The Donut Hole Discount increases in 2017 (... and what this means to you)

The 2017 Donut Hole discount will increase to 60% from the 2016 discount of 55% for all brand-name medications purchased in the Donut Hole (you pay 40% of the retail cost and get 90% credit toward TrOOP) and the 2017 generic Donut Hole discount will increase to 51% (you pay 49% of the retail cost).

When buying brand-name prescriptions in the Donut Hole: You will have additional savings on brand-name drugs in the 2017 Coverage Gap. For example, if you reach the 2017 Donut Hole and purchase a brand-name medication with a retail cost of $100, you will pay $40 for the medication, and receive $90 credit toward meeting your 2017 out-of-pocket spending limit or TrOOP – or Donut Hole exit point.

When buying generic prescriptions in the Donut Hole: You will save more on generic medications in the 2017 Coverage Gap. As an example, if you reach the 2017 Donut Hole phase of your Medicare Part D plan, and your generic medication has a retail cost of $100, you will pay $51. The $51 that you spend will count toward your out-of-pocket spending limit or TrOOP.

Will you enter the Donut Hole in 2017? If the retail cost of your medications is over $308 per month, you will enter the 2017 Donut Hole. And, if your monthly retail drug costs are somewhere around $673, you probably will spend your way through the 2017 Donut Hole and enter your Medicare Part D plan's 2017 Catastrophic Coverage phase. No matter where you are at the end of the plan year, your Medicare Part D plan coverage (and Donut Hole) ends on December 31st and the whole process begins again on January 1st of the next year.

Popular Question: So who is paying the Donut Hole discount and does the discount count toward getting out of the Coverage Gap? The generic drug Donut Hole discount is paid by your Medicare Part D plan and does not count toward TrOOP (getting out of the Donut Hole).

The brand-name drug discount is split into two parts (beginning in 2013). The first portion, is a 50% discount paid by the drug manufacturer as it has been since 2011. The additional 10% discount in 2017 is considered Medicare plan coverage and is paid by your 2016 Medicare Part D prescription drug plan (or Medicare Advantage plan that includes drug coverage).

Since both the generic discount and this additional 10% brand-name drug discount are paid by your plan and considered plan coverage, they do not count toward getting out of the Donut Hole or meeting your True Out-of-Pocket costs (TrOOP).

Therefore, 50% of the brand-name discount – that portion paid by the manufacturer, will continue to count toward your TrOOP along with the 40% of the retail price that you will pay - for a total of 90% of the retail cost credited toward your 2017 TrOOP limit of $4,950.

Here is how a formulary drug purchase is calculated throughout your 2017 Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide).

* 25% co-pay or cost-sharing

** 60% Brand-name Discount

*** 49% Generic Discount

**** you pay 5% of retail or $8.25 for brand drugs whatever is higher or 5% of retail or $3.30 for generic or multi-source drugs whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

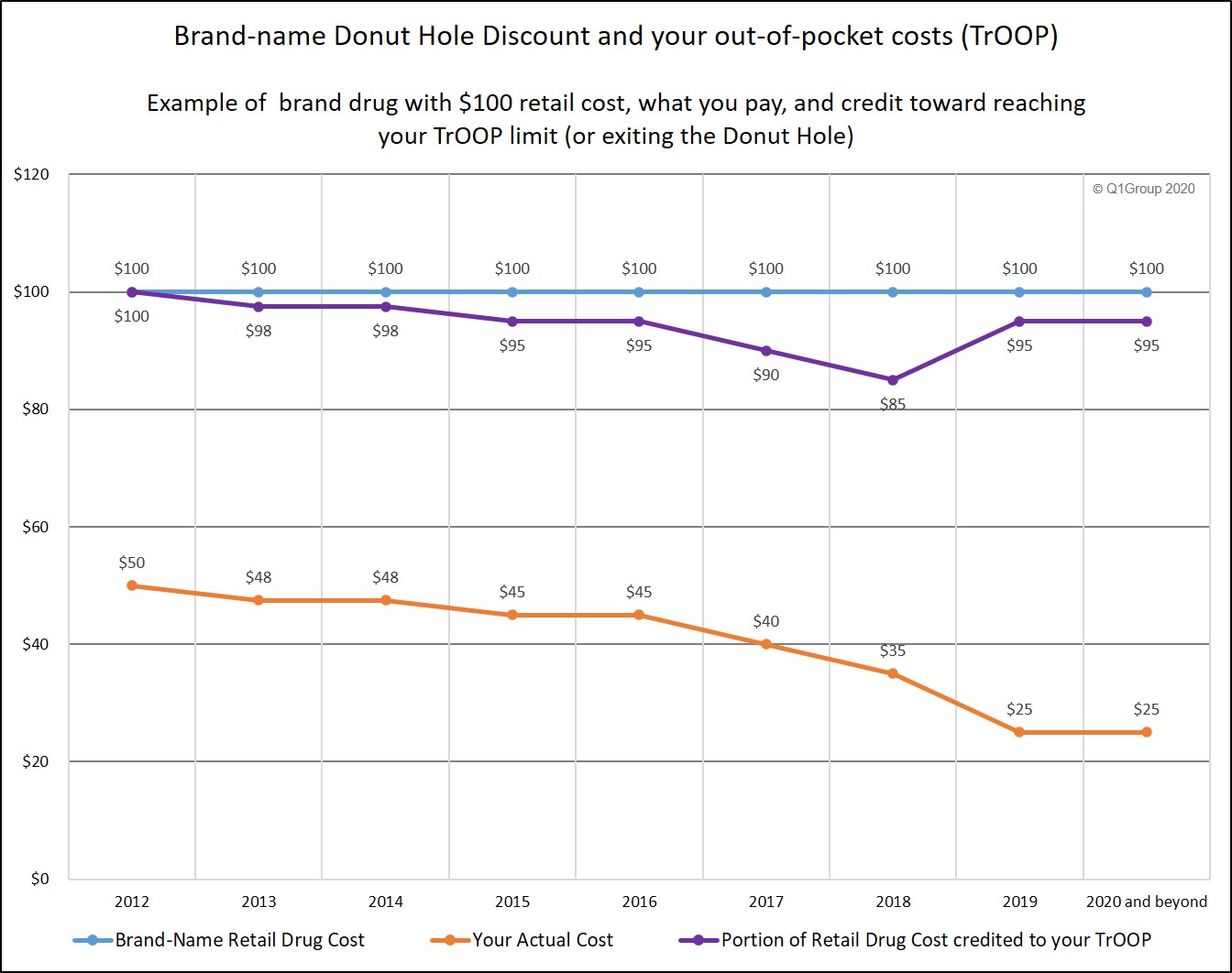

The following chart shows how the Donut Hole discount changes until 2020 and how your out-of-pocket spending limit or TrOOP TrOOP is impacted by brand-name drug purchases.

How does this actually work?

In 2017, if you buy a brand-name drug that has a retail price of $100, you will pay $40 (a 60% discount). For this Donut Hole purchase, $90 will count toward getting out of the 2017 Donut Hole (or meeting your 2017 TrOOP limit of $4,950 ) – the $40 you paid plus the $50 brand-name drug discount paid by the drug manufacturer.

The extra $10 portion of the discount will not count toward TrOOP because it was paid by your Medicare Part D plan and is considered plan coverage.

However, if you purchased a $100 generic medication while in the 2017 Donut Hole, you would pay $51 (receiving a 49% discount) and only the $51 you paid would count toward your 2017 TrOOP or Donut Hole exit point.

Please also see our Blogs:

Our 2017 PDP-Planner (or Donut Hole Calculator) is available to illustrate your monthly estimated costs for 2017. Several examples are available to help you get started. Click here for an example of a Medicare beneficiary with relatively high monthly prescription drug costs (a retail drug cost of $800 per month).

You can also click on the following link to learn more about the 2017 Medicare Part D drug coverage.

When buying brand-name prescriptions in the Donut Hole: You will have additional savings on brand-name drugs in the 2017 Coverage Gap. For example, if you reach the 2017 Donut Hole and purchase a brand-name medication with a retail cost of $100, you will pay $40 for the medication, and receive $90 credit toward meeting your 2017 out-of-pocket spending limit or TrOOP – or Donut Hole exit point.

When buying generic prescriptions in the Donut Hole: You will save more on generic medications in the 2017 Coverage Gap. As an example, if you reach the 2017 Donut Hole phase of your Medicare Part D plan, and your generic medication has a retail cost of $100, you will pay $51. The $51 that you spend will count toward your out-of-pocket spending limit or TrOOP.

Will you enter the Donut Hole in 2017? If the retail cost of your medications is over $308 per month, you will enter the 2017 Donut Hole. And, if your monthly retail drug costs are somewhere around $673, you probably will spend your way through the 2017 Donut Hole and enter your Medicare Part D plan's 2017 Catastrophic Coverage phase. No matter where you are at the end of the plan year, your Medicare Part D plan coverage (and Donut Hole) ends on December 31st and the whole process begins again on January 1st of the next year.

Popular Question: So who is paying the Donut Hole discount and does the discount count toward getting out of the Coverage Gap? The generic drug Donut Hole discount is paid by your Medicare Part D plan and does not count toward TrOOP (getting out of the Donut Hole).

The brand-name drug discount is split into two parts (beginning in 2013). The first portion, is a 50% discount paid by the drug manufacturer as it has been since 2011. The additional 10% discount in 2017 is considered Medicare plan coverage and is paid by your 2016 Medicare Part D prescription drug plan (or Medicare Advantage plan that includes drug coverage).

Since both the generic discount and this additional 10% brand-name drug discount are paid by your plan and considered plan coverage, they do not count toward getting out of the Donut Hole or meeting your True Out-of-Pocket costs (TrOOP).

Therefore, 50% of the brand-name discount – that portion paid by the manufacturer, will continue to count toward your TrOOP along with the 40% of the retail price that you will pay - for a total of 90% of the retail cost credited toward your 2017 TrOOP limit of $4,950.

Here is how a formulary drug purchase is calculated throughout your 2017 Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide).

|

When you purchase a formulary medication |

||||||

|

Retail Cost |

You Pay |

Medicare Plan Pays |

Pharma Mfgr Pays |

Gov. pays |

Amount toward your TrOOP |

|

|

Initial Deductible |

$100 |

$100 |

$0 |

$0 |

$0 |

$100 |

|

Initial Coverage Phase * |

$100 |

$25 |

$75 |

$0 |

$0 |

$25 |

|

Coverage Gap - brand-name ** |

$100 |

$40 |

$10 |

$50 |

$0 |

$90 |

|

Coverage Gap - generic *** |

$100 |

$51 |

$49 |

$0 |

$0 |

$51 |

|

Catastrophic Coverage (brand drug) **** |

$200 |

$10 |

$30 |

$0 |

$160 |

n/a |

|

Catastrophic Coverage (generic drug) **** |

$100 |

$5 |

$15 |

$0 |

$80 |

n/a |

* 25% co-pay or cost-sharing

** 60% Brand-name Discount

*** 49% Generic Discount

**** you pay 5% of retail or $8.25 for brand drugs whatever is higher or 5% of retail or $3.30 for generic or multi-source drugs whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

The following chart shows how the Donut Hole discount changes until 2020 and how your out-of-pocket spending limit or TrOOP TrOOP is impacted by brand-name drug purchases.

How does this actually work?

In 2017, if you buy a brand-name drug that has a retail price of $100, you will pay $40 (a 60% discount). For this Donut Hole purchase, $90 will count toward getting out of the 2017 Donut Hole (or meeting your 2017 TrOOP limit of $4,950 ) – the $40 you paid plus the $50 brand-name drug discount paid by the drug manufacturer.

The extra $10 portion of the discount will not count toward TrOOP because it was paid by your Medicare Part D plan and is considered plan coverage.

However, if you purchased a $100 generic medication while in the 2017 Donut Hole, you would pay $51 (receiving a 49% discount) and only the $51 you paid would count toward your 2017 TrOOP or Donut Hole exit point.

Please also see our Blogs:

Our 2017 PDP-Planner (or Donut Hole Calculator) is available to illustrate your monthly estimated costs for 2017. Several examples are available to help you get started. Click here for an example of a Medicare beneficiary with relatively high monthly prescription drug costs (a retail drug cost of $800 per month).

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service