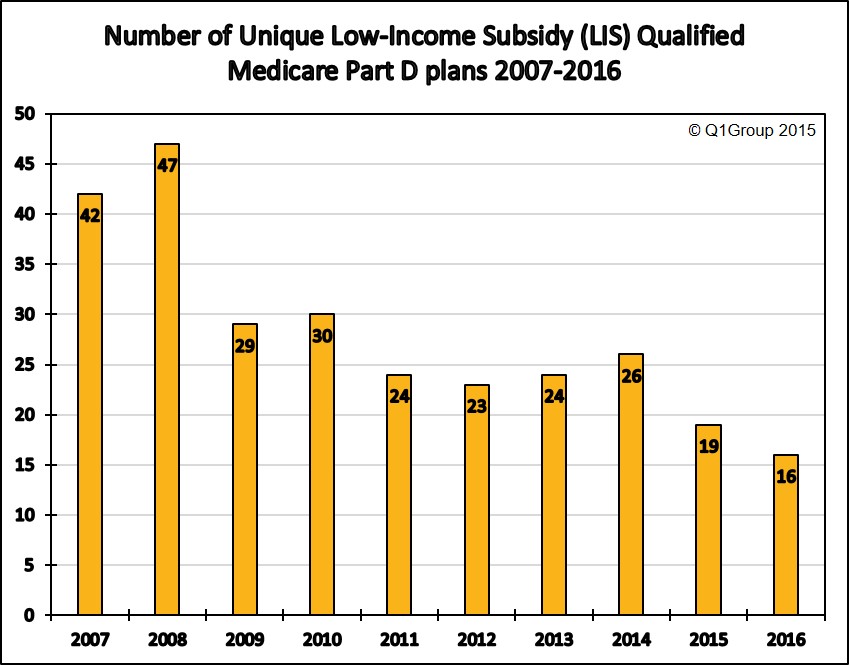

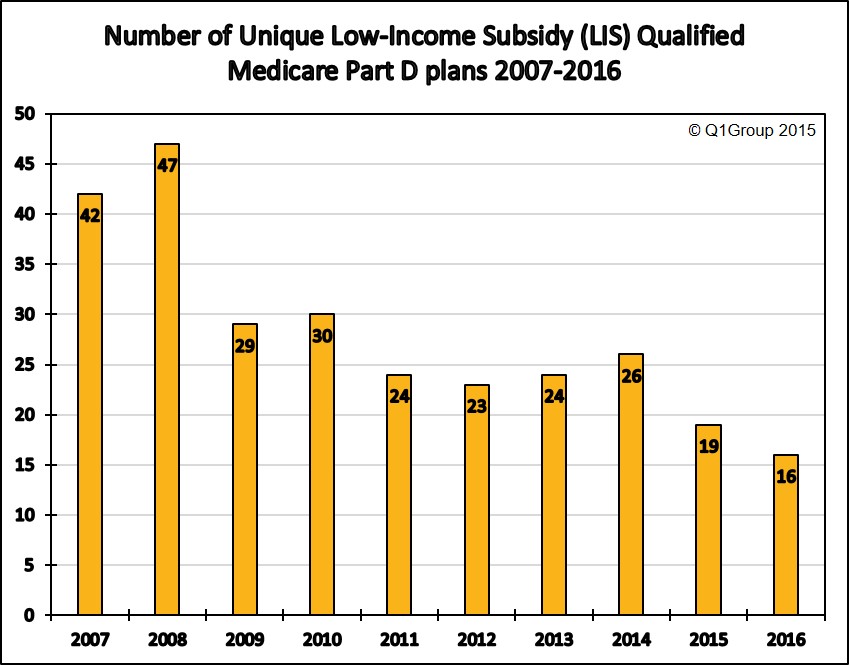

Q1Group 2016 PDP Analysis: fewer Medicare Part D plans qualifying for the $0 Low-Income Subsidy (LIS) premium in 2016

Based on the recently released Centers for Medicare and Medicaid Services (CMS) 2016 Medicare Part D landscape data, fewer unique 2016 Medicare Part D plans qualify for the state’s Low-Income Subsidy (LIS) $0 premium.

On our national stand-alone PDP-Facts page, you can scroll to the bottom to see a table showing the 2015 and 2016 Medicare Part D plans (sorted by Plan ID) qualifying for the $0 premium Low-Income Subsidy.

As an example of state plan changes, Arkansas will offer 4 LIS $0 premium qualifying 2016 Medicare Part D plans as compared to the 6 LIS-qualifying plans last year and 12 plans offered back in 2014.

Which Medicare Part D plans qualify for the full Low-Income Subsidy $0 premium in your state?

Each year, insurance companies adjust their Medicare plan’s monthly premiums. Some Medicare Part D plans raise their premiums and move their prescription drug plans above the state low-income subsidy (LIS) benchmark limits, while other Part D plan sponsors lower their monthly premiums so that their plans can qualify for a state’s $0 premium. This means that the Medicare Part D plans qualifying for the LIS $0 premium can change each year.

The state offering the smallest selection of $0 premium LIS plans in 2016 is: Hawaii, with 2 plans (down from 9 plans last year). In comparison, in 2015, the states with the fewest 2015 Part D plans qualifying for the LIS $0 premium were Nevada and Florida, both with only four (4) LIS $0 premium Part D plans.

The state offering the largest selection of ten $0 premium LIS plans in 2016 is: Arizona. (UPDATE: with the latest release of the CMS PDP landscape data, Idaho, Pennsylvania, Utah, and West Virginia will have nine $0 premium LIS plans in 2016 - and not 10 as reported earlier).

In comparison, in 2015, the states with the largest selection of LIS $0 premium plans were Alabama, Arizona, Idaho, Tennessee, and Utah, all with 12 Medicare Part D plans qualifying for the 2015 LIS $0 premium.

The state with the most Medicare beneficiaries qualifying for the low-income subsidy is California (almost 1.4 million “Extra Help” recipients). In 2016, California LIS recipients will again have six Medicare Part D plan choices qualifying for the $0 premium.

More on Extra Help

The Medicare Part D Extra Help or the Low-Income Subsidy (LIS) is a federal program helping low-income Medicare beneficiaries pay a portion of their Medicare Part D prescription drug costs. Based on a person’s income and financial resources, the Extra Help or LIS program pays all or part of a person’s monthly Medicare Part D plan premiums and a significant portion of the beneficiary’s medication costs.

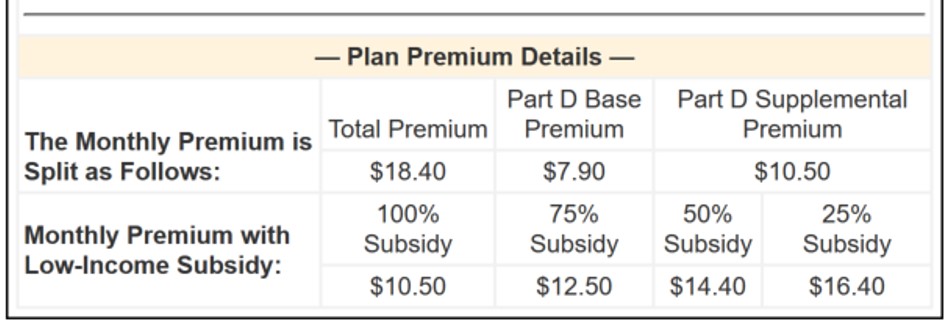

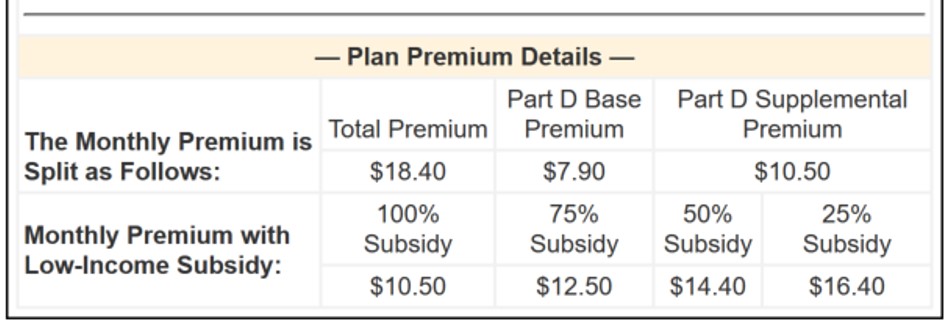

If you qualify for the full-LIS program, you can choose a Medicare Part D plan that qualifies for your state’s $0 monthly premium or allow yourself to be automatically enrolled in a plan that qualifies for the $0 premium. If you enroll in a Medicare Part D plan that does not qualify for the $0 premium, you will pay a portion of the premium. The monthly premium amount you will pay is shown under the "Benefit Details" button on our Medicare Part D plan finder.

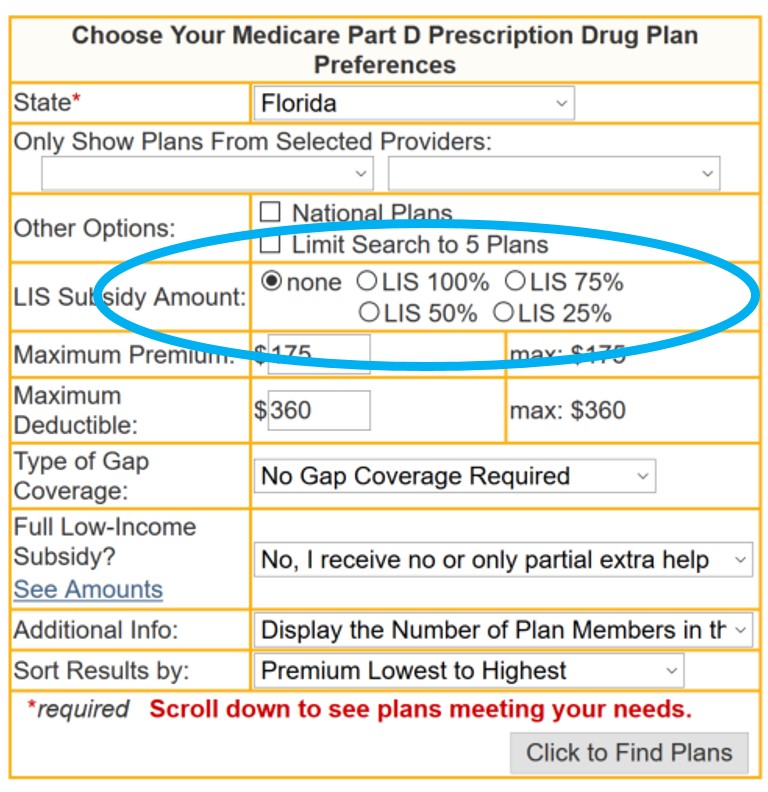

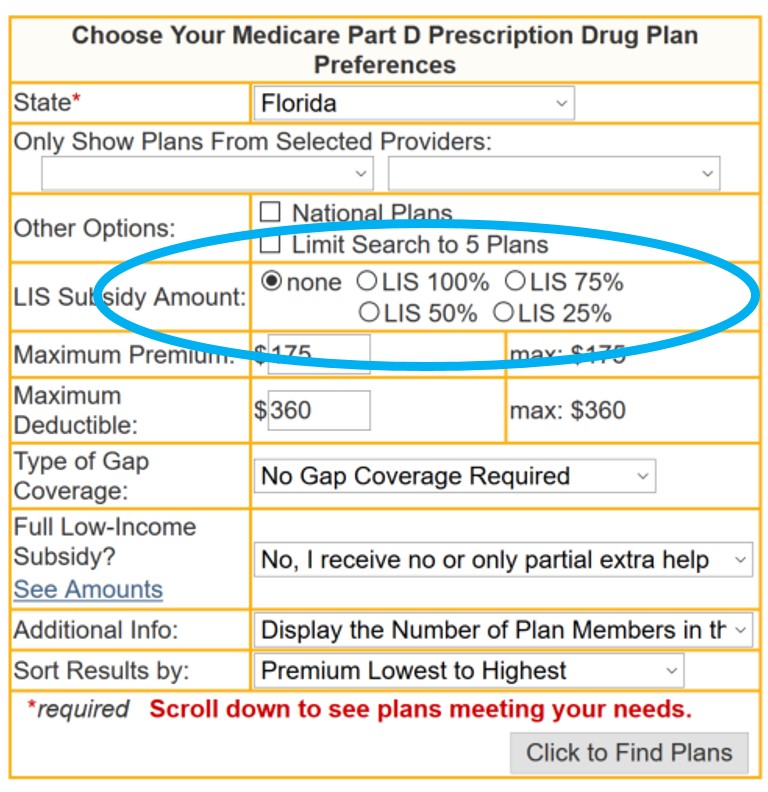

As can be seen in the above graphic, if you qualify for only partial-LIS benefits (such as 50% LIS), you will also only pay a portion of the plan's monthly premium. Please note, we have now added a new feature to our Medicare Part D plan finder so you can see the premiums of a Medicare Part D plan when you receive if you receive full- or partial-LIS benefits. The new feature looks like:

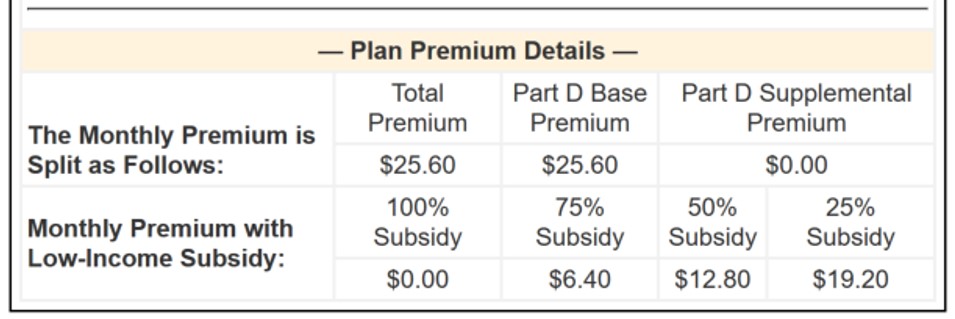

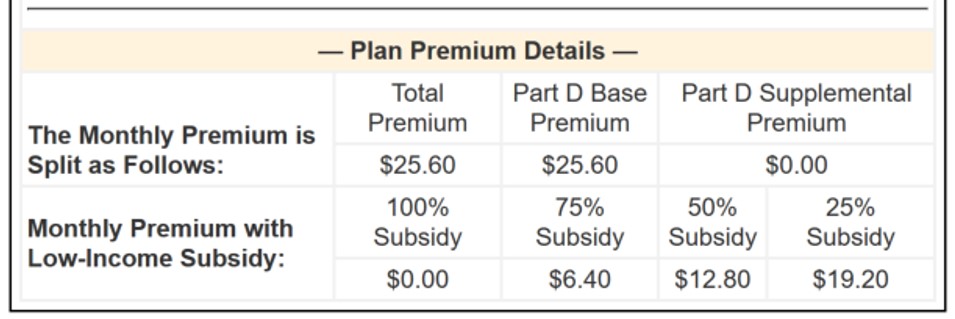

The applicable monthly premium will be shown in the search results and can be found on our "Benefit Details" page, for example:

The applicable monthly premium will be shown in the search results and can be found on our "Benefit Details" page, for example:

PLEASE NOTE: Because of changes in the annual Medicare Part D plan premiums and LIS benchmarks, some full low-income subsidy qualifying Medicare beneficiaries (Medicare / Medicaid dual-eligible beneficiaries) may be automatically reassigned to new 2016 Part D plans that will still qualify for the $0 monthly premium. However, Extra Help recipients who chose their own plan in the past (or "choosers") may not be auto-reassigned to a new 2016 plan and may need to select a new 2016 Medicare Part D plan that still meets the $0 monthly premium threshold (or pay the small monthly premium). You can use our PDP-Finder to see LIS qualifying plans in your state. Be sure to select “Yes, show only plans that qualify for $0 premium". Click here to see an example for Texas.

Not sure where to begin?

For more information on Medicare Part D plans that qualify for your state's low-income $0 premium benchmark, please call Medicare toll-free at 1-800-633-4227 and speak with a Medicare representative to learn more about your Medicare Part D and Medicare Advantage plan options.

On our national stand-alone PDP-Facts page, you can scroll to the bottom to see a table showing the 2015 and 2016 Medicare Part D plans (sorted by Plan ID) qualifying for the $0 premium Low-Income Subsidy.

As an example of state plan changes, Arkansas will offer 4 LIS $0 premium qualifying 2016 Medicare Part D plans as compared to the 6 LIS-qualifying plans last year and 12 plans offered back in 2014.

Which Medicare Part D plans qualify for the full Low-Income Subsidy $0 premium in your state?

Each year, insurance companies adjust their Medicare plan’s monthly premiums. Some Medicare Part D plans raise their premiums and move their prescription drug plans above the state low-income subsidy (LIS) benchmark limits, while other Part D plan sponsors lower their monthly premiums so that their plans can qualify for a state’s $0 premium. This means that the Medicare Part D plans qualifying for the LIS $0 premium can change each year.

The state offering the smallest selection of $0 premium LIS plans in 2016 is: Hawaii, with 2 plans (down from 9 plans last year). In comparison, in 2015, the states with the fewest 2015 Part D plans qualifying for the LIS $0 premium were Nevada and Florida, both with only four (4) LIS $0 premium Part D plans.

The state offering the largest selection of ten $0 premium LIS plans in 2016 is: Arizona. (UPDATE: with the latest release of the CMS PDP landscape data, Idaho, Pennsylvania, Utah, and West Virginia will have nine $0 premium LIS plans in 2016 - and not 10 as reported earlier).

In comparison, in 2015, the states with the largest selection of LIS $0 premium plans were Alabama, Arizona, Idaho, Tennessee, and Utah, all with 12 Medicare Part D plans qualifying for the 2015 LIS $0 premium.

The state with the most Medicare beneficiaries qualifying for the low-income subsidy is California (almost 1.4 million “Extra Help” recipients). In 2016, California LIS recipients will again have six Medicare Part D plan choices qualifying for the $0 premium.

More on Extra Help

The Medicare Part D Extra Help or the Low-Income Subsidy (LIS) is a federal program helping low-income Medicare beneficiaries pay a portion of their Medicare Part D prescription drug costs. Based on a person’s income and financial resources, the Extra Help or LIS program pays all or part of a person’s monthly Medicare Part D plan premiums and a significant portion of the beneficiary’s medication costs.

If you qualify for the full-LIS program, you can choose a Medicare Part D plan that qualifies for your state’s $0 monthly premium or allow yourself to be automatically enrolled in a plan that qualifies for the $0 premium. If you enroll in a Medicare Part D plan that does not qualify for the $0 premium, you will pay a portion of the premium. The monthly premium amount you will pay is shown under the "Benefit Details" button on our Medicare Part D plan finder.

As can be seen in the above graphic, if you qualify for only partial-LIS benefits (such as 50% LIS), you will also only pay a portion of the plan's monthly premium. Please note, we have now added a new feature to our Medicare Part D plan finder so you can see the premiums of a Medicare Part D plan when you receive if you receive full- or partial-LIS benefits. The new feature looks like:

PLEASE NOTE: Because of changes in the annual Medicare Part D plan premiums and LIS benchmarks, some full low-income subsidy qualifying Medicare beneficiaries (Medicare / Medicaid dual-eligible beneficiaries) may be automatically reassigned to new 2016 Part D plans that will still qualify for the $0 monthly premium. However, Extra Help recipients who chose their own plan in the past (or "choosers") may not be auto-reassigned to a new 2016 plan and may need to select a new 2016 Medicare Part D plan that still meets the $0 monthly premium threshold (or pay the small monthly premium). You can use our PDP-Finder to see LIS qualifying plans in your state. Be sure to select “Yes, show only plans that qualify for $0 premium". Click here to see an example for Texas.

Not sure where to begin?

For more information on Medicare Part D plans that qualify for your state's low-income $0 premium benchmark, please call Medicare toll-free at 1-800-633-4227 and speak with a Medicare representative to learn more about your Medicare Part D and Medicare Advantage plan options.

News Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service