An explanation of the 2016 Medicare Part D Coverage Gap or Donut Hole.

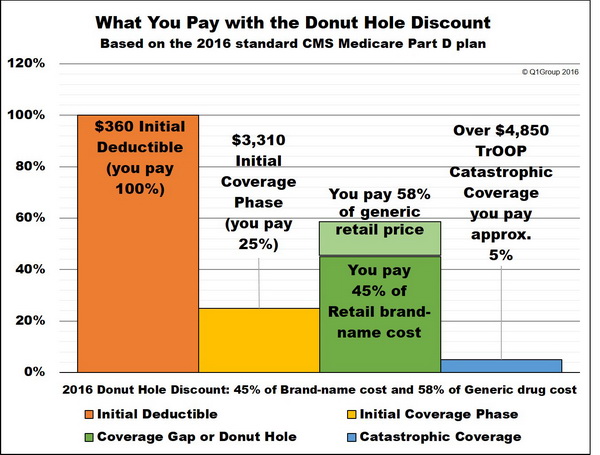

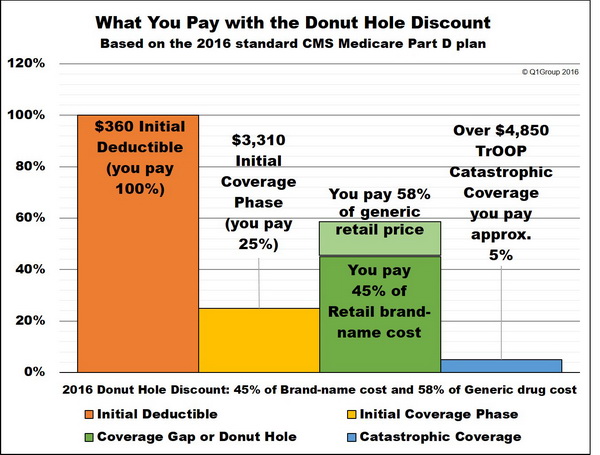

The Medicare Part D Coverage Gap or Donut Hole is similar to a second deductible in an insurance policy where you are responsible for paying your own coverage after receiving a certain amount of insurance benefits.

However, with the introduction of the Donut Hole discount in 2011, you are now responsible for only a portion of your own drug coverage in the Coverage Gap or Donut Hole - and in 2020, the Coverage Gap will be considered "closed" when both generic and brand-name drugs will cost beneficiaries 25% of the retail drug price.

(1) The Initial Deductible Phase (if you Medicare plan has a $0 deductible, you will skip directly to the Initial Coverage Phase): If your Medicare Part D plan has an Initial Deductible, you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole and your out-of-pocket spending limit (TrOOP). However, some Medicare Part D prescription drug plans are now covering your generic medications in the Initial Deductible. So, whether you - or your plan - pays for your medications in the Initial Deductible, the retail value of your medications counts toward your Initial Coverage Limit (see next section) and counts toward entering into the Donut Hole or Coverage Gap.

The standard Initial Deductible can change each year. In 2015, the Initial Deductible was $320 - in 2016, the Initial Deductible is $360.

(2) The Initial Coverage Phase: After the Initial Deductible (if any), you will continue into your Initial Coverage Phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance). You will leave your Initial Coverage Phase and enter the Donut Hole or Coverage Gap when your retail medication costs reach a certain amount.

Please note: the Initial Coverage Limit is not measured by the amount you paid for your drugs, but instead, the retail value of the medications you purchased - for example, if you buy a medication with a retail value of $100 and pay a a $30 co-payment, the $100 retail value counts toward your Initial Coverage Limit - the $30 counts toward your TrOOP.

The Initial Coverage Limit can change each year. In 2014, the Donut Hole entry point began when a person's total retail drug costs exceeded $2,850 - in 2015, the Donut Hole entry point began when retail drug costs exceeded $2,960 - in 2016, the Initial Coverage Limit or Donut Hole entry point is when retail drug costs exceed $3,310.

Bottom Line: If the monthly retail cost of your medications is over $276 per month, you will enter the 2016 Donut Hole.

Please note, if you use an expensive medication, you might find that one large drug purchase (or multiple drug purchases in a single month) can actually move you from the Initial Coverage Phase into the Donut Hole, so the only way to know exactly when you will enter or leave the doughnut hole is by watching your monthly Medicare Part D plan's Explanation of Benefits statement carefully (you received this printed form in the mail) or you can contact your Medicare Part D plan and ask the Member Services representative where you are relative to the plan's Coverage Gap.

(3) The Coverage Gap or Donut Hole: As mentioned, this is the portion of your Medicare Part D coverage where you pay a larger percentage of the retail drug cost. Back in 2006 through 2010, you might be responsible for 100% of your drug costs, unless your Medicare plan included some Donut Hole coverage. But, since 2011, you have received some discount on your Medicare Part D plan purchases while in the Donut Hole.

Again, the 2016 Donut Hole discount is 55% for brand-name drugs (you pay 45%) and 42% for generic drugs (you pay 58%). For more information about the Donut Hole discount, you can click here to see how the Donut Hole discount increases over the next few years until, in 2020, the discount reaches 75% and the Donut Hole is considered “closed”.

How much could you save on brand-name medication purchases while in your 2016 Donut Hole?

About $2,167.07 - maybe even a little more depending on your Medicare Part D plan. You can click here to read more.

(4) The Catastrophic Coverage Phase: You will stay in the Donut Hole phase until your out-of-pocket costs (also called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2016 is $4,850. So if you have spent around $4,850 on Medicare Part D drugs (not including monthly Medicare plan premiums), you will exit the Donut Hole and enter the Catastrophic Coverage phase.

As a reminder: TrOOP is the total of:

An extra note on TrOOP vs. Retail Cost: Without considering your Donut Hole discount, your 2016 TrOOP (true or total out-of-pocket costs) should equate to about $7,062.50 in retail drug costs. But with the Donut Hole discount, Medicare (the Centers for Medicare and Medicaid Services or CMS) estimates that your retail drug cost should be around $7,515.22 before exiting the 2016 Donut Hole. The estimate is based on historic brand name and generic drug purchases while in the Donut Hole.

Bottom Line: If your monthly retail drug costs are somewhere around $589 to $686, you probably will spend your way through the 2016 Donut Hole and enter your Medicare Part D plan's 2016 Catastrophic Coverage phase.

Once you enter the 2016 Catastrophic Coverage portion of your Medicare Part D plan, you pay the greater of 5% or $2.95 for generic drugs (or preferred drug that is a multi-source drug) or the greater of 5% or $7.40 for all other drugs (such as brand-name medications).

For example, if you purchase a brand-name medication in the 2016 Catastrophic Coverage phase that has a retail cost of $100, you will pay $7.40 (since this fixed cost of $7.40 is higher than $5.00 ($100 * 5%).

Here is how a formulary drug purchase is calculated throughout your 2016 Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide).

* 25% co-pay or cost-sharing

** 55% Brand-name Discount

*** 42% Generic Discount

**** approx. 5% of retail or $7.40 for brand drugs (or $2.95 for a generic) whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

No matter where you are at the end of the plan year, your Medicare Part D plan coverage ends on December 31st and the whole process begins again on January 1st of the next year.

To help you visualize the phases of your Medicare Part D prescription drug plan coverage, we have a Donut Hole Calculator or 2016 PDP-Planner online illustrating the changes in your monthly estimated costs based on the established 2016 standard Medicare Part D plan limits mentioned above.

We also have several examples online to help you get started with our 2016 PDP-Planner tool. You can click here for an example of a Medicare beneficiary with relatively high monthly prescription drug costs (retail prescription drug cost of $800 per month) and then change the monthly drug cost to whatever you wish.

However, with the introduction of the Donut Hole discount in 2011, you are now responsible for only a portion of your own drug coverage in the Coverage Gap or Donut Hole - and in 2020, the Coverage Gap will be considered "closed" when both generic and brand-name drugs will cost beneficiaries 25% of the retail drug price.

- At this time, the 2016 Donut Hole discount for generic medications is 42% (you will pay 58% of your Medicare plan's negotiated retail price for a generic).

- If you reach the 2016 Coverage Gap and use brand-name prescriptions, the 2016 Donut Hole discount for brand-name drugs is 55% (you pay 45% of the negotiated retail price) and you will receive credit for 95% of the retail drug cost toward meeting your 2016 total out-of-pocket maximum (TrOOP) or Donut Hole exit point (the 45% you spend plus the 50% drug manufacturer discount).

As a reminder, your Medicare Part D plan has four separate parts or phases:

(1) The Initial Deductible Phase (if you Medicare plan has a $0 deductible, you will skip directly to the Initial Coverage Phase): If your Medicare Part D plan has an Initial Deductible, you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole and your out-of-pocket spending limit (TrOOP). However, some Medicare Part D prescription drug plans are now covering your generic medications in the Initial Deductible. So, whether you - or your plan - pays for your medications in the Initial Deductible, the retail value of your medications counts toward your Initial Coverage Limit (see next section) and counts toward entering into the Donut Hole or Coverage Gap.

The standard Initial Deductible can change each year. In 2015, the Initial Deductible was $320 - in 2016, the Initial Deductible is $360.

(2) The Initial Coverage Phase: After the Initial Deductible (if any), you will continue into your Initial Coverage Phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance). You will leave your Initial Coverage Phase and enter the Donut Hole or Coverage Gap when your retail medication costs reach a certain amount.

Please note: the Initial Coverage Limit is not measured by the amount you paid for your drugs, but instead, the retail value of the medications you purchased - for example, if you buy a medication with a retail value of $100 and pay a a $30 co-payment, the $100 retail value counts toward your Initial Coverage Limit - the $30 counts toward your TrOOP.

The Initial Coverage Limit can change each year. In 2014, the Donut Hole entry point began when a person's total retail drug costs exceeded $2,850 - in 2015, the Donut Hole entry point began when retail drug costs exceeded $2,960 - in 2016, the Initial Coverage Limit or Donut Hole entry point is when retail drug costs exceed $3,310.

Bottom Line: If the monthly retail cost of your medications is over $276 per month, you will enter the 2016 Donut Hole.

Please note, if you use an expensive medication, you might find that one large drug purchase (or multiple drug purchases in a single month) can actually move you from the Initial Coverage Phase into the Donut Hole, so the only way to know exactly when you will enter or leave the doughnut hole is by watching your monthly Medicare Part D plan's Explanation of Benefits statement carefully (you received this printed form in the mail) or you can contact your Medicare Part D plan and ask the Member Services representative where you are relative to the plan's Coverage Gap.

(3) The Coverage Gap or Donut Hole: As mentioned, this is the portion of your Medicare Part D coverage where you pay a larger percentage of the retail drug cost. Back in 2006 through 2010, you might be responsible for 100% of your drug costs, unless your Medicare plan included some Donut Hole coverage. But, since 2011, you have received some discount on your Medicare Part D plan purchases while in the Donut Hole.

Again, the 2016 Donut Hole discount is 55% for brand-name drugs (you pay 45%) and 42% for generic drugs (you pay 58%). For more information about the Donut Hole discount, you can click here to see how the Donut Hole discount increases over the next few years until, in 2020, the discount reaches 75% and the Donut Hole is considered “closed”.

How much could you save on brand-name medication purchases while in your 2016 Donut Hole?

About $2,167.07 - maybe even a little more depending on your Medicare Part D plan. You can click here to read more.

(4) The Catastrophic Coverage Phase: You will stay in the Donut Hole phase until your out-of-pocket costs (also called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2016 is $4,850. So if you have spent around $4,850 on Medicare Part D drugs (not including monthly Medicare plan premiums), you will exit the Donut Hole and enter the Catastrophic Coverage phase.

As a reminder: TrOOP is the total of:

- what you pay during the Initial Deductible (if you have one) plus

- what you personally pay in the Initial Coverage Phase, before the Donut Hole, plus

- what you pay in the Donut Hole (and plus you get credit for the 50% brand-name discount paid by the drug manufacturer in the donut hole - for instance, if in the 2016 Donut Hole you buy a brand-name drug with a $100 retail value, you pay the $45 discounted price, but actually get credit for $95 toward meeting your TrOOP limit).

An extra note on TrOOP vs. Retail Cost: Without considering your Donut Hole discount, your 2016 TrOOP (true or total out-of-pocket costs) should equate to about $7,062.50 in retail drug costs. But with the Donut Hole discount, Medicare (the Centers for Medicare and Medicaid Services or CMS) estimates that your retail drug cost should be around $7,515.22 before exiting the 2016 Donut Hole. The estimate is based on historic brand name and generic drug purchases while in the Donut Hole.

Bottom Line: If your monthly retail drug costs are somewhere around $589 to $686, you probably will spend your way through the 2016 Donut Hole and enter your Medicare Part D plan's 2016 Catastrophic Coverage phase.

Once you enter the 2016 Catastrophic Coverage portion of your Medicare Part D plan, you pay the greater of 5% or $2.95 for generic drugs (or preferred drug that is a multi-source drug) or the greater of 5% or $7.40 for all other drugs (such as brand-name medications).

Here is how a formulary drug purchase is calculated throughout your 2016 Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide).

|

When you purchase a formulary medication |

||||||

|

Retail Cost |

You Pay |

Medicare Plan Pays |

Pharma Mfgr Pays |

Gov. pays |

Amount toward your TrOOP |

|

|

Initial Deductible |

$100 |

$100 |

$0 |

$0 |

$0 |

$100 |

|

Initial Coverage Phase * |

$100 |

$25 |

$75 |

$0 |

$0 |

$25 |

|

Coverage Gap - brand-name ** |

$100 |

$45 |

$5 |

$50 |

$0 |

$95 |

|

Coverage Gap - generic *** |

$100 |

$58 |

$42 |

$0 |

$0 |

$58 |

|

Catastrophic Coverage (generic drug) **** |

$100 |

$5 |

$15 |

$0 |

$80 |

n/a |

* 25% co-pay or cost-sharing

** 55% Brand-name Discount

*** 42% Generic Discount

**** approx. 5% of retail or $7.40 for brand drugs (or $2.95 for a generic) whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

No matter where you are at the end of the plan year, your Medicare Part D plan coverage ends on December 31st and the whole process begins again on January 1st of the next year.

We also have several examples online to help you get started with our 2016 PDP-Planner tool. You can click here for an example of a Medicare beneficiary with relatively high monthly prescription drug costs (retail prescription drug cost of $800 per month) and then change the monthly drug cost to whatever you wish.

News Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service