The Big Picture: Changes again in the national SNP landscape resulting in more 2023 SNP options.

First, based on our analysis, the bad news is that about 14% of the

2022 Medicare Advantage Special Needs Plans (SNPs) will be discontinued in 2023 —

this is consistent with the change from 2021 to 2022.

However, the good news is a large number of new 2023 Medicare Advantage SNPs will be introduced -

and with these newly released SNPs, we will actually see a 11%

increase in the total nationwide 2023 SNP landscape, and a 13% increase in

chronic care SNPs (c-SNPs). The vast

majority of SNPs remains Dual-Eligible (D-SNPs) (61%).

Across the country, we will see an increase in the total number of 2023 Medicare Advantage

Special Needs Plans (SNPs);

and SNP gains in some counties will more than offset SNP losses in other areas (or even the same counties). You can see plan year 2022 to 2023 SNP gains and losses with our Medicare Advantage plan comparison tool MA-Compare

found at MA-Compare.com.

The types of 2023 Special Needs Plans

- Chronic Care SNPs or C-SNPs (like diabetes, heart disease, or ESRD),

- Dual-Eligible Medicare/Medicaid SNPs or D-SNPs (for Medicare and Medicaid beneficiaries), and

- Institutional SNPs (for Nursing and Long-Term Care (LTC) residents).

| 2023 Special Needs Medicare Advantage Plans by Type of Special Need |

||||||||

| SNP Type | 2023 Plans | 2022 Plans | Net Change* | % Net Change | Dropped Plans* | % of '22 SNPs Dropped | 2021 Plans | 2020 Plans |

| Chronic Illness | 306 | 272 | 34 | 13% | 40 | 15% | 203 | 165 |

| Dual Eligible | 789 | 700 | 89 | 13% | 85 | 12% | 598 | 540 |

| Institutional | 189 | 184 | 5 | 3% | 32 | 17% | 174 | 150 |

| Total | 1,284 | 1,156 | 128 | 11% | 157 | 14% | 975 | 855 |

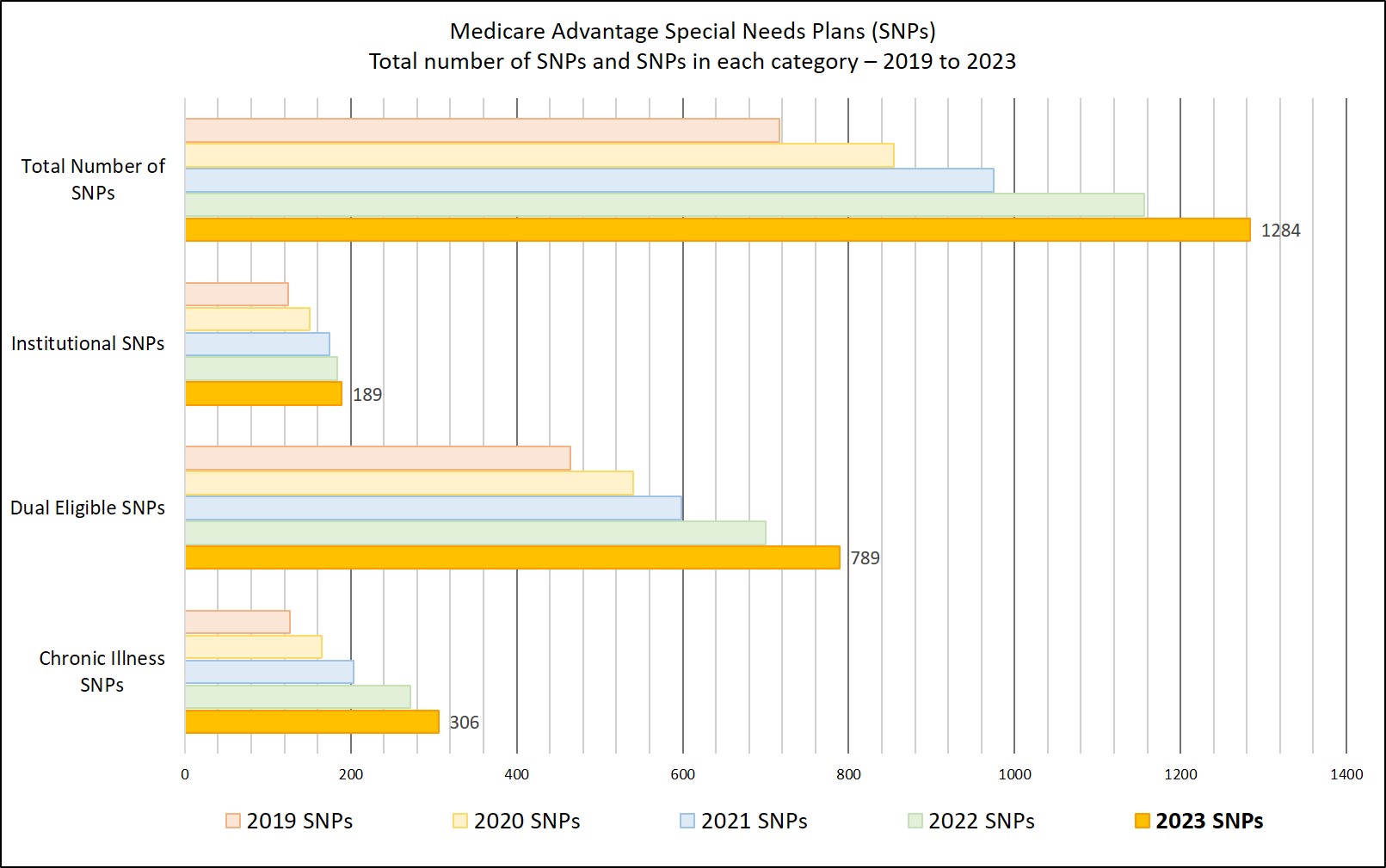

The chart below summarizes the 2023 Special Needs Plan landscape and how the SNP landscape has changed over the years.

You can learn more about the 2023 SNPs available in your area by using our Medicare Advantage plan finder (MA-Finder.com/2023) or add your ZIP code to the MA-Finder.com link to see plans in your area (MA-Finder.com/2023/90001).

To get you started, here is an example of all 2023 Special Needs Plans available in Allegheny County, PA.

Please note, if you are using our MA-Finder and looking for a Dual-Eligible Medicare/Medicaid SNP (D-SNP), be sure to indicate "100%" for the "LIS Subsidy Amount" to see the actual D-SNP monthly premiums for full dual-eligible Medicare/Medicaid beneficiaries.

As in past years, the most Special Needs Plans are available within a few counties located in New York, Florida, and California.

| Counties with the Largest Number of 2023 Special Needs Plans |

||||||||

| Locations | SNPs | |||||||

| Miami-Dade County, FL | 55 | |||||||

| Hillsborough County, FL | 55 | |||||||

| Broward County, FL | 54 | |||||||

| Pinellas County, FL | 53 | |||||||

| Palm Beach County, FL | 52 | |||||||

| Orange County, FL | 51 | |||||||

| Pasco County, FL | 51 | |||||||

| Polk County, FL | 51 | |||||||

| Seminole County, FL | 49 | |||||||

| Osceola County, FL | 48 | |||||||

| Bronx County, NY | 47 | |||||||

| Kings County, NY | 47 | |||||||

A closer look at the types of 2023 Chronic Care SNPs (C-SNPs)

Medicare Advantage Chronic Care Special Needs Plans can be further divided into the type of chronic care that the plan is designed to address - and the specific types of chronic conditions addressed by the SNPs varies slightly year-to-year, with a notable increase in "Cardiovascular Disorders, Chronic Heart Failure and Diabetes" SNPs.

| 2023 Special Needs – Chronic Care Plans Compared to the 2022 Plan Year |

|||||

| Chronic Care | Number of SNPs | ||||

| 2023 Plans | 2022 Plans | Net Change | 2021 Plans | 2020 Plans | |

| Cardiovascular Disorders | 1 | 1 | 0 | 1 | 0 |

| Cardiovascular Disorders and Chronic Heart Failure | 22 | 20 | 2 | 14 | 10 |

| Cardiovascular Disorders and Diabetes | 5 | 4 | 1 | 6 | 2 |

| Cardiovascular Disorders, Chronic Heart Failure and Diabetes | 164 | 141 | 23 | 93 | 67 |

| Chronic and Disabling Mental Health Conditions | 2 | 5 | -3 | 3 | 2 |

| Cardiovascular Disorders or Chronic Heart Failure or Diabetes Mellitus | 5 | 3 | 2 | 3 | 2 |

| Chronic Heart Failure | 3 | 3 | 0 | 3 | 1 |

| Chronic Heart Failure and Diabetes | 2 | 4 | -2 | 3 | 6 |

| Chronic Lung Disorders | 35 | 29 | 6 | 23 | 16 |

| Dementia | 6 | 8 | -2 | 7 | 8 |

| Diabetes Mellitus | 36 | 34 | 2 | 34 | 37 |

| End-stage Renal Disease Requiring Dialysis (any mode of dialysis) | 23 | 17 | 6 | 9 | 10 |

| End-stage Renal Disease Requiring Dialysis or HIV/AIDS | 3 | 3 | 0 | 0 | 0 |

| HIV/AIDS | 3 | 3 | 0 | 4 | 4 |

| Total Chronic Illness SNPs | 310 | 275 | 35 | 203 | 165 |

Changes within the SNP county-specific landscape

When comparing SNP reach (SNP plan multiplied by counties in the plan’s service area) we see an overall increase in plan reach. There is a notable increase in both dual-eligible and chronic care SNPs and a small increase in the number of institutional SNPs.

| 2023 Special Needs Plan Reach by Type of Need |

|||||||

| SNP Type | 2023 | 2022 | Change '22 to '23 | Percent Change '22 to '23 | 2021 | 2020 | 2013 |

| Chronic Care | 4,566 | 3,437 | 1,129 | 33% | 2,667 | 2,364 | 6,402 |

| Dual Eligible | 24,789 | 18,831 | 5,958 | 32% | 15,235 | 11,930 | 5,284 |

| Institutional | 3,410 | 3,122 | 288 | 9% | 2,441 | 1,906 | 537 |

| Total | 32,765 | 25,390 | 7,375 | 29% | 20,343 | 16,200 | 12,223 |

Important Reminder: A Medicare Advantage Special Needs Plan (SNP) is not for everyone.

Often you will find a Medicare Advantage SNP in your area that is very well-priced with feature-rich benefits and an extensive drug formulary - making the plan a very appealing coverage option.

But, please remember that you cannot join (or remain in) a Medicare Advantage SNP unless you qualify for the plan’s “Special Need” - that is, SNPs are designed for people with specific conditions, diseases, or characteristics -- and you must meet (and continue to meet) the plan's "Special Need" to be eligible for enrollment.

For example, if you do not qualify for your state's Medicaid program, you will not be eligible to join a Dual-Eligible (Medicare/Medicaid) SNP. For more information about qualifying for a SNP, please contact a local SHIP volunteer or telephone a Medicare representative at 1-800-Medicare." class="textred">and continue to meet) the plan's "Special Need" to be eligible for enrollment.

For example, if you do not qualify for your state's Medicaid program, you will not be eligible to join a Dual-Eligible (Medicare/Medicaid) SNP. For more information about qualifying for a SNP, please contact a local SHIP volunteer or telephone a Medicare representative at 1-800-Medicare.

8am to 5pm MST

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service