Information update: the 2023 Medicare Part D and Medicare Advantage 30-day cost-sharing and health benefit information is now online at Q1Medicare.com

With the latest release of Medicare plan data from the Centers for Medicare & Medicaid Services (CMS), the Q1Medicare.com Medicare Part D Plan Finder, Medicare Advantage Plan Finder, and other online tools have been updated with the following 2023 Medicare Part D prescription drug plan information, including:

We will include the Medicare plan Star Ratings and Medicare prescription drug (formulary) details including drug tiers excluded from the deductible, cost-sharing for all phases and pharmacy types as soon as released.

-

30-day prescription drug cost-sharing - both co-payment (such as $1 for Tier 1 drugs) and co-insurance (such as 25% of retail) for each formulary tier.

-

Formulary (Drug List) size - we now have the total number of drugs included on each plan’s formulary - represented by unique national drug codes (NDCs). Drug list details will be added as soon as the data is released.

-

Initial Coverage Limits (ICL)

- the ICL is the retail value of medications that you can buy before

entering the 2023 Donut Hole or Coverage Gap. The standard ICL for 2023

is $4,660. The ICL is online for all 2023 Medicare Advantage (MAPDs) and stand-alone Medicare Part D prescription drug plans (PDPs).

-

Full- and partial-LIS premiums

- the Low-Income Subsidy monthly premium information is online and you

can see plan premiums for a 100%, 75%, 50%, and 25% LIS-subsidy. You

can click here to learn more about the 2023 LIS $0 qualifying plans and partial-LIS premiums.

- Medicare Advantage Plan Health Plan Benefits & Maximum Out-of-Pocket Limits (MOOP)-Medicare Part A and Part B health care coverage, supplemental benefits, Medicare Part B Giveback amount, and MOOP are online for all 2023 Medicare Advantage plans, including, MA, MAPD, MMPs, and SNPs.

We will include the Medicare plan Star Ratings and Medicare prescription drug (formulary) details including drug tiers excluded from the deductible, cost-sharing for all phases and pharmacy types as soon as released.

Q1Medicare.com tools available to review 2023 Medicare plans

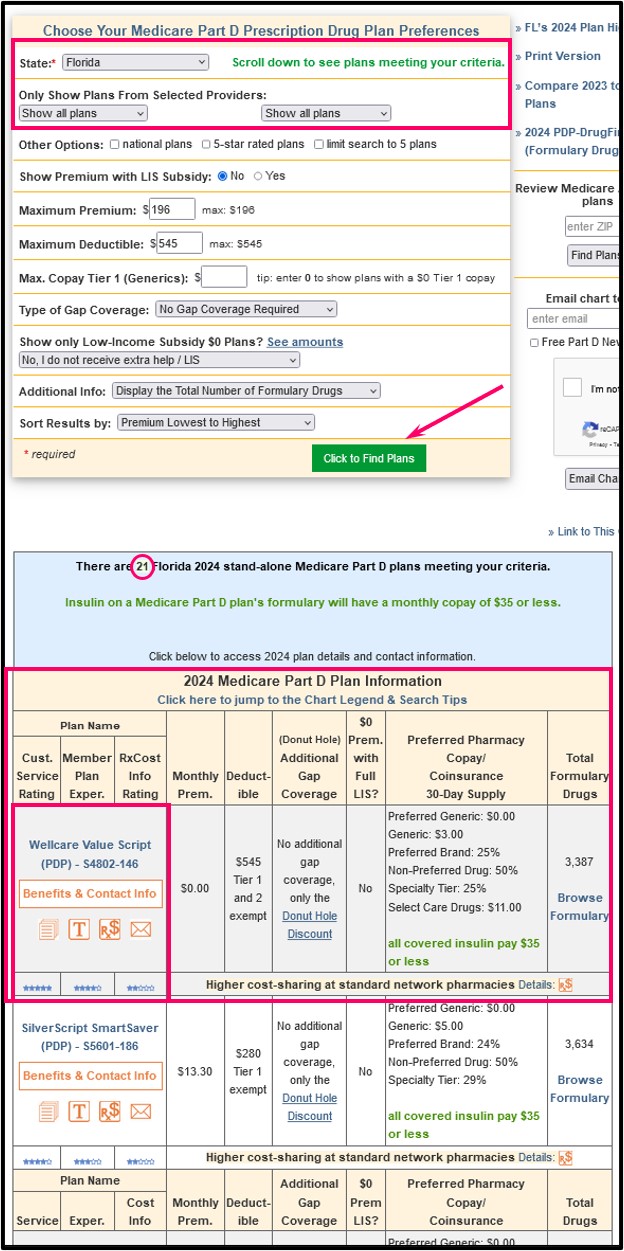

- Reviewing 2023 stand-alone Medicare Part D prescription drug plans (PDPs)?

As an example, click on the link below to see the 23 stand-alone Medicare Part D plans available to Floridians in 2023. Again, you can just choose a new state to see the Medicare Part D plans offered in your area: PDP-Finder.com/FL.

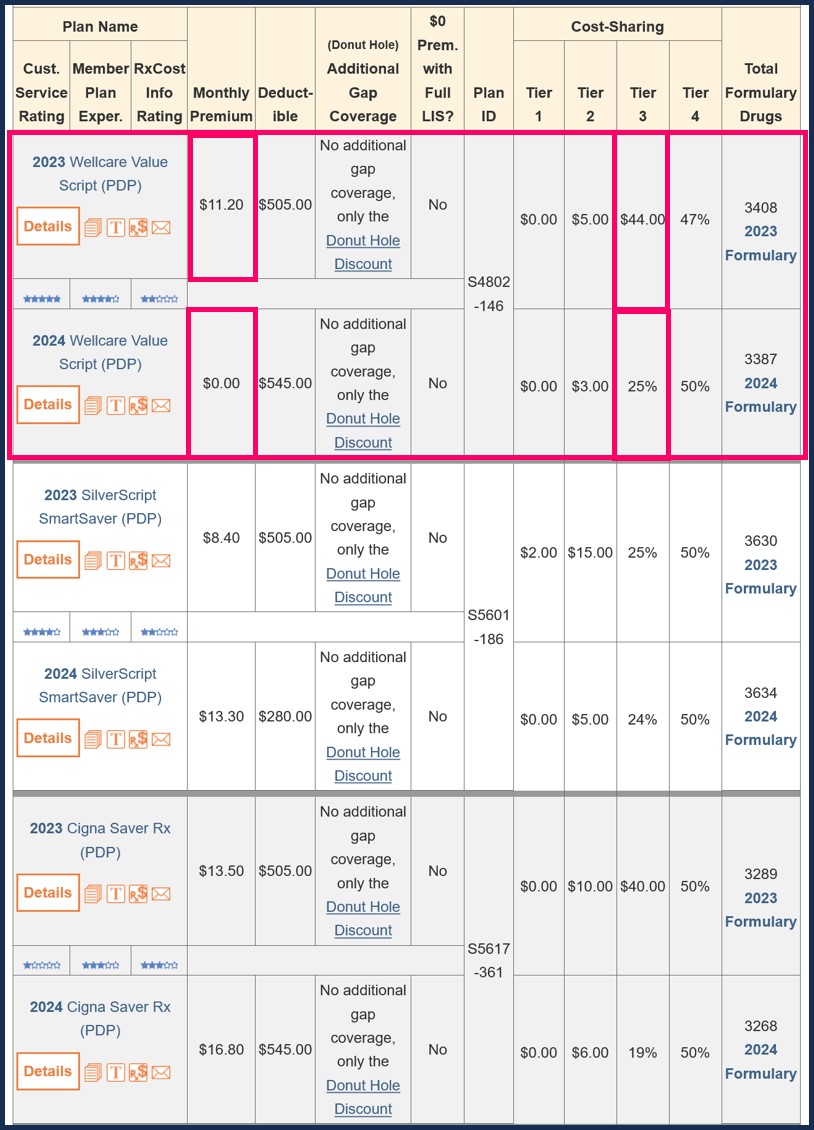

- Comparing stand-alone Medicare Part D prescription drug plan (PDP) changes from 2022 to 2023?

PDP-Compare has also been updated to include plan crosswalks – plans whose members will be automatically transitioned to a different plan for 2023. To get you started, you can click here for an example of how all 2022 Medicare Part D plans in Arizona will change in 2023 (again, you can change the state in the drop-down-box to your home state).

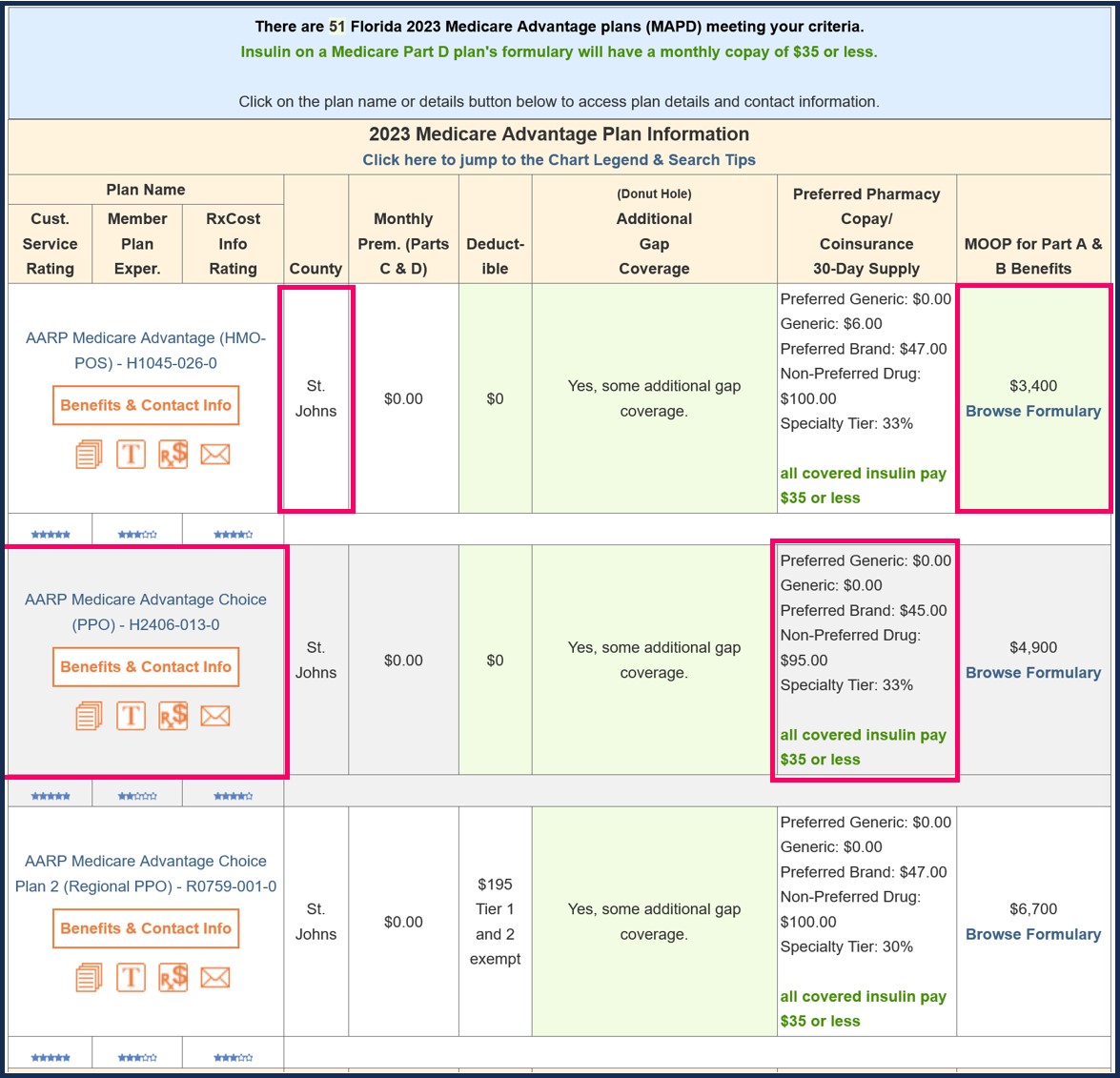

- Reviewing all 2023 Medicare Advantage plans in your area?

Similar to our PDP-Finder, the 2023 MA-Finder allows you to view all 2023 Medicare Advantage plans found in your area by just entering your ZIP code and then tapping “Click to Find Plans”. The 2023 Medicare Advantage plan information now includes monthly plan premiums, drug plan coverage (if available), the plan’s maximum out-of-pocket limit (or MOOP), initial coverage limit, Medicare Part B Giveback amount, and prescription drug 30-day cost-sharing. You can click on the “Details” button or the plan’s name to review a Medicare Advantage plan’s medical benefits and coverage details.

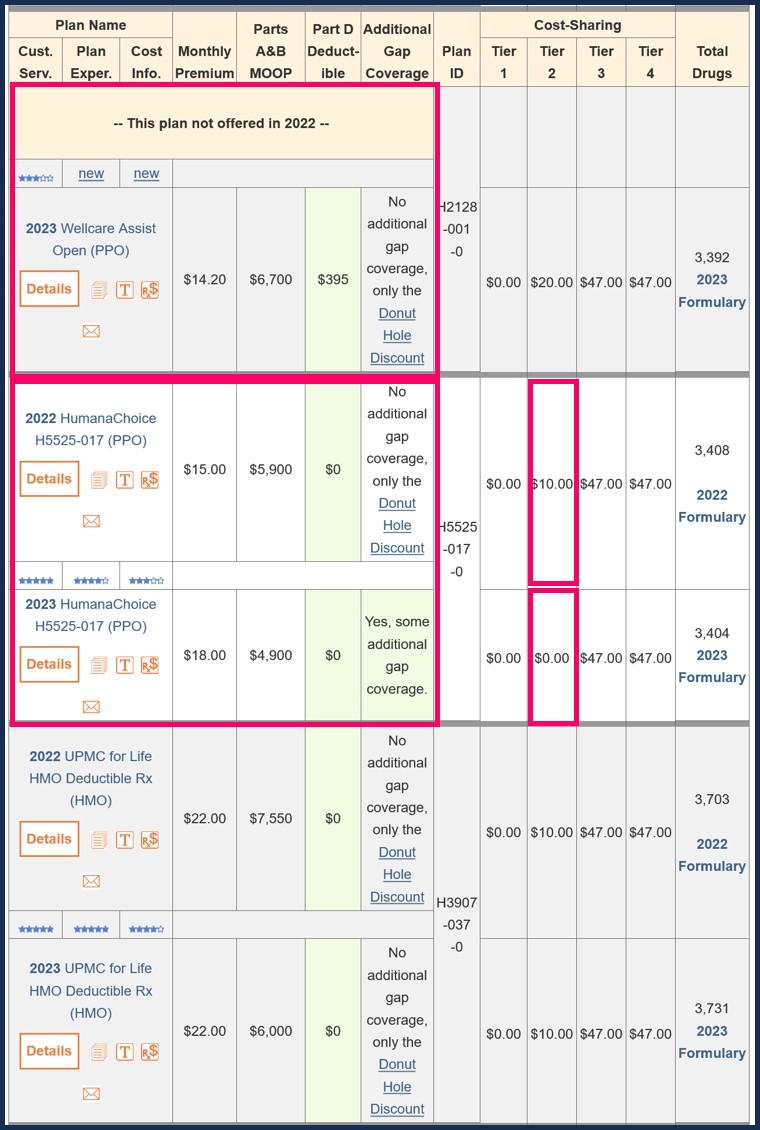

- Comparing Medicare Advantage plan changes from 2022 to 2023?

Reminder: No need to rush.

The annual Open Enrollment Period for 2023 Medicare Part D plans and Medicare Advantage plans begins on October 15th and continues through December 7, 2022. Your new Medicare plan coverage will begin on January 1, 2023.

Questions?

If you have any general questions about Medicare Part D plans or Medicare Advantage plans, please let us know.

You can click here for our online Help Desk to submit a question.

For more detailed questions, we suggest that you speak with a Medicare representative at 1-800-Medicare (1-800-633-4227 TTY 1-877-486-2048).

News Categories

Compare Prices Using a Drug Discount Card

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service