Q1Group 2016 MA/MAPD Analysis: Medicare Advantage plans (MAs and MAPDs) shows premium stability since 2014

In general, monthly Medicare Advantage plan premiums have remained stable over the past several years with almost 70% of all Medicare Advantage plans (MA and MAPD combined) having premiums under $50 per month.

In 2016, 34.82% of Medicare Advantage plan will have a $0 premium and an additional 10% of the 2016 Medicare Advantage plans will have a premium between $0.10 and $25. Overall, 69.54% of the 2016 Medicare Advantage plans will have a premium of $50 or less.

As a comparison, in 2015, 34.55% of Medicare Advantage plan had a $0 premium and an additional 9% of the 2015 Medicare Advantage plans had a premium between $0.70 and $25. Here is a table showing how the MA/MAPD premiums have varied over the past three years.

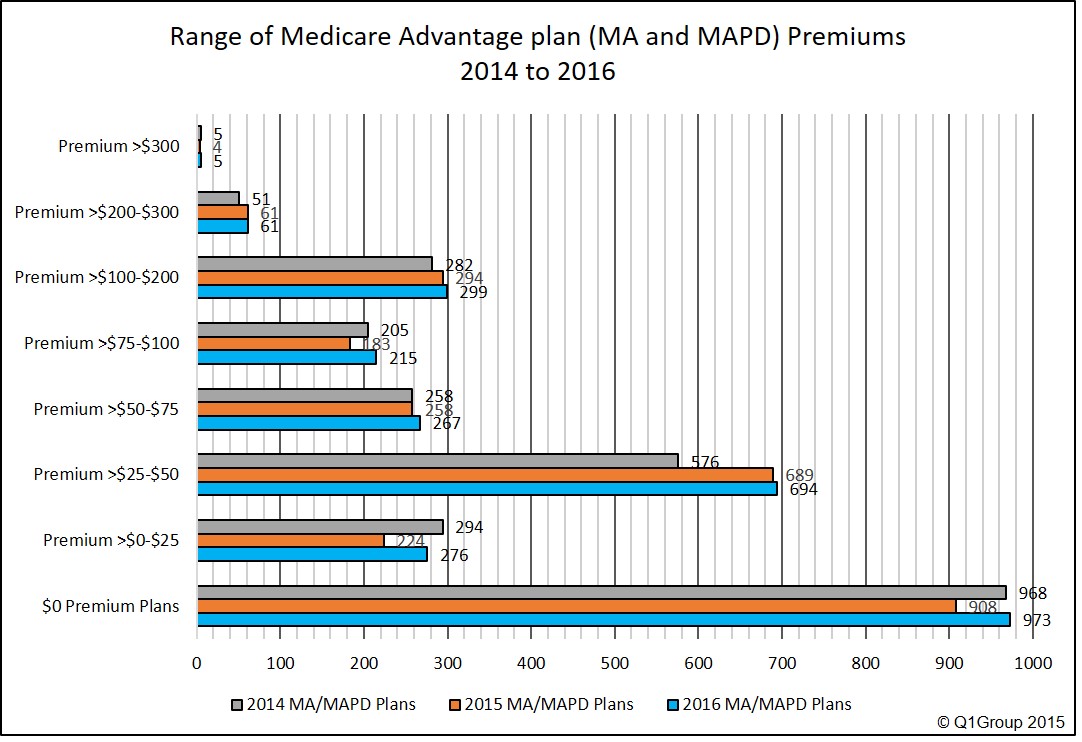

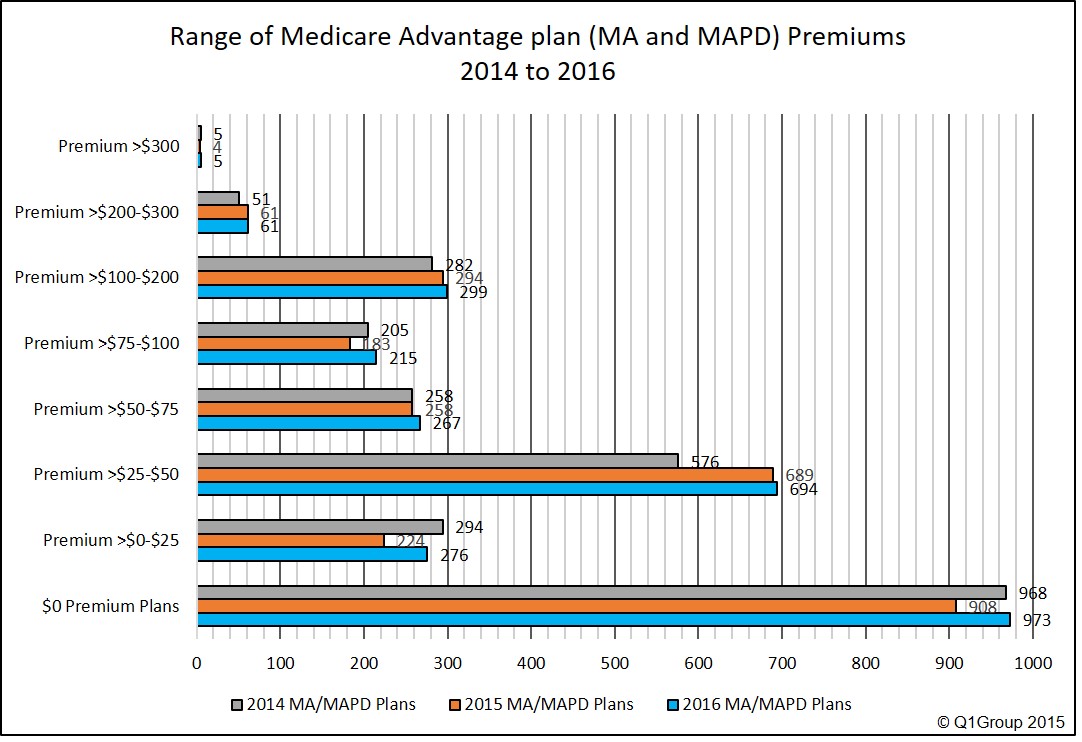

The corresponding graph better illustrates the same stability of Medicare Advantage plan premiums for plan years 2014 through 2016.

Please note: The overall stability of Medicare Advantage plan premiums does not indicate that your Medicare Advantage plan premium will not change in 2016. To see how your 2015 Medicare Advantage plan is changing in 2016, please use our Medicare Advantage plan comparison tool (MA-Compare.com). For more information, you can telephone Medicare at 1-800-633-4227 to speak with a Medicare representative.

Please note: The overall stability of Medicare Advantage plan premiums does not indicate that your Medicare Advantage plan premium will not change in 2016. To see how your 2015 Medicare Advantage plan is changing in 2016, please use our Medicare Advantage plan comparison tool (MA-Compare.com). For more information, you can telephone Medicare at 1-800-633-4227 to speak with a Medicare representative.

Reminder: October 15th starts the annual Open Enrollment Period

The annual Medicare Open Enrollment Period (or Annual Coordinated Election Period) for 2016 Medicare Part D plans and Medicare Advantage plans begins on Thursday, October 15th and continues through Monday, December 7th, with 2016 Medicare plan coverage beginning on Friday, January 1, 2016.

In 2016, 34.82% of Medicare Advantage plan will have a $0 premium and an additional 10% of the 2016 Medicare Advantage plans will have a premium between $0.10 and $25. Overall, 69.54% of the 2016 Medicare Advantage plans will have a premium of $50 or less.

As a comparison, in 2015, 34.55% of Medicare Advantage plan had a $0 premium and an additional 9% of the 2015 Medicare Advantage plans had a premium between $0.70 and $25. Here is a table showing how the MA/MAPD premiums have varied over the past three years.

| Premium Range | 2016 MA/MAPD Plans | 2015 MA/MAPD Plans | 2014 MA/MAPD Plans | |||

| # | % | # | % | # | % | |

| Total Plans | 2794 | 2628 | 2645 | |||

| MSA no Premium | 4 | 0.14% | 7 | 0.27% | 6 | 0.23% |

| $0 Premium Plans | 973 | 34.82% | 908 | 34.55% | 968 | 36.60% |

| Premium >$0-$25 | 276 | 9.88% | 224 | 8.52% | 294 | 11.12% |

| Premium >$25-$50 | 694 | 24.84% | 689 | 26.22% | 576 | 21.78% |

| Premium $0-$50 | 1943 | 69.54% | 1821 | 69.29% | 1838 | 69.49% |

| Premium >$50-$75 | 267 | 9.56% | 258 | 9.82% | 258 | 9.75% |

| Premium >$75-$100 | 215 | 7.70% | 183 | 6.96% | 205 | 7.75% |

| Premium >$100-$200 | 299 | 10.70% | 294 | 11.19% | 282 | 10.66% |

| Premium >$200-$300 | 61 | 2.18% | 61 | 2.32% | 51 | 1.93% |

| Premium >$300 | 5 | 0.18% | 4 | 0.15% | 5 | 0.19% |

The corresponding graph better illustrates the same stability of Medicare Advantage plan premiums for plan years 2014 through 2016.

Reminder: October 15th starts the annual Open Enrollment Period

The annual Medicare Open Enrollment Period (or Annual Coordinated Election Period) for 2016 Medicare Part D plans and Medicare Advantage plans begins on Thursday, October 15th and continues through Monday, December 7th, with 2016 Medicare plan coverage beginning on Friday, January 1, 2016.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service