Many counties across the country will see one or more 2020 Medicare Advantage plans discontinued in 2021

As noted in our "More 2021 Medicare

Advantage plan choices..." article,

the total number of 2021 Medicare Advantage plans across the country will increase by 13%. However, when viewed in detail, many 2020 Medicare Advantage plans will be

terminated or merged into other 2021 plans -- and many counties will see

significant changes in their Medicare Advantage plan landscape.

A Closer Look: County-Specific changes in the 2021 Medicare Advantage plan landscapes (Losses and Gains)

As an example of how the Medicare Advantage plan landscape can change on a local level, we found that in 2021, Monroe County, PA will lose 11 of the 50 currently offered 2020 Medicare Advantage plans. However, in the same county, 7 new 2021 Medicare Advantage plans will be introduced.

The counties in the chart below will have the highest number of non-renewing Medicare Advantage plans.

|

Counties

with Largest Number of Non-Renewing Medicare Advantage Plans |

|

| County | Number of Non-Renewing Plans* |

| Monroe County, PA | 11 |

| Lackawanna County, PA | 10 |

| Luzerne County, PA | 10 |

| Harris County, TX | 5 |

| Montgomery County, TX | 6 |

| Fort Bend County, TX | 6 |

| Galveston County, TX | 4 |

| Liberty County, TX | 4 |

| Polk County, TX | 4 |

| Jefferson County, TX | 4 |

| Waller County, TX | 4 |

| Brazoria County, TX | 3 |

| Bexar County, TX | 5 |

Note about "crosswalk" information: *The term "Crosswalk" is used when a 2020 Medicare plans automatically moves plan members to a different plan for 2021 because the 2020 Medicare plan will no longer be offered next year. At this time, we do not know which 2020 plans will "crosswalk" members into other 2021 plans - however, we will learn more as Medicare releases more 2021 plan data. In short, it is possible that some of these Medicare Advantage plans will terminate within the county, but transfer or "crosswalk" their 2020 plan members to a different 2021 Medicare Advantage plan.

Bottom Line: Please check to be sure that your 2020 Medicare Advantage plan is being offered in 2021. You can learn more by reading your Medicare plan's Annual Notice of Change (ANOC) letter that your plan will send you late-September or early-October. You can also telephone your current Medicare Advantage plan using the toll-free Member Services number found on your Member ID card.

Learning more about how your 2020 Medicare plan is changing in 2021.

(1) Review your Medicare plan's Annual Notice of Change (ANOC) letter that you will receive in late-September or early-October. Your ANOC will tell you how your current Medicare Part D or Medicare Advantage plan is changing next year - for example, changes in monthly premiums, deductibles, co-pays.

(2) For more information about 2020/2021 plan changes, please call Medicare at 1-800-633-4227 and speak with a Medicare representative about Medicare plans that are available in your service area.

(3) Try our Medicare Advantage plan comparison tool (MA-Compare.com). You can see more 2021 Medicare Part D plan changes using our MA-Compare tool found at: MA-Compare.com/2021 or Browse Medicare Advantage or Part D plans by state and county.

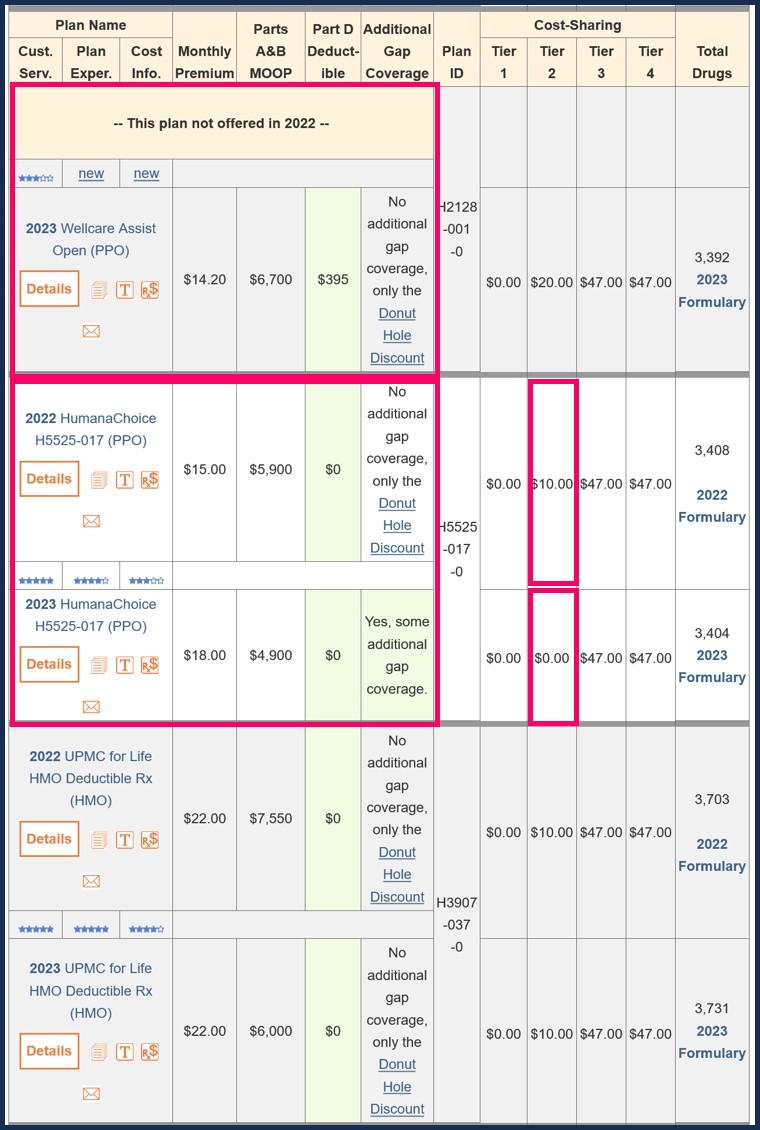

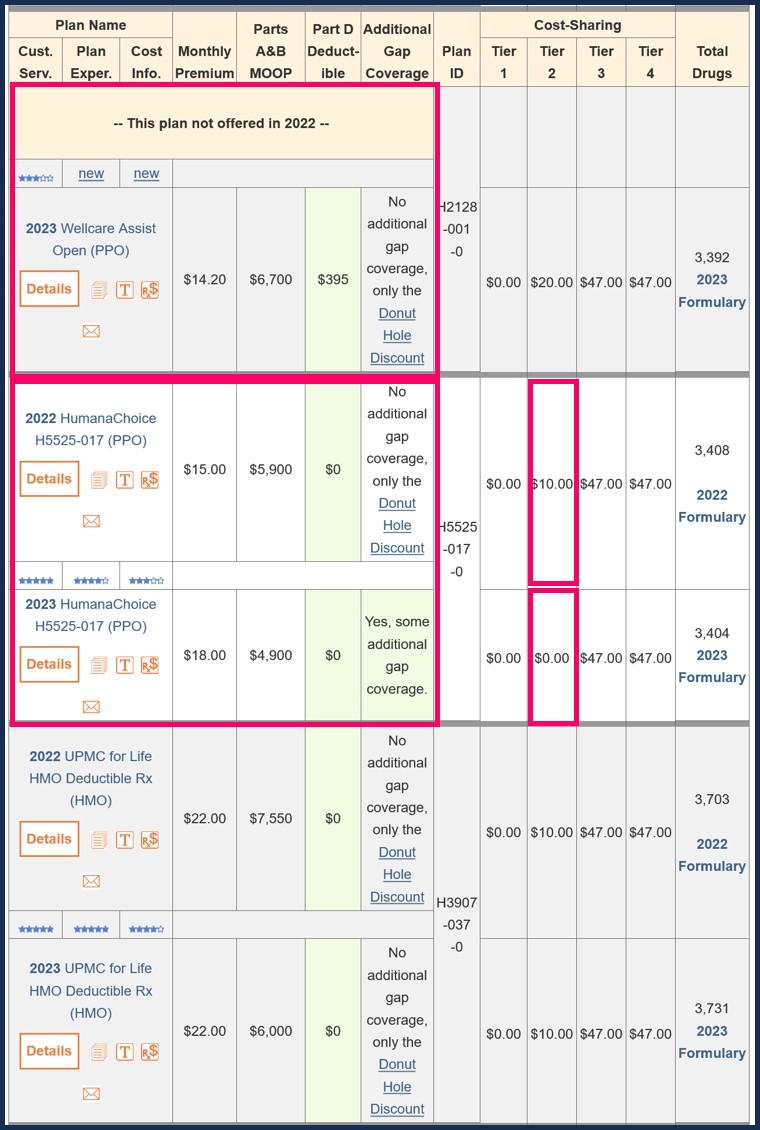

For example, in our 2020/2021 MA-Compare tool, you can enter your Zip Code and see how 2020 Medicare Advantage plans are changing in 2021 - as you can see below, this county is showing "57 Medicare Advantage plans that meet your criteria", representing the total number of Medicare Advantage plan changes. Plan changes can mean Medicare Advantage plans leaving in 2021, plans remaining in 2021, and new Medicare Advantage plans entering the area in 2021. In this example, there are 50 Medicare Advantage plans in 2020, of these 50 plans, 11 plans will exit in 2021, and 7 new Medicare Advantage plans will enter in 2021 for a new total of 46 Medicare Advantage plan in 2021.

From the graphic you can also see how existing 2020 Medicare Advantage

plans can change in 2021 with new premiums or plan co-pays or new

maximum out-of-pocket spending limits (MOOP).

From the graphic you can also see how existing 2020 Medicare Advantage

plans can change in 2021 with new premiums or plan co-pays or new

maximum out-of-pocket spending limits (MOOP).

(1) Review your Medicare plan's Annual Notice of Change (ANOC) letter that you will receive in late-September or early-October. Your ANOC will tell you how your current Medicare Part D or Medicare Advantage plan is changing next year - for example, changes in monthly premiums, deductibles, co-pays.

(2) For more information about 2020/2021 plan changes, please call Medicare at 1-800-633-4227 and speak with a Medicare representative about Medicare plans that are available in your service area.

(3) Try our Medicare Advantage plan comparison tool (MA-Compare.com). You can see more 2021 Medicare Part D plan changes using our MA-Compare tool found at: MA-Compare.com/2021 or Browse Medicare Advantage or Part D plans by state and county.

For example, in our 2020/2021 MA-Compare tool, you can enter your Zip Code and see how 2020 Medicare Advantage plans are changing in 2021 - as you can see below, this county is showing "57 Medicare Advantage plans that meet your criteria", representing the total number of Medicare Advantage plan changes. Plan changes can mean Medicare Advantage plans leaving in 2021, plans remaining in 2021, and new Medicare Advantage plans entering the area in 2021. In this example, there are 50 Medicare Advantage plans in 2020, of these 50 plans, 11 plans will exit in 2021, and 7 new Medicare Advantage plans will enter in 2021 for a new total of 46 Medicare Advantage plan in 2021.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service