If your stand-alone Medicare Part D prescription drug plan (PDP) - or Medicare Advantage plan that

includes drug coverage (MAPD) - has an initial deductible, you will usually pay 100% of your

prescription drug costs until you have met the deductible. For example, if your Medicare plan has a $505 deductible, you will pay the full retail price for your

medications until you have spent $505 and then your plan coverage will begin (and you will only pay

a portion of the retail cost, such as a $30 co-pay or 25% co-insurance on your medications).

Reminder: Low-costing formulary tiers may be excluded from your deductible.

Although most stand-alone Medicare Part D drug plans (and some Medicare Advantage plans) have an initial deductible, many 2023 Medicare Part D plans have certain drug tiers excluded from the initial deductible.

For example, you may find that your 2023 Medicare Part D plan has a $505 initial deductible, but

the deductible only applies to medications on formulary Tier 3, Tier 4, and Tier 5 - and your

lower-costing Tier 1 and Tier 2 drugs are covered even before you have met the $505 deductible.

About 14 million people will see a $25 increase in their standard initial deductible.

Each year standard Medicare Part D plan designs change and in 2023, the annual standard initial deductible will increase to $505 from the $480 standard

deductible in 2022 and this $25 increase in deductible could impact

about 14,049,495 people currently enrolled in a 2022 stand-alone

Medicare Part D plan -- although many of the plan members receive "Extra

Help" and do not pay the deductible (or pay a reduced deductible based on their level of Extra Help) -- and, as noted, many of these drug plans

exclude lower-cost generics from the deductible.

Some people will see a larger increase in their initial deductible beyond the $25 increase in the standard initial deductible.

With changes in Medicare Part D plan coverage, over 909,000 people will see

an increase in their 2023 initial deductible of $45 or more. As an example, over 78,000 stand-alone Medicare Part D beneficiaries are enrolled in a MediBlue Rx Standard PDP that

will have an initial deductible increase from $75 to $155.

The following table illustrates other 2023 initial deductible increases.

|

Medicare Prescription Drug Plan |

||||||

|

2023 Plan Name |

Deductible |

States |

Members Affected |

|||

2023 |

2022 |

Incr. |

% Incr. | |||

| MediBlue Rx Standard (PDP) | $505 | $350 to $430 | $75 to $155 | 17% to 44% | 11 states | 78,959 |

| Blue MedicareRx Value (PDP) | $495 to $505 | $400 | $95 to $105 | 24% to 26% | 3 states | 25,796 |

| AARP MedicareRx Walgreens (PDP) | $350 | $310 | $40 | 12% | All States | 770,583 |

| BlueCross Rx Value (PDP) | $450 | $400 | $50 | 12.5 | in SC | 9,576 |

| Horizon Medicare Blue Rx Saver (PDP) | $450 | $400 | $50 | 12.5 | in NJ | 13,704 |

| Asuris Medicare Script Basic (PDP) | $455 | $410 | $45 | 11% | in OR and WA | 2,578 |

| Amerivantage Rx Basic (PDP) | $505 | $415 to $460 | $45 to $90 |

10% to 21% |

in TX and AZ | 470 |

The Good News: About 820,000 people

will see a decrease in their initial deductible.

As in past years, some stand-alone Medicare Part D plans (PDPs)

have chosen to reduce their initial deductible for the new plan year.

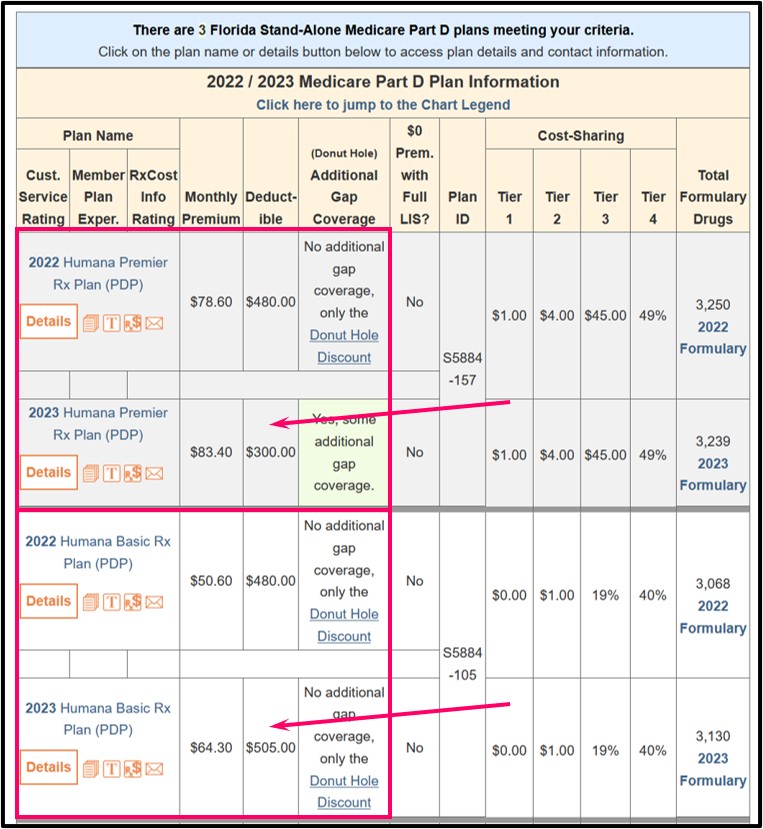

The 747,000 members of the Humana Premier Rx Plan (PDP) will have a

$300 deductible in 2023 down from $480 in 2022 -- and Humana Premier Rx Plan (PDP) members in AR, MO, PA and WV will have a deductible of $200.

How to see the changes in your 2023 initial deductible.

Our PDP-Compare

and MA-Compare

tools highlight coverage changes for each stand-alone Medicare Part D prescription drug

(PDP) and Medicare Advantage (MA or MAPD) plan and include 2022 / 2023 changes

in

plan features such as premium, deductible, cost-sharing and formulary

size changes. Our compare tools also show plans that will be merged or

discontinued and plans that will be added in 2023.

Not sure whether you want an initial deductible?

Medicare beneficiaries can telephone Medicare at 1-800-633-4227, speak with a Medicare representative, and learn more about Medicare plan coverage and their 2023 Medicare Part D and Medicare Advantage plan options.

8am to 5pm MST

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service