I am qualified for Medicaid, so why am I still paying a monthly premium for my Part D drug plan?

There are a few reasons why you are still paying a monthly Medicare Part D plan premium

even though you are qualified for both Medicaid and Medicare or just qualified for Medicare Part D Extra Help benefits:

(1) You are new to the Medicare Part D Low Income Subsidy (LIS) / Extra Help program and it may take a few months for your paperwork to catch up. However, you will be reimbursed for the paid premiums back to your date of LIS qualification.

If you have applied for and were granted LIS status or now qualify for Medicaid and automatically receive LIS benefits, you may find that it will take some time for your monthly Medicare Part D premium to reflect your new LIS status. If this occurs, please contact your local Medicaid office for assistance - and ensure that no error has occurred.

(2) Your current Medicare drug plan does not meet your state's Part D LIS benchmark premium.

If you have chosen to enroll in a Medicare Part D prescription drug plan that does not qualify for your state's Low Income Subsidy (LIS) $0 monthly premium, you will be responsible for a portion of your monthly Part D premium.

Each state's LIS benchmark premium is released every year and establishes the maximum premium subsidy that would completely pay the monthly Medicare Part D premiums for people who qualify to receive LIS benefits. The LIS $0 benchmark premium is usually slightly different for every CMS Part D region.

How does this work? If you qualify for the Medicare Part D Low-Income Subsidy or Extra Help program and enroll in a "basic" Medicare Part D plan (a Part D drug plan with a designation of DS, AE, or BA) and your Part D plan has a monthly premium at or below your state’s LIS premium benchmark, you should have a $0 monthly premium for your Part D drug coverage. Alternatively, if you qualify for LIS benefits, but choose a Part D plan with a monthly premium higher than the state benchmark, you may pay a portion of your premium that exceeds your state’s benchmark.

In this 2024 example, the 2024 California $0 LIS Benchmark Premium is $40.98 and if you qualify for Extra Help and enrolled in a "basic" Medicare Part D plan with a premium below (or slightly over) the benchmark, you would pay a $0 premium. So if you chose the 2024 Wellcare Classic (PDP) Medicare Part D plan that has a $35.90 premium, you would pay a $0 premium.

However, in the same situation, if you enrolled in the 2024 AARP MedicareRx Saver Plus (PDP) that has a $89.80 premium, you would pay $48.80 per month premium (roughly the $89.80 premium - the $40.98 California LIS benchmark premium).

(3) Your plan is not a "basic" Part D drug plan and includes "enhanced" or supplemental coverage features.

If you qualify for LIS benefits, but choose a Medicare Part D plan with "enhanced" features (like $0 deductible), the Medicare Part D plan does not qualify for the $0 monthly Low-Income Subsidy (LIS) premium and you may pay a portion of your premium allocated to the supplemental Part D premium (and possibly any portion of the basic Part D premium above the state's LIS $0 benchmark premium). This type of Medicare Part D plan is designated as an "EA" or Enhanced Alternative plan because of the enhanced features beyond basic Medicare Part D coverage.

Bottom Line: The $0 LIS premium only applies to Medicare Part D plans with "basic" or standard features.

Using California as our 2024 example state that has a $40.98 benchmark premium, and you qualify for Extra Help benefits and decide to join the 2024 Wellcare Value Script (PDP) that has a $0.40 monthly premium, you would pay a monthly premium of $0.40 because the plan has "enhanced" features and does not qualify for the $0 premium even though the $0.40 premium is well below the state's $40.98 benchmark premium.

For more information about the different type of Medicare Part D plans, please see our Frequently Asked Question:

"What are the Medicare Part D abbreviations: EA BA DS AE in the plan benefit type?"

Question: How to see whether a Part D plan is EA, BA, DS, or AE benefit design?

We show the type of Medicare Part D drug plan design in our Medicare Part D Plan Finder and within the plan coverage pages.

Review of Extra Help and the LIS $0 premium benchmark

If you qualify for your state's Medicaid program, then you automatically qualify for the Medicare Part D Extra Help program, and the cost of your monthly Medicare Part D premiums will be covered up to a certain level – called your state’s Low-Income Subsidy (LIS) Benchmark premium.

For example, if you live in a state with a benchmark premium of $25, the Medicare Part D Extra Help program will pay for your monthly premium up to this $25 level (or slightly above) and you will have a $0 premium when you enroll in a "basic" Medicare Part D plan with a premium around $25 or lower.

But, if your chosen Medicare Part D plan's monthly premium is over the benchmark amount or if your chosen plan has enhanced features, you can be charged the amount of the premium that exceeds the benchmark, or the portion of the premium that covered the cost of the supplemental features.

So, in this example, if you Medicare plan has a $30 monthly premium, you may be charged the $5 additional cost over your state's $25 LIS benchmark premium.

Question: Where do you find your state's LIS Benchmark Premium?

Each year, the Centers for Medicare and Medicaid Services (CMS) releases the LIS $0 premium Benchmark amount for all states. To see how these benchmark values have changed over the past years, please see: “2025 State Low-Income Subsidy Benchmark Premium Amounts - with a comparison of benchmark changes since 2006".

Question: Where can I see if a Medicare Part D plan qualifies for a $0 premium?

You can see whether a Medicare Part D plan qualifies for your state’s $0 LIS premium using our Medicare Part D Plan Finder where all Part D plans available in each state are shown and LIS $0 premium plans are noted.

Here is an example link to the stand-alone 2024 California Medicare Part D plans (you can choose a link to view plans in another state): PDPFinder.com/CA

You will notice on the PDP Finder results page that the column showing "$0 Prem LIS?" is marked with "Yes" and a mint-green background for qualifying plans.

For example, using the link above, if you scroll down through the California plans, the 2024 “Cigna Secure Rx (PDP) - S5617-158” shows a $34.50 premium and "Yes" in the "$0 Prem LIS?".

So, for anyone who qualifies for LIS benefits, they would have a $0 premium because this Medicare plan meets the Low-Income Subsidy benchmark premium for California. When you look at the LIS Benchmark page, you will notice that the 2024 California LIS benchmark premium is $40.98.

If a plan does not qualify for the Low-Income Subsidy $0 Premium, the "$0 Prem LIS?" column will state "No" and there will be no green background.

However, if you select "Yes" to the "Show Premium with LIS Subsidy" question in the filter box, the premiums shown for all plans will be those for people qualifying for the Low Income Subsidy (Extra Help). For example, when "Yes" is checked, you will note that the 2024 Humana Walmart Value Rx Plan (PDP) shows a premium of $18.00.

(1) You are new to the Medicare Part D Low Income Subsidy (LIS) / Extra Help program and it may take a few months for your paperwork to catch up. However, you will be reimbursed for the paid premiums back to your date of LIS qualification.

If you have applied for and were granted LIS status or now qualify for Medicaid and automatically receive LIS benefits, you may find that it will take some time for your monthly Medicare Part D premium to reflect your new LIS status. If this occurs, please contact your local Medicaid office for assistance - and ensure that no error has occurred.

(2) Your current Medicare drug plan does not meet your state's Part D LIS benchmark premium.

If you have chosen to enroll in a Medicare Part D prescription drug plan that does not qualify for your state's Low Income Subsidy (LIS) $0 monthly premium, you will be responsible for a portion of your monthly Part D premium.

Each state's LIS benchmark premium is released every year and establishes the maximum premium subsidy that would completely pay the monthly Medicare Part D premiums for people who qualify to receive LIS benefits. The LIS $0 benchmark premium is usually slightly different for every CMS Part D region.

How does this work? If you qualify for the Medicare Part D Low-Income Subsidy or Extra Help program and enroll in a "basic" Medicare Part D plan (a Part D drug plan with a designation of DS, AE, or BA) and your Part D plan has a monthly premium at or below your state’s LIS premium benchmark, you should have a $0 monthly premium for your Part D drug coverage. Alternatively, if you qualify for LIS benefits, but choose a Part D plan with a monthly premium higher than the state benchmark, you may pay a portion of your premium that exceeds your state’s benchmark.

In this 2024 example, the 2024 California $0 LIS Benchmark Premium is $40.98 and if you qualify for Extra Help and enrolled in a "basic" Medicare Part D plan with a premium below (or slightly over) the benchmark, you would pay a $0 premium. So if you chose the 2024 Wellcare Classic (PDP) Medicare Part D plan that has a $35.90 premium, you would pay a $0 premium.

However, in the same situation, if you enrolled in the 2024 AARP MedicareRx Saver Plus (PDP) that has a $89.80 premium, you would pay $48.80 per month premium (roughly the $89.80 premium - the $40.98 California LIS benchmark premium).

(3) Your plan is not a "basic" Part D drug plan and includes "enhanced" or supplemental coverage features.

If you qualify for LIS benefits, but choose a Medicare Part D plan with "enhanced" features (like $0 deductible), the Medicare Part D plan does not qualify for the $0 monthly Low-Income Subsidy (LIS) premium and you may pay a portion of your premium allocated to the supplemental Part D premium (and possibly any portion of the basic Part D premium above the state's LIS $0 benchmark premium). This type of Medicare Part D plan is designated as an "EA" or Enhanced Alternative plan because of the enhanced features beyond basic Medicare Part D coverage.

Bottom Line: The $0 LIS premium only applies to Medicare Part D plans with "basic" or standard features.

Using California as our 2024 example state that has a $40.98 benchmark premium, and you qualify for Extra Help benefits and decide to join the 2024 Wellcare Value Script (PDP) that has a $0.40 monthly premium, you would pay a monthly premium of $0.40 because the plan has "enhanced" features and does not qualify for the $0 premium even though the $0.40 premium is well below the state's $40.98 benchmark premium.

For more information about the different type of Medicare Part D plans, please see our Frequently Asked Question:

"What are the Medicare Part D abbreviations: EA BA DS AE in the plan benefit type?"

Question: How to see whether a Part D plan is EA, BA, DS, or AE benefit design?

We show the type of Medicare Part D drug plan design in our Medicare Part D Plan Finder and within the plan coverage pages.

Review of Extra Help and the LIS $0 premium benchmark

If you qualify for your state's Medicaid program, then you automatically qualify for the Medicare Part D Extra Help program, and the cost of your monthly Medicare Part D premiums will be covered up to a certain level – called your state’s Low-Income Subsidy (LIS) Benchmark premium.

For example, if you live in a state with a benchmark premium of $25, the Medicare Part D Extra Help program will pay for your monthly premium up to this $25 level (or slightly above) and you will have a $0 premium when you enroll in a "basic" Medicare Part D plan with a premium around $25 or lower.

But, if your chosen Medicare Part D plan's monthly premium is over the benchmark amount or if your chosen plan has enhanced features, you can be charged the amount of the premium that exceeds the benchmark, or the portion of the premium that covered the cost of the supplemental features.

So, in this example, if you Medicare plan has a $30 monthly premium, you may be charged the $5 additional cost over your state's $25 LIS benchmark premium.

Question: Where do you find your state's LIS Benchmark Premium?

Each year, the Centers for Medicare and Medicaid Services (CMS) releases the LIS $0 premium Benchmark amount for all states. To see how these benchmark values have changed over the past years, please see: “2025 State Low-Income Subsidy Benchmark Premium Amounts - with a comparison of benchmark changes since 2006".

Question: Where can I see if a Medicare Part D plan qualifies for a $0 premium?

You can see whether a Medicare Part D plan qualifies for your state’s $0 LIS premium using our Medicare Part D Plan Finder where all Part D plans available in each state are shown and LIS $0 premium plans are noted.

Here is an example link to the stand-alone 2024 California Medicare Part D plans (you can choose a link to view plans in another state): PDPFinder.com/CA

You will notice on the PDP Finder results page that the column showing "$0 Prem LIS?" is marked with "Yes" and a mint-green background for qualifying plans.

For example, using the link above, if you scroll down through the California plans, the 2024 “Cigna Secure Rx (PDP) - S5617-158” shows a $34.50 premium and "Yes" in the "$0 Prem LIS?".

So, for anyone who qualifies for LIS benefits, they would have a $0 premium because this Medicare plan meets the Low-Income Subsidy benchmark premium for California. When you look at the LIS Benchmark page, you will notice that the 2024 California LIS benchmark premium is $40.98.

If a plan does not qualify for the Low-Income Subsidy $0 Premium, the "$0 Prem LIS?" column will state "No" and there will be no green background.

However, if you select "Yes" to the "Show Premium with LIS Subsidy" question in the filter box, the premiums shown for all plans will be those for people qualifying for the Low Income Subsidy (Extra Help). For example, when "Yes" is checked, you will note that the 2024 Humana Walmart Value Rx Plan (PDP) shows a premium of $18.00.

A note about "Auto-enrollment" and "Choosers"

Auto-enrollment

If you qualify for the full Medicare Part D Low-Income Subsidy (LIS or Extra Help), Medicare may randomly, auto-enroll you into a Medicare Part D plan that qualifies for your state’s $0 monthly premium - without regard to your prescription usage.

However, if you are not satisfied with your current Medicare drug plan, you may be able to use the Dual-Eligible Special Enrollment Period to change Medicare Part D plans throughout the year. Beginning in 2025, the ability for Extra Help beneficiaries to change plans during the plan year will depend on whether your Medicare plan is a stand-alone Part D plan or a Medicare Advantage plan. Learn more about the timing for the Dual-Eligible SEP.

"Choosers"

If you qualify for the full Medicare Part D Low-Income Subsidy (LIS or Extra Help) and select your own Medicare plan (after being auto-enrolled), you become a "chooser" and Medicare will not automatically change your enrollment for the next plan year -- even if your selected Medicare Part D plan no longer qualifies for the state’s LIS $0 monthly premium.

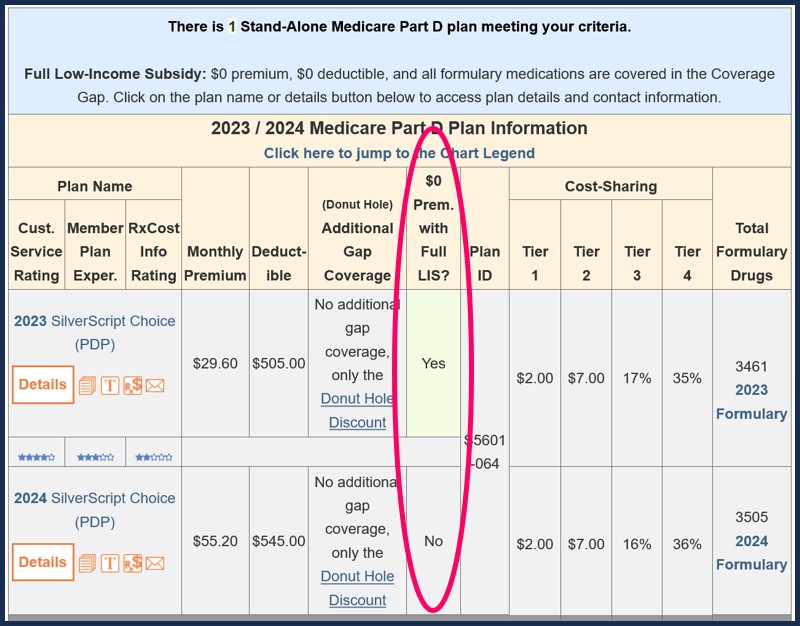

In other words, it is possible that in 2023 you chose a Medicare Part D plan that qualified for the $0 premium - but in 2024, the same Medicare plan no longer qualifies for the $0 premium and since Medicare will not automatically change your plan, you have a monthly premium to pay.

One such example is the 2024 SilverScript Choice (PDP) that no longer qualifies for the $0 premium. Beneficiaries with LIS will pay a 2024 monthly premium of $14.20, unless they switch plans.

More about LIS status and changing Part D drug plans

As noted above, Medicare beneficiaries qualifying for Extra Help (the Low-Income Subsidy) may be able to use the Dual-Eligible Special Enrollment Period allowing you the opportunity to change your Medicare drug plan coverage (for better drug coverage or lower premium costs or additional benefits). Your new plan will take effect on the first day of the following month. Beginning in 2025, the ability for Extra Help beneficiaries to change plans during the plan year will depend on whether your Medicare plan is a stand-alone Part D plan or a Medicare Advantage plan. Learn more about the timing for the Dual-Eligible SEP.

An example of annual Medicare Part D plan changes where the new Part D plan no longer qualifies for the $0 LIS benchmark premium.

All of our Medicare plan finder (PDP-Finder.com or MA-Finder.com) and comparison tools show if a plan qualifies for the full LIS $0 monthly premium and you can use the search filters to see the plan premium based on your LIS.

As shown in the results of our PDP-Compare.com for 2023 California LIS plans no long LIS qualifying in 2024, you can see that the 2024 SilverScript Choice plan no longer qualifies for the $0 LIS premium.

Please remember that all Medicare Part D plans, even Part D plans that do not qualify for the LIS $0 premium, can offer their plans at a reduced premium for people receiving Extra Help.

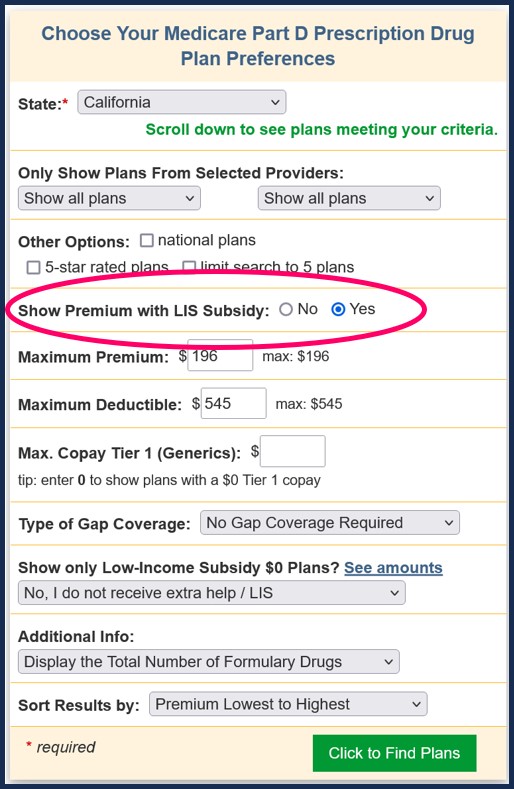

Our PDP-Finder.com 2024 California Medicare Part D plans - LIS premium search shows there are 23 plans available in California ranging in premium from $0 to $147.40. To see premiums for the LIS subsidy, you would select "Yes" next to "Show Premium with LIS Subsidy" in the criteria box. See the red box in the image below:

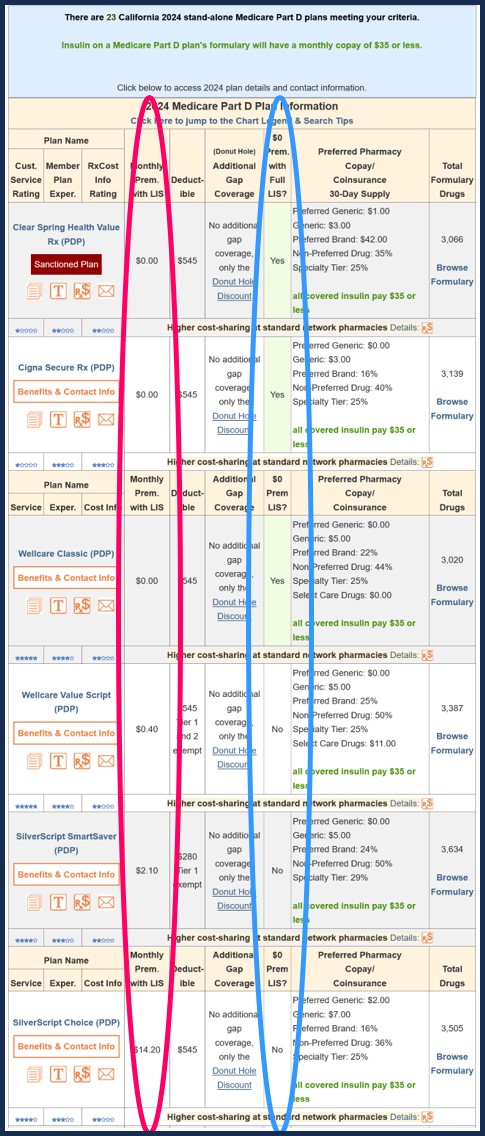

A sampling of the results are shown below. The red circle shows the monthly premium for LIS recipients. The blue circle shows whether the plan qualifies for the LIS $0 monthly premium.

As you can see in the above chart, if you receive the LIS subsidy (at the bottom of the red circle), you would be charged a premium of $2.10 per month for the 2024 California SilverScript SmartSaver plan.

Pre-2024 - A bit of Medicare Part D history... Full and Partial-LIS Benefits

Prior to plan year 2024, Medicare beneficiaries may have only received partial-LIS. The Inflation Reduction Act (IRA) expanded the Extra Help program to provide full-LIS benefits to people who formerly only received partial-LIS.

An example of how Pre-2024 Medicare premiums could change with the level of Extra Help benefits.

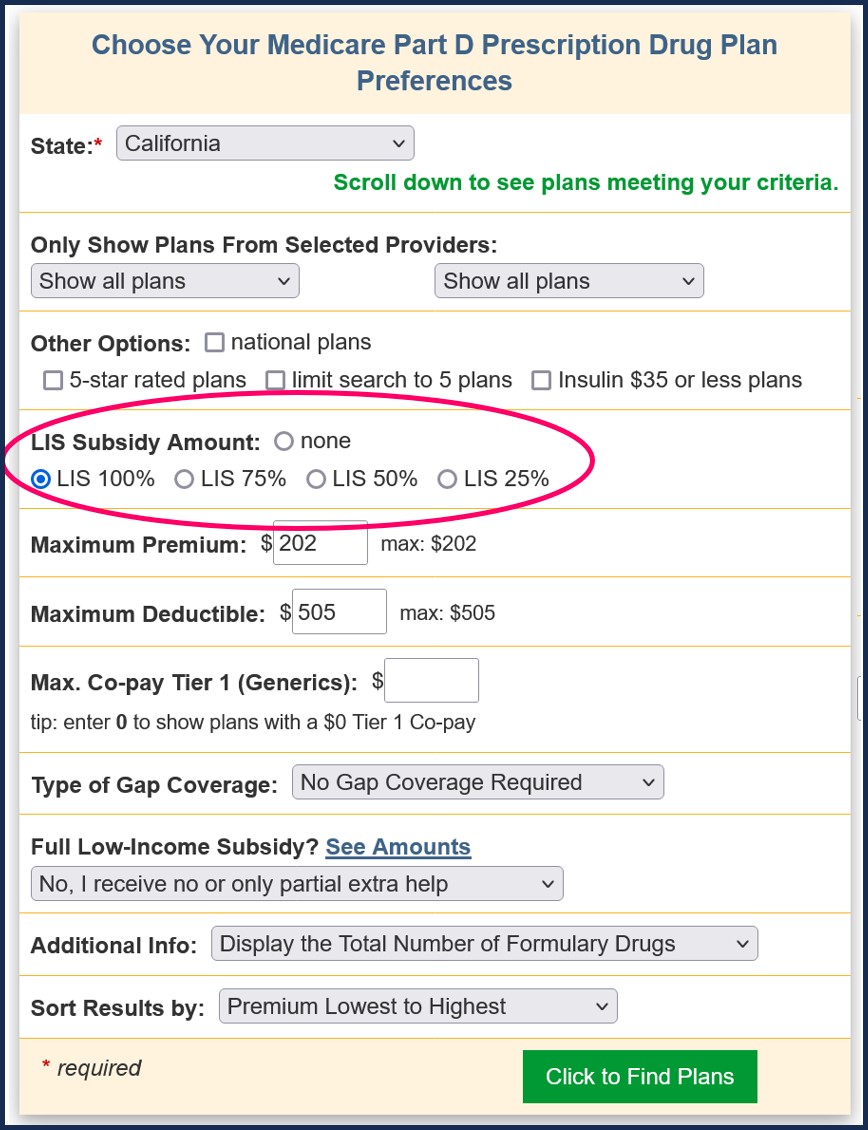

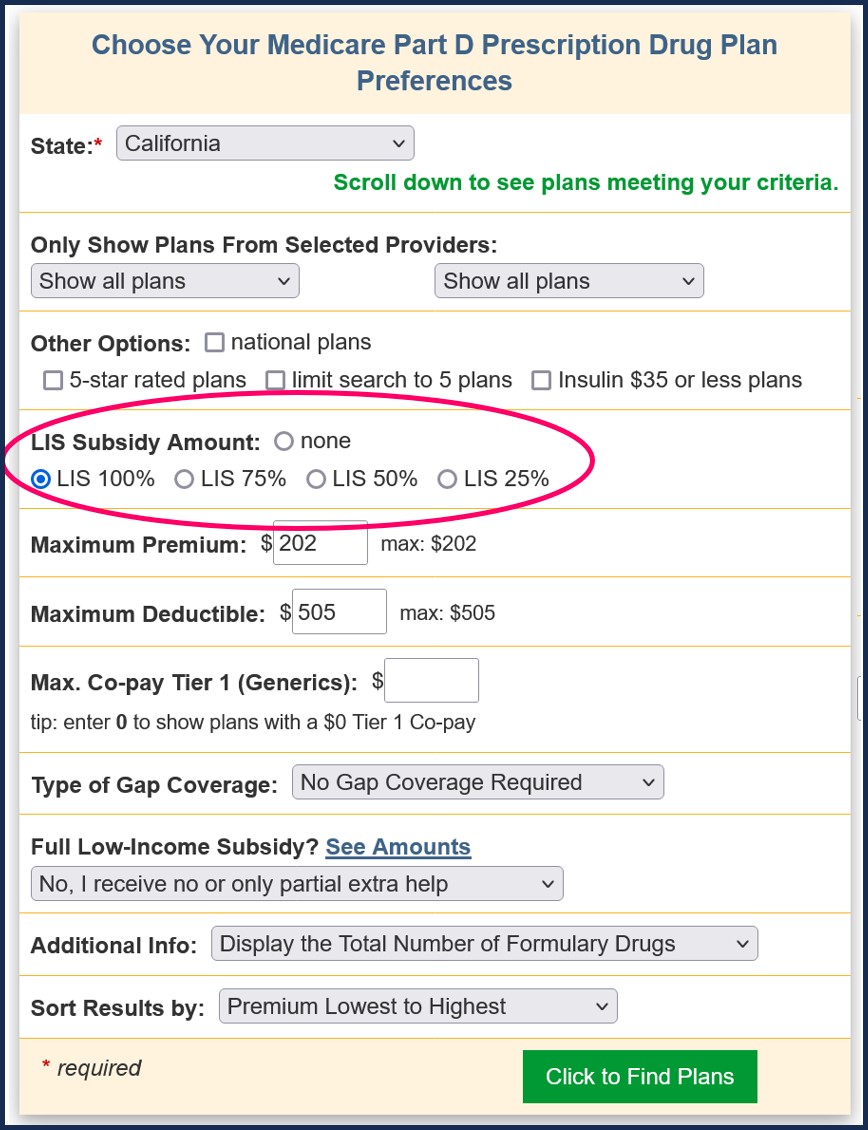

Our PDP-Finder.com 2023 California Medicare Part D plans - 100% LIS premium search shows there were 26 plans available in California ranging in premium from $0 to $133.60. To see premiums for the various full and partial LIS subsidies, you would select the appropriate subsidy level in the criteria box. See the red box in the image below:

A sampling of the results are shown below. The red circle shows the monthly premium at a specific LIS subsidy level -- in this case 100%. The blue circle shows whether the plan qualifies for the full LIS $0 monthly premium.

As you can see in the above chart, if you receive a 100% LIS subsidy (at the bottom of the red circle), you would be charged a premium of $2.90 per month for the 2023 California AARP MedicareRx Walgreens plan.

A specific 2022/2023 plan example:

The 2022 California Elixir RxSecure plan qualified for the $0 premium in 2022, but it no longer qualified for the $0 premium in 2023. This means that, even if you qualified for 100% LIS benefits, your monthly Medicare Part D premium would have increased to $26.20 - and not $0.

A chart of the monthly premium at 25%, 50%, 75%, and 100% is shown on our 2023 Elixir RxSecure (PDP) Plan Benefits & Contact page and looks like this:

For more details on your Medicare Part D plan premium, you can speak with a Medicare representative who can look into your records and provide more information about why you are paying a premium.

You can telephone Medicare at 1-800-633-4227, select the prescription drug option, and then choose the option to speak with a Medicare representative or say "representative" several times during the automated menu options. Once connected, you can explain your situation to a Medicare representative and ask for assistance determining whether you are paying the correct premium.

Prior to plan year 2024, Medicare beneficiaries may have only received partial-LIS. The Inflation Reduction Act (IRA) expanded the Extra Help program to provide full-LIS benefits to people who formerly only received partial-LIS.

An example of how Pre-2024 Medicare premiums could change with the level of Extra Help benefits.

Our PDP-Finder.com 2023 California Medicare Part D plans - 100% LIS premium search shows there were 26 plans available in California ranging in premium from $0 to $133.60. To see premiums for the various full and partial LIS subsidies, you would select the appropriate subsidy level in the criteria box. See the red box in the image below:

A sampling of the results are shown below. The red circle shows the monthly premium at a specific LIS subsidy level -- in this case 100%. The blue circle shows whether the plan qualifies for the full LIS $0 monthly premium.

As you can see in the above chart, if you receive a 100% LIS subsidy (at the bottom of the red circle), you would be charged a premium of $2.90 per month for the 2023 California AARP MedicareRx Walgreens plan.

A specific 2022/2023 plan example:

The 2022 California Elixir RxSecure plan qualified for the $0 premium in 2022, but it no longer qualified for the $0 premium in 2023. This means that, even if you qualified for 100% LIS benefits, your monthly Medicare Part D premium would have increased to $26.20 - and not $0.

A chart of the monthly premium at 25%, 50%, 75%, and 100% is shown on our 2023 Elixir RxSecure (PDP) Plan Benefits & Contact page and looks like this:

| 2023 California Elixir RxSecure (PDP) | ||||

| Full Premium |

25% Subsidy |

50% Subsidy |

75% Subsidy |

100% Subsidy |

| $65.10 | $55.40 | $45.70 | $36.00 | $26.20 |

For more details on your Medicare Part D plan premium, you can speak with a Medicare representative who can look into your records and provide more information about why you are paying a premium.

You can telephone Medicare at 1-800-633-4227, select the prescription drug option, and then choose the option to speak with a Medicare representative or say "representative" several times during the automated menu options. Once connected, you can explain your situation to a Medicare representative and ask for assistance determining whether you are paying the correct premium.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2025 Medicare Part D plan Facts & Figures

- 2025 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2024/2025 Medicare Part D plan changes

- 2025 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2024 to 2025

- Drug Finder: 2025 Medicare Part D drug search

- Formulary Browser: View any 2025 Medicare plan's drug list

- 2025 Browse Drugs By Letter

- Guide to Consumer Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2026 Medicare Part D Reminder Service