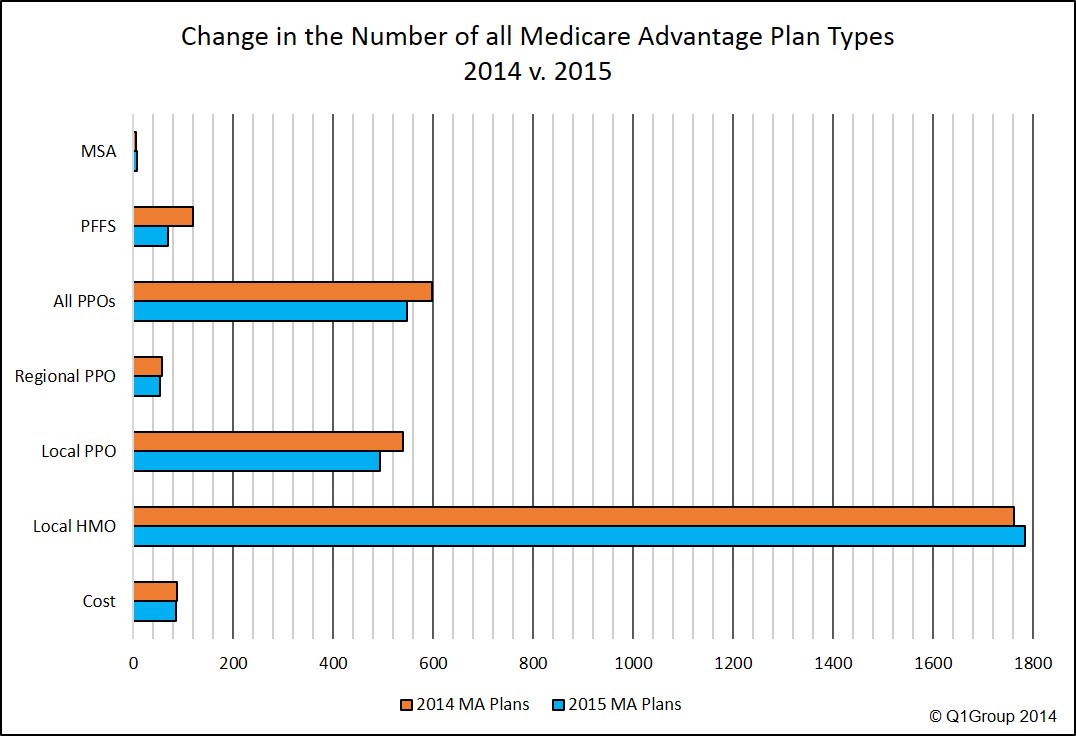

The types of Medicare Advantage plans - When looking at a summary of the 2015 Medicare Advantage plans (with and without prescription drug coverage) across the entire country, we can see that the majority of Medicare Advantage plans are in the form of local HMO plans. HMOs also show the greatest increase in the total number of 2015 plans (with the addition of 40 HMO plans).

On the other hand, Private Fee for Service (PFFS) Medicare Advantage plans are decreasing by 43% in 2015 (with PFFS Medicare Advantage plans that offer prescription drug coverage seeing a 66% decrease, losing 33 PFFS MAPD plans in 2015.

Jump to MAPD Plan chart

Jump to MA Plan chart

Jump to Health Plan Type definitions

| Change in the Number of All Medicare Advantage Plans (MA & MA-PD) in the 50 States |

|||||

| All Medicare Advantage Plans (MA & MA-PD) |

Number of Plans | ||||

| 2015 | 2014 | Change ’14 to ‘15 |

Percent Change ’14 to ‘15 |

||

| Cost | 86 | 87 | -1 | -1% | |

| Local HMO | 1,785 | 1,763 | 22 | 1% | |

| Local PPO | 493 | 540 | -47 | -9% | |

| Regional PPO | 54 | 58 | -4 | -7% | |

| All PPOs | 547 | 598 | -51 | -9% | |

| PFFS | 69 | 120 | -51 | -43% | |

| MSA | 7 | 6 | 1 | 17% | |

| MMP | 32 | 4* | 28 | 700% | |

| Total MA & MAPD plans | 2,526 | 2,578 | -52 | -2% | |

*Note: this is number of MMP plans in the September, 2013 landscape file

Medicare Advantage Plan - Health Plan Coverage Types

As you browse through the 2015 Medicare Advantage plans, you will see in our Medicare Advantage search tools that there are seven common types of Medicare Advantage plans offered.

- HMO - Health Maintenance Organizations: HMOs are wellness based and usually have the most-restrictive healthcare provider network, meaning that your healthcare costs may be considerably higher if you go outside of your plan’s established network. Also, depending on your HMO plan, you may only be allowed outside of your plan network with a referral from your doctor. Local HMOs are often very affordable compared to other Medicare Advantage plans because the restrictive network helps to control healthcare costs. The majority of 2015 Medicare Advantage plans will be HMOs (Health Maintenance Organizations).

- HMO POS - Health Maintenance Organizations Point-of-Service: These Medicare Advantage HMO’s have a less-restrictive network allowing you to seek care outside of your plan’s network by paying a higher cost-sharing rate – good for people who travel. For instance, you may have a $30 co-payment when you visit a healthcare provider in-network and pay $60 when you visit a provider outside of the plan’s network. Important: Some 2014 HMO POS plans will convert to HMOs (without the POS option) in 2015.

- PPO - Preferred Provider Organization: Medicare Advantage PPOs have a less-restrictive provider network, but again, you will pay a higher cost-sharing rate when you visit a healthcare provider outside of your plan’s network.

- PFFS - Private Fee for Service: PFFS plans have the most flexible network, meaning that you can go to any health care provider as long as they accept Medicare and the terms and conditions of your PFFS plan. In 2015, PFFS plans will become rare, but some people still find PFFS plans as a flexible and economic alternative to other Medicare Advantage plans.

- SNPs - Special Needs Plans: SNPs are Medicare Advantage plans designed for a people with specific conditions or financial needs. Certain SNPs are available only to diabetics, people with chronic cardiac conditions, nursing home residents, or people eligible for both Medicare and Medicaid. If you do not have the plan’s “special need”, you will not be allowed to join one of these plans.

- MSAs - Medical Savings Accounts: MSAs are like Health Savings Accounts (or HSAs) or a high-deductible health plan combined with a spending account that you can use to pay for your health care costs. MSAs do not provide prescription drug coverage and you would need to join a separate Medicare Part D plan for your prescription needs.

- MMPs - Medicare-Medicaid Plans: MMP plans were newly introduced in 2014 and are only offered in a few locations across the country.

| Change in the Number of MA-PD Plans in the 50 States |

|||||

| Medicare Advantage Plans With Drug Coverage (MA-PD) |

Number of Plans | ||||

| 2015 | 2014 | Change ’14 to ‘15 |

2013 | Change ’13 to ‘14 |

|

| Cost | 39 | 39 | 0 | 46 | -7 |

| Local HMO | 1649 | 1609 | 40 | 1,551 | +58 |

| Local PPO | 441 | 470 | -29 | 575 | -105 |

| PFFS | 50 | 83 | -33 | 110 | -27 |

| Regional PPO | 37 | 18 | -1 | 49 | -9 |

| Total MAPD Plans | 2,216 | 2,219 | -3 | 2,331 | -112 |

As compared to the 2,216 MAPDs or Medicare Advantage plans that provide prescription drug coverage in 2015, there are only 278 different 2015 MAs or Medicare Advantage plans that offer health coverage only (no prescription drug coverage). And across the country, there will be 55 fewer MA plans in 2015.

| Change in the Number of MA Plans in the 50 States |

|||||

| Medicare Advantage Plans Without Drug Coverage (MA) |

Number of Plans | ||||

| 2015 | 2014 | Change ’14 to ‘15 |

2013 | Change ’13 to ‘14 |

|

| Cost | 47 | 48 | -1 | 50 | -2 |

| Local HMO | 136 | 154 | -18 | 164 | -10 |

| Local PPO | 52 | 70 | -18 | 70 | 0 |

| MSA | 7 | 6 | 1 | 6 | 0 |

| PFFS | 19 | 37 | -1 | 66 | -29 |

| Regional PPO | 17 | 18 | -1 | 19 | -1 |

| Total MA Plans w/o Rx Cov. | 278 | 333 | -55 | 375 | -42 |

2015 Medicare Advantage plan information available in our 2015 Medicare Advantage plan finder (or MA-Finder) that can be found directly at: MA-Finder.com/2015.

See how each 2014 Medicare Advantage plan is changing in 2015. Our Medicare Advantage comparison tool can be found directly at MA-Compare.com/2015.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service