Can my Medicare Advantage plan drop me from my plan?

No. In general, your Medicare Advantage (MA) plan can NOT drop your Medicare Advantage coverage unless you are enrolled in a Special Needs Plan (SNP) and no longer have the plan's "special need" -- see below for more information.

A Medicare Advantage plan can also involuntarily disenroll you for specific actions - for example, if you fail to pay your premiums or IRMAA, if you move outside of your plan's Service Area, or you engage in disruptive behavior.

A Medicare Advantage plan is considered "guarantee issue" for anyone who has both Medicare Part A and Part B coverage and lives within the Medicare Advantage plan's Service Area (usually a county or Zip Code area). (And from 2006 through 2020, you also could not have End-Stage Renal Disease (ESRD), but since 2021, you can have ESRD and join a Medicare Advantage plan.)

This means that Medicare beneficiaries are welcomed into a Medicare Advantage Plan without any extensive review of their previous medical history. As mentioned, prior to 2021, there was the limited exception is that a Medicare Advantage Plan could not accept new members who had End Stage Renal Disease (ESRD).

Your Medicare Advantage plan is then automatically renewable each year. However, . . .

Question: Can a Medicare Advantage plan simply quit offering coverage the plan in my county?

Yes. Each year Medicare Advantage plans must also gain approval of their MA plan designs with CMS (Centers for Medicare and Medicaid Services). So it is possible that an insurance company may decide to withdraw from the Medicare Advantage market and not renew their CMS contract - or CMS can cancel a Medicare Advantage plan's contract. In this event, you would be sent a letter that your Medicare Advantage plan is being discontinued and you should move to another Medicare Advantage plan or back to traditional Medicare A and B coverage. We detail the Medicare Advantage plans that are being discontinued in our Medicare articles on annual plan changes and in our Medicare Advantage plan compare tool: MA-Compare.com.

Medicare Advantage plan Service Area Reductions

A Medicare Advantage plan can choose to terminate the plan year-to-year or not offer the Medicare plan in your county or area next year.

For example, if you were enrolled in Medicare plan XYZ in 2024, you may find that in late-September or early-October your plan will send you an Annual Notice of Change letter that will inform you that your plan will not be offered in 2025. During the annual Open Enrollment Period (OEP - October 15 to December 7) you will then need to find another Medicare Advantage plan or Medicare Part D plan that is offered in your area for 2025.

If you make no decision to join a new Medicare plan, you will be returned to Original Medicare Part A and Part B starting January 1st.

If your plan is no longer offered next year, you will also be provide with a Service Area Reduction Special Enrollment Period (SAR SEP) that begins December 8 and continues through February. Using the SAR SEP, you will be able to enroll in a Medicare plan with coverage beginning the first day of the month after enrollment. So if you do not join a new Medicare plan during the OEP, you can still use the SAR SEP to join a 2025 Medicare plan.

A Medicare Advantage plan can also involuntarily disenroll you for specific actions - for example, if you fail to pay your premiums or IRMAA, if you move outside of your plan's Service Area, or you engage in disruptive behavior.

A Medicare Advantage plan is considered "guarantee issue" for anyone who has both Medicare Part A and Part B coverage and lives within the Medicare Advantage plan's Service Area (usually a county or Zip Code area). (And from 2006 through 2020, you also could not have End-Stage Renal Disease (ESRD), but since 2021, you can have ESRD and join a Medicare Advantage plan.)

This means that Medicare beneficiaries are welcomed into a Medicare Advantage Plan without any extensive review of their previous medical history. As mentioned, prior to 2021, there was the limited exception is that a Medicare Advantage Plan could not accept new members who had End Stage Renal Disease (ESRD).

Your Medicare Advantage plan is then automatically renewable each year. However, . . .

Question: Can a Medicare Advantage plan simply quit offering coverage the plan in my county?

Yes. Each year Medicare Advantage plans must also gain approval of their MA plan designs with CMS (Centers for Medicare and Medicaid Services). So it is possible that an insurance company may decide to withdraw from the Medicare Advantage market and not renew their CMS contract - or CMS can cancel a Medicare Advantage plan's contract. In this event, you would be sent a letter that your Medicare Advantage plan is being discontinued and you should move to another Medicare Advantage plan or back to traditional Medicare A and B coverage. We detail the Medicare Advantage plans that are being discontinued in our Medicare articles on annual plan changes and in our Medicare Advantage plan compare tool: MA-Compare.com.

Medicare Advantage plan Service Area Reductions

A Medicare Advantage plan can choose to terminate the plan year-to-year or not offer the Medicare plan in your county or area next year.

For example, if you were enrolled in Medicare plan XYZ in 2024, you may find that in late-September or early-October your plan will send you an Annual Notice of Change letter that will inform you that your plan will not be offered in 2025. During the annual Open Enrollment Period (OEP - October 15 to December 7) you will then need to find another Medicare Advantage plan or Medicare Part D plan that is offered in your area for 2025.

If you make no decision to join a new Medicare plan, you will be returned to Original Medicare Part A and Part B starting January 1st.

If your plan is no longer offered next year, you will also be provide with a Service Area Reduction Special Enrollment Period (SAR SEP) that begins December 8 and continues through February. Using the SAR SEP, you will be able to enroll in a Medicare plan with coverage beginning the first day of the month after enrollment. So if you do not join a new Medicare plan during the OEP, you can still use the SAR SEP to join a 2025 Medicare plan.

Question: Even though I can stay with the same Medicare Advantage plan year-to-year, will my plan coverage change each year?

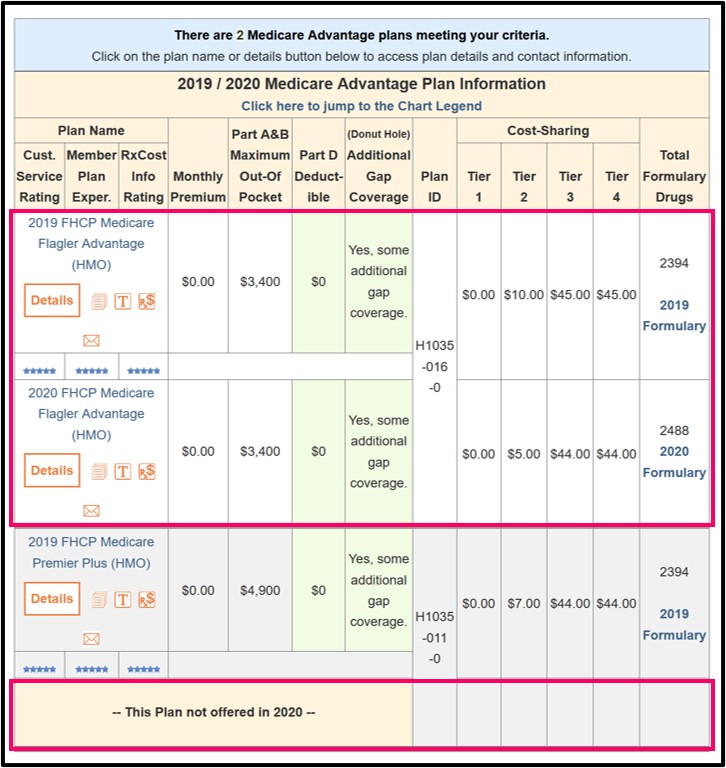

Yes. Each year marks a new beginning for your Medicare plan coverage and, before the start of each new coverage period, your existing Medicare Advantage Plan will send you a letter (Annual Notice of Change or ANOC Letter) explaining any changes or enhancements in your Medicare Advantage plan coverage. Important: You should be certain to read the ANOC to learn about changes to your next-year's coverage. If you do not make any changes to your plan coverage during the annual Open Enrollment Period (AEP - October 15th through December 7th) and your Medicare plan renews its contract with CMS, your Medicare Advantage plan should continue so long as you pay your premiums. We also show basic year-to-year changes to Medicare Advantage plans in our Medicare Advantage plan compare tool: MA-Compare.com

Question: Can I stay with my Medicare Advantage "Special Needs Plan" (SNP) year-after-year?

Maybe. As an additional note, to enroll in a Medicare Advantage plan Special Needs Plan (SNP) you must meet the plan's eligibility requirements, in addition to the general requirement for enrolling in a Medicare Advantage plan (see above).

But, you can stay enrolled in a SNP only if you continue to meet the special conditions served by the plan. For example, if you joined a Medicare SNP that only serves members with both Medicare and Medicaid (D-SNP) and you lose your Medicaid eligibility, Medicare requires the plan to disenroll you if you don’t become eligible for Medicaid again within the plan’s grace period. The grace period is at least 1 month long, but plans can choose to have longer grace periods. If you lose eligibility for the plan, you will have a Special Enrollment Period to make another choice. You will receive a Special Enrollment Period to join a different Medicare Advantage plan or you can return to Original Medicare.

To wrap up: You probably can continue indefinitely in your Medicare Advantage plan – even if you have End Stage Renal Disease (but, you cannot stay with a Medicare Advantage SNP if you no longer have the "special need").

If you stay with your Medicare Advantage plan year-after-year it is important to remember that your Medicare Advantage plan can change coverage benefits each year - and each year you should review the coverage changes and decide whether you wish to stay with the same plan or join another plan.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2025 Medicare Part D plan Facts & Figures

- 2025 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2024/2025 Medicare Part D plan changes

- 2025 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2024 to 2025

- Drug Finder: 2025 Medicare Part D drug search

- Formulary Browser: View any 2025 Medicare plan's drug list

- 2025 Browse Drugs By Letter

- Guide to Consumer Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2026 Medicare Part D Reminder Service