How do I choose between a stand-alone Medicare Part D prescription drug plan (PDP) and a Medicare Advantage plan that includes prescription drug coverage (MAPD)?

If you are eligible for Medicare and you don't have drug coverage through your employer, VA, or other source, additional prescription drug coverage is available to you through either:

(1) a stand-alone Medicare Part D prescription drug plan (PDP) or

(2) a Medicare Advantage plan that includes prescription drug coverage (MAPD).

. . . And with both alternatives you would choose the specific drug plan that provides the most economic drug coverage.

So what is the difference?

A Medicare Part D prescription drug plan (PDP) only provides out-patient prescription drug coverage - and may include coverage of some "bonus" or supplemental drugs that are usually not covered by the Medicare drug program.

A Medicare Advantage (MAPD) plan provides Medicare Part D drug coverage - and also provides Medicare Part A (hospitalization and in-patient) coverage - and Medicare Part B (doctor and out-patient) coverage - and probably will include additional healthcare (limited hearing, dental, or optical) coverage and non-healthcare coverage (such as fitness benefits or limited emergency transportation).

Medicare Part D prescription drug coverage: The Big Picture.

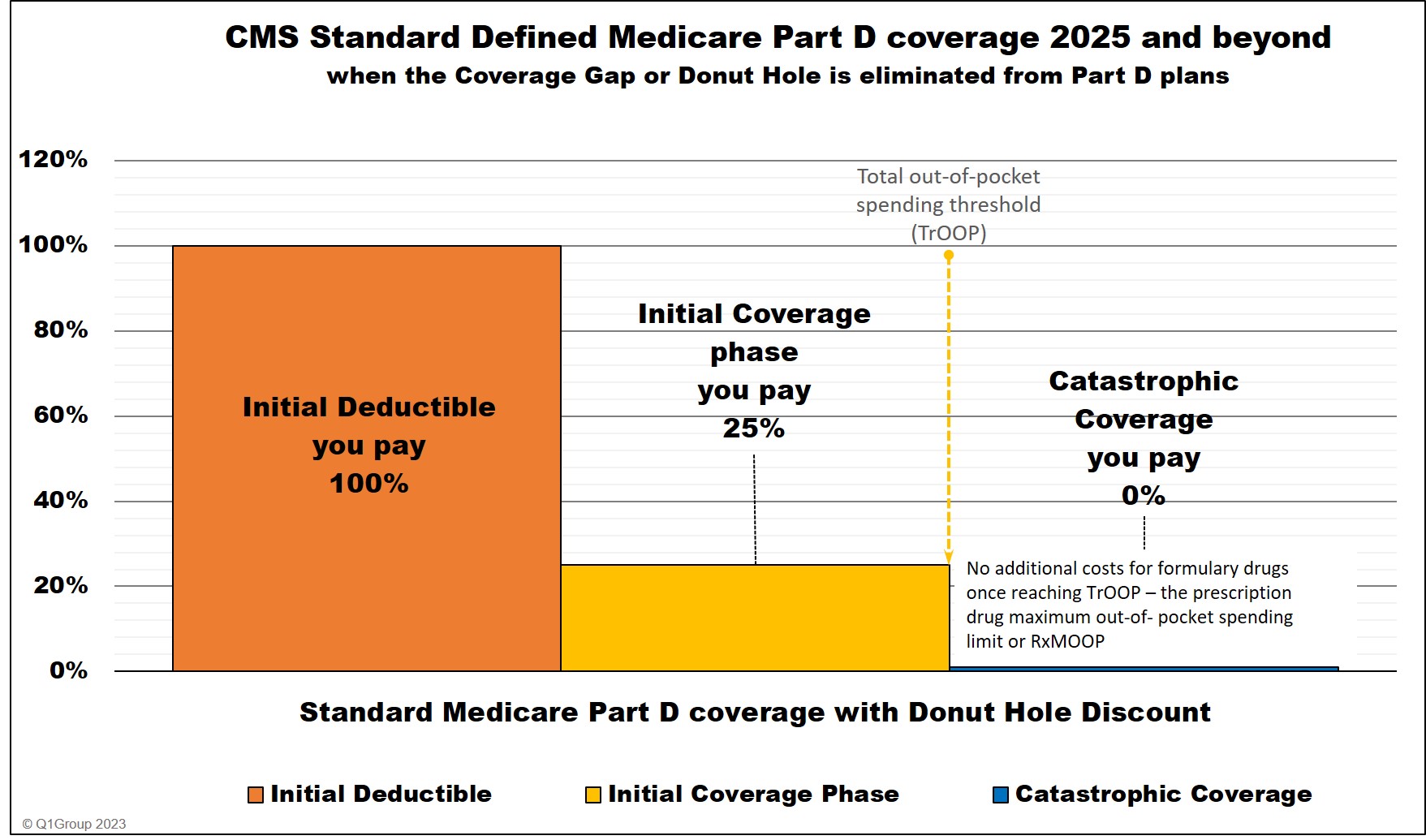

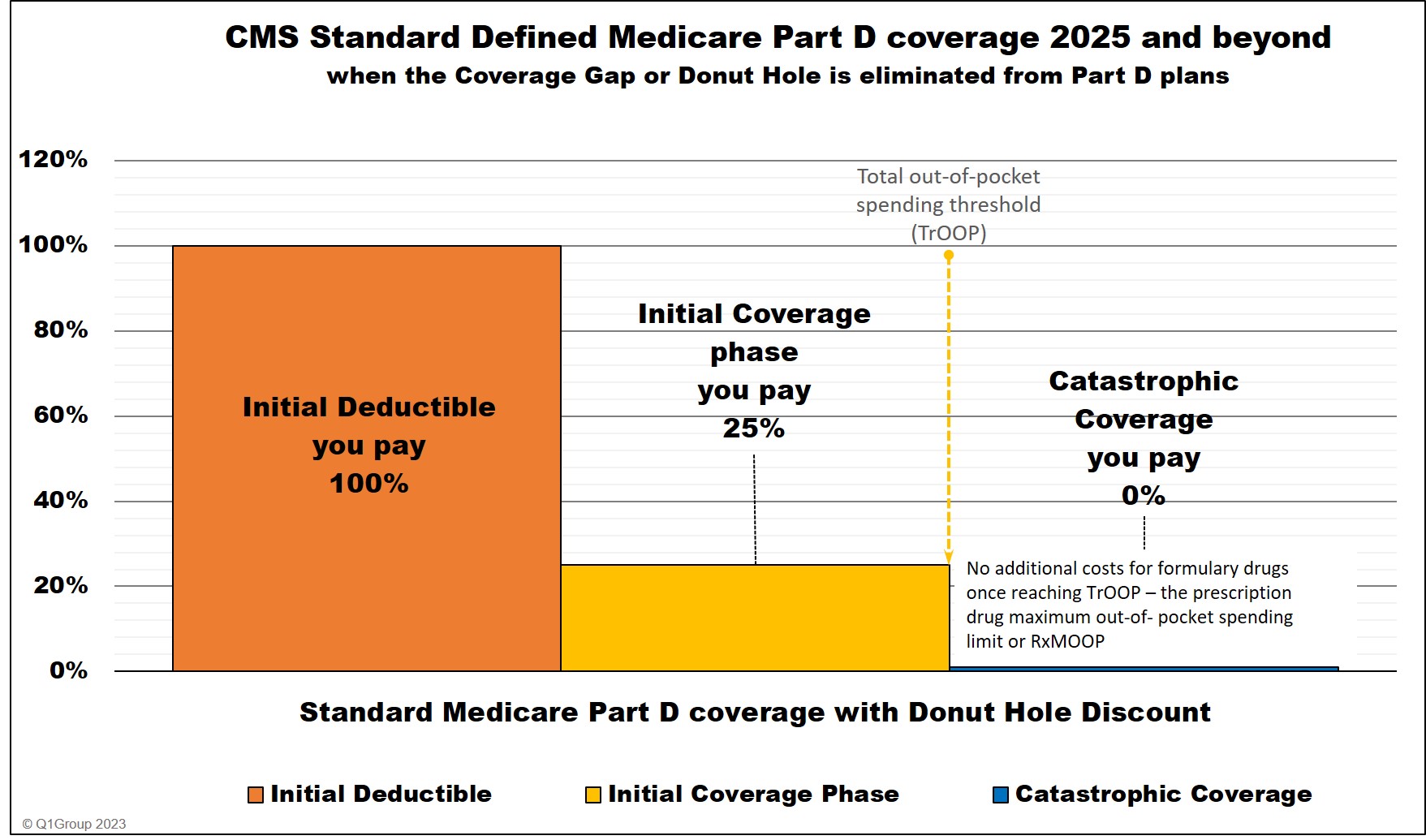

A Medicare drug plan (PDP or MAPD) has several phases and you will move through the phases or parts of your drug plan as you purchase formulary Part D drugs. Your Medicare drug plan may start with an initial deductible where you pay for your formulary drugs (some plans have a $0 deductible or exclude certain low-cost drugs from your deductible) and then move on to coverage where you share the cost of your formulary drugs (standard cost-sharing is 25% of retail, but you may have copays that are more or less than this amount). Catastrophic Coverage is the final phase of coverage and since 2024, there is no cost sharing for any formulary drugs purchased once you reached this last phase.

Starting January, 2025, your Medicare drug plan has only three possible phases: your Initial Deductible phase, your Initial Coverage phase, and the Catastrophic Coverage phase. The Coverage Gap (also known as the Donut Hole) ended December 31, 2024.

(1) a stand-alone Medicare Part D prescription drug plan (PDP) or

(2) a Medicare Advantage plan that includes prescription drug coverage (MAPD).

. . . And with both alternatives you would choose the specific drug plan that provides the most economic drug coverage.

So what is the difference?

A Medicare Part D prescription drug plan (PDP) only provides out-patient prescription drug coverage - and may include coverage of some "bonus" or supplemental drugs that are usually not covered by the Medicare drug program.

A Medicare Advantage (MAPD) plan provides Medicare Part D drug coverage - and also provides Medicare Part A (hospitalization and in-patient) coverage - and Medicare Part B (doctor and out-patient) coverage - and probably will include additional healthcare (limited hearing, dental, or optical) coverage and non-healthcare coverage (such as fitness benefits or limited emergency transportation).

Medicare Part D prescription drug coverage: The Big Picture.

A Medicare drug plan (PDP or MAPD) has several phases and you will move through the phases or parts of your drug plan as you purchase formulary Part D drugs. Your Medicare drug plan may start with an initial deductible where you pay for your formulary drugs (some plans have a $0 deductible or exclude certain low-cost drugs from your deductible) and then move on to coverage where you share the cost of your formulary drugs (standard cost-sharing is 25% of retail, but you may have copays that are more or less than this amount). Catastrophic Coverage is the final phase of coverage and since 2024, there is no cost sharing for any formulary drugs purchased once you reached this last phase.

Starting January, 2025, your Medicare drug plan has only three possible phases: your Initial Deductible phase, your Initial Coverage phase, and the Catastrophic Coverage phase. The Coverage Gap (also known as the Donut Hole) ended December 31, 2024.

Choosing between a PDP and MAPD

(1) Consider choosing a stand-alone Medicare PDP if . . .

- you only want prescription drug coverage and wish to use

Original Medicare for your Medicare Part A and Medicare Part B - or you

have some other form of healthcare coverage such as VA or TRICARE health

coverage.

- you have a Medicare Supplement (Medigap plan), you will want to choose a PDP for your Medicare drug coverage. Remember that you cannot use a Medicare Supplement with a Medicare Advantage plan.

- you are enrolled in a Medicare Advantage MSA (Medicare Savings Account) or Medicare Advantage PFFS (Private fee-for-service) plan that does not provide drug coverage (MA instead of MAPD).

- there are no Medicare Advantage plans in your county (or ZIP

Code region) (or no acceptable Medicare Advantage plans).

- need both drug coverage and comprehensive Medicare coverage with a maximum out-of-pocket spending limit (MOOP).

- wish to have the lowest-costing premium and healthcare coverage

(or healthcare is of no concern to you). If available, you may wish to look into a $0

premium MAPD (that is a health and Part D drug plan with a $0 cost). You may also find some MAPDs are available

in your area that not only have a $0 premium per month, but also pay you back a

portion of your Medicare Part B premium - these "give back"

or "dividend" MAPD plans are not available everywhere in the country,

but are gaining in popularity especially in counties with a high Medicare

beneficiary population (such as, Florida, California, New York,

Pennsylvania).

- have a specific chronic condition or financial need. In this situation, you may wish to consider a Medicare Advantage Special Needs Plan (SNP)

where drug coverage and healthcare is tailored to a certain chronic

condition (such as Diabetes or heart disease or ESRD) or personal need (people eligible

for both Medicare and Medicaid) or residents of a long term care (LTC)

facility.

- wish to have drug coverage, healthcare coverage, and supplemental benefits

such as basic hearing, vision, dental, fitness coverage - and possible

non-health related benefits such as transportation or limited meal

delivery.

Tip: Have you had too much information already?

No problem, you can always call a Medicare representative at 1-800-633-4227 (1-800-Medicare) and someone will assist you with your Medicare plan enrollment decision. You can also telephone a SHIP representative for assistance or speak with a local Medicare advocate - or you can keep reading for more information . . .

No problem, you can always call a Medicare representative at 1-800-633-4227 (1-800-Medicare) and someone will assist you with your Medicare plan enrollment decision. You can also telephone a SHIP representative for assistance or speak with a local Medicare advocate - or you can keep reading for more information . . .

What drug coverage do PDPs and MAPDs have in common?

- Lower-cost prescriptions - A PDP and an MAPD both

provide Medicare drug coverage for a certain group of out-patient

prescription drugs where you should pay less for your prescriptions -

and avoid the late-enrollment premium penalty should you ever wish to have drug coverage in the future.

- Large list of covered drugs - Both Medicare drug plans

have a formulary or drug list that shows what brand and generic

prescriptions are covered by the plan (formularies will vary between

plans and can have anywhere between 2,000 to 4,000+ drugs).

- Large network of pharmacies - Both a Medicare PDP and an MAPD have a network of 50,000 to 60,000+ pharmacies where you can use the drug benefit.

- Cost-sharing for drugs - Both drug plans have different

cost-sharing for drugs on different levels or formulary "tiers" (for

example, you may have a $30 copay for a Tier 3 brand-name drug, a $2

copay for a Tier 1 generic drug, and pay 25% of retail for a Tier 4

Specialty Drug)

- Same rules and procedures - Both PDP and MAPDs plans are governed by

similar rules and provide you with similar rights. You can also move from one type of plan to another without

noticing much change in how your drug plan functions.

As noted, choosing how you receive Medicare drug coverage ultimately depends on your situation and personal preferences - and whether you need only prescription drug coverage or you wish to have prescription drug coverage and additional healthcare coverage. To help you make a decision, you might want to compare PDP and MAPD plan options based on:

- Extent of Coverage

PDP - A stand-alone Medicare Part D prescription drug plan (PDP) covers only out-patient prescription drugs. A Medicare Part D plan will work together with VA or TRICARE coverage, but will not usually work together with an employer or union healthcare plan that includes drug coverage.

MAPD - A Medicare Advantage plan with drug coverage (MAPD) includes the same Medicare Part D prescription drug coverage as a PDP - and also includes, at a minimum, the medically-necessary coverage of Original Medicare Part A (in-patient care) and Medicare Part B (out-patient and physician care) and sometimes includes limited dental, hearing, fitness, vision, and other supplemental coverage. As with a PDP, you, most likely, cannot enroll in an MAPD and still keep your employer health plan.

As noted, if you are enrolled in a Medicare Supplement (Medigap policy) and wish to have drug coverage, you can only choose a stand-alone PDP for your drug coverage - you cannot use a Medicare Advantage plan with a Medicare Supplement.

- Complexity

PDP - Stand-alone Medicare Part D plans (PDPs) are simpler than MAPDs - as PDP only provide prescription drug coverage. When choosing a PDP, you will need to ensure that your medications are affordably covered on the plan's formulary - and check to see whether the plan has imposed any Usage Management Restriction on your medications (such as a limit on the quantity you can use in a month or whether your drugs need prior authorization from the plan before providing coverage) - and check that your local pharmacies are included in the prescription drug plan's pharmacy network (and, depending on your plan, be aware that some plans use both "preferred" and "standard" pharmacies in their network where preferred network pharmacies may charge you less for formulary drugs than standard network pharmacies).

MAPD - If you choose to enroll an MAPD, you will look at the drug coverage the same as for a Medicare Part D PDP: Are your drugs affordably covered? Are there network pharmacies in your area? Are your local pharmacies preferred or standard network pharmacies - and is there a cost difference between pharmacies?

However, an MAPD also provides coverage of your Medicare Part A (hospital and in-patient care) and Medicare Part B (doctor and out-patient care), so MAPDs provide broader healthcare coverage beyond a PDP and you need to be prepared to ask questions beyond just drug coverage.

If you consider an MAPD you will want to know whether your preferred physicians or specialists and hospitals are included within the Medicare Advantage plan's healthcare network. If you rely on a certain group of healthcare providers, you may find that they are not included in your plan’s network - and you will need to have plan approval (pre-authorization) before visiting a healthcare provider outside of the plan's network - and may pay more for out-of-network services.

- Cost

PDP - A stand-alone drug plan will have a monthly premium (from $0 to over $190), may have an initial deductible (you pay the first $400 - $590 ($615 in 2026) in before your plan begins to pay), and some form of cost-sharing for your drugs ($30 copay or 25% of retail drug prices).

MAPD - just like a PDP, you may have an initial deductible and your plan will have some form of cost-sharing for the formulary drugs, however, your monthly MAPD premium may be lower than a PDP premium. In many areas across the country, you can join a $0 premium Medicare Advantage plan (if available) that includes drug coverage (MAPD) - and you may find in your area a "giveback" MAPD that has a $0 premium and actually pays you back a portion of your Medicare Part B premium. In addition, if you have chronic health issues, a Medicare Advantage plan’s Maximum out of Pocket (MOOP) limit may help contain your annual Part A and Part B medical costs - up to $9,350 in-network for 2025 ($8,850 in 2024), depending on the plan.

- Availability and Eligibility

PDP - To enroll into a Medicare Part D prescription drug plan (PDP), you must have either Medicare Part A and/or Medicare Part B. Remember: Monthly Medicare Part D premiums are paid in addition to your Medicare Part A (if any) and/or Part B premiums. There are no health-related questions when applying for Medicare Part D coverage (that is, pre-existing health problems are not considered for enrollment).

You must live in the Medicare Part D plan's Service Area (usually a single state or a group of states). You can see all Medicare Part D plans in your area by using our PDP Finder: PDP-Finder.com.

MAPD - To enroll into a Medicare Advantage plan, you must have both Medicare Parts A and B. Remember: Monthly Medicare Advantage plan premiums (if any) are also paid in addition to your Medicare A and Medicare Part B premiums.

Like a PDP, there are no health-related questions when applying for a MAPD (that is, pre-existing health problems are not considered for enrollment) - except for Medicare Advantage Special Needs Plans (SNPs)where you must attest to the "Special Need" required by the plan. (The 21st Century Cures Act amended the Social Security Act allowing all Medicare-eligible individuals with kidney failure/ESRD to enroll in Medicare Advantage plans beginning January 1, 2021 with the ESRD question being removed from Medicare Advantage plan enrollment applications.)

You must also live in the Medicare Advantage plan's Service Area (usually a county, partial county, or ZIP Code region). You can view all of the Medicare Advantage plans in your area using our Medicare Advantage Plan Finder (or MA-Finder.com).

Medicare Part D drug plans and Medicare Supplements

Do you only need drug coverage? Do you already have a Medicare Supplement or other Medical insurance? You cannot use a Medicare Advantage plan with a Medicare Supplement. If you have healthcare through your employer, you probably do not want to enroll in a PDP or an MAPD (or risk losing your employer coverage).

- Enrollment

To enroll into either a stand-alone Medicare Part D PDP or a Medicare Advantage plan, you can use:

- Your IEP - Initial Enrollment Period - the 7-month period surrounding your Medicare eligibility date (such as 65th birthday).

- The AEP - annual Medicare Open Enrollment Period starting each year on October 15th and continuing through December 7th.

- The MAOEP - the Medicare Advantage Open Enrollment Period that starts January 1st and continues through March 31 (only to change or drop a Medicare Advantage plan, not for changing PDPs).

- an SEP - Special Enrollment Periods - if you find an applicable SEP, you may be permitted to change plans throughout the year (outside of normal enrollment periods).

Once you are ready, you can enroll into a Medicare plan many different ways including through an agent, online, through a SHIP, or by calling a Medicare representative at 1-800-633-4227 (1-800-Medicare).

- Although we have only discussed MAPDs, Medicare Advantage plans are available in two general varieties: (1) Medicare

Advantage plans with prescription drug coverage (MAPDs) and (2) Medicare

Advantage plans without prescription drug coverage (MAs).

If you want a Medicare Advantage plan and you want Medicare prescription drug coverage, you will usually need to join an MAPD. In most cases, you are not able to join an MA and then add a stand-alone Medicare Part D plan for your prescription drug coverage (unless you join an MA that is a private-fee for service (PFFS) plan or MSA - with these two types of MAs, you can add a stand-alone Medicare Part D prescription drug plan).

Medicare Advantage plans can be further defined by how the private insurance carriers choose to implement the Medicare Part A and Medicare Part B coverage. Some MAPDs/MAs are PPOs (Preferred Provider Organizations) or HMOs (Health Management Organizations) - and still other MAPDs/MAs are set up as PFFS (Private Fee for Service Organizations). Medicare Advantage Special Needs Plans (SNPs) are also available and require that you have the condition or "need" for which the plan is designed (for instance, a specific chronic condition (like Kidney Failure) or financial status).

"What is the difference between a Medicare Advantage plan and a stand-alone Medicare Part D plan?": Q1FAQ.com/647

Did we answer your question or do you have another question? Click here to let us know.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2025 Medicare Part D plan Facts & Figures

- 2025 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2024/2025 Medicare Part D plan changes

- 2025 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2024 to 2025

- Drug Finder: 2025 Medicare Part D drug search

- Formulary Browser: View any 2025 Medicare plan's drug list

- 2025 Browse Drugs By Letter

- Guide to Consumer Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2026 Medicare Part D Reminder Service