Inflation Reduction Act (IRA): Changes to Medicare Part D prescription drug coverage 2023 and beyond.

The passage of the “Inflation Reduction Act of 2022” (IRA) [P.L. 117-169] on August 16, 2022 brought many changes and, in particular, will significantly impact future Medicare Part D prescription drug plan coverage and costs.

Here is a year-by-year summary of some of the top Medicare Part D prescription drug plan changes stretching from 2023 to 2029 and beyond, jump to: 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029

Beginning in 2023

Here is a year-by-year summary of some of the top Medicare Part D prescription drug plan changes stretching from 2023 to 2029 and beyond, jump to: 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029

Beginning in 2023

- Drug price increases tied to inflation

Drug companies will be required to pay rebates to Medicare if retail drug prices (for Part B and Part D drugs) rise faster than inflation (CPI-U).

- No co-pay vaccines

Medicare Part D beneficiaries will have no cost sharing for vaccines that are recommended by the Advisory Committee on Immunization Practices (ACIP), such as Shingles and Pneumonia vaccines.

- Max $35 copay for insulin

Insulin included on a Medicare Part D plan formulary will have a $35 monthly co-pay and will not be subject to the plan’s deductible. The cost of insulin will then stay consistent throughout the Initial Coverage Phase, Coverage Gap (Donut Hole), and will not exceed the $35 co-pay in the Catastrophic Coverage phase (meaning that the cost of insulin will be $35 or less).

In addition, beginning July 1, 2023, insulin furnished through Medicare Part B durable medical equipment (DME), will also have a monthly co-pay of no more than $35.

This new low-cost insulin provision is similar to the current Medicare Part D Senior Savings Model where 2021 and 2022 Medicare Part D plans had the option to offer select forms of insulin on the plan's formulary for a copay of $35 or less.

Note: Who pays for your 2023 Medicare Part D plan coverage?

Purchasing a formulary medication during your 2023 Medicare Part D prescription drug coverage

When you purchase a Part D formulary medication with a $100 retail drug cost

(or purchase a brand-name drug with a $300 retail drug cost in the Catastrophic Coverage phase)

Retail Cost You Pay Your Medicare

drug plan paysPharma

Mfgr. paysFederal

Govern.

paysAmount counted

toward your TrOOP

Threshold

Initial Deductible $100 $100 $0 $0 $0 $100 Initial Coverage phase * $100 $25 $75 $0 $0 $25 Coverage Gap - brand-name ** $100 $25 $5 $70 $0 $95 Coverage Gap - generic *** $100 $25 $75 $0 $0 $25 Catastrophic Coverage (brand drug) **** $300 $15 $45 $0 $240 n/a Catastrophic Coverage (generic drug) **** $100 $5 $15 $0 $80 n/a

* 25% co-pay or cost-sharing

** 75% Brand-name Donut Hole Discount

*** 75% Generic Donut Hole Discount

**** In 2023, you pay 5% of retail or $10.35 for brand drugs whatever is higher or 5% of retail or $4.15 for generic or multi-source drugs whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

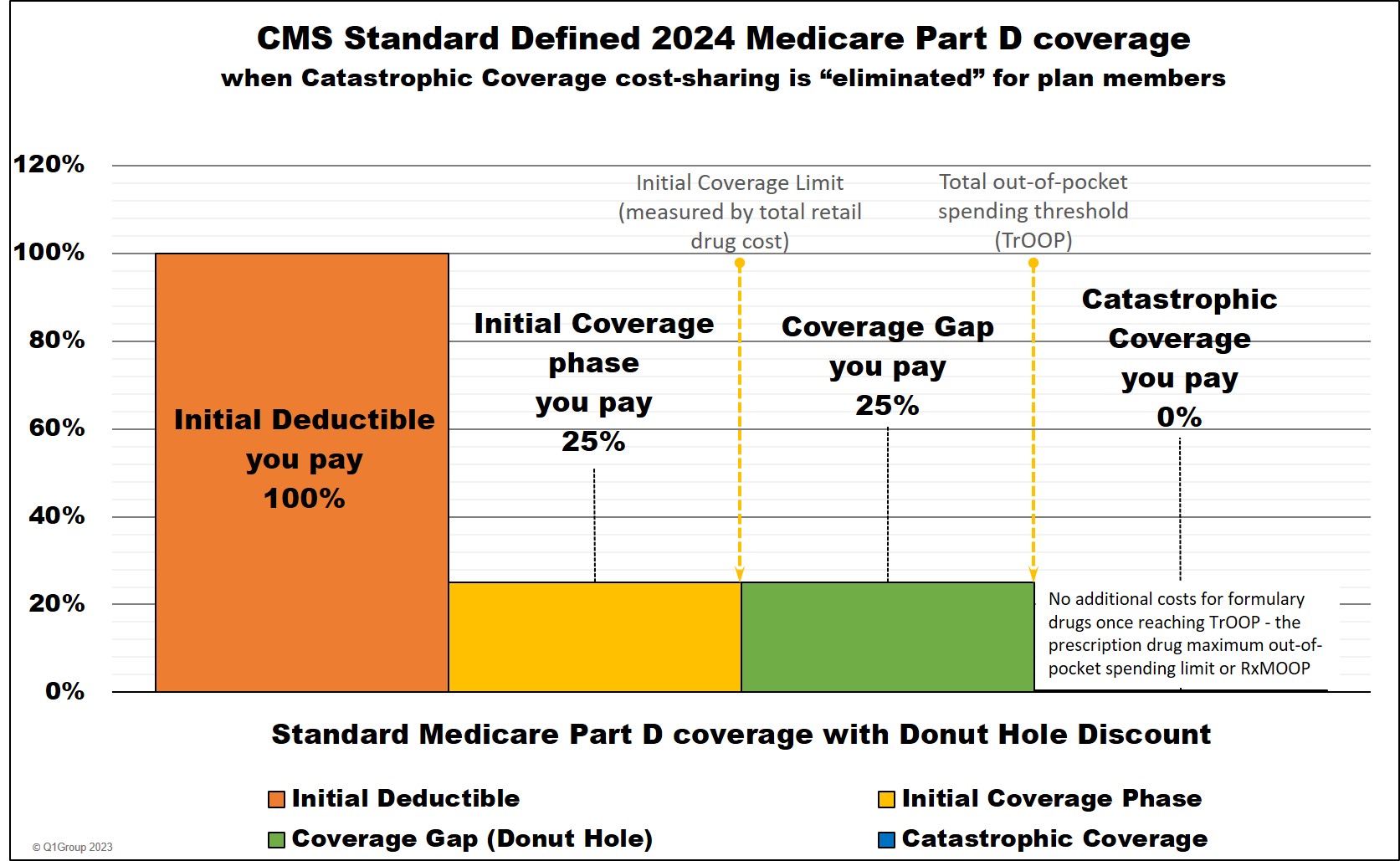

- No cost-sharing for Part D formulary drugs after reaching 2024 TrOOP threshold of $8,000

The 5% coinsurance (or any cost-sharing) will be eliminated in the Catastrophic Coverage phase with the establishment of a maximum out-of-pocket prescription drug spending limit (RxMOOP) capping formulary drug costs at the annual 2024 total out-of-pocket cost threshold or TrOOP threshold ($8,000 in 2024 - equating to Part D formulary drugs with an estimated retail value of $12,447).

2024 Medicare Part D coverage

Note: Who pays for your 2024 Medicare Part D plan coverage?

The chart below shows how example formulary drug purchases are paid throughout your 2024 Medicare Part D plan coverage -- using the CMS defined standard benefit Medicare Part D plan with a fixed 25% coinsurance for calculating cost-sharing.

Beginning January 1, 2024

When you purchase a Part D formulary medication

with a $100 retail cost

Retail Cost You Pay Your Medicare

drug plan paysPharma

Mfgr. paysFederal

Govern.

paysAmount counted

toward your TrOOP

Threshold

Initial Deductible $100 $100 $0 $0 $0 $100 Initial Coverage phase * $100 $25 $75 $0 $0 $25 Coverage Gap - brand-name ** $100 $25 $5 $70 $0 $95 Coverage Gap - generic *** $100 $25 $75 $0 $0 $25 Catastrophic Coverage (brand drug) **** $100 $0 $20 $0 $80 n/a Catastrophic Coverage (generic drug) **** $100 $0 $20 $0 $80 n/a

* 25% coinsurance

** 75% Brand-name Discount

*** 75% Generic Discount

**** In 2024, the Catastrophic Coverage phase will still exist, but a plan member will not have any out-of-pocket costs for formulary drugs after reaching the plan's $8,000 total out-of-pocket threshold (TrOOP).

- Full-LIS status expanded to include previous Partial-LIS status

Benefits for the low-income subsidy (LIS) program will be extended with full-LIS benefit qualifications increased to 150% of the Federal Poverty Level (FPL) and consequently, the current partial-LIS status (135% to 150% of FPL) will be eliminated. With full-LIS or Extra Help benefits, Medicare Part D beneficiaries can have a $0 monthly premium, no deductible, and very-low drug co-pays. (Section 11404)

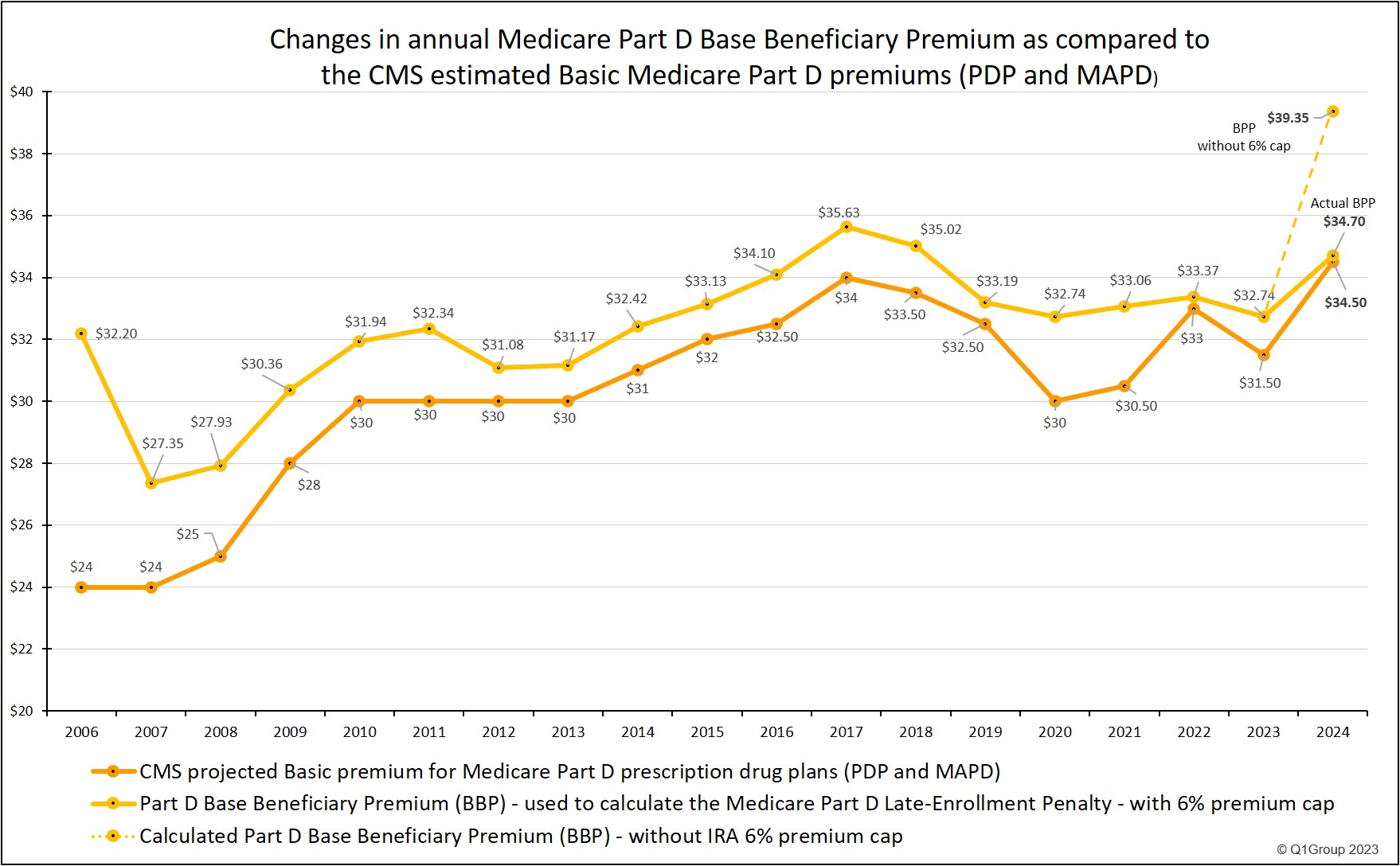

- Premium Stabilization: Eliminate large Part D premium increases with annual Part D Base plan premium not to increase more than 6% per year.

As noted by Medicare: "[b]eginning in 2024, the annual growth in the Base Beneficiary Premium [BBP] will be capped at 6 percent. The Base Beneficiary Premium for Part D is limited to the lesser of a 6 percent annual increase, or the amount that would otherwise apply under the prior methodology had the IRA not been enacted."

The Part D Base Beneficiary Premium is calculated every year by the Centers for Medicare and Medicaid Services (CMS) using, in part, the Part D national average monthly premium bid which is weighted by Medicare plan enrollment and is "used to calculate a plan-specific monthly premium for the basic benefit offered by each Part D plan, called the basic Part D premium".

In 2023, the Base Beneficiary Premium (BBP) was $32.74. As noted by Medicare: "[I]f the BBP as calculated prior to the application of section 1860D-13(a)(8) for [2024] is less than or equal to 106 percent of the BBP for [2023], that amount will be used as the BBP for CY 2024. If it is higher than 106 percent of the BBP for CY 2023, then the CY 2024 BBP will be equal to 106 percent of the CY 2023 BBP."

CMS then noted in their July 31, 2023 Fact Sheet "CMS Releases 2024 Projected Medicare Part D Premium and Bid Information":

"In 2024, the premium stabilization provision [of the IRA] reduced the increase in the base beneficiary premium by 14 percentage points; the base beneficiary premium will increase by 6% in 2024 to $34.70 [from the 2023 base premium of $32.74]. Without premium stabilization, the 2024 base beneficiary premium would have been $39.35, or $4.65 higher [or 20% higher]."

(see: https://www.cms.gov/newsroom/fact-sheets/ cms-releases-2024-projected-medicare-part-d-premium- and-bid-information)

The following chart shows how the estimated monthly Basic Part D premium has changed in comparison with the Medicare Part D Base Beneficiary Premium and how the BBP would have increase in 2024 if the value was not capped at a 6% increase.

- The Part D Senior Savings Model will no longer be continued.

The Senior Savings Model which provided select insulin products at a $35 or less co-pay through participating Part D drug plans will be discontinued with the implementation of the IRA's $35 or less copay for a 30-day supply of any insulin product covered by a Medicare Part D plan - throughout the entire plan's coverage.

As noted by CMS: "The Inflation Reduction Act caps cost-sharing for each insulin product covered under a Medicare prescription drug plan at $35 for a month’s supply, beginning January 1, 2023. Also, Part D deductibles will not apply to these covered insulin products. The Part D Senior Savings Model, which first tested a similar benefit in Model-participating plans, will end on December 31, 2023." (see: https://innovation.cms.gov/media/document/partd-sensav-hpms-status-update-feb2023)

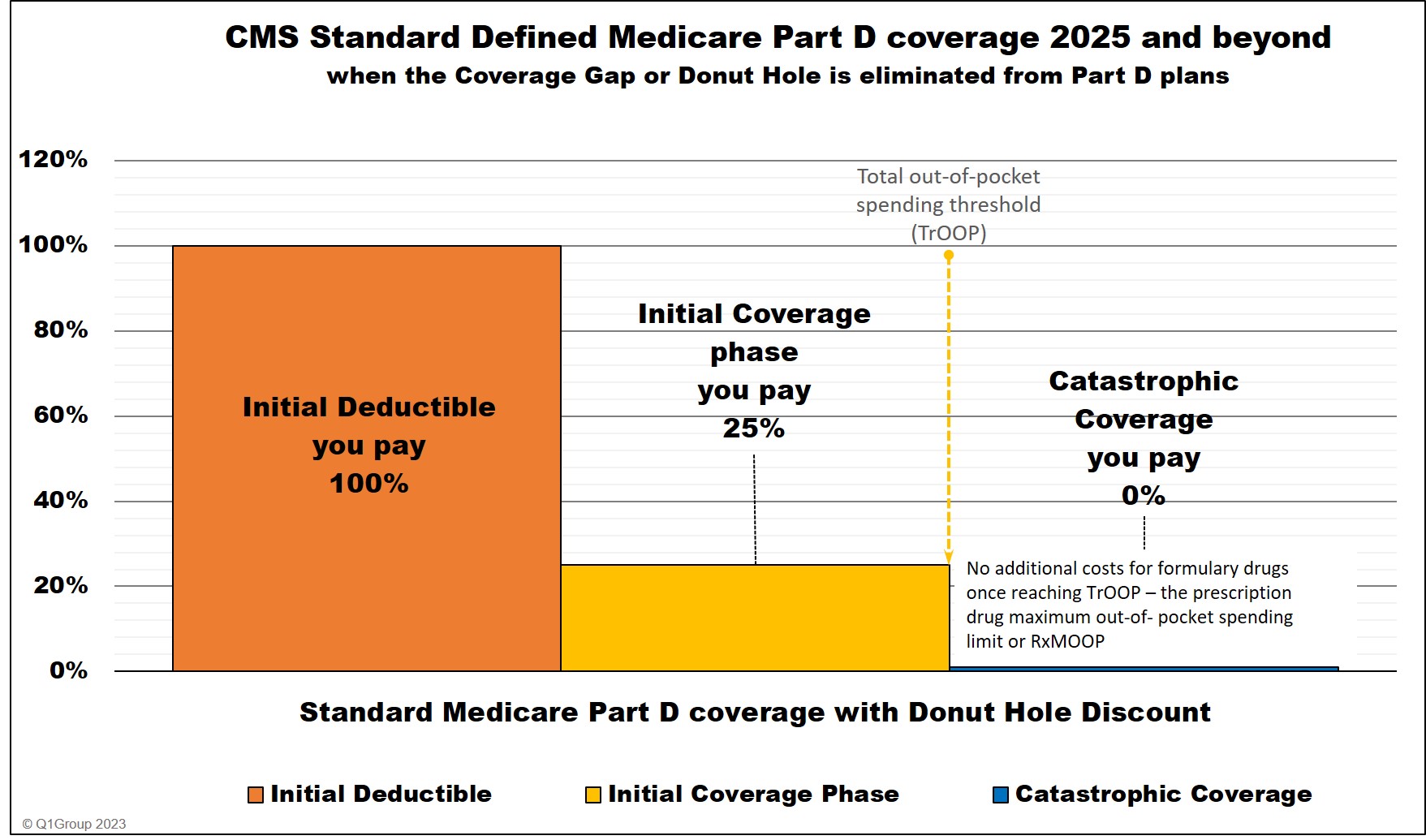

Beginning in 2025

- No cost for Part D formulary drugs after reaching $2,000 out-of-pocket cap

Medicare Part D beneficiaries will have a $2,000 maximum cap on out-of-pocket spending for Part D formulary drugs (RxMOOP). In 2025, the $2,000 RxMOOP should be reached when a person purchases Medicare Part D formulary drugs with a retail value totaling $6,230. In other words, starting in 2025, Medicare Part D beneficiaries will not spend more than $2,000 out-of-pocket for formulary drugs.

The $2,000 RxMOOP or out-of-pocket spending limit can increase every year like other Medicare Part D parameters*.

Note: Who pays for your Medicare Part D plan coverage in 2025 and and beyond?

The chart below shows how example formulary drug purchases are paid throughout your 2025 Medicare Part D plan coverage -- using the CMS defined standard benefit Medicare Part D plan with a fixed 25% coinsurance for calculating cost-sharing.

Beginning January 1, 2025

When you purchase a Part D formulary medication

with a $100 retail cost

Brand-name

Drug

Retail CostYou Pay Your Medicare

drug plan paysPharma

Mfgr. paysFederal

Govern.

paysAmount counted

toward your

RxMOOP

Threshold

Initial Deductible (if any)

$100 $100 $0 $0 $0 $100 Initial Coverage phase - brand-drugs * $100 $25 $65 $10** $0 $25 Initial Coverage phase - generic-drugs * $100 $25 $75 $0 $0 $25 Catastrophic Coverage (brand drug) **** $100 $0 $60 $20 $20 n/a Catastrophic Coverage (generic drug) **** $100 $0 $60 $0 $40 n/a

* 25% coinsurance until you reach the $2,000 RxMOOP, then your Part D formulary drug costs are $0 for the remainder of the year.

** The 10% brand-name drug manufacturer discount applied in the 2025 Initial Coverage Phase (after the standard deductible) does not apply toward the $2,000 TrOOP or RxMOOP threshold

**** Starting in 2025, the Coverage Gap (or Donut Hole) will no longer exist for plan members. A plan member will stay in the Initial Coverage phase until exceeding the plan's $2,000 out-of-pocket spending threshold and enter Catastrophic Coverage where for the remainder of the year, the person will not have any out-of-pocket costs for formulary drugs. As noted above, the $2,000 out-of-pocket threshold or RxMOOP can change every year.

- Change to Medicare Part D plan designs: Coverage Gap phase eliminated

With the addition of the $2,000 RxMOOP, Medicare Part D plans will have only three parts of coverage: (1) the Initial Deductible (if any), (2) the Initial Coverage phase that would continue until the $2,000 RxMOOP is met, and (3) the Catastrophic Coverage phase where a plan member will have no additional cost-sharing for formulary drugs for the remainder of the year. Medicare Part D plans will no longer have the Part D Coverage Gap (Donut Hole with the accompanying Donut Hole discount).

Medicare Part D coverage 2025 and beyond

- A person's drug costs can be evenly spread over the year

In 2025, the "Medicare Prescription Payment Plan" will begin and will require Medicare Part D plans to provide plan members an option to spread their monthly prescription drug costs evenly over the year. For example, if a person purchases an expensive medication in January 2025 and the cost exceeds the $2,000 out-of-pocket threshold, the person could spread the $2,000 cost evenly over the entire year to lessen the impact of a single $2,000 payment with monthly payments capped at $167. Again, after reaching the $2,000 RxMOOP, the plan member would not pay any additional cost-sharing for formulary drugs through the remainder of the year.

Beginning in 2026

*1860D-2(b)(6) Annual percentage increase - The annual percentage increase specified in this paragraph for a year is equal to the annual percentage increase in average per capita aggregate expenditures for covered part D drugs in the United States for part D eligible individuals, as determined by the Secretary for the 12-month period ending in July of the previous year using such methods as the [HHS] Secretary shall specify.

** 1860D-2(b)(9)(D) APPLICABLE COPAYMENT AMOUNT.—

In this paragraph, the term ‘applicable copayment amount’ means, with respect to a covered insulin product under a prescription drug plan or an MA–PD plan dispensed —

(i) during plan years 2023, 2024, and 2025, $35; and

(ii) during plan year 2026 and each subsequent plan year, the lesser of—

(I) $35;

(II) an amount equal to 25 percent of the maximum fair price established for the covered insulin production accordance with part E of title XI [PRICE NEGOTIATION PROGRAM TO LOWER PRICES FOR CERTAIN HIGH-PRICED SINGLE SOURCE DRUGS];or

(III) an amount equal to 25 percent of the negotiated price of the covered insulin product under the prescription drug plan or MA–PD plan.

See also:

The New Medicare Drug Bill Is Big, But Seniors Won't See Many Of Its Benefits For Years

https://www.forbes.com/sites/howardgleckman/2022/08/10/the-new-medicare-drug-bill-is-big-but-seniors-wont-see-many-of-its-benefits-for-years

Calendar Year (CY) 2024 Advance Notice for the Medicare Advantage (MA) and Part D Prescription Drug Programs -https://www.cms.gov/files/document/2024-advance-notice.pdf

What is RxMOOP? Q1FAQ.com/732

Sources include:

https://www.kff.org/medicare/understanding-the-health-provisions-in-the-senate-reconciliation-legislation/

Urban Institute: "Capping Medicare Beneficiary Part D Spending at $2,000: Who Would It Help and How Much?" https://www.urban.org/research/publication/capping-medicare-beneficiary-part-d-spending-2000-who-would-it-help-and-how

see: Subtitle B—Prescription Drug Pricing Reform

PART 1—LOWERING PRICES THROUGH DRUG PRICE NEGOTIATION

SEC. 11001. PROVIDING FOR LOWER PRICES FOR CERTAIN HIGH-PRICED SINGLE SOURCE DRUGS.

PART E—PRICE NEGOTIATION PROGRAM TO LOWER PRICES FOR CERTAIN HIGH-PRICED SINGLE SOURCE DRUGS

PART 2 — PRESCRIPTION DRUG INFLATION REBATES

SEC. 11101. MEDICARE PART B REBATE BY MANUFACTURERS

SEC. 11102. MEDICARE PART D REBATE BY MANUFACTURERS

PART 3—PART D IMPROVEMENTS AND MAXIMUM OUT-OF-POCKET CAP FOR MEDICARE BENEFICIARIES

SEC. 11201. MEDICARE PART D BENEFIT REDESIGN

(Social Security Act SEC. 1860D–14C. MANUFACTURER DISCOUNT PROGRAM)

SEC. 11202. MAXIMUM MONTHLY CAP ON COST-SHARING PAYMENTS UNDER PRESCRIPTION DRUG

PLANS AND MA–PD PLANS

PART 5—MISCELLANEOUS

SEC. 11401. COVERAGE OF ADULT VACCINES RECOMMENDED BY THE ADVISORY COMMITTEE5

ON IMMUNIZATION PRACTICES UNDER MEDICARE PART D

SEC. 11404. EXPANDING ELIGIBILITY FOR LOW-INCOME SUBSIDIES UNDER PART D OF THE MEDICARE PROGRAM.

SEC. 11406. APPROPRIATE COST-SHARING FOR COVERED INSULIN PRODUCTS UNDER MEDICARE PART D.

SEC. 11407. LIMITATION ON MONTHLY COINSURANCE AND ADJUSTMENTS TO SUPPLIER PAYMENT UNDER MEDICARE PART B FOR INSULIN FURNISHED THROUGH DURABLE MEDICAL EQUIPMENT.

- Federal government drug price negotiation

In 2026, HHS will be allowed to negotiate prices for 10 Medicare Part D drugs (single-source drugs with the highest Medicare Part D spending over the past 12 months).

- Insulin copay may be less than $35

Insulin covered by a Medicare Part D plan will cost the lesser of the $35 co-pay or 25% of the retail price (as negotiated by the plan or by the government** (HHS)).

- Federal government drug price negotiation

The Department of Health and Human Services [HHS] will negotiate prices for 15 additional Medicare Part D drugs with high spending.

- Federal government drug price negotiation

HHS will negotiate prices for 15 Medicare Part D and Part B drugs with high spending.

- Federal government drug price negotiation

HHS will negotiate prices for 20 additional Medicare Part D and Part B drugs with high spending.

*1860D-2(b)(6) Annual percentage increase - The annual percentage increase specified in this paragraph for a year is equal to the annual percentage increase in average per capita aggregate expenditures for covered part D drugs in the United States for part D eligible individuals, as determined by the Secretary for the 12-month period ending in July of the previous year using such methods as the [HHS] Secretary shall specify.

** 1860D-2(b)(9)(D) APPLICABLE COPAYMENT AMOUNT.—

In this paragraph, the term ‘applicable copayment amount’ means, with respect to a covered insulin product under a prescription drug plan or an MA–PD plan dispensed —

(i) during plan years 2023, 2024, and 2025, $35; and

(ii) during plan year 2026 and each subsequent plan year, the lesser of—

(I) $35;

(II) an amount equal to 25 percent of the maximum fair price established for the covered insulin production accordance with part E of title XI [PRICE NEGOTIATION PROGRAM TO LOWER PRICES FOR CERTAIN HIGH-PRICED SINGLE SOURCE DRUGS];or

(III) an amount equal to 25 percent of the negotiated price of the covered insulin product under the prescription drug plan or MA–PD plan.

See also:

The New Medicare Drug Bill Is Big, But Seniors Won't See Many Of Its Benefits For Years

https://www.forbes.com/sites/howardgleckman/2022/08/10/the-new-medicare-drug-bill-is-big-but-seniors-wont-see-many-of-its-benefits-for-years

Calendar Year (CY) 2024 Advance Notice for the Medicare Advantage (MA) and Part D Prescription Drug Programs -https://www.cms.gov/files/document/2024-advance-notice.pdf

What is RxMOOP? Q1FAQ.com/732

Sources include:

https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_of_2022.pdf

https://www.congress.gov/bill/117th-congress/house-bill/5376/text

The Kaiser Family Foundation (KFF):

"Understanding the Health Provisions in the Senate Reconciliation Legislation" https://www.congress.gov/bill/117th-congress/house-bill/5376/text

https://www.kff.org/medicare/understanding-the-health-provisions-in-the-senate-reconciliation-legislation/

Urban Institute: "Capping Medicare Beneficiary Part D Spending at $2,000: Who Would It Help and How Much?" https://www.urban.org/research/publication/capping-medicare-beneficiary-part-d-spending-2000-who-would-it-help-and-how

see: Subtitle B—Prescription Drug Pricing Reform

PART 1—LOWERING PRICES THROUGH DRUG PRICE NEGOTIATION

SEC. 11001. PROVIDING FOR LOWER PRICES FOR CERTAIN HIGH-PRICED SINGLE SOURCE DRUGS.

PART E—PRICE NEGOTIATION PROGRAM TO LOWER PRICES FOR CERTAIN HIGH-PRICED SINGLE SOURCE DRUGS

PART 2 — PRESCRIPTION DRUG INFLATION REBATES

SEC. 11101. MEDICARE PART B REBATE BY MANUFACTURERS

SEC. 11102. MEDICARE PART D REBATE BY MANUFACTURERS

PART 3—PART D IMPROVEMENTS AND MAXIMUM OUT-OF-POCKET CAP FOR MEDICARE BENEFICIARIES

SEC. 11201. MEDICARE PART D BENEFIT REDESIGN

(Social Security Act SEC. 1860D–14C. MANUFACTURER DISCOUNT PROGRAM)

SEC. 11202. MAXIMUM MONTHLY CAP ON COST-SHARING PAYMENTS UNDER PRESCRIPTION DRUG

PLANS AND MA–PD PLANS

PART 5—MISCELLANEOUS

SEC. 11401. COVERAGE OF ADULT VACCINES RECOMMENDED BY THE ADVISORY COMMITTEE5

ON IMMUNIZATION PRACTICES UNDER MEDICARE PART D

SEC. 11404. EXPANDING ELIGIBILITY FOR LOW-INCOME SUBSIDIES UNDER PART D OF THE MEDICARE PROGRAM.

SEC. 11406. APPROPRIATE COST-SHARING FOR COVERED INSULIN PRODUCTS UNDER MEDICARE PART D.

SEC. 11407. LIMITATION ON MONTHLY COINSURANCE AND ADJUSTMENTS TO SUPPLIER PAYMENT UNDER MEDICARE PART B FOR INSULIN FURNISHED THROUGH DURABLE MEDICAL EQUIPMENT.

News Categories

Compare Local Pharmacy Prices Using a Drug Discount Card

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service