Q1Medicare Top 10 highlights of the 2024 Medicare Advantage plan landscape

The 2024 Medicare Advantage plan information

recently released by the Centers for

Medicare and Medicaid Services (CMS) shows that Medicare beneficiaries can

expect about the same number of Medicare Advantage plans in many areas across the country with

continued low monthly premiums.

First, here are a few important points about Medicare Advantage plans:

(1) A Medicare Advantage plan includes your Medicare Part A (in-patient and hospitalization coverage), Medicare Part B (out-patient and physician coverage), and may include prescription drug coverage (MAPD) or can be offered without drug coverage (MA).

(2) A Medicare Advantage plan may include supplemental healthcare benefits such as vision, dental, or fitness coverage. A Medicare Advantage plan may also include non-health related benefits such as meal delivery (in limited situations) and non-health related transportation.

(3) You cannot add a stand-alone Medicare Part D prescription drug plan (PDP) if you are enrolled in a Medicare Advantage plan that does not include drug coverage (MA) – unless your Medicare Advantage (MA) plan is a PFFS, MSA, or Cost plan.

(4) A Medicare Advantage plan is not a Medicare Supplement (Medigap plan) and a Medicare Advantage plan cannot be used with a Medicare Supplement.

Our Top 10 highlights of the 2024 Medicare Advantage plan landscape:

(1) The total number of 2024 Medicare Advantage plans will remain steady.

Across the country, there will only be 0.15% more Medicare Advantage plans offered in 2024 – with 5,377 Medicare Advantage plans (MAs and MAPDs) available as compared to 5,369 Medicare Advantage plans offered in 2023.

Read more about the changes in the number (and type) of Medicare Advantage plans over the past few years.

(2) Most 2024 Medicare Advantage plans include Part D drug coverage (MAPDs) and are local HMOs.

As in past years, over 91% of 2024 Medicare Advantage plans will include prescription drug coverage (MAPDs) and the majority (61.6%) of 2024 Medicare Advantage plans will be local HMOs (Health Maintenance Organizations), although the total number of HMO plans will decrease by 2.6%. In addition, there will be a 6% increase in 2024 Local PPO (Preferred Provider Organization) Medicare Advantage plans.

You can click here for a chart showing how the number and type of MAPDs and MAs has changed over the past years.

(3) Even with slightly more 2024 Medicare Advantage plans, many counties across the country will see significant changes in their Medicare Advantage plan landscape.

When viewed in detail, many 2023 Medicare Advantage plans will be terminated in 2024 or merged into other 2024 plans ("crosswalked*") – and new 2024 Medicare Advantage plans will be introduced. As an example, Dallas County, TX will lose 34 of the 110 currently-offered 2023 Medicare Advantage plans. However, in the same county, 25 new 2024 Medicare Advantage plans will be introduced.

As another example of the ever-changing Medicare Advantage plan landscape, in 2022, Monroe County, PA had a total of 58 Medicare Advantage plans. Then in 2023, four (4) plans left and 13 plans entered the county for a new total of 67 plans. Now in 2024, five (5) Medicare Advantage plans are leaving the county and 11 plans are entering the area for a new total of 73 Medicare Advantage plans.

You can see more 2024 Medicare plan changes using our 2023/2024 Medicare Advantage plan compare tool: MA-Compare.com/2024.

A Closer Look: County-specific changes in the 2024 Medicare Advantage plan landscape (Losses and Gains)

The counties in the chart below will have the highest number of non-renewing Medicare Advantage plans.

Note about "crosswalk" information: *The term "Crosswalk" is used when a 2023 Medicare plan automatically moves plan members to a different plan for 2024 because the 2023 Medicare plan will no longer be offered next year. Some of the plans above will "crosswalk" their 2023 plan members to a different 2024 Medicare Advantage plan. The new Medicare plan for crosswalked members is noted in our MA Compare tool. For example, 19 of the 2023 Medicare Advantage plans that will no longer be available in Los Angeles County, CA will "crosswalk" or move their members to a different 2024 Medicare Advantage plan.

Bottom Line: Read your Medicare Advantage plan’s Annual Notice of Change (ANOC) letter to ensure that your Medicare plan is being offered in 2024 or to see whether you are being automatically moved to another 2024 Medicare Advantage plan.

(4) Changes in the Special Needs Plan (SNP) landscape result in wider availability of 2024 SNP options.

Special Needs Plans (SNPs) are a type of Medicare Advantage plan with plan benefits, healthcare provider choices, and drug formularies (list of covered drugs) designed to accommodate the needs of a particular group of people meeting certain requirements – such as people suffering from a chronic condition or illness (for example, diabetes or a chronic cardiac conditions) or nursing home residents or people who have limited financial resources (for example, people eligible for both Medicare and Medicaid).

Although about 21% of the 2023 Medicare Advantage Special Needs Plans (SNPs) will be discontinued in 2024, the number of 2023 SNPs leaving the market will be offset by the introduction of new 2024 SNPs, resulting in a 4% actual increase in the total number of SNPs.

As in past years, the vast majority (64%) of SNPs remain Dual-Eligible Medicare/Medicaid plans (D-SNPs). However, the number of counties across the country offering a Medicare Advantage Chronic Care C-SNP will increase by 10% and the number of counties offering an Institutional I-SNP will increase almost 17%.

Learn more about 2024 Medicare Advantage Special Needs Plans and how the SNP landscape has changed over recent years.

(5) 2024 Medicare Medical Savings Accounts (MSAs) will no longer be widely available.

According to the latest data available from CMS, in 2024, Medicare Medical Savings Accounts (MSAs) will be available in Wisconsin as compared to being available in 37 states in 2023. Unlike other Medicare Advantage plans, MSAs are made up of a high-deductible health plan and a medical savings account funded by an annual tax-free deposit. MSA members can use the medical savings account to pay for healthcare costs before the health plan deductible is met. MSA members can enroll in any available stand-alone Medicare Part D plan (PDP) for their drug coverage.

Read more about the changes in the number (and type) of Medicare Advantage plans over the past few years.

First, here are a few important points about Medicare Advantage plans:

(1) A Medicare Advantage plan includes your Medicare Part A (in-patient and hospitalization coverage), Medicare Part B (out-patient and physician coverage), and may include prescription drug coverage (MAPD) or can be offered without drug coverage (MA).

(2) A Medicare Advantage plan may include supplemental healthcare benefits such as vision, dental, or fitness coverage. A Medicare Advantage plan may also include non-health related benefits such as meal delivery (in limited situations) and non-health related transportation.

(3) You cannot add a stand-alone Medicare Part D prescription drug plan (PDP) if you are enrolled in a Medicare Advantage plan that does not include drug coverage (MA) – unless your Medicare Advantage (MA) plan is a PFFS, MSA, or Cost plan.

(4) A Medicare Advantage plan is not a Medicare Supplement (Medigap plan) and a Medicare Advantage plan cannot be used with a Medicare Supplement.

Our Top 10 highlights of the 2024 Medicare Advantage plan landscape:

(1) The total number of 2024 Medicare Advantage plans will remain steady.

Across the country, there will only be 0.15% more Medicare Advantage plans offered in 2024 – with 5,377 Medicare Advantage plans (MAs and MAPDs) available as compared to 5,369 Medicare Advantage plans offered in 2023.

Read more about the changes in the number (and type) of Medicare Advantage plans over the past few years.

(2) Most 2024 Medicare Advantage plans include Part D drug coverage (MAPDs) and are local HMOs.

As in past years, over 91% of 2024 Medicare Advantage plans will include prescription drug coverage (MAPDs) and the majority (61.6%) of 2024 Medicare Advantage plans will be local HMOs (Health Maintenance Organizations), although the total number of HMO plans will decrease by 2.6%. In addition, there will be a 6% increase in 2024 Local PPO (Preferred Provider Organization) Medicare Advantage plans.

You can click here for a chart showing how the number and type of MAPDs and MAs has changed over the past years.

(3) Even with slightly more 2024 Medicare Advantage plans, many counties across the country will see significant changes in their Medicare Advantage plan landscape.

When viewed in detail, many 2023 Medicare Advantage plans will be terminated in 2024 or merged into other 2024 plans ("crosswalked*") – and new 2024 Medicare Advantage plans will be introduced. As an example, Dallas County, TX will lose 34 of the 110 currently-offered 2023 Medicare Advantage plans. However, in the same county, 25 new 2024 Medicare Advantage plans will be introduced.

As another example of the ever-changing Medicare Advantage plan landscape, in 2022, Monroe County, PA had a total of 58 Medicare Advantage plans. Then in 2023, four (4) plans left and 13 plans entered the county for a new total of 67 plans. Now in 2024, five (5) Medicare Advantage plans are leaving the county and 11 plans are entering the area for a new total of 73 Medicare Advantage plans.

You can see more 2024 Medicare plan changes using our 2023/2024 Medicare Advantage plan compare tool: MA-Compare.com/2024.

A Closer Look: County-specific changes in the 2024 Medicare Advantage plan landscape (Losses and Gains)

The counties in the chart below will have the highest number of non-renewing Medicare Advantage plans.

|

Counties

with Largest Number of Non-Renewing Medicare Advantage Plans |

|

| County | Number of Non-Renewing

Plans including crosswalks* |

| Dallas County, TX | 34 |

| Tarrant County, TX | 34 |

| Denton County, TX | 31 |

| Los Angeles County, CA | 29 |

| Collin County, TX | 29 |

| Gwinnett County, GA | 26 |

| Broward County, FL | 25 |

| Miami-Dade County, FL | 25 |

| Bexar County, TX | 25 |

| Santa Clara County, CA | 24 |

| DeKalb County, GA | 24 |

| San Bernardino County, CA | 23 |

Note about "crosswalk" information: *The term "Crosswalk" is used when a 2023 Medicare plan automatically moves plan members to a different plan for 2024 because the 2023 Medicare plan will no longer be offered next year. Some of the plans above will "crosswalk" their 2023 plan members to a different 2024 Medicare Advantage plan. The new Medicare plan for crosswalked members is noted in our MA Compare tool. For example, 19 of the 2023 Medicare Advantage plans that will no longer be available in Los Angeles County, CA will "crosswalk" or move their members to a different 2024 Medicare Advantage plan.

Bottom Line: Read your Medicare Advantage plan’s Annual Notice of Change (ANOC) letter to ensure that your Medicare plan is being offered in 2024 or to see whether you are being automatically moved to another 2024 Medicare Advantage plan.

(4) Changes in the Special Needs Plan (SNP) landscape result in wider availability of 2024 SNP options.

Special Needs Plans (SNPs) are a type of Medicare Advantage plan with plan benefits, healthcare provider choices, and drug formularies (list of covered drugs) designed to accommodate the needs of a particular group of people meeting certain requirements – such as people suffering from a chronic condition or illness (for example, diabetes or a chronic cardiac conditions) or nursing home residents or people who have limited financial resources (for example, people eligible for both Medicare and Medicaid).

Although about 21% of the 2023 Medicare Advantage Special Needs Plans (SNPs) will be discontinued in 2024, the number of 2023 SNPs leaving the market will be offset by the introduction of new 2024 SNPs, resulting in a 4% actual increase in the total number of SNPs.

As in past years, the vast majority (64%) of SNPs remain Dual-Eligible Medicare/Medicaid plans (D-SNPs). However, the number of counties across the country offering a Medicare Advantage Chronic Care C-SNP will increase by 10% and the number of counties offering an Institutional I-SNP will increase almost 17%.

Learn more about 2024 Medicare Advantage Special Needs Plans and how the SNP landscape has changed over recent years.

(5) 2024 Medicare Medical Savings Accounts (MSAs) will no longer be widely available.

According to the latest data available from CMS, in 2024, Medicare Medical Savings Accounts (MSAs) will be available in Wisconsin as compared to being available in 37 states in 2023. Unlike other Medicare Advantage plans, MSAs are made up of a high-deductible health plan and a medical savings account funded by an annual tax-free deposit. MSA members can use the medical savings account to pay for healthcare costs before the health plan deductible is met. MSA members can enroll in any available stand-alone Medicare Part D plan (PDP) for their drug coverage.

Read more about the changes in the number (and type) of Medicare Advantage plans over the past few years.

(6) Monthly 2024 Medicare Advantage plan premiums will remain low.

As noted in a recent CMS press release, the average Medicare Advantage plan premium is expected to increase from $17.86 in 2023 to $18.50 in 2024 (an increase of $0.64). Our analysis shows just over 88% of all 2024 Medicare Advantage plans have a monthly premium under $50 and almost 55% of all 2024 Medicare Advantage plans have a $0 premium.

You can click here to read more about changes in Medicare Advantage plan premiums and see a chart of how plan premiums have changed in recent years.

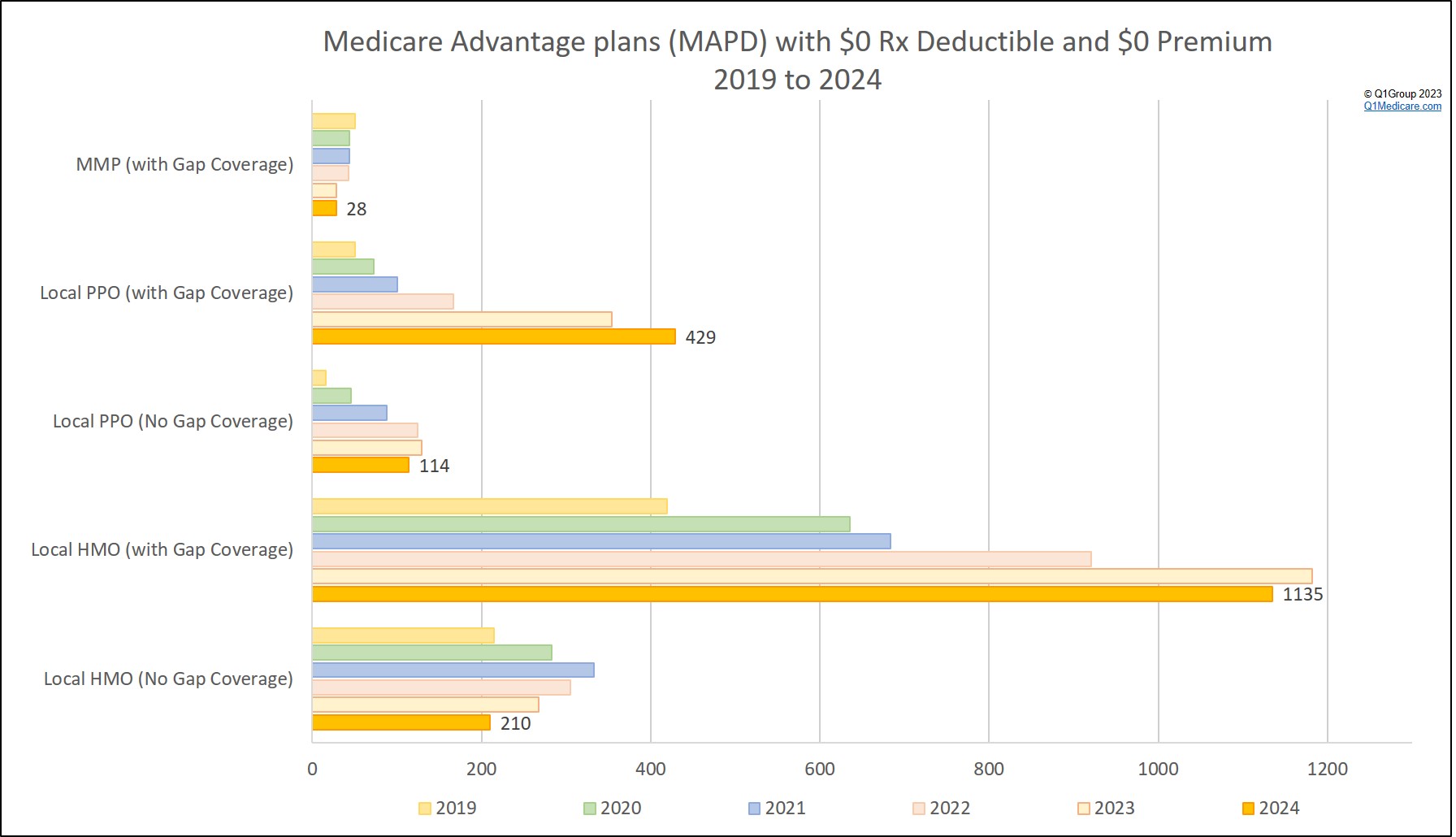

(7) Slightly fewer 2024 MAPDs have a $0 premium and $0 drug deductible ($0/$0 plans) and fewer $0/$0 plans will refund a portion of your Part B premium.

In addition to the overall lower-premium 2024 plans, 39% of all 2024 Medicare Advantage plans that include prescription drug coverage (MAPDs) will have a $0 premium and $0 initial drug deductible (down from 40% in 2023).

Below is a chart showing the different types of $0/$0 Medicare Advantage plans (MAPDs) along with their gap coverage offering.

The number of Part B Giveback plans has increased over time, and will increase slightly in 2024. However in 2024, only 275 Medicare Advantage plans with a $0 premium and $0 deductible ($0/$0 plans) will return a portion of your Medicare Part B premium as compared to 305 $0/$0 Giveback plans in 2023. The good news is that these plans will be available in more counties in 2024. In more detail, over 3,083 counties include at least one 2024 Medicare Advantage plan with a Part B premium “Giveback” or refund.

Learn more in our article, Slightly more 2024 Medicare Advantage plans include a Medicare Part B premium Giveback feature.

(8) Slightly more 2024 MAPDs will offer supplemental Donut Hole coverage.

The 2024 Donut Hole discount remains 75% for all formulary medications – you pay 25% of retail for both brand-name and generic formulary medications purchased while in the Coverage Gap. However, 52.43% of 2024 MAPD plans will offer some level of additional gap coverage beyond the Donut Hole discount compared to 51.70% in 2023. For brand-name drug purchases in the Donut Hole, the 70% brand-name drug manufacturer’s portion of the Donut Hole discount is applied to this supplemental gap coverage.

You can read more on the 2024 Donut Hole.

(9) About 4.4 million Medicare Advantage plan members will see an increase in their in-network 2024 Maximum Out-of-Pocket (MOOP) limit.

One key benefit of a Medicare Advantage plan is that annual spending for in-network Medicare Part A (in-patient or hospitalization) and Medicare Part B (out-patient or doctor visit) eligible services is capped by the plan’s Maximum Out-of-Pocket spending limit (MOOP). Once you reach your plan’s MOOP you will no longer pay cost-sharing for eligible, in-network Part A or Part B services.

A Medicare Advantage plan’s MOOP limit can change every year and in 2024, MOOP limits will range from $198 to $8,850 (although Medicare Advantage plans designed for low-income beneficiaries have a $0 MOOP). And based on our analysis, about 4.4 million Medicare Advantage plan members will see an increase in their plan's in-network 2024 MOOP limit. The MOOP increase can range from $50 to $5,400.

In general, most Medicare Advantage plans have a MOOP under $6,350 – with 29% of 2024 Medicare Advantage plans having a MOOP at, or below, $3,850. On the higher end, 24% of 2024 Medicare Advantage plans will have a MOOP between $6,351 and $8,850.

And this means: The lower the MOOP, the less you will spend per year for your total Medicare Part A and Medicare Part B covered services.

Learn more about the Maximum Out-of-Pocket limits for 2024 Medicare Advantage plans and how MOOP limits have changed in recent years.

(10) All 2024 Medicare Advantage plans with drug coverage (MAPD) will offer insulin at a $35 (or less) copay, cover ACIP Part D vaccines at a $0 copay, and have no additional formulary drug cost-sharing in the Catastrophic Coverage phase.

Based on the Inflation Reduction Act, all 2024 Medicare Advantage plans with drug coverage (MAPDs) will offer all insulin found on the plan’s formulary for a copay of $35 (or less) for a 30-day supply through all phases of Part D coverage.

In addition, all Medicare Advantage plans with drug coverage (MAPDs) will offer $0 cost sharing for Part D vaccines that are recommended by the Advisory Committee on Immunization Practices (ACIP), such as Shingles and Pneumonia vaccines.

And in 2024, cost-sharing in the Part D Catastrophic Coverage phase will be eliminated. Meaning: If you have high drug costs and exit the 2024 Donut Hole, you will have no additional costs for formulary drugs through the remainder of the year.

Need

an overview of Medicare Advantage plan options in your area?

To get you started with your review of 2024 Medicare Advantage plans available in your area, just click on your state and then click on your county name: AK AL AR AS AZ CA CO CT DC DE FL GA GU HI IA ID IL IS IN KS KY LA MA MD ME MI MN MO MS MT NC ND NE NH NJ NM NV NY OH OK OR PA PR RI SC SD TN TX UT VA VI VT WA WI WV WY.

You can also use our 2024 Medicare Advantage plan finder (MA-Finder) to review plans in your area – found directly at: MA-Finder.com/2024. The MA-Finder currently displays the plan premium, prescription deductible, supplemental Gap or Donut Hole coverage, 30-day cost-sharing, health benefits, and Medicare Part A and Part B Maximum Out-of-Pocket limit (MOOP).

You can use our 2023/2024 MA-Compare tool to see how your 2023 Medicare Advantage plan is changing in 2024. Our Medicare Advantage comparison tool can be found directly at: MA-Compare.com/2024.

To get you started with your review of 2024 Medicare Advantage plans available in your area, just click on your state and then click on your county name: AK AL AR AS AZ CA CO CT DC DE FL GA GU HI IA ID IL IS IN KS KY LA MA MD ME MI MN MO MS MT NC ND NE NH NJ NM NV NY OH OK OR PA PR RI SC SD TN TX UT VA VI VT WA WI WV WY.

You can also use our 2024 Medicare Advantage plan finder (MA-Finder) to review plans in your area – found directly at: MA-Finder.com/2024. The MA-Finder currently displays the plan premium, prescription deductible, supplemental Gap or Donut Hole coverage, 30-day cost-sharing, health benefits, and Medicare Part A and Part B Maximum Out-of-Pocket limit (MOOP).

You can use our 2023/2024 MA-Compare tool to see how your 2023 Medicare Advantage plan is changing in 2024. Our Medicare Advantage comparison tool can be found directly at: MA-Compare.com/2024.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service