CMS projects slightly higher 2021 Medicare prescription drug plan premiums

The Centers for Medicare and Medicaid Services (CMS) recently announced in their press release entitled, "Trump Administration Continues to Keep Out-of-Pocket Drug Costs Low for Seniors", that the average basic monthly Medicare Part D plan premium is expected to increase slightly.

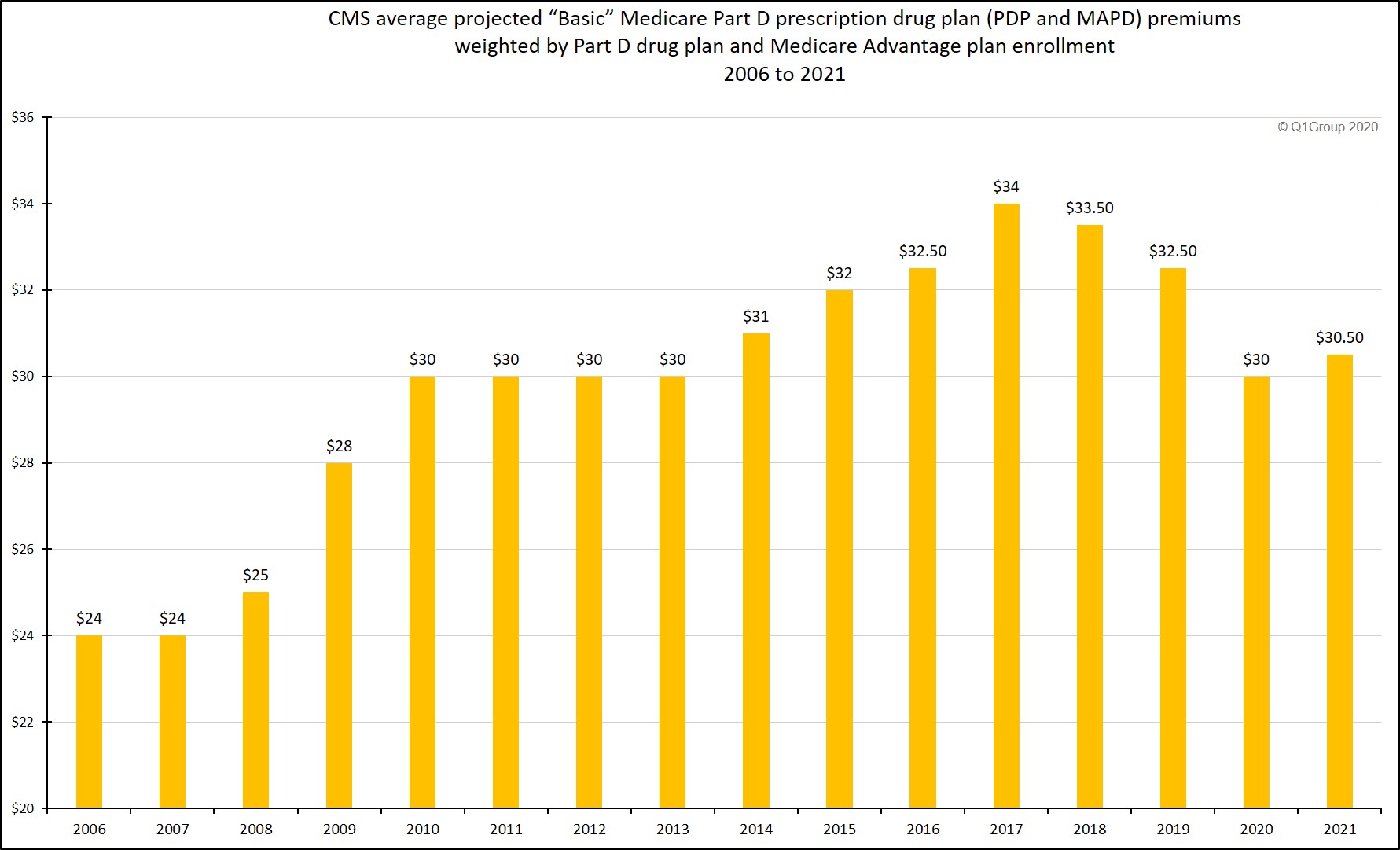

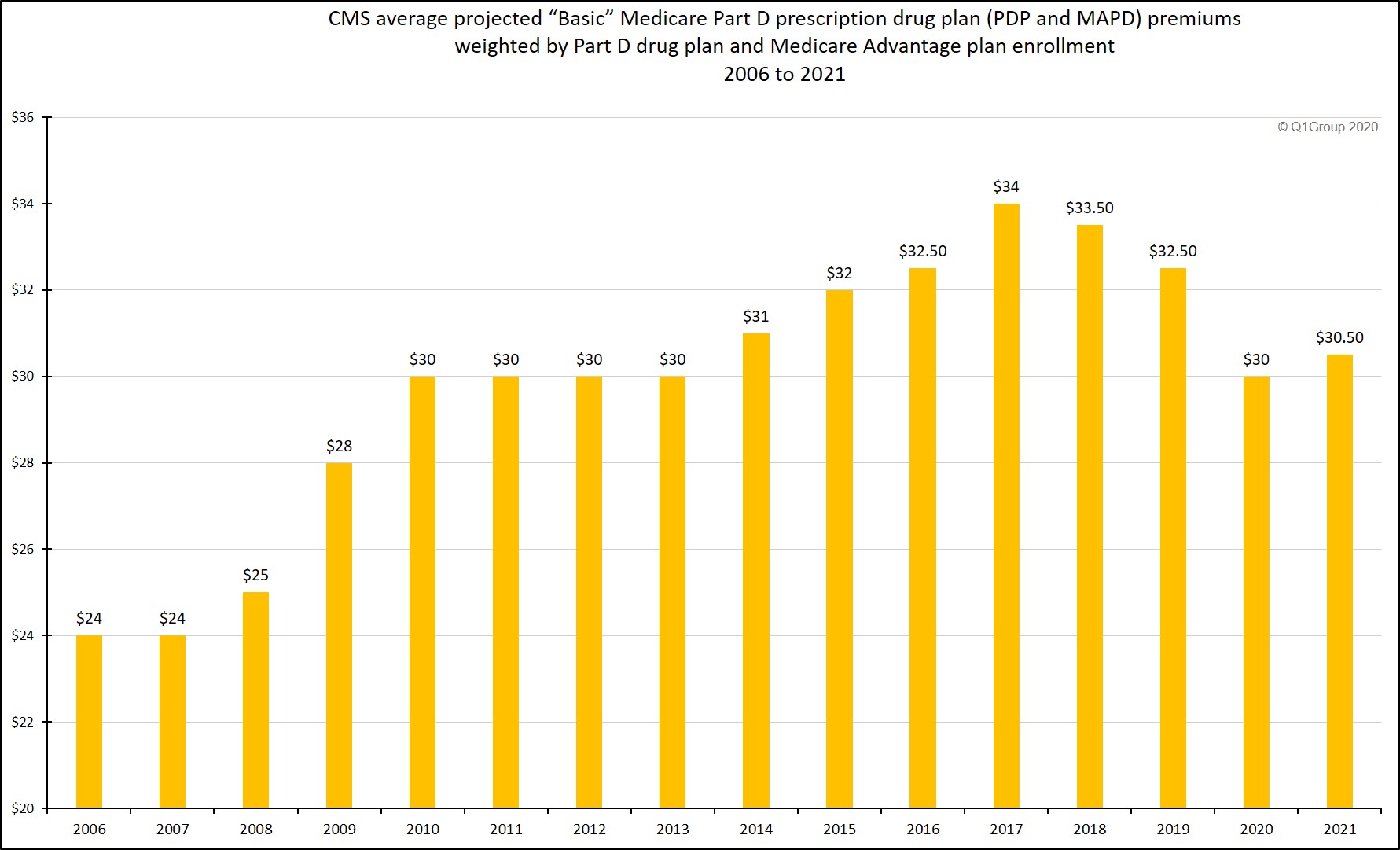

Based on the 2021 Medicare Part D plan bids and current Medicare drug plan (PDP and MAPD) enrollment, the 2021 average weighted basic monthly premium is projected to be around $30.50 per month - an increase of $0.50 from the $30 per month premium projected for 2020 - and down $2.00 from the $32.50 average that was projected for 2019.

Question: Does the projected increase in projected average Medicare Part D premiums mean you will pay more for your 2021 Medicare Part D plan?

Not exactly. The average monthly Medicare Part D premium figure released by CMS may not reflect the actual changes you see in your 2021 Medicare Part D prescription drug plan premiums - or overall coverage.

The CMS projected 2021 average premium of $30.50 suggests that you should be able to shop around during the annual Open Enrollment Period and find a stand-alone 2021 Medicare prescription drug plan (PDP) with about the same monthly premium as you currently have now, or you may want to consider changing enrollment to a low-premium (or $0 premium) Medicare Advantage plan that includes prescription drug coverage (MAPD).

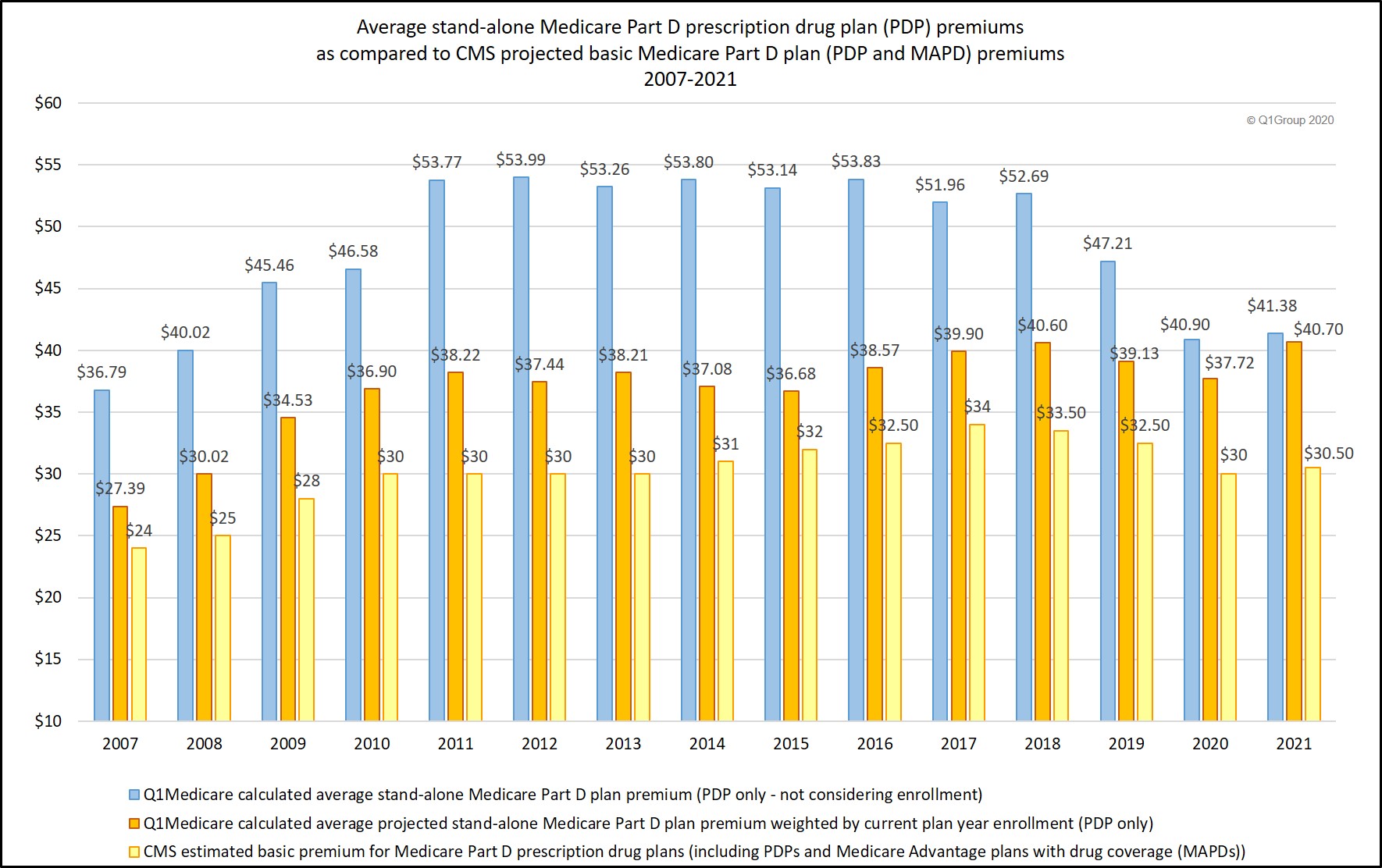

In addition, our analysis (see below) shows that, although average (unweighted) Medicare Part D plan premiums have been decreasing for the past few years, the average stand-alone Medicare Part D (PDP-only) premium weighted by plan enrollment has been increasing, perhaps indicating that Medicare beneficiaries are choosing Medicare Part D plans with higher premiums or staying with their same plans although their plan premiums have increased.

Question: When can I see the 2021 Medicare Part D and Medicare Advantage plans?

Starting in October, people with Medicare Part D can begin to research their Medicare health and prescription plan options. During the annual Open Enrollment Period (AEP) that begins October 15th and ends December 7, 2020, beneficiaries can switch Medicare plans by enrolling in their newly selected plan. If you are not sure where to begin with the annual plan review process, you can start by calling a Medicare representative at 1-800-MEDICARE for more information.

Question: Will my 2020 Medicare Part D plan inform me about 2021 plan changes?

Yes. Everyone with a Medicare Part D or Medicare Advantage plan should review their Medicare plan's Annual Notice of Change letter (ANOC) that will be mailed in late-September. Even if your Medicare Part D plan premium remains stable (or decrease) – this does not mean that your 2021 Medicare plan’s drug coverage costs will decrease. Your Medicare drug plan's prescription coverage - which drugs are covered and at what cost - usually changes every year, even if your monthly Medicare plan premium remains the same or decreases slightly.

Finally, Medicare Part D plan members should review their Medicare plan's 2021 Evidence of Coverage (EOC) document mailed to them in early-October - or made available electronically for download. The EOC is a 200+ page document that includes detailed information about the Medicare plan's coverage.

Bottom Line: Medicare Part D plans change each year, so please be prepared to review your 2021 Medicare plan options starting in early October.

Question: How have projected Medicare Part D premiums changed over time?

The following are Medicare's annual projected basic Medicare Part D premiums weighted by enrollment. The actual annual average Medicare Part D premium reported by Medicare may be slightly higher or lower than the projected premium depending on actual Medicare plan enrollment for the year (for example, the actual 2018 average premium was $33.59 as compared to the projected average Part D premium of $33.50).

Based on the 2021 Medicare Part D plan bids and current Medicare drug plan (PDP and MAPD) enrollment, the 2021 average weighted basic monthly premium is projected to be around $30.50 per month - an increase of $0.50 from the $30 per month premium projected for 2020 - and down $2.00 from the $32.50 average that was projected for 2019.

Question: Does the projected increase in projected average Medicare Part D premiums mean you will pay more for your 2021 Medicare Part D plan?

Not exactly. The average monthly Medicare Part D premium figure released by CMS may not reflect the actual changes you see in your 2021 Medicare Part D prescription drug plan premiums - or overall coverage.

The CMS projected 2021 average premium of $30.50 suggests that you should be able to shop around during the annual Open Enrollment Period and find a stand-alone 2021 Medicare prescription drug plan (PDP) with about the same monthly premium as you currently have now, or you may want to consider changing enrollment to a low-premium (or $0 premium) Medicare Advantage plan that includes prescription drug coverage (MAPD).

In addition, our analysis (see below) shows that, although average (unweighted) Medicare Part D plan premiums have been decreasing for the past few years, the average stand-alone Medicare Part D (PDP-only) premium weighted by plan enrollment has been increasing, perhaps indicating that Medicare beneficiaries are choosing Medicare Part D plans with higher premiums or staying with their same plans although their plan premiums have increased.

Question: When can I see the 2021 Medicare Part D and Medicare Advantage plans?

Starting in October, people with Medicare Part D can begin to research their Medicare health and prescription plan options. During the annual Open Enrollment Period (AEP) that begins October 15th and ends December 7, 2020, beneficiaries can switch Medicare plans by enrolling in their newly selected plan. If you are not sure where to begin with the annual plan review process, you can start by calling a Medicare representative at 1-800-MEDICARE for more information.

Question: Will my 2020 Medicare Part D plan inform me about 2021 plan changes?

Yes. Everyone with a Medicare Part D or Medicare Advantage plan should review their Medicare plan's Annual Notice of Change letter (ANOC) that will be mailed in late-September. Even if your Medicare Part D plan premium remains stable (or decrease) – this does not mean that your 2021 Medicare plan’s drug coverage costs will decrease. Your Medicare drug plan's prescription coverage - which drugs are covered and at what cost - usually changes every year, even if your monthly Medicare plan premium remains the same or decreases slightly.

Finally, Medicare Part D plan members should review their Medicare plan's 2021 Evidence of Coverage (EOC) document mailed to them in early-October - or made available electronically for download. The EOC is a 200+ page document that includes detailed information about the Medicare plan's coverage.

Bottom Line: Medicare Part D plans change each year, so please be prepared to review your 2021 Medicare plan options starting in early October.

Question: How have projected Medicare Part D premiums changed over time?

The following are Medicare's annual projected basic Medicare Part D premiums weighted by enrollment. The actual annual average Medicare Part D premium reported by Medicare may be slightly higher or lower than the projected premium depending on actual Medicare plan enrollment for the year (for example, the actual 2018 average premium was $33.59 as compared to the projected average Part D premium of $33.50).

|

Projected basic stand-alone Medicare Part D premiums 2006 to 2021 weighted by Medicare plan enrollment.

Question: How does the CMS estimated average weighted Medicare Part D premium compare to actual stand-alone Medicare Part D (PDP) premiums?

The projected average basic Medicare Part D premiums reported by CMS include both stand-alone Medicare Part D plans (PDPs) and Medicare Advantage plans that include drug coverage (MAPDs) - and are usually much lower than the actual average Medicare Part D premiums we report each year in our PDP landscape analysis or PDP-Facts section.

The difference between the CMS average premium projection and our analysis is because we only consider stand-alone Medicare Part D prescription drug plans (PDPs) in our premium calculations (or calculations showing average premiums weighted by plan enrollment). Unlike CMS, we do not include the premiums for Medicare Advantage plans offering prescription drug coverage (MAPDs) with stand-alone Medicare Part D plans (PDPs) for several reasons:

-

First, Medicare Part D plans (PDPs) are offered on a statewide (or multi-state regional) basis and Medicare Advantage prescription drug plans (MAPDs) are offered within much smaller service areas (ZIP code, partial-ZIP, or county basis) - and more MAPDs are available in densely populated areas where Medicare plans can easily establish healthcare networks as compared to rural areas. So low-premium MAPDs may not be widely available to all Medicare beneficiaries in a state. (As a note, there are no Medicare Advantage plans (MA or MAPD) available anywhere in Alaska - except those offered in a small area by employer plans).

- In addition, many popular MAPDs have a low or $0 premium and these low premiums tend to skew the average weighted monthly premium for prescription drug coverage toward lower values that are not reflective of the stand-alone Medicare Part D plan (PDP) landscape. In short, a national average of combined PDP and MAPD premiums weighted by enrollment may not reflect the actual stand-alone Medicare Part D plan premiums available to all seniors.

Question: So how do the CMS projected Medicare Part D premiums actually compare to the stand-alone Medicare Part D (PDP) plan landscape?

The following chart shows variations or trends in CMS projected basic Medicare Part D plan premiums (PDP and MAPD) as compared to our calculated average stand-alone Medicare Part D plan (PDP-only) premiums and stand-alone Medicare Part D plan (PDP-only) premiums weighted by plan enrollment.

Average premiums weighted by enrollment as compared to Average Premiums

Over time we have seen trends of increasing average stand-alone Medicare Part D (PDP) premiums weighted by plan enrollment (even though projected and average Medicare Part D premiums have been decreasing over the past few years) - and this increase in weighted premiums may indicate people are either choosing more expensive stand-alone Medicare Part D plans with additional coverage benefits (such as more generous formularies or formulary structures favoring fixed co-pays for popular drugs instead of co-insurance based on ever-changing retail drug prices) - or perhaps people are seeking stability and staying with their same Medicare Part D plans even when their premiums increase and lower-premium plan alternatives are available. Again, our average premiums are for PDPs only - we are not considering any Medicare Advantage plans (MAPDs) that may include low-costing or $0 premium MAPDs.

CMS estimated average basic Medicare Part D

premiums vs. actual weighted (and unweighted) stand-alone Medicare Part D

premiums from 2007 to 2021

- We calculated the 2021 average and weighted average monthly premiums across all

stand-alone Medicare Part D plans (not considering Medicare Advantage

plans offering prescription drug coverage or MAPDs) to be $41.38 - or $40.70 when weighted by stand-alone Medicare Part D plan enrollment. (updated 09/25/2020). You can find these values and others statistics at PDP-Facts.com/2021.

- We calculated the 2020 average monthly premium across all

stand-alone Medicare Part D plans (not considering Medicare Advantage

plans offering prescription drug coverage or MAPDs) to be $40.90 - or $41.40 (adjusted to $37.72 on 09/25/2020) when weighted by stand-alone Medicare Part D plan enrollment. (updated 09/26/2019 and again on 09/25/2020)

- We calculated the 2019 average monthly premium across all stand-alone Medicare Part D plans (not considering Medicare Advantage plans offering prescription drug coverage or MAPDs) to be $47.21 - or $41.29 when weighted by stand-alone Medicare Part D plan enrollment. (updated 08/04/2019)

- We calculated the 2018 average monthly premium across all

stand-alone Medicare Part D plans (not considering Medicare Advantage

plans offering prescription drug coverage or MAPDs) to be $52.69 - or $43.69

when weighted by stand-alone Medicare Part D plan enrollment. Please

note that "enrollment weighting" can change throughout the plan year as

Medicare plans are sanctioned (and plan members leave the plan) or CMS

lifts Medicare plan sanctions and the plan resumes enrollment or plan

members use a Special Enrollment Period (SEP) to change Medicare plans mid-year. (updated 09/29/2017)

- We calculated the 2017 average monthly premium across all

stand-alone Medicare Part D plans (not considering Medicare Advantage

plans offering prescription drug coverage or MAPDs) to be $51.96 or $42.70

when weighted by stand-alone Medicare Part D plan enrollment.

Please note that "enrollment weighting" can change throughout the plan

year as Medicare plans are sanctioned or removed from sanctions.

(updated 08/02/2017)

- We calculated the 2016 average monthly premium across all stand-alone Medicare Part D plans (not considering Medicare Advantage plans offering prescription drug coverage or MAPDs) to be $53.83 or $39.08 when weighted by stand-alone Medicare Part D plan enrollment

(note: the "enrollment weighting" can change throughout the plan year as Medicare plans are sanctioned or removed from sanctions).

- We calculated the 2015 average monthly premium across all stand-alone Medicare Part D plans (not considering Medicare Advantage plans offering prescription drug coverage or MAPDs) to be $53.14 or $36.75 when weighted by stand-alone Medicare Part D plan enrollment.

- We calculated the 2014 average monthly premium across all stand-alone Medicare Part D plans (not considering Medicare Advantage plans offering prescription drug coverage or MAPDs) to be $53.80 or $41.23 when weighted by stand-alone Medicare Part D plan enrollment.

- We calculated the 2013 average monthly premium across all stand-alone Medicare Part D plans to be $53.26 or $40.63 when weighted by all stand-alone Medicare Part D plan enrollment.

- We calculated the 2012 average premium across all stand-alone Medicare Part D plans to be $53.99 or $39.62 when weighted by plan enrollment.

- In 2011, we calculated the average monthly premium across all stand-alone Medicare Part D plans as $53.77 -- or $41.05 when weighted by Medicare Part D plan enrollment.

The full text of the July 29, 2020 CMS Press Release is included below:

The average basic Part D premium will be approximately $30.50 in 2021 [as compared to $30 in 2020]. The 2021 and 2020 average basic premiums are the second lowest and lowest, respectively, average basic premiums in Part D since 2013 [see Chart above for other years]. This trend of lower Part D premiums, which have decreased by 12 percent since 2017, means that beneficiaries have saved nearly $1.9 billion in premium costs over that time. Further, Part D continues to be an extremely popular program, with enrollment increasing by 16.7 percent since 2017.

"At every turn, the Trump Administration has prioritized policies that introduce choice and competition in Part D," said CMS Administrator Seema Verma. "The result is lower prices for life-saving drugs like insulin, which will be available to Medicare beneficiaries at this fall’s Open Enrollment for no more than $35 a month. In short, Part D premiums continue to stay at their lowest levels in years even as beneficiaries enjoy a more robust set of options from which to choose a plan that meets their needs."

In addition to the $1.9 billion in premium savings for beneficiaries since 2017, the Trump Administration has produced substantial Part D program savings for taxpayers. With about 200 additional standalone prescription drug plans and 1,500 additional Medicare Advantage plans with prescription drug coverage joining the program between 2017 and 2020, and that trend expected to continue in 2021, increased market competition has led to lower costs and lower Medicare premium subsidies, which has saved taxpayers approximately $8.5 billion over the past four years.

Earlier this year, CMS launched the Part D Senior Savings Model, which will allow Medicare beneficiaries to choose a plan that provides access to a broad set of insulins at a maximum $35 copay for a month’s supply. Starting January 1, 2021, beneficiaries who select these plans will save, on average, $446 per year, or 66 percent, on their out-of-pocket costs for insulin. Beneficiaries will be able to choose from more than 1,600 participating standalone Medicare Part D prescription drug plans and Medicare Advantage plans with prescription drug coverage, all across the country this open enrollment period, which runs from October 15th through December 7th. And because the majority of participating Medicare Advantage plans with prescription drug coverage do not charge a Part D premium, beneficiaries who enroll in those plans will save on insulin and not pay any extra premiums.

In January 2020, CMS, through the Part D Payment Modernization Model, offered an innovative new opportunity for Part D plan sponsors to lower costs for beneficiaries, while improving care quality. Under this model, Part D sponsors can better manage prescription drug costs through all phases of the Part D benefit, including the catastrophic phase. Through the use of better tools and program flexibilities, sponsors are better able to negotiate on high cost drugs and design plans that increase access and lower out-of-pocket costs for beneficiaries. For CY 2021, there will be nine plan options in Utah, New Mexico, Idaho and Pennsylvania that participate in this model.

In Medicare Part D, beneficiaries choose the prescription drug plan that best meets their needs, and plans have to improve quality and lower costs to attract beneficiaries. This competitive dynamic sets up clear incentives that drive towards value. CMS has taken steps to modernize the Part D program by providing beneficiaries the opportunity to choose among plans with greater negotiating tools that have been developed in the private market and by providing patients with more transparency on drug prices. Improvements to the Medicare Part D program that CMS has made to date include:

More information on the Part D Senior Savings Model can be viewed at: https://innovation.cms.gov/ initiatives/ part-d-savings-model.

To view the 2021 Part D base beneficiary premium, the Part D national average monthly bid amount, the Part D regional low-income premium subsidy amounts, the de minimis amount, the Medicare Advantage employer group waiver plan regional payment rates, and the Medicare Advantage regional PPO benchmarks, visit:

###

[Emphasis and Highlighting added]

Trump Administration Continues to Keep Out-of-Pocket Drug Costs Low for Seniors

Today, the Centers for Medicare & Medicaid Services (CMS) announced the average basic premium for Medicare Part D prescription drug plans, which cover prescription drugs that beneficiaries pick up at a pharmacy. Under the leadership of President Trump, for the first time seniors that use insulin will be able to choose a prescription drug plan in their area that offers a broad set of insulins for no more than $35 per month per prescription.The average basic Part D premium will be approximately $30.50 in 2021 [as compared to $30 in 2020]. The 2021 and 2020 average basic premiums are the second lowest and lowest, respectively, average basic premiums in Part D since 2013 [see Chart above for other years]. This trend of lower Part D premiums, which have decreased by 12 percent since 2017, means that beneficiaries have saved nearly $1.9 billion in premium costs over that time. Further, Part D continues to be an extremely popular program, with enrollment increasing by 16.7 percent since 2017.

"At every turn, the Trump Administration has prioritized policies that introduce choice and competition in Part D," said CMS Administrator Seema Verma. "The result is lower prices for life-saving drugs like insulin, which will be available to Medicare beneficiaries at this fall’s Open Enrollment for no more than $35 a month. In short, Part D premiums continue to stay at their lowest levels in years even as beneficiaries enjoy a more robust set of options from which to choose a plan that meets their needs."

In addition to the $1.9 billion in premium savings for beneficiaries since 2017, the Trump Administration has produced substantial Part D program savings for taxpayers. With about 200 additional standalone prescription drug plans and 1,500 additional Medicare Advantage plans with prescription drug coverage joining the program between 2017 and 2020, and that trend expected to continue in 2021, increased market competition has led to lower costs and lower Medicare premium subsidies, which has saved taxpayers approximately $8.5 billion over the past four years.

Earlier this year, CMS launched the Part D Senior Savings Model, which will allow Medicare beneficiaries to choose a plan that provides access to a broad set of insulins at a maximum $35 copay for a month’s supply. Starting January 1, 2021, beneficiaries who select these plans will save, on average, $446 per year, or 66 percent, on their out-of-pocket costs for insulin. Beneficiaries will be able to choose from more than 1,600 participating standalone Medicare Part D prescription drug plans and Medicare Advantage plans with prescription drug coverage, all across the country this open enrollment period, which runs from October 15th through December 7th. And because the majority of participating Medicare Advantage plans with prescription drug coverage do not charge a Part D premium, beneficiaries who enroll in those plans will save on insulin and not pay any extra premiums.

In January 2020, CMS, through the Part D Payment Modernization Model, offered an innovative new opportunity for Part D plan sponsors to lower costs for beneficiaries, while improving care quality. Under this model, Part D sponsors can better manage prescription drug costs through all phases of the Part D benefit, including the catastrophic phase. Through the use of better tools and program flexibilities, sponsors are better able to negotiate on high cost drugs and design plans that increase access and lower out-of-pocket costs for beneficiaries. For CY 2021, there will be nine plan options in Utah, New Mexico, Idaho and Pennsylvania that participate in this model.

In Medicare Part D, beneficiaries choose the prescription drug plan that best meets their needs, and plans have to improve quality and lower costs to attract beneficiaries. This competitive dynamic sets up clear incentives that drive towards value. CMS has taken steps to modernize the Part D program by providing beneficiaries the opportunity to choose among plans with greater negotiating tools that have been developed in the private market and by providing patients with more transparency on drug prices. Improvements to the Medicare Part D program that CMS has made to date include:

- Beginning in 2021, providing more information on out-of-pocket costs for

prescription drugs to beneficiaries by requiring Part D plans to provide a real time benefit tool

to clinicians with information that they can discuss with patients on out-of-pocket drug costs

at the time a prescription is written.

- Implementing Part D legislation signed by President Trump to prohibit "gag clauses," which keep pharmacists from telling patients about lower-cost ways to obtain prescription drugs.

- Beginning in 2021, requiring the Explanation of Benefits document that Part D beneficiaries receive each month to include information on drug price increases and lower-cost therapeutic alternatives.

- Providing beneficiaries with more drug choices and empowering beneficiaries to select a plan that meets their needs by allowing plans to cover different prescription drugs for different indications, an approach used in the private sector.

- Reducing the maximum amount that low-income beneficiaries pay for certain innovative medicines known as "biosimilars," which will lower the out-of-pocket cost of these innovative medicines for these beneficiaries.

- Empowering Medicare Advantage to negotiate lower costs for physician-administered prescription drugs for seniors for the first time, as well allowing Part D plans to substitute certain generic drugs to onto plan formularies more quickly during the year, so beneficiaries immediately have access to the generic, which typically has lower cost sharing than the brand.

- Increasing competition among plans by removing the requirement that certain Part D plans have to "meaningfully differ" from each other, making more plan options available for beneficiaries.

More information on the Part D Senior Savings Model can be viewed at: https://innovation.cms.gov/ initiatives/ part-d-savings-model.

To view the 2021 Part D base beneficiary premium, the Part D national average monthly bid amount, the Part D regional low-income premium subsidy amounts, the de minimis amount, the Medicare Advantage employer group waiver plan regional payment rates, and the Medicare Advantage regional PPO benchmarks, visit:

https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Ratebooks-and-Supporting-Data.html and select "2021."

###

[Emphasis and Highlighting added]

(https://www.cms.gov/newsroom/press-releases/trump-administration-continues-keep-out-pocket-drug-costs-low-seniors)

- 2024 PY CMS Press Release: Q1News.com/1007

- 2023 PY CMS Press Release: Q1News.com/981

- 2022 PY CMS Press Release: Q1News.com/887

- 2021 PY CMS Press Release: Q1News.com/833

- 2020 PY CMS Press Release: Q1News.com/780

- 2019 PY CMS Press Release: Q1News.com/718

- 2018 PY CMS Press Release: Q1News.com/639

- 2017 PY CMS Press Release: Q1News.com/581

- 2016 PY CMS Press Release: Q1News.com/481

- 2015 PY CMS Press Release: Q1News.com/360

- 2014 PY CMS Press Release: Q1News.com/300

- 2013 PY CMS Press Release: Q1News.com/224

- 2012 PY CMS Press Release: Q1News.com/163

- 2011 PY CMS Press Release: Q1News.com/149

- 2010 PY CMS Press Release: Q1News.com/131

- 2009 PY CMS Press Release: Q1News.com/93

- 2008 PY CMS Press Release: Q1News.com/34

- 2007 PY CMS Press Release: Q1News.com/164

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service