2023 Medicare Advantage plan Maximum Out-Of-Pocket (MOOP) limits are changing and can reach $8,300 -- with 1.4 million members seeing a MOOP increase from $50 to $4,850

Your Medicare Advantage plan's Maximum Out-of-Pocket

(MOOP)

threshold limits how much you will

spend on healthcare copayments and coinsurance for eligible Medicare Part A (in-patient

or hospitalization) and Medicare Part B (out-patient or doctor visit)

coverage. A higher MOOP limit means you will spend more out-of-pocket

for your

Medicare Part A and Medicare Part B covered services before reaching

the annual maximum cost threshold.

Each year MOOP limits can change and, starting back in 2021, the Centers for Medicare & Medicaid Services (CMS) began increasing the Maximum Out-of-Pocket limits for Medicare Advantage plan health benefit. In 2023, Medicare Advantage plans can increase their Maximum Out-of-Pocket limit to $8,300. Based on these annually established MOOP limits, each Medicare Advantage plan then sets their plan's MOOP (see below for an explanation) — with the approval of CMS.

And this means: If you have high healthcare expenses, you may want to watch out for an increase in your Medicare Advantage plan's out-of-pocket spending limit. If you find that your MOOP is increasing, you may wish to search for another Medicare Advantage plan having a lower MOOP limit ($3,650 or less). In short, the higher the MOOP limit, the higher your covered healthcare total expenses can be for the year. However, on a positive note, your Part A & Part B expenses will not exceed $8,300 for in-network Medicare cost-sharing (remember, this does not include Part D prescription drug expenses).

How many people will see an increase in their in-network MOOP?

About 1.4 million Medicare Advantage plan members will see an increase in their in-network MOOP in 2023. The MOOP increase can range from $50 to $4,850.

For example, the members of the Wellcare Plus Open PPO in Vermont will see an increase of $4,850 in the in-network MOOP and members of the Louisiana Blue Advantage (HMO) will see a MOOP increase of $4,400.

In-network vs. Out-of-network MOOP

The MOOP limit is a cap on your out-of-pocket expenses and applies to in-network Medicare Part A and Medicare Part B eligible medical cost-sharing. Please note that local and regional PPO Medicare Advantage plans can have a combined maximum MOOP of $12,450 (for in-network and out-of-network coverage).

The range of in-network 2023 MOOP thresholds

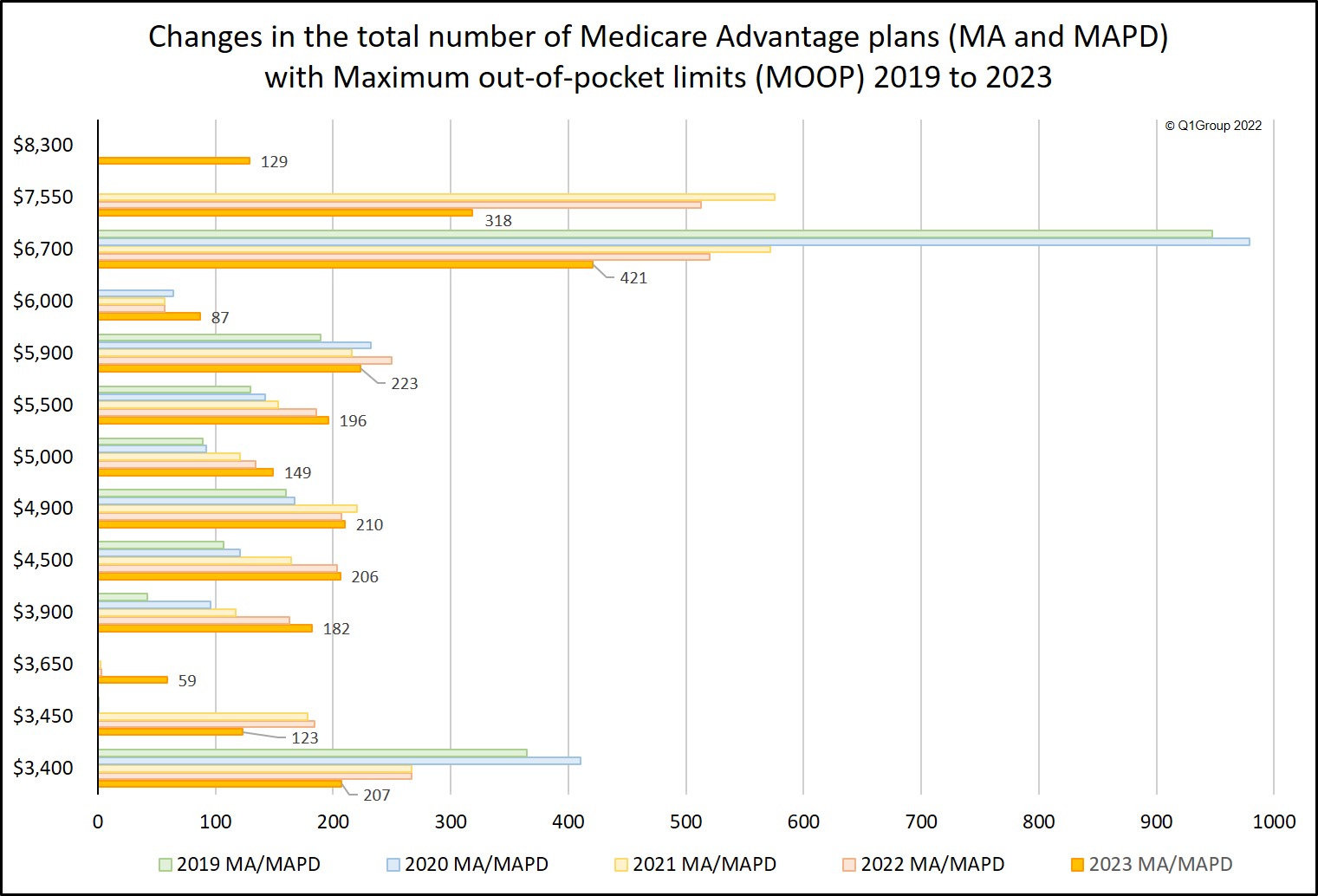

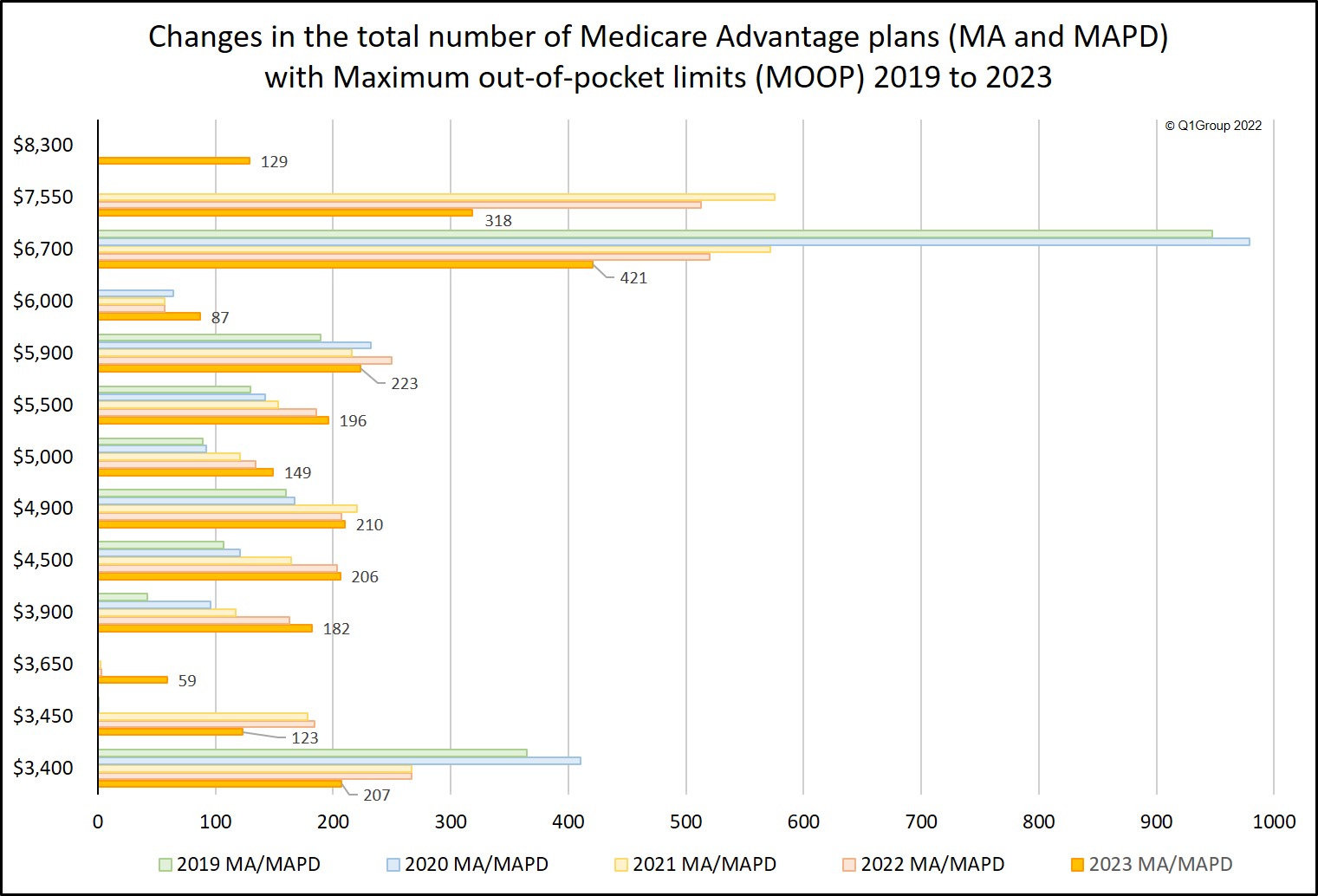

The 2023 Medicare Advantage MOOPs range from $0 to $8,300 — and often Medicare Advantage plans with a MOOP of $0 are Medicare Advantage PFFS plans, MSAs, or Cost plans. The following chart shows how the MOOP range has changed from 2019 through 2023. Our chart excludes $0 MOOP plans. Remember, starting in 2021 Medicare began to increase the allowable voluntary and mandatory MOOP limits, and for 2023, Medicare has renamed the voluntary MOOP to "lower" MOOP and added a third intermediate MOOP limit between the two MOOPs -- so the MOOP limits are now "lower", "intermediate", and "mandatory" MOOP.

As reference, you can see each Medicare Advantage plan's MOOP using our 2023 Medicare Advantage Plan Finder (MA-Finder.com/2023) or you can browse through the states/counties via our 2023 Overview by State.

The 2023 MOOP dispersion: Different out-of-pocket limits for different Medicare Advantage plans

We found that across all 2023 Medicare Advantage plans, only 392 plans increased their MOOP, 2,254 plans kept the same MOOP as last year, and 952 plans reduced the plan's MOOP limit.

When MOOP is evaluated across all Medicare Advantage plans (excluding MMPs and SNPs which do not have a MOOP), we see a decrease in the average 2023 MOOP limit. The 2023 average MOOP is around $5,061 as compared to $5,164 in 2022.

Each year MOOP limits can change and, starting back in 2021, the Centers for Medicare & Medicaid Services (CMS) began increasing the Maximum Out-of-Pocket limits for Medicare Advantage plan health benefit. In 2023, Medicare Advantage plans can increase their Maximum Out-of-Pocket limit to $8,300. Based on these annually established MOOP limits, each Medicare Advantage plan then sets their plan's MOOP (see below for an explanation) — with the approval of CMS.

And this means: If you have high healthcare expenses, you may want to watch out for an increase in your Medicare Advantage plan's out-of-pocket spending limit. If you find that your MOOP is increasing, you may wish to search for another Medicare Advantage plan having a lower MOOP limit ($3,650 or less). In short, the higher the MOOP limit, the higher your covered healthcare total expenses can be for the year. However, on a positive note, your Part A & Part B expenses will not exceed $8,300 for in-network Medicare cost-sharing (remember, this does not include Part D prescription drug expenses).

How many people will see an increase in their in-network MOOP?

About 1.4 million Medicare Advantage plan members will see an increase in their in-network MOOP in 2023. The MOOP increase can range from $50 to $4,850.

2023 Medicare Advantage Plans In-Network MOOP Limit Increases |

|

| MOOP Limit Increase Range | Members Affected |

| $4,000 to $4,850 | 10,485 |

| $3,000 to $3,999 | 34,749 |

| $2,000 to $2,999 | 38,925 |

| $1,000 to $1,999 | 223,951 |

| $500 to $999 | 431,999 |

| less than $500 | 638,040 |

For example, the members of the Wellcare Plus Open PPO in Vermont will see an increase of $4,850 in the in-network MOOP and members of the Louisiana Blue Advantage (HMO) will see a MOOP increase of $4,400.

In-network vs. Out-of-network MOOP

The MOOP limit is a cap on your out-of-pocket expenses and applies to in-network Medicare Part A and Medicare Part B eligible medical cost-sharing. Please note that local and regional PPO Medicare Advantage plans can have a combined maximum MOOP of $12,450 (for in-network and out-of-network coverage).

The range of in-network 2023 MOOP thresholds

The 2023 Medicare Advantage MOOPs range from $0 to $8,300 — and often Medicare Advantage plans with a MOOP of $0 are Medicare Advantage PFFS plans, MSAs, or Cost plans. The following chart shows how the MOOP range has changed from 2019 through 2023. Our chart excludes $0 MOOP plans. Remember, starting in 2021 Medicare began to increase the allowable voluntary and mandatory MOOP limits, and for 2023, Medicare has renamed the voluntary MOOP to "lower" MOOP and added a third intermediate MOOP limit between the two MOOPs -- so the MOOP limits are now "lower", "intermediate", and "mandatory" MOOP.

As reference, you can see each Medicare Advantage plan's MOOP using our 2023 Medicare Advantage Plan Finder (MA-Finder.com/2023) or you can browse through the states/counties via our 2023 Overview by State.

The 2023 MOOP dispersion: Different out-of-pocket limits for different Medicare Advantage plans

We found that across all 2023 Medicare Advantage plans, only 392 plans increased their MOOP, 2,254 plans kept the same MOOP as last year, and 952 plans reduced the plan's MOOP limit.

When MOOP is evaluated across all Medicare Advantage plans (excluding MMPs and SNPs which do not have a MOOP), we see a decrease in the average 2023 MOOP limit. The 2023 average MOOP is around $5,061 as compared to $5,164 in 2022.

The table below illustrates some of the more frequently occurring 2023 MOOP limits across all types of Medicare Advantage plans. Note that 74% of 2023 Medicare Advantage plans have a MOOP over the $3,650 lower MOOP as compared to 76% over the 2022 voluntary MOOP of $3,450.

Top 2023 MOOP Limits for Medicare Advantage Plans and new low, intermediate, and mandatory MOOP limits |

||||||

| Number of

Medicare Advantage Plans (MA & MAPD) |

||||||

| MOOP Limits | 2023 | 2022 | Change '22 to '23 | Percent | 2021 | 2020 |

| $6,700 | 421 | 520 | -99 | -19% | 572 | 979 |

| $7,550 | 318 | 513 | -195 | -38% | 575 | |

| $5,900 | 223 | 250 | -27 | -11% | 216 | 232 |

| $4,900 | 210 | 207 | 3 | 1% | 220 | 167 |

| $3,400 | 207 | 267 | -60 | -22% | 267 | 410 |

| $4,500 | 206 | 203 | 3 | 1% | 164 | 121 |

| $5,500 | 196 | 186 | 10 | 5% | 153 | 142 |

| $3,900 | 182 | 163 | 19 | 12% | 117 | 96 |

| $5,000 | 149 | 134 | 15 | 11% | 121 | 92 |

| $3,450 | 123 | 184 | -61 | -33% | 178 | 1 |

| 2023 lower, intermediate, and mandatory MOOP limits | ||||||

| $3,650 | 59 | 3 | 56 | 1,867% | 2 | |

| $6,000 | 87 | 57 | 30 | 53% | 57 | 64 |

| $8,300 | 129 | 129 | 0% | |||

Comparison of the number of plans falling into the MOOP ranges.

Medicare Advantage Plans per CMS Defined MOOP Limits |

|||||

| 2023 | 2022 | ||||

| MOOP Limit Range | Nbr of Plans | % of Plans | MOOP Limit Range | Nbr of Plans | % of Plans |

| Lower: $0 to $3,650 |

1,165 | 26% | Voluntary: $0 to $3,450 |

992 | 24% |

| Intermediate: $3,651 to $6,000 |

1,955 | 44% | |

|

|

| Mandatory: $6001 to $8,300 |

1,307 | 30% | Mandatory: $3,451 to $7,550 |

3,197 | 76% |

Medicare Advantage plans may set their MOOP threshold as any amount within the

ranges shown in the CMS table below. As an example, HMO plans can set

their plan's MOOP as high as $8,300; however, an HMO plan that sets MOOP within

the lower ($0 - $3,650) or intermediate ($3,651 - $6,000) range is granted greater flexibility for individual

service category cost-sharing.

Important: In-network MOOP and out-of-network MOOP

As can be seen in the table above, out-of-network cost-sharing expenses may fall into a higher MOOP (for example, see Regional PPO above with a higher "combined" MOOP limit) or (IMPORTANT!) your out-of-network cost-sharing may not count toward your MOOP limit, as with the HMO POS plan type. Please notice that the lower, intermediate and mandatory MOOP limits now change yearly and the 2023 limits are slightly higher than the 2022 figures.

Question: How are the lower, intermediate and mandatory MOOP limit set?

The lower, intermediate and mandatory MOOP limits are set by the Centers for Medicare and Medicaid Services (CMS). Per CMS, the mandatory MOOP amount represented approximately the 95th percentile of projected beneficiary out-of-pocket spending. In other words, five percent of Original Medicare beneficiaries are expected to incur approximately $8,300 or more in Parts A and B deductibles, copayments and coinsurance. The lower MOOP amount of $3,650 represents approximately the 85th percentile of projected Original Medicare out-of-pocket costs. The voluntary MOOP was renamed to lower MOOP in 2023 when the intermediate MOOP was added. The intermediate MOOP is set at the numeric midpoint of the mandatory and lower MOOP limits.

MOOP and Special Needs Plans (and MMPs)

You may notice that Medicare Advantage MMP (Medicare-Medicaid plans) and Special Needs Plans, such as for dual Medicare/Medicaid eligible beneficiaries (D-SNPs), do not have a MOOP.

Reminder about Medicare Advantage MOOP and Part D Drug Plan TrOOP

Your Total Out-of-Pocket Limit (TrOOP) for your Medicare Part D prescription drug coverage is not the same as your Medicare Part A and Medicare Part B Maximum Out-of-Pocket (MOOP). (For more information, please see our Frequently Asked Question: TrOOP is not MOOP.)

Bottom Line: Please review your 2023 Medicare Advantage plan's coverage information to learn more about your plan's MOOP. You should be able to find your 2023 MOOP in your plan's 2022/2023 Annual Notice of Change letter (ANOC). You can also telephone your current Medicare Advantage plan using the toll-free Member Services number found on your Member ID card for more information.

Need additional assistance? Please call Medicare at 1-800-633-4227 and speak with a Medicare representative about Medicare plans that are available in your service area.

You can see more 2023 Medicare Part D plan changes using our MA-Compare tool found at: MA-Compare.com/2023 or Browse Medicare Advantage or Part D plans by state and county.

| 2023 Lower, Intermediate and Mandatory MOOP Range by Type of Medicare Advantage plan |

|||||

| Plan Type | Lower (Voluntary) | Intermediate | Mandatory | ||

| HMO | $0 - $3,650 | $3,651 - $6,000 | $6,001 - $8,300 | ||

| HMO POS | $0 - $3,650 In-network | $3,651 - $6,000 | $6,001 - $8,300 In-network | ||

| Local PPO | $0

- $3,650 In-network and $0 - $5,450 Combined |

$3,651 - $6,000 In-network and $3,651 - $8,950 Combined |

$6,001

- $8,300 In-network and $6,001 - $12,450 Combined |

||

| Regional PPO | $0

- $3,650 In-network and

$0 - $5,450 Combined |

$3,651 - $6,000 In-network and $3,651 - $8,950 Combined |

$6,001

- $8,300 In-network and $6,001 - $12,450 Combined |

||

| PFFS (full network) | $0

- $3,650 |

$3,651 - $6,000 | $6,001 - $8,300 Combined | ||

| PFFS (partial network) | $0 - $3,650 | $3,651 - $6,000 | $6,001 - $8,300 Combined | ||

| PFFS (non-network) | $0 - $3,650 | $3,651 - $6,000 | $6,001 - $8,300 | ||

Important: In-network MOOP and out-of-network MOOP

As can be seen in the table above, out-of-network cost-sharing expenses may fall into a higher MOOP (for example, see Regional PPO above with a higher "combined" MOOP limit) or (IMPORTANT!) your out-of-network cost-sharing may not count toward your MOOP limit, as with the HMO POS plan type. Please notice that the lower, intermediate and mandatory MOOP limits now change yearly and the 2023 limits are slightly higher than the 2022 figures.

Question: How are the lower, intermediate and mandatory MOOP limit set?

The lower, intermediate and mandatory MOOP limits are set by the Centers for Medicare and Medicaid Services (CMS). Per CMS, the mandatory MOOP amount represented approximately the 95th percentile of projected beneficiary out-of-pocket spending. In other words, five percent of Original Medicare beneficiaries are expected to incur approximately $8,300 or more in Parts A and B deductibles, copayments and coinsurance. The lower MOOP amount of $3,650 represents approximately the 85th percentile of projected Original Medicare out-of-pocket costs. The voluntary MOOP was renamed to lower MOOP in 2023 when the intermediate MOOP was added. The intermediate MOOP is set at the numeric midpoint of the mandatory and lower MOOP limits.

MOOP and Special Needs Plans (and MMPs)

You may notice that Medicare Advantage MMP (Medicare-Medicaid plans) and Special Needs Plans, such as for dual Medicare/Medicaid eligible beneficiaries (D-SNPs), do not have a MOOP.

Reminder about Medicare Advantage MOOP and Part D Drug Plan TrOOP

Your Total Out-of-Pocket Limit (TrOOP) for your Medicare Part D prescription drug coverage is not the same as your Medicare Part A and Medicare Part B Maximum Out-of-Pocket (MOOP). (For more information, please see our Frequently Asked Question: TrOOP is not MOOP.)

Bottom Line: Please review your 2023 Medicare Advantage plan's coverage information to learn more about your plan's MOOP. You should be able to find your 2023 MOOP in your plan's 2022/2023 Annual Notice of Change letter (ANOC). You can also telephone your current Medicare Advantage plan using the toll-free Member Services number found on your Member ID card for more information.

Need additional assistance? Please call Medicare at 1-800-633-4227 and speak with a Medicare representative about Medicare plans that are available in your service area.

You can see more 2023 Medicare Part D plan changes using our MA-Compare tool found at: MA-Compare.com/2023 or Browse Medicare Advantage or Part D plans by state and county.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service