2023 State Low-Income Subsidy Benchmark Premium Amounts - with a comparison of benchmark changes since 2006

The Centers for Medicare and Medicaid Services (CMS) released the 2023 low-income premium subsidy

amounts (or Benchmark premiums) for Medicare Part D plans on July 29, 2022, and in 2023, seven (7) regions will lower their Medicare Part D Low-Income Subsidy (LIS)

benchmark premium, one will remain the same, and twenty-six (26) regions will increase

their benchmark premium.

Here are a few state highlights of the 2023 LIS benchmarks:

What is the LIS Benchmark Premium?

The benchmark premium is the maximum* monthly Medicare Part D plan premium that will be paid by CMS for persons qualifying for the low-income subsidy (LIS) or the Medicare Part D "Extra Help" program.

For example, if you qualify for full Extra Help benefits and live in a state with a benchmark premium of $25, the Medicare Part D Extra Help program will pay for the premium of a "Basic" Medicare Part D plan up to this premium level (or slightly above*) and you will have a $0 monthly premium for your drug coverage. If you qualify for partial Extra Help, your monthly premium will not be $0, but your premium will be reduced.

What happens when someone joins a Medicare plan that has a premium higher than the benchmark?

If a person receiving the low-income subsidy enrolls in a Medicare Part D plan that has a premium higher than their state's benchmark premium, the beneficiary is responsible for paying the difference in premiums - unless the difference between the benchmark premium and the plan premium are relatively small (please see the explanation of the de minimis premium policy below*).

In addition, if the full-LIS person enrolls in a low-premium Medicare Part D plan with "enhanced" features, they may also pay a partial premium, even when the plan premium is below the benchmark since the plan is not considered "basic".

Do benchmark premiums change over time?

Yes. State LIS benchmark premiums usually change every year and annual decreases (or increases) in Benchmark Premiums may provide an indication that the state will offer Medicare Part D beneficiaries more (or fewer) stand-alone Medicare Part D plans qualifying for the $0 LIS Medicare Part D premium.

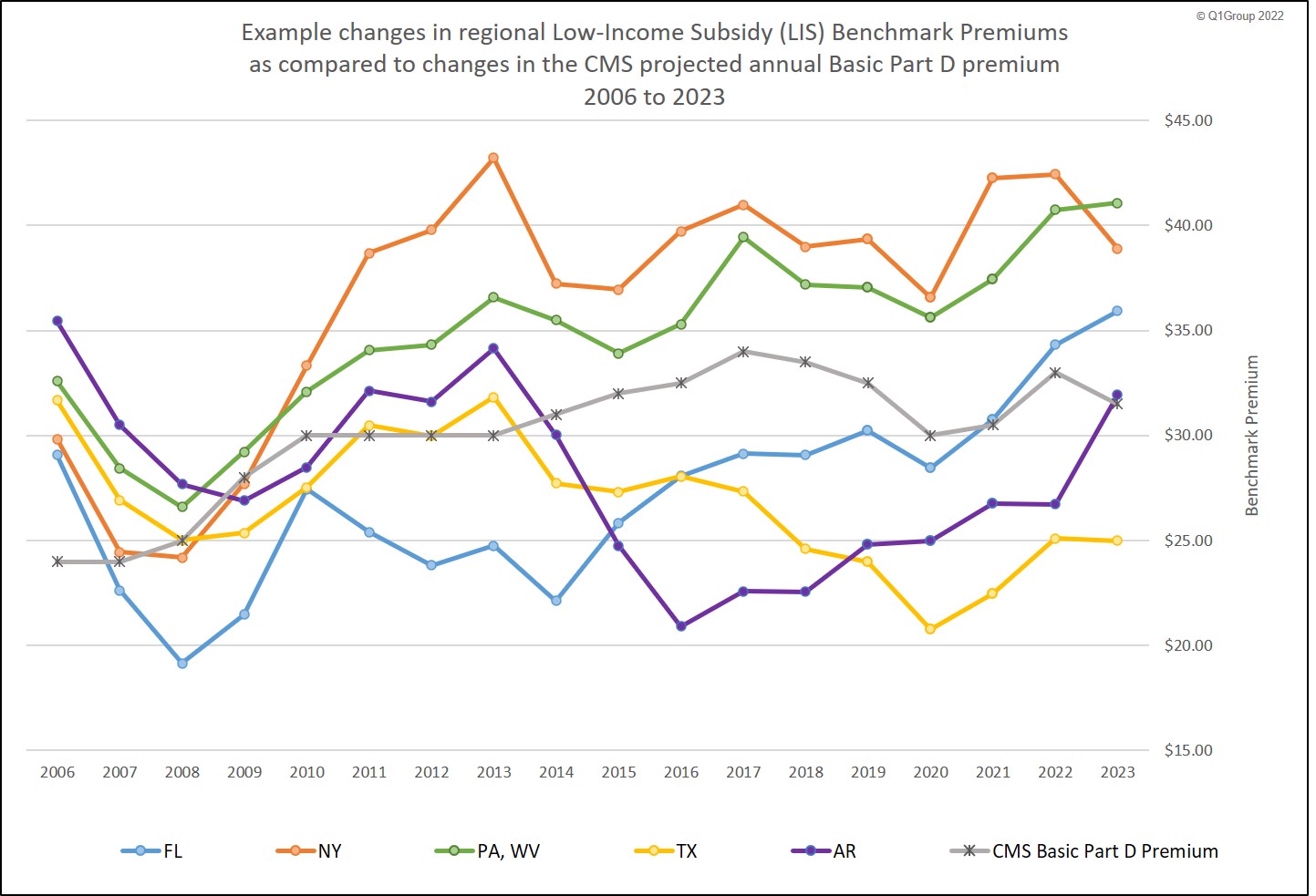

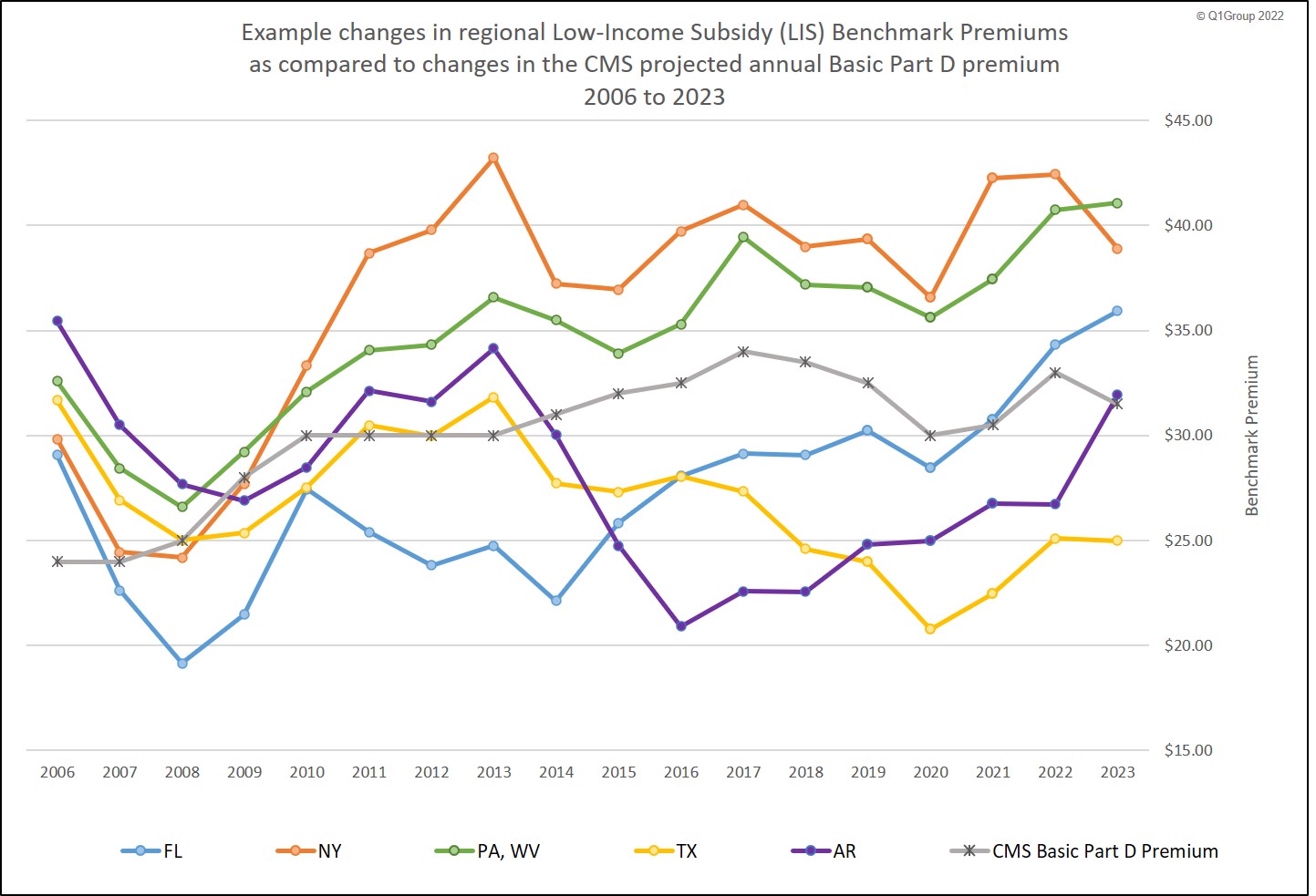

As reference, the following chart shows how the annual Medicare Part D LIS Benchmark premiums in a few example states have fluctuated since 2006. The example states were chosen due to their relatively large population of seniors or Medicare beneficiaries.

You can click on the premium subsidy in the table below to see the stand-alone Medicare Part D prescription drug plans (PDPs) for the selected year that qualify for the $0 LIS premium (the 2023 Medicare Part D plan information will be available no later than October 1, 2022).

Here are a few state highlights of the 2023 LIS benchmarks:

- New York

will see the largest benchmark decrease with a 2023 LIS subsidy of

$38.90

as compared to

$42.43 in 2022.

New Jersey

had the largest benchmark decrease last year.

- South Carolina

will have the largest benchmark increase with a 2023 LIS benchmark

of $37.84

as compared to

$31.12

in 2022.

New Mexico

had the largest benchmark increase in 2022.

- Wisconsin

will have the highest 2023 benchmark premium of all CMS PDP

regions at $43.10.

Last year, Idaho and Utah had the highest benchmark premium of $42.93.

- Texas continues to have the lowest benchmark premium at $25.00. Texas had the lowest 2022 benchmark at $25.10.

What is the LIS Benchmark Premium?

The benchmark premium is the maximum* monthly Medicare Part D plan premium that will be paid by CMS for persons qualifying for the low-income subsidy (LIS) or the Medicare Part D "Extra Help" program.

For example, if you qualify for full Extra Help benefits and live in a state with a benchmark premium of $25, the Medicare Part D Extra Help program will pay for the premium of a "Basic" Medicare Part D plan up to this premium level (or slightly above*) and you will have a $0 monthly premium for your drug coverage. If you qualify for partial Extra Help, your monthly premium will not be $0, but your premium will be reduced.

What happens when someone joins a Medicare plan that has a premium higher than the benchmark?

If a person receiving the low-income subsidy enrolls in a Medicare Part D plan that has a premium higher than their state's benchmark premium, the beneficiary is responsible for paying the difference in premiums - unless the difference between the benchmark premium and the plan premium are relatively small (please see the explanation of the de minimis premium policy below*).

In addition, if the full-LIS person enrolls in a low-premium Medicare Part D plan with "enhanced" features, they may also pay a partial premium, even when the plan premium is below the benchmark since the plan is not considered "basic".

Do benchmark premiums change over time?

Yes. State LIS benchmark premiums usually change every year and annual decreases (or increases) in Benchmark Premiums may provide an indication that the state will offer Medicare Part D beneficiaries more (or fewer) stand-alone Medicare Part D plans qualifying for the $0 LIS Medicare Part D premium.

As reference, the following chart shows how the annual Medicare Part D LIS Benchmark premiums in a few example states have fluctuated since 2006. The example states were chosen due to their relatively large population of seniors or Medicare beneficiaries.

You can click on the premium subsidy in the table below to see the stand-alone Medicare Part D prescription drug plans (PDPs) for the selected year that qualify for the $0 LIS premium (the 2023 Medicare Part D plan information will be available no later than October 1, 2022).

| CMS Region |

State(s) |

2023 Subsidy |

2022 Subsidy |

2021 Subsidy |

2020 Subsidy |

2019 Subsidy |

2018 Subsidy |

2017 Subsidy |

2016 Subsidy |

2015 Subsidy |

2014 Subsidy |

2013 Subsidy |

2012 Subsidy |

2011 Subsidy |

2010 Subsidy |

2009 Subsidy |

2008 Subsidy |

2007 Subsidy |

2006 Subsidy |

| 1 | NH, ME | $31.10 | $30.53 | $29.08 | $29.67 | $33.20 | $34.27 | $32.99 | $32.82 | $29.60 | $27.78 | $33.49 | $31.18 | $28.90 | $26.96 | $28.12 | $30.64 | $30.72 | $36.09 |

| 2 | CT, MA, RI, VT | $36.27 | $36.27 | $35.16 | $34.77 | $36.20 | $35.58 | $34.83 | $31.14 | $29.65 | $27.99 | $31.35 | $32.04 | $33.66 | $34.57 | $31.74 | $29.17 | $27.35 | $30.27 |

| 3 | NY | $38.90 | $42.43 | $42.27 | $36.55 | $39.33 | $38.98 | $40.99 | $39.73 | $36.94 | $37.23 | $43.22 | $39.79 | $38.69 | $33.32 | $27.71 | $24.18 | $24.45 | $29.83 |

| 4 | NJ | $35.02 | $37.07 | $37.33 | $35.48 | $37.16 | $35.97 | $40.81 | $39.98 | $37.64 | $37.10 | $37.04 | $36.00 | $35.74 | $35.01 | $30.99 | $31.23 | $28.12 | $31.37 |

| 5 | DE, DC, MD | $39.22 | $36.96 | $32.30 | $29.65 | $29.98 | $30.70 | $33.22 | $33.45 | $30.61 | $32.34 | $34.96 | $34.57 | $34.28 | $33.71 | $30.85 | $30.78 | $29.65 | $33.46 |

| 6 | PA, WV | $41.08 | $40.74 | $37.45 | $35.63 | $37.03 | $37.18 | $39.45 | $35.30 | $33.91 | $35.50 | $36.57 | $34.32 | $34.07 | $32.09 | $29.23 | $26.59 | $28.45 | $32.59 |

| 7 | VA | $34.55 | $35.11 | $31.37 | $27.88 | $30.61 | $30.05 | $32.52 | $32.78 | $29.47 | $29.34 | $30.06 | $30.95 | $33.25 | $34.15 | $31.72 | $31.03 | $30.52 | $34.42 |

| 8 | NC | $38.38 | $35.82 | $30.34 | $26.36 | $28.91 | $30.16 | $31.37 | $31.07 | $29.34 | $28.28 | $32.04 | $33.00 | $34.87 | $34.90 | $33.45 | $33.43 | $32.13 | $36.30 |

| 9 | SC | $37.84 | $31.12 | $27.56 | $23.78 | $24.55 | $23.03 | $26.03 | $26.57 | $28.78 | $33.87 | $38.75 | $36.15 | $36.90 | $35.02 | $32.01 | $31.12 | $31.41 | $34.88 |

| 10 | GA | $37.30 | $32.38 | $29.80 | $25.34 | $25.68 | $24.53 | $26.43 | $25.78 | $26.47 | $29.32 | $34.22 | $31.18 | $32.83 | $29.62 | $29.16 | $30.04 | $31.07 | $33.15 |

| 11 | FL | $35.92 | $34.32 | $30.76 | $28.47 | $30.25 | $29.07 | $29.13 | $28.07 | $25.83 | $22.13 | $24.76 | $23.82 | $25.41 | $27.45 | $21.47 | $19.16 | $22.63 | $29.07 |

| 12 | AL, TN | $35.16 | $32.72 | $30.20 | $28.69 | $31.40 | $30.62 | $31.76 | $31.32 | $30.20 | $29.67 | $33.69 | $31.71 | $33.72 | $30.73 | $29.80 | $28.29 | $29.60 | $32.33 |

| 13 | MI | $32.65 | $31.49 | $30.08 | $30.15 | $32.91 | $33.28 | $34.17 | $33.47 | $31.46 | $32.46 | $34.18 | $34.37 | $34.71 | $34.92 | $32.08 | $30.49 | $30.79 | $33.22 |

| 14 | OH | $34.71 | $33.54 | $29.83 | $28.54 | $32.92 | $31.95 | $32.30 | $29.52 | $28.64 | $28.93 | $29.87 | $29.41 | $29.67 | $30.47 | $28.40 | $26.82 | $28.51 | $30.69 |

| 15 | IN, KY | $28.11 | $29.65 | $29.61 | $29.52 | $31.75 | $31.24 | $32.06 | $31.90 | $31.79 | $34.95 | $37.22 | $35.92 | $36.44 | $35.75 | $33.95 | $33.50 | $32.42 | $35.69 |

| 16 | WI | $43.10 | $42.29 | $40.70 | $39.91 | $40.80 | $40.04 | $40.09 | $37.70 | $35.32 | $37.03 | $38.25 | $36.67 | $36.96 | $38.20 | $38.15 | $31.03 | $29.67 | $31.27 |

| 17 | IL | $27.35 | $29.05 | $27.43 | $26.04 | $27.37 | $27.50 | $28.68 | $29.60 | $28.23 | $28.59 | $30.94 | $30.23 | $30.65 | $31.59 | $30.18 | $30.26 | $29.66 | $31.60 |

| 18 | MO | $36.27 | $33.42 | $30.48 | $30.10 | $32.06 | $29.99 | $30.07 | $26.13 | $28.28 | $31.21 | $34.59 | $32.05 | $34.92 | $40.01 | $31.89 | $26.71 | $27.88 | $31.37 |

| 19 | AR | $31.93 | $26.72 | $26.76 | $24.96 | $24.81 | $22.56 | $22.58 | $20.92 | $24.76 | $30.03 | $34.15 | $31.62 | $32.12 | $28.48 | $26.89 | $27.69 | $30.51 | $35.45 |

| 20 | MS | $31.92 | $29.22 | $26.95 | $25.13 | $26.85 | $25.81 | $26.53 | $28.14 | $29.33 | $30.56 | $34.56 | $33.40 | $33.01 | $33.02 | $31.53 | $31.35 | $31.70 | $36.39 |

| 21 | LA | $38.35 | $36.35 | $34.27 | $32.21 | $33.06 | $30.92 | $32.80 | $32.13 | $31.28 | $31.75 | $37.33 | $35.01 | $34.75 | $31.32 | $27.48 | $24.62 | $28.45 | $34.14 |

| 22 | TX | $25.00 | $25.10 | $22.48 | $20.78 | $23.96 | $24.59 | $27.34 | $28.05 | $27.31 | $27.73 | $31.83 | $29.99 | $30.48 | $27.53 | $25.36 | $25.01 | $26.93 | $31.68 |

| 23 | OK | $32.90 | $30.90 | $29.11 | $28.74 | $30.84 | $29.65 | $30.83 | $30.72 | $29.97 | $30.18 | $32.80 | $31.53 | $33.62 | $32.31 | $29.36 | $28.04 | $30.35 | $35.13 |

| 24 | KS | $32.96 | $32.92 | $31.78 | $31.53 | $32.46 | $31.43 | $30.27 | $30.67 | $30.32 | $34.21 | $36.04 | $36.67 | $36.94 | $35.77 | $33.66 | $30.62 | $30.56 | $33.44 |

| 25 | IA, MN, MT, ND, NE, SD, WY | $39.87 | $38.88 | $37.96 | $35.37 | $35.78 | $33.99 | $34.02 | $30.93 | $30.00 | $32.23 | $34.61 | $36.02 | $37.47 | $37.55 | $33.19 | $30.61 | $29.50 | $33.11 |

| 26 | NM | $36.41 | $34.31 | $28.17 | $23.58 | $26.61 | $24.60 | $22.84 | $20.72 | $21.19 | $19.92 | $22.54 | $21.27 | $22.62 | $21.42 | $20.55 | $19.28 | $22.72 | $25.95 |

| 27 | CO | $41.62 | $39.81 | $34.30 | $31.26 | $32.00 | $34.18 | $32.04 | $29.89 | $28.93 | $26.90 | $31.92 | $32.38 | $32.85 | $30.99 | $30.17 | $24.59 | $27.37 | $28.92 |

| 28 | AZ | $42.60 | $40.04 | $36.07 | $32.09 | $32.62 | $32.88 | $35.11 | $33.17 | $32.89 | $27.49 | $29.41 | $26.84 | $27.34 | $24.75 | $16.22 | $15.92 | $21.37 | $24.62 |

| 29 | NV | $32.50 | $31.68 | $26.48 | $23.91 | $25.33 | $27.08 | $27.09 | $25.38 | $24.25 | $22.78 | $20.35 | $22.97 | $30.06 | $27.31 | $20.20** | $16.64 | $20.56 | $23.46 |

| 30 | OR, WA | $41.03 | $40.48 | $35.97 | $32.57 | $33.80 | $34.58 | $34.83 | $33.80 | $33.81 | $34.82 | $37.46 | $36.45 | $35.30 | $35.60 | $31.76 | $30.19 | $28.71 | $30.60 |

| 31 | ID, UT | $42.95 | $42.93 | $38.80 | $36.84 | $38.66 | $40.24 | $39.66 | $39.51 | $39.74 | $39.02 | $42.15 | $40.86 | $40.68 | $40.89 | $37.46 | $33.53 | $31.77 | $33.62 |

| 32 | CA | $38.86 | $33.16 | $31.45 | $32.01 | $34.79 | $35.51 | $36.28 | $31.05 | $28.84 | $28.10 | $29.88 | $30.86 | $32.35 | $28.99 | $24.86 | $19.80 | $21.03 | $23.25 |

| 33 | HI | $35.26 | $35.98 | $31.12 | $25.21 | $25.73 | $25.38 | $26.52 | $26.23 | $27.91 | $25.69 | $33.33 | $30.41 | $29.76 | $25.55 | $25.01 | $24.32 | $26.35 | $27.44 |

| 34 | AK | $34.78 | $32.63 | $29.77 | $31.36 | $33.60 | $32.92 | $34.06 | $36.36 | $32.86 | $37.07 | $34.71 | $36.46 | $36.89 | $38.00 | $36.00 | $36.42 | $33.56 | $34.66 |

How many Medicare Part D plans are offered each year that qualify for the $0 premium?

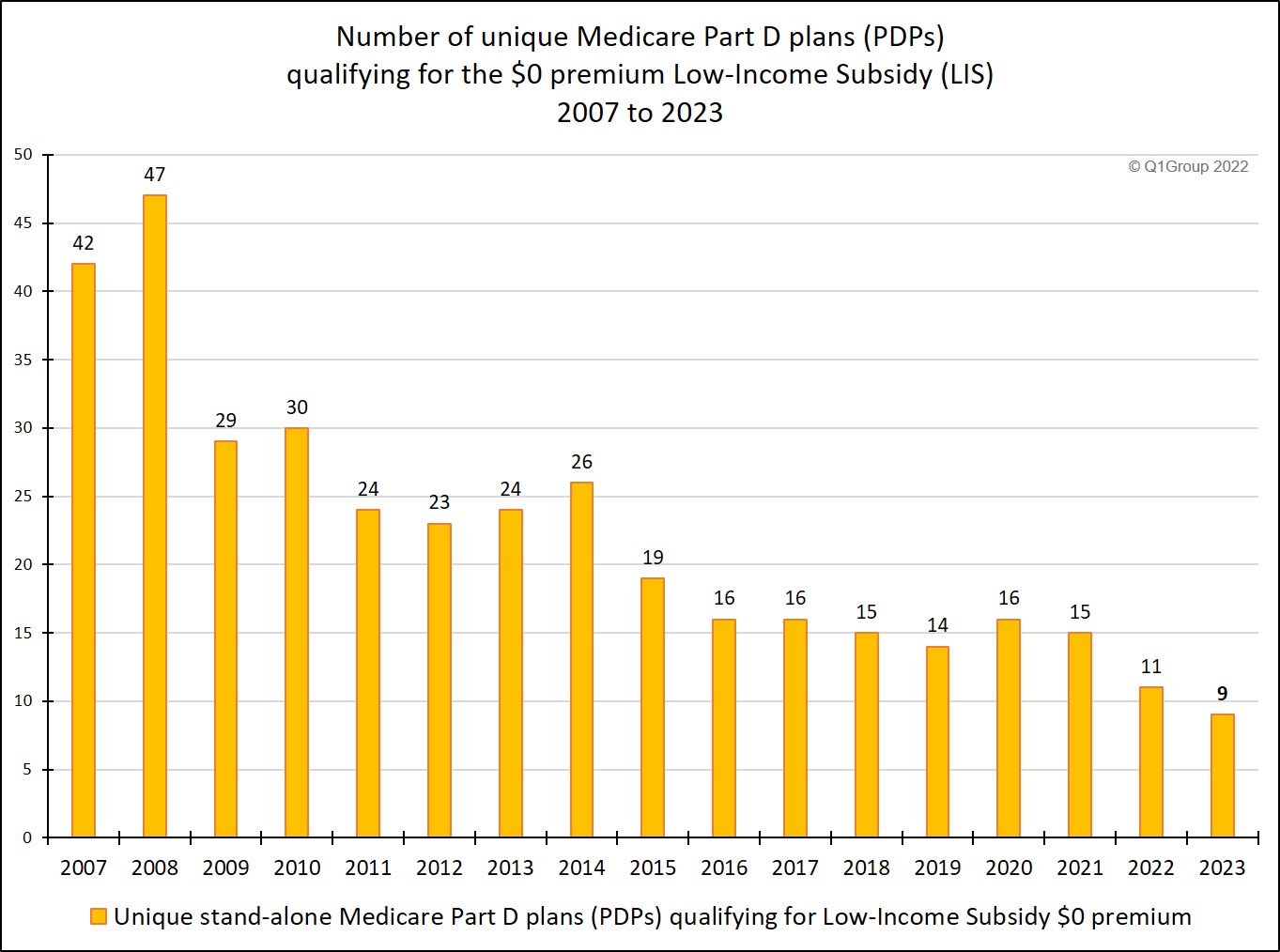

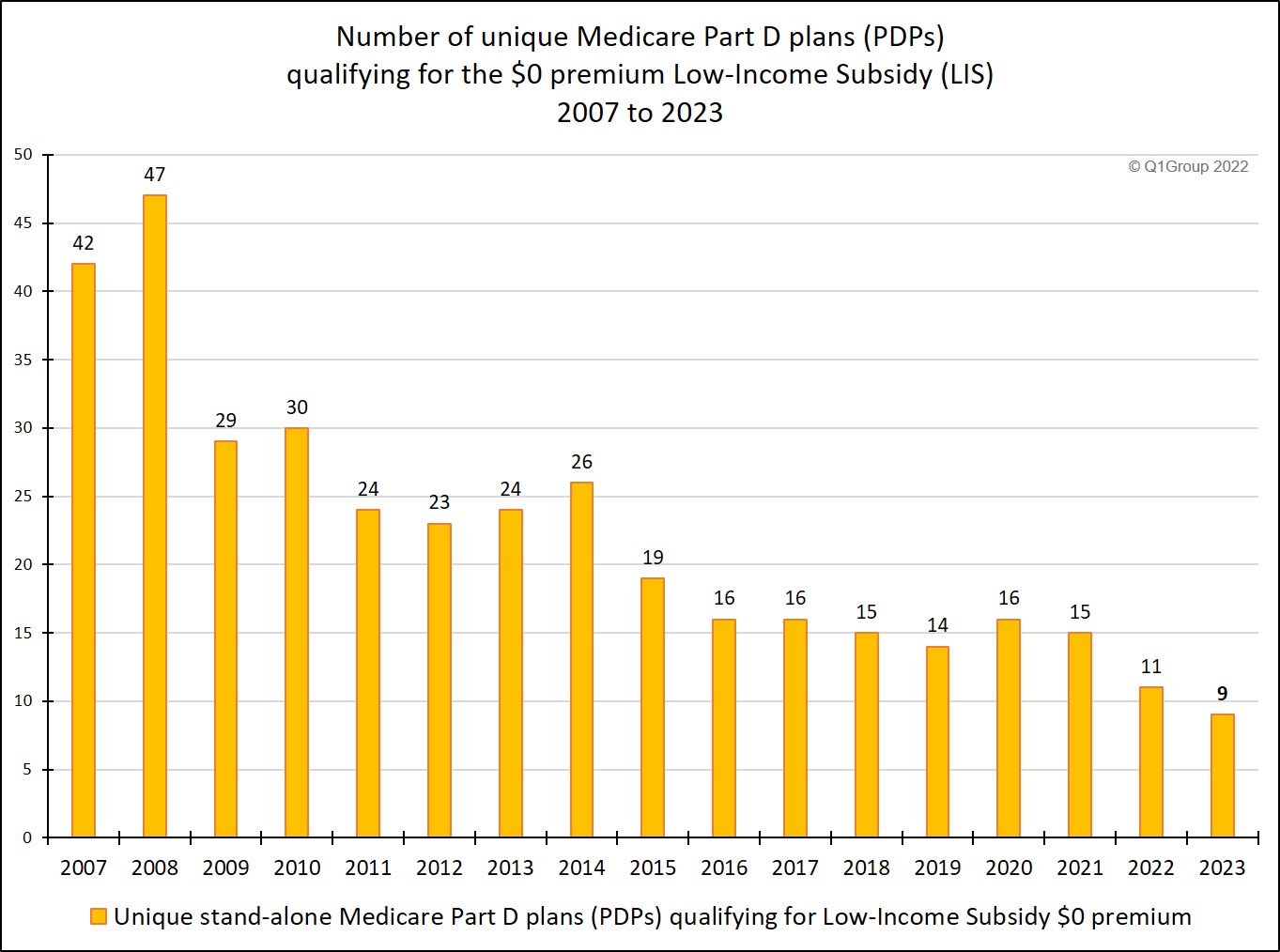

The number of stand-alone Medicare Part D plans qualifying for the $0 LIS premium changes each year, with the number of unique Part D drug plans leveling out over the past years - and then decreasing again to a new-low in 2023 as shown by this chart displaying $0 premium qualifying Part D plans from 2007 through 2023.

*Note: Under the CMS de minimis premium policy, "Part D plans are required to charge full-premium subsidy eligible beneficiaries a monthly Part D beneficiary premium equal to the applicable low-income premium subsidy amount, if the plan’s beneficiary premium for basic prescription drug coverage exceeds the low-income premium subsidy amount by $2 or less."

"Under the Affordable Care Act (ACA) §3303(a), a prescription drug plan (PDP) or Medicare Advantage plan with prescription drug coverage (MA-PD) may volunteer to waive the portion of the monthly adjusted basic beneficiary premium that is a de minimis amount above the low-income subsidy (LIS) benchmark for a subsidy eligible individual. The law prohibits CMS from reassigning LIS members from plans who volunteered to waive the de minimis amount. The de minimis amount for 2023 will be $2."

As an example of the de minimis premium policy, in 2020 North Carolina had a benchmark premium of $26.36 and 3 of the 9 Medicare Part D plans qualifying for the full-LIS $0 premium had monthly premiums higher than the benchmark – but still within the “de minimis” range".

**Note: When the lowest Part D premium is greater than the region's benchmark -- The 2009 low-income benchmark premium amount calculated for Region 29 is $19.68. The low-income premium subsidy amount of $20.20 is the lowest monthly beneficiary premium for a PDP that offers basic coverage in Region 29. Section 1860D-14(b)(3) of the Social Security Act states that the low-income premium subsidy amount is the greater of the lowest monthly beneficiary premium for a PDP that offers basic coverage and the low-income benchmark premium amount.

The number of stand-alone Medicare Part D plans qualifying for the $0 LIS premium changes each year, with the number of unique Part D drug plans leveling out over the past years - and then decreasing again to a new-low in 2023 as shown by this chart displaying $0 premium qualifying Part D plans from 2007 through 2023.

*Note: Under the CMS de minimis premium policy, "Part D plans are required to charge full-premium subsidy eligible beneficiaries a monthly Part D beneficiary premium equal to the applicable low-income premium subsidy amount, if the plan’s beneficiary premium for basic prescription drug coverage exceeds the low-income premium subsidy amount by $2 or less."

"Under the Affordable Care Act (ACA) §3303(a), a prescription drug plan (PDP) or Medicare Advantage plan with prescription drug coverage (MA-PD) may volunteer to waive the portion of the monthly adjusted basic beneficiary premium that is a de minimis amount above the low-income subsidy (LIS) benchmark for a subsidy eligible individual. The law prohibits CMS from reassigning LIS members from plans who volunteered to waive the de minimis amount. The de minimis amount for 2023 will be $2."

As an example of the de minimis premium policy, in 2020 North Carolina had a benchmark premium of $26.36 and 3 of the 9 Medicare Part D plans qualifying for the full-LIS $0 premium had monthly premiums higher than the benchmark – but still within the “de minimis” range".

**Note: When the lowest Part D premium is greater than the region's benchmark -- The 2009 low-income benchmark premium amount calculated for Region 29 is $19.68. The low-income premium subsidy amount of $20.20 is the lowest monthly beneficiary premium for a PDP that offers basic coverage in Region 29. Section 1860D-14(b)(3) of the Social Security Act states that the low-income premium subsidy amount is the greater of the lowest monthly beneficiary premium for a PDP that offers basic coverage and the low-income benchmark premium amount.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service