as PDP-Finder.com/NY to see all Medicare Part D plans in New York state. You can also choose any state from the links above the search box to see Medicare Part D plans in your area.

If you look in the right column, you will see the number of drugs (or distinct National Drug Codes) on any formulary. (Again, you might notice at the top of the Plan Finder page that we have a search filter box and, in the field "Additional Info:", you will see that the text: "Display the Total Number of Formulary Drugs" is chosen by default.)

From this example screen, you can see that the 2016 SilverScript Choice (PDP) plan covered 2971 unique medications (that can also be variations of the same medication).

Please notice that, if a Medicare plan is "sanctioned" by the Centers for Medicare and Medicaid Services (CMS) or for other reasons, CMS has not yet released the plan's formulary data, we will mark the formulary size as "tbd" (or to be determined).

Need more details about how the formulary drugs are organized?

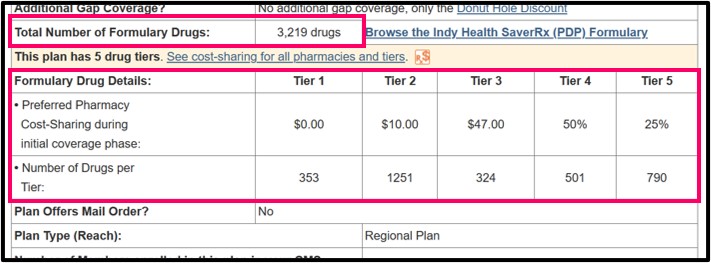

In the plan results page above, you can then click on the Medicare plan name and see more details about the plan's formulary - that is, how many drugs are organized on each drug tier.

In this example screen, you can see the plan covers 3,219 unique drugs with the prescriptions organized over five different formulary tiers (and Tier 2 including the majority or 1,251 unique medications - only 353 drugs are in Tier 1 with a $0 copay).

Example of number of formulary drugs on a Medicare Advantage plan that includes drug coverage (MAPD).

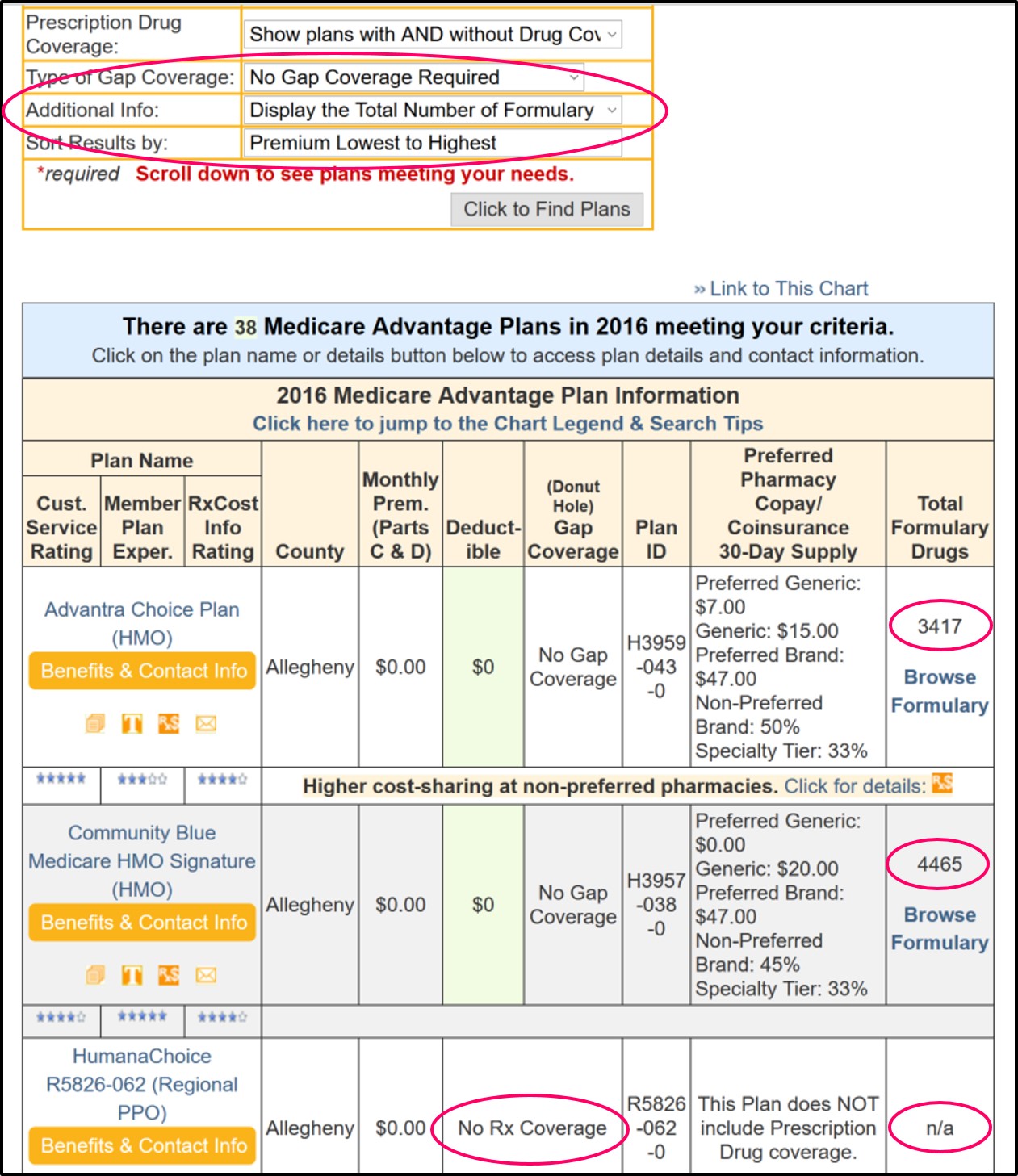

In our Medicare Advantage Plan Finder, you will need to change the search filter's "Additional Info:" search field to: "Display the Total Number of Formulary Drugs" and then click on the "Click to Find Plans" button again. (The default setting for this Medicare Advantage Plan Finder field is showing "Display Part A & Part B Benefit MOOP Limit" or Maximum out of pocket limit). Now the right-hand column should show you the formulary size.

For example, MA-Finder.com/15238 will show you all Medicare Advantage plans in ALLEGHENY County, Pennsylvania and you can change the search field to see the number of formulary drugs. The example below is 2016 Medicare Advantage plans found in Allegheny County, Pennsylvania.

You can enter any ZIP Code for Medicare Advantage plans in your area.

Please notice that, if a Medicare Advantage plan does not include prescription drug coverage (an MA and not an MAPD) or the drug data is not yet available, we will mark the formulary size as "n/a" (or the formulary size is not available).

Need more details about how the Medicare plan organizes the formulary drugs?

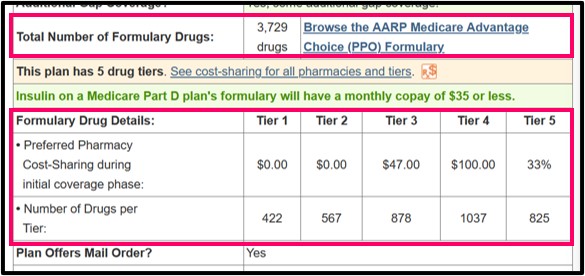

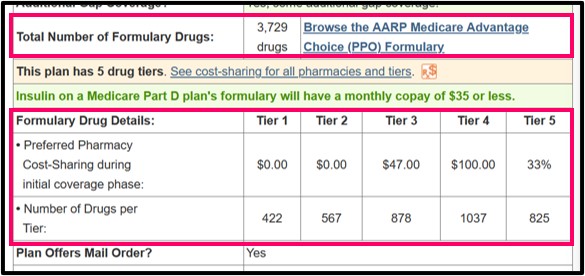

You can then click on the Medicare Advantage plan's name and see more details about the plan's formulary - that is, how many drugs are organized on each drug tier.

In this example screen, you can see the plan covers 3,729 unique drugs with the prescriptions organized over five different formulary tiers (and Tier 4 including the majority or 1,037 unique medications - 422 drugs are in Tier 1 with a $0 copay).

In our Medicare Advantage Plan Finder, you will need to change the search filter's "Additional Info:" search field to: "Display the Total Number of Formulary Drugs" and then click on the "Click to Find Plans" button again. (The default setting for this Medicare Advantage Plan Finder field is showing "Display Part A & Part B Benefit MOOP Limit" or Maximum out of pocket limit). Now the right-hand column should show you the formulary size.

For example, MA-Finder.com/15238 will show you all Medicare Advantage plans in ALLEGHENY County, Pennsylvania and you can change the search field to see the number of formulary drugs. The example below is 2016 Medicare Advantage plans found in Allegheny County, Pennsylvania.

You can enter any ZIP Code for Medicare Advantage plans in your area.

Please notice that, if a Medicare Advantage plan does not include prescription drug coverage (an MA and not an MAPD) or the drug data is not yet available, we will mark the formulary size as "n/a" (or the formulary size is not available).

Need more details about how the Medicare plan organizes the formulary drugs?

You can then click on the Medicare Advantage plan's name and see more details about the plan's formulary - that is, how many drugs are organized on each drug tier.

In this example screen, you can see the plan covers 3,729 unique drugs with the prescriptions organized over five different formulary tiers (and Tier 4 including the majority or 1,037 unique medications - 422 drugs are in Tier 1 with a $0 copay).

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service