Medicare Part D 2020: CMS releases the finalized 2020 Medicare Part D standard drug plan coverage parameters

On April 1st, the Centers for Medicare and

Medicaid Services (CMS) released

the 2020 Announcement and Final Call Letter that includes the defined

standard benefits parameters for 2020 Medicare Part D prescription drug plan coverage.

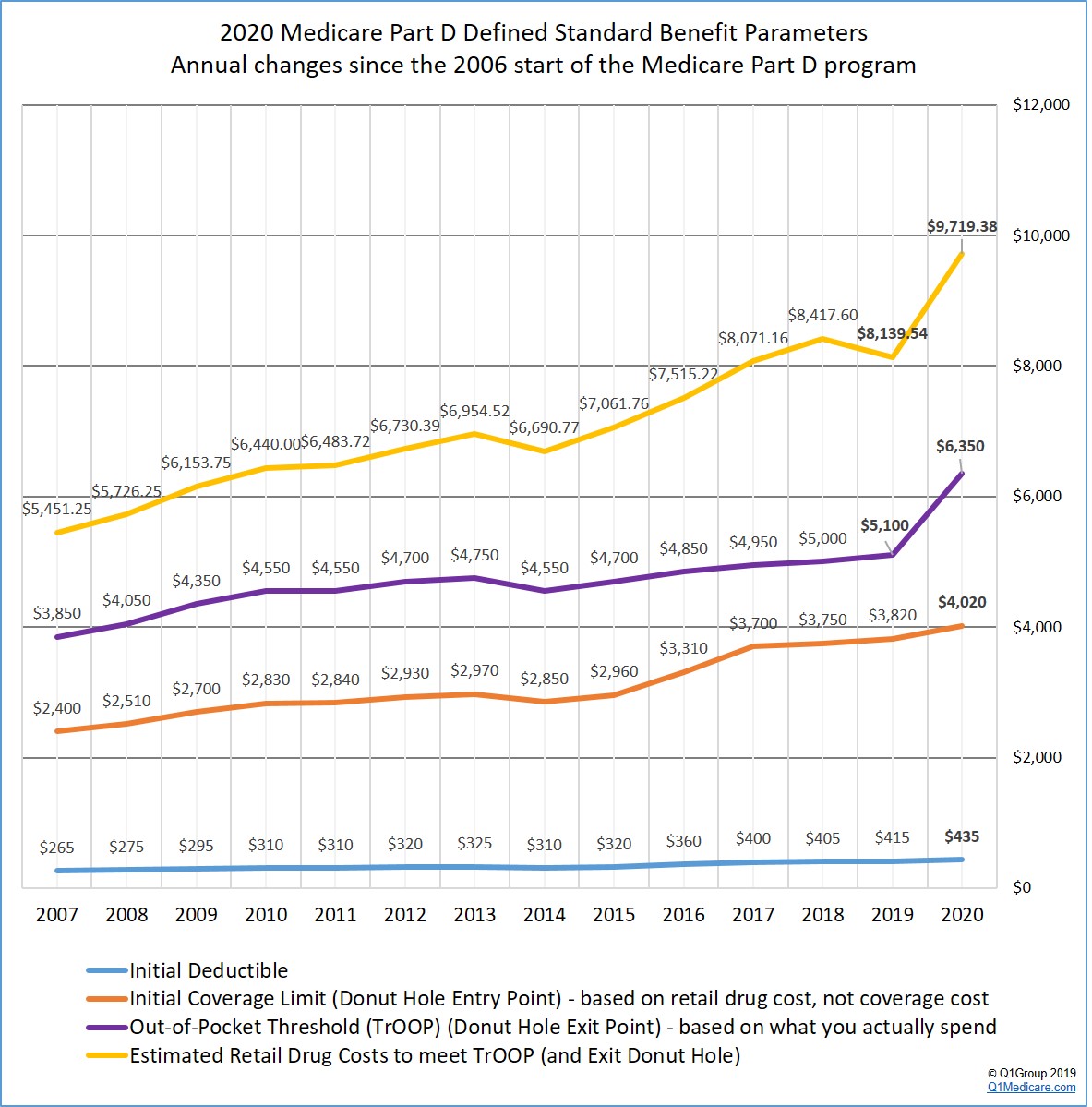

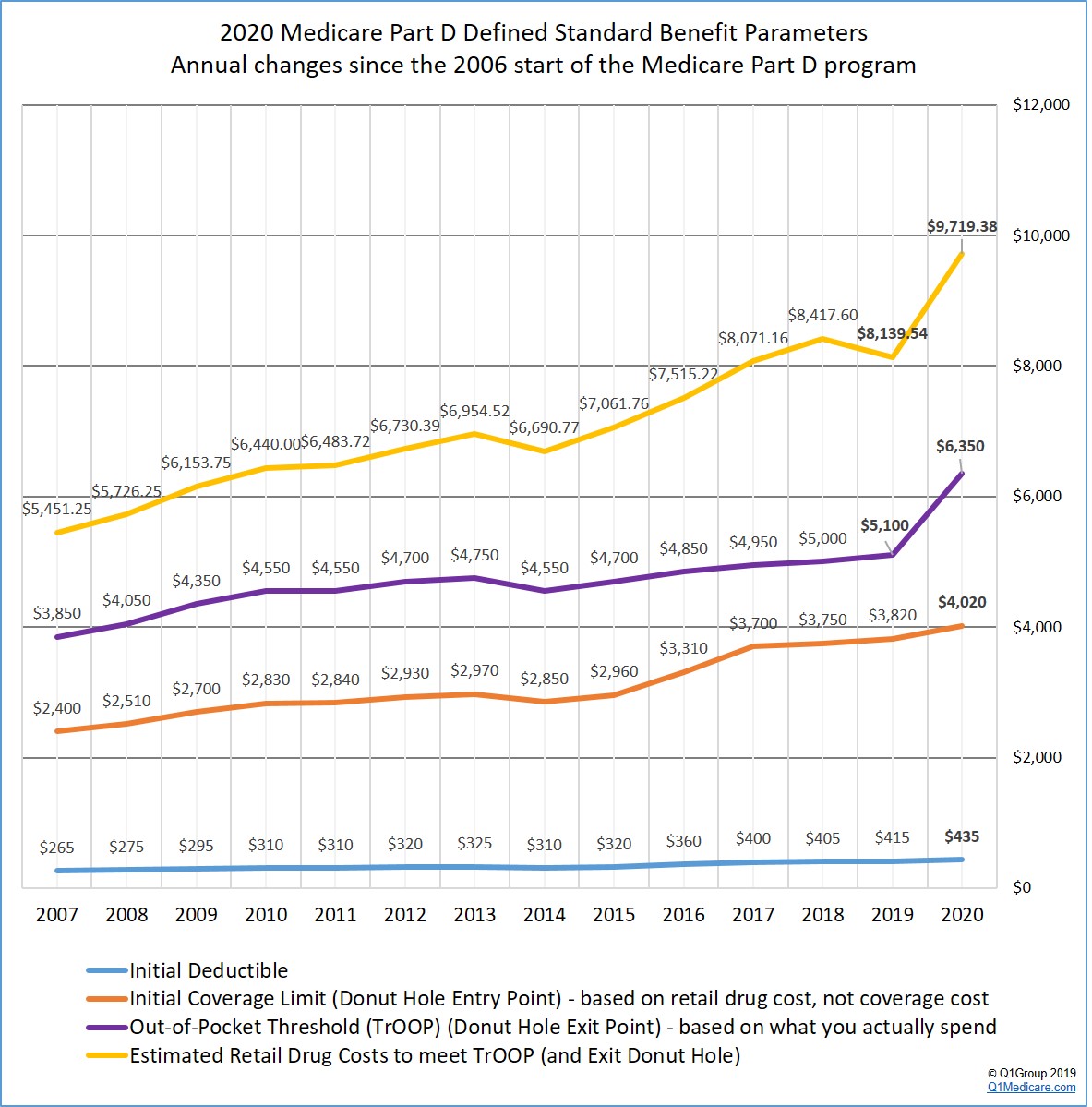

The following chart shows the 2020 Medicare Part D plan parameters and how standard Medicare Part D plan coverage has changed each year since the 2006 beginning of the Medicare Part D program - for a more detailed overview of annual plan changes, you can click here for a table comparing Medicare Part D standard benefit parameters from the 2006 through 2020 .

Based on the Final CMS Announcement, here are a few changes to the standard 2020 Medicare Part D prescription drug coverage:

The following chart shows the 2020 Medicare Part D plan parameters and how standard Medicare Part D plan coverage has changed each year since the 2006 beginning of the Medicare Part D program - for a more detailed overview of annual plan changes, you can click here for a table comparing Medicare Part D standard benefit parameters from the 2006 through 2020 .

Based on the Final CMS Announcement, here are a few changes to the standard 2020 Medicare Part D prescription drug coverage:

- The standard 2020 Initial Deductible will increase about 5%.

The 2020 standard Initial Deductible will increase by $20 to $435 from the current 2019 standard Initial Deductible of $415. As reference, the 2018 standard Initial Deductible was $405, the 2017 standard Initial Deductible was $400, the 2016 standard Initial Deductible was $360, and the 2015 Initial Deductible was $320.

This means: The Initial Deductible is the amount that you pay before your Medicare Part D plan begins to share in the cost of coverage. So, if you enroll in a 2020 Medicare Part D prescription drug plan with a standard Initial Deductible, you will spend slightly more out-of-pocket in 2020 before your plan coverage begins. As a note, the majority of 2019 Medicare Part D plans have an initial deductible. But, as we see in 2019, many popular Medicare Part D plans exclude lower-costing Tier 1 and Tier 2 drugs from the deductible, providing plan Members with immediate coverage for some lower-costing medications.

Reminder: The Initial Deductible will not impact when you enter the Donut Hole or Coverage Gap, but will affect when you leave the Donut Hole and enter Catastrophic Coverage. In other words, what you spend toward your Initial Deductible is counted toward your total out-of-pocket spending threshold or TrOOP (see below for more about TrOOP).

- The

2020 Initial Coverage Limit will increase 5%.

The 2020 Initial Coverage Limit (ICL) is proposed to increase $200 to $4,020 from the current 2019 ICL of $3,820. The Initial Coverage Limit marks the Donut Hole entry point. Medicare beneficiaries enter the Donut Hole or Coverage Gap when the total negotiated retail value of their prescription drug purchases exceeds their plan’s Initial Coverage Limit. As reference, the 2018 ICL was $3,750, the 2017 Initial Coverage Limit was $3,700, the 2016 Initial Coverage Limit was $3,310, and the 2015 Initial Coverage Limit was $2,960.

This means: You will be able to buy more medications before reaching the 2020 Donut Hole or Coverage Gap (assuming that the retail price of your medications does not increase over time).

- Will you enter the 2020 Donut Hole?

You can estimate now (based on your current retail drug prices remaining stable) that, if you purchase medications with an average retail value of over $335 per month, you will enter the 2020 Donut Hole at some point during the year.

- The

2020 Donut Hole discount will increase to 75% for all generic drugs.

If you reach the 2020 Donut Hole or Coverage Gap phase of your Medicare Part D plan coverage, the generic drug discount will increase from 63% to 75%. (So your generic drug costs in the Donut Hole will be 25% of your plan's negotiated retail prices.)

This means: If you are in the 2020 Donut Hole and your generic medication has a retail cost of $100, you will pay only $25. And the $25 that you spend for a formulary drug will count toward your 2020 out-of-pocket spending limit or TrOOP.

- The

Donut Hole discount will remain the same (75%) for brand-name drugs.

The 2020 brand-name drug Donut Hole discount remains at 75% (you pay 25% of retail costs). The pharmaceutical industry will be responsible for 70% of the cost of medications in the Coverage Gap, therefore you will receive credit for 95% of the retail drug cost toward meeting your 2020 total out-of-pocket maximum or Donut Hole exit point (the 25% of retail costs you pay plus the 70% drug manufacturer discount).

This means: If you reach the 2020 Donut Hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the formulary medication, and receive $95 credit toward meeting your 2020 out-of-pocket spending limit – or Donut Hole exit point.

- The amount you need to spend to exit the 2020 Donut Hole will increase by 25%

Your 2020 Total Out-of-Pocket Cost (TrOOP) threshold will increase by $1,250 to $6,350 from the current 2019 TrOOP limit of $5,100. TrOOP is the dollar figure you must spend (or someone else spends on your behalf) to get out of the Donut Hole or Coverage Gap and into the Catastrophic Coverage phase of your Medicare Part D plan.

Remember that TrOOP does not include monthly premiums or non-formulary purchases. As reference, the 2018 TrOOP limit was $5,000, the 2017 TrOOP limit was $4,950, the 2016 TrOOP limit was $4,850, and the 2015 TrOOP threshold value was $4,700.

The good news: As noted above, brand-name medication purchases in the 2020 Donut Hole are discounted by 75% (you pay 25%), but you will receive credit of 95% of the retail drug price toward meeting the 2020 TrOOP threshold - so we estimate that someone purchasing only brand-name medications (100% brand) in the 2020 Donut Hole should actually spend up to $376 more (as compared to 2019) before meeting the higher 2020 TrOOP (since 70% of the retail cost paid by the pharmaceutical industry is counted toward meeting TrOOP). The Henry J Kaiser Family Foundation (KFF) estimated that someone purchasing 100% brand drugs in the 2020 Donut Hole should actually spend $375 more than 2019 -- and then in a later study, Kaiser increased the estimate to be "nearly $400 more".

If you use 100% generics in the Donut Hole, your spending in the Donut Hole will increase by $1,185.

Since your overall TrOOP will increase by $1,250 in 2020, your spending while in the 2020 Donut Hole will increase by up to $1,185 depending on your mix of generic and brand name drugs. If you are purchasing only generic drug in the Donut Hole, your Donut Hole spending before exiting the Donut Hole will increase by the full $1,185.

If you use 100% brand drugs in the Donut Hole, your spending in the Donut Hole will increase by $312.

If you are purchasing only brand name drugs in the Donut Hole (and have standard Medicare Part D plan parameters), we estimate your spending will increase by up to $312 while in the 2020 Donut Hole (which is the same as found in the October 2019 Kaiser study).

Please note, our calculations are using the standard 2020 Medicare Part D plan parameters ($435 deductible and $4,020 Initial Coverage Limit) when determining that people will need to spend up to $1,185 more while in the 2020 Donut Hole (when using 100% generic drugs). The difference between the $1,250 TrOOP change (2020 TrOOP - 2019 TrOOP) and our $1,185 additional Donut Hole spending estimate is that we are taking into consideration the $20 increase in the standard deductible (2020 deductible - 2019 deductible) and the increase in the 2020 Initial Coverage Limits multiplied by standard 25% cost-sharing (2020 ICL - 2019 ICL)*.25 = $45. So if you only use generic drugs while in the 2020 Donut Hole, you will spend $20 more to meet the 2020 deductible + $45 more before entering enter the Donut Hole + up to $1,185 more while in the donut hole = $1,250 increase in the 2020 TrOOP.

- What will this 25% increased in 2020 TrOOP mean to you?

You can use our 2020 Donut Hole calculator (found at PDP-Planner.com/2020) to estimate your actual Donut Hole spending based on your estimated mix of generic and brand-name drugs purchased in the 2020 Coverage Gap.

-- If your Donut Hole drug mix is: 90.18% brands and 9.82% generics

If you use the CMS estimate of 90.18% brand drugs and 9.82% generic drugs (based on past overall drug usage in the Donut Hole) - and assume you have a $435 deductible and the retail cost of your drugs is about $810 per month, you can expect your actual annual costs to be around $2,860 before meeting the $6,350 TrOOP and exiting the Donut Hole - your Medicare Part D plan would spend about $3,360 and the pharmaceutical manufacturers would spend about $3,590. The total retail value of your drug purchases needed to exit the Donut Hole would be $9,719.

-- If your Donut Hole drug mix is: 100% generics

If you use only generic drugs (100% generic) in the Donut Hole - and assume you have a $435 deductible and the retail cost of your drugs is about $1,943 per month, you can expect your actual annual costs to be $6,350 (or the same as the 2020 TrOOP) before exiting the Donut Hole - your Medicare Part D plan would spend about $16,970 and the pharmaceutical manufacturers would spend $0. The total retail value of your drug purchases needed to exit the Donut Hole would be $23,316.

-- If your Donut Hole drug mix is: 100% brands

If you use only brand drugs (100% brands) - and assume you have a $435 deductible and the retail cost of your drugs is about $775 per month, you can expect your actual annual costs to be around $2,652 before meeting the $6,350 TrOOP and exiting the Donut Hole - your Medicare Part D plan would spend about $2,953 and the pharmaceutical manufacturers would spend about $3,696. The total retail value of your drug purchases needed to exit the Donut Hole would be $9,303.

This means: You will spend more out-of-pocket to exit the 2020 Donut Hole as compared to 2019 - and you would exit the Donut Hole and enter Catastrophic Coverage faster by using brand-name medications in the Donut Hole since the pharmaceutical industry brand-name discount will accelerate you toward meeting your TrOOP.

Not sure how the 2020 Donut Hole or Coverage Gap functions?

To help you visualize how your current drug spending relates to your Medicare Part D plan coverage, we have our updated 2020 Donut Hole calculator found at PDP-Planner.com/2020. Our Donut Hole calculator helps you estimate what you can expect to pay throughout the different phases of your 2020 Medicare Part D plan coverage. We have several options for you to choose the percentage of generic and brand drugs you use and you can even change your mix of prescriptions to be 100% generic or 100% brand.

To get you started, you can click here to see an example of the 2020 Medicare prescription drug plan phases for someone with $800 per month brand drug retail cost. (Spoiler alert: If the retail cost of your formulary medications is $800 per month, you can expect to spend about $2,666.83 out-of-pocket in 2020 - assuming a $435 deductible and an average cost-sharing of 25% of retail - and not including monthly premiums).

- The estimated retail value of drug purchases needed to exit the Donut Hole will increase 19%.

CMS estimates that a person will use a mix of 90.18% brand drugs and 9.82% generic drugs while in the 2020 Donut Hole (an increase in estimated brand-name drug use as compared to the 2019 estimated mix of 89.31% brand drugs and 10.69% generic drugs while in the Donut Hole). As reference, in 2018, the CMS retail drug-cost estimate was calculated using a mix of 87.9% brand drugs and 12.1% generic drugs and the estimated retail cost to meet 2018 TrOOP and exit the 2018 Donut Hole is $8,417.60.

As a result, CMS calculates that a person will be able to purchase drugs with an approximate retail value of $9,719.38 before meeting the $6,320 out-of-pocket threshold (TrOOP) and exiting the 2020 Donut Hole.

Please note, in 2019 CMS originally estimated that people would be able to purchase drugs with an approximate retail value of $8,906.55 in last-years February Draft Call Letter, and then increased that estimate to $8,139.54 in the 2019 Final Call Letter (based on the increased brand-name Donut Hole discount). Our chart is using the $8,139.54 value from the 2019 Final Call Letter.

- Will you enter the 2020 Catastrophic Coverage phase?

Based on CMS drug purchase estimates, if your monthly retail formulary drug costs are more than $810 per month, you will exit the 2020 Donut Hole and enter Catastrophic Coverage portion of your Medicare Part D plan.

- Your Catastrophic Coverage

costs could increase slightly.

The Catastrophic Coverage portion of your Medicare Part D plan begins when you leave the Coverage Gap or Donut Hole. In the 2020 Catastrophic Coverage phase, you pay a minimum of $8.95 for brand drugs or $3.60 for generics (or 5% of retail costs, whichever is higher). As reference, in the 2018 Catastrophic Coverage phase, you paid a minimum of $8.35 for brand drugs or $3.35 for generics (or 5%, whichever is higher) and in 2017 Catastrophic Coverage you paid a minimum of $8.25 for brand drugs or $3.30 for generics.

This means: If you purchase a brand name medication with a retail price of over $179 or a generic medication with a retail price of over $72, you will pay 5% of retail or more than the minimum $8.95 for brand drugs or $3.60 for generics.

For example, if you are using the expensive medication IMBRUVICA 140 MG CAPSULE (90 EA ) (NDC: 57962014009), your monthly retail drug costs may be over $17,000, so your catastrophic coverage cost would be approximately $850 per month since this 5% of retail cost is more than the minimum $8.95 brand-name catastrophic coverage cost (based on 2019 retail drug costs).

- And for Medicare Advantage plans:

Additional changes to the Supplemental Benefits (non-primarily health related benefit) that a Medicare Advantage plan can offer people with certain chronic conditions.

As noted by CMS in the April 1st Fact sheet that was released with the 2020 Final Call Letter: Medicare Advantage plans in 2020 "will have greater flexibility to offer chronically ill patients a broader range of supplemental benefits that are tailored to their specific needs, such as providing meals beyond a limited basis, transportation for non-medical needs, and home environment services if these benefits have a reasonable expectation of improving or maintaining the health or overall function of the patient as it relates to their chronic condition or illness."

Medicare Advantage plans will be responsible for determining which of their plan members are identified as "chronically ill" and thus able to receive the Supplemental Benefits (or Special Supplemental Benefits for the Chronically Ill (SSBCI)). In the Final Call Letter, CMS notes that about 73% of current Medicare Advantage plan members have one or more chronic conditions (as listed by CMS).

Medicare Advantage plans also will be responsible for determining whether "the non-primarily health related benefit will have a reasonable expectation of improving the chronic disease or maintaining the health or overall function of the enrollee receiving the benefit".

Examples of non-primarily health related Supplemental Benefits (as provide by CMS) include:

- A Medicare Advantage plan could provide a plan member with asthma coverage for "home air cleaners and carpet shampooing to reduce irritants that may trigger asthma attacks".

- A Medicare Advantage plan could provide a plan member with heart disease coverage for "heart healthy food or produce".

- A Medicare Advantage plan "may offer items and services that include capital or structural improvements (e.g., permanent ramps, and widening hallways or doorways) if those items and services have a reasonable expectation of improving or maintaining the health or overall function of the enrollee as it relates to the chronic condition or illness".

- A Medicare Advantage plan could provide a plan member with asthma coverage for "home air cleaners and carpet shampooing to reduce irritants that may trigger asthma attacks".

When considering Supplemental Benefits, CMS reminded Medicare Advantage plans that, "SSBCI are supplemental benefits and, therefore, must not be items or services covered by original Medicare." In addition, CMS reminded Medicare Advantage plans that a member's request for Supplemental Benefits was to be treated as any other benefit request and subject to the appeals process.

References:

https://www.cms.gov/newsroom/fact-sheets/2020-medicare-advantage-and-part-d-advance-notice-part-ii-and-draft-call-letter,

https://www.cms.gov/newsroom/fact-sheets/2020-medicare-advantage-and-part-d-rate-announcement-and-final-call-letter-fact-sheet,

https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Announcements-and-Documents-Items/2020Announcement.html, and

https://www.kff.org/medicare/issue-brief/closing-the-medicare-part-d-coverage-gap-trends-recent-changes-and-whats-ahead

https://www.kff.org/medicare/issue-brief/how-will-the-medicare-part-d-benefit-change-under-current-law-and-leading-proposals/

https://www.cms.gov/newsroom/fact-sheets/2020-medicare-advantage-and-part-d-advance-notice-part-ii-and-draft-call-letter,

https://www.cms.gov/newsroom/fact-sheets/2020-medicare-advantage-and-part-d-rate-announcement-and-final-call-letter-fact-sheet,

https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Announcements-and-Documents-Items/2020Announcement.html, and

https://www.kff.org/medicare/issue-brief/closing-the-medicare-part-d-coverage-gap-trends-recent-changes-and-whats-ahead

https://www.kff.org/medicare/issue-brief/how-will-the-medicare-part-d-benefit-change-under-current-law-and-leading-proposals/

News Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service