Almost 3.8 million Medicare beneficiaries will see at least 100 more medications on their 2023 Medicare Part D drug plan formulary

Watch for annual Medicare drug plan formulary changes.

With each new plan year - and throughout the plan year - your Medicare Part D plan (PDP) - or Medicare Advantage plan that provides prescription coverage (MAPD) - can (and usually does) change their formulary or drug list, introducing or removing medications.

Although Medicare drug plans often reduce the size of their formularies year-to-year, almost 3.8 million Medicare beneficiaries currently enrolled in a 2022 Medicare Part D plan will see at least 100 medications added to their 2023 Medicare Part D drug plan's formulary.

The largest increase in a 2023 stand-alone prescription drug plan formulary size is the MedicareBlue Rx Premier (PDP) plan in PDP region 25 (IA, MN, MT, NE, ND, SD, and WY) with the addition of 415 specific prescription drug or drug NDCs bring their formulary size up to 3,483 drugs in 2023 - up from 3,068 drugs in 2022.

Alternatively, only 123,442 members are currently enrolled in a stand-alone 2022 Medicare Part D prescription drug plan that will see a 2023 reduction of at least 100 medications from their current plan formulary. For example, the SecureRx - Option 1 (PDP) in PA and WV will lose 362 "NDCs" from their formulary.

Changes in the largest 2022 Medicare Part D formularies for 2023

Here are several further examples of 2022 stand-alone Medicare Part D plans with the largest formularies and how their formularies are changing in 2023. (Again, the formulary size in the chart below is measured in NDCs or National Drug Codes - used by pharmacies to uniquely identify a medication, the strength, and the packaging).

With each new plan year - and throughout the plan year - your Medicare Part D plan (PDP) - or Medicare Advantage plan that provides prescription coverage (MAPD) - can (and usually does) change their formulary or drug list, introducing or removing medications.

Although Medicare drug plans often reduce the size of their formularies year-to-year, almost 3.8 million Medicare beneficiaries currently enrolled in a 2022 Medicare Part D plan will see at least 100 medications added to their 2023 Medicare Part D drug plan's formulary.

The largest increase in a 2023 stand-alone prescription drug plan formulary size is the MedicareBlue Rx Premier (PDP) plan in PDP region 25 (IA, MN, MT, NE, ND, SD, and WY) with the addition of 415 specific prescription drug or drug NDCs bring their formulary size up to 3,483 drugs in 2023 - up from 3,068 drugs in 2022.

Alternatively, only 123,442 members are currently enrolled in a stand-alone 2022 Medicare Part D prescription drug plan that will see a 2023 reduction of at least 100 medications from their current plan formulary. For example, the SecureRx - Option 1 (PDP) in PA and WV will lose 362 "NDCs" from their formulary.

A note about "NDCs" and determining the size of a formulary

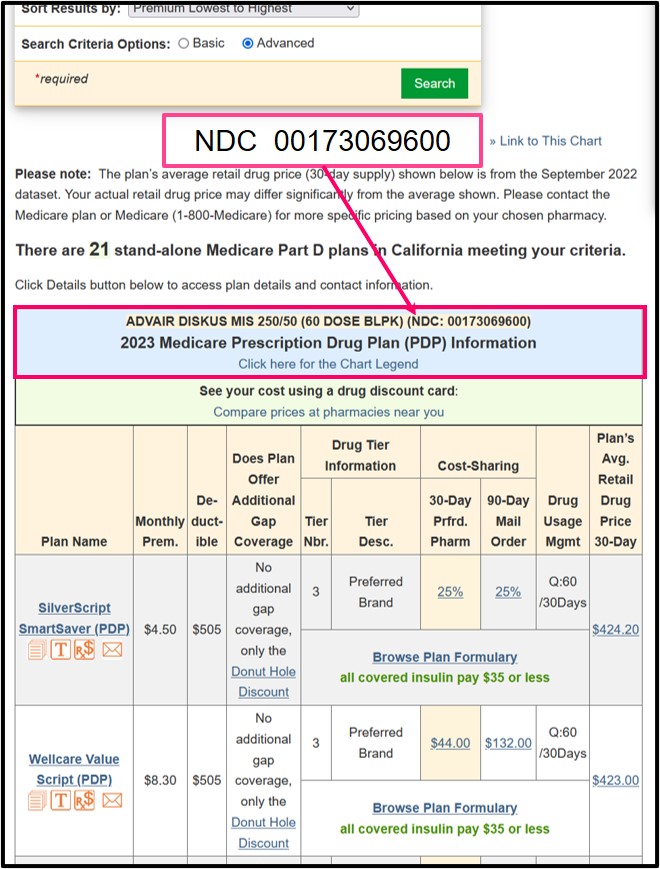

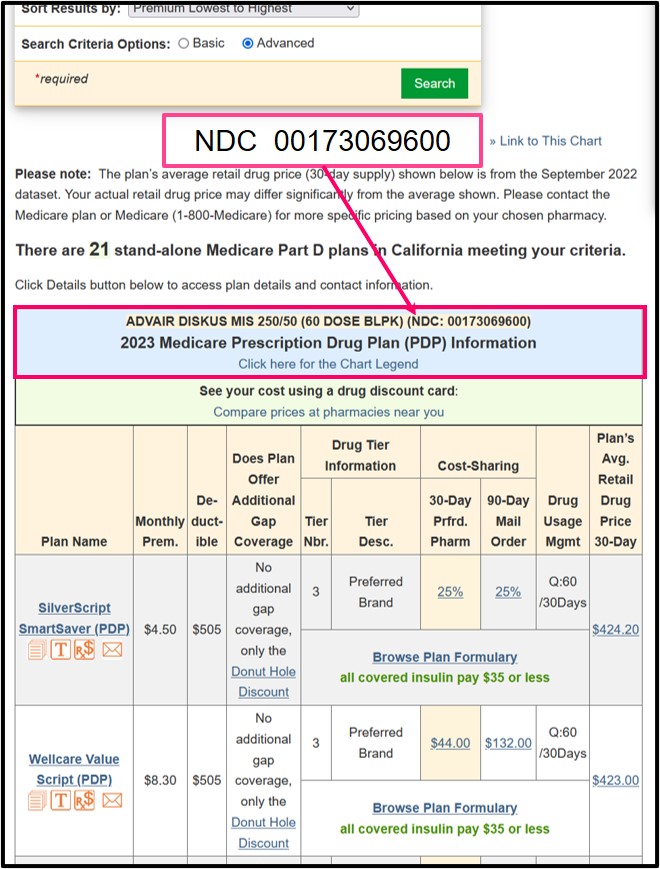

The size of a Medicare Part D prescription drug plan formulary is measured in NDCs or National Drug Codes. These 11-digit codes are used by doctors and pharmacies to uniquely identify a medication, the strength, and the drug packaging. The NDC for your personal prescription medication appears on the label of your prescription bottle. (Please note: Throughout this article, we use the terms "drugs", "medications", and "NDCs" interchangeably.) You can click here to see the Q1Rx Drug Finder results of the graphic below:

The size of a Medicare Part D prescription drug plan formulary is measured in NDCs or National Drug Codes. These 11-digit codes are used by doctors and pharmacies to uniquely identify a medication, the strength, and the drug packaging. The NDC for your personal prescription medication appears on the label of your prescription bottle. (Please note: Throughout this article, we use the terms "drugs", "medications", and "NDCs" interchangeably.) You can click here to see the Q1Rx Drug Finder results of the graphic below:

Changes in the largest 2022 Medicare Part D formularies for 2023

Here are several further examples of 2022 stand-alone Medicare Part D plans with the largest formularies and how their formularies are changing in 2023. (Again, the formulary size in the chart below is measured in NDCs or National Drug Codes - used by pharmacies to uniquely identify a medication, the strength, and the packaging).

| 2022 Medicare Part D Plans with the Largest Formularies and Change for 2023 |

||||

| Plan Name | 2023 Formulary Size |

2022 Formulary Size | Change in Size |

Members Affected |

| AR BlueMedicare Premier Rx (PDP) | 4,413 | 4,367 | 46 | 5,494 |

| PA WV Blue Rx PDP Complete and Plus plans | 4,141 | 4,160 | -19 | 19,864 |

| CA SilverScript SmartRx (PDP) | 3,630 | 3,586 | 44 | 1,455,393 |

| PR AARP MedicareRx Preferred (PDP) | 3,624 | 3,571 | 53 | 12,698 |

| PA WV SecureRx - Option 1 (PDP) | 3,177 | 3,539 | -362 | 3,390 |

| IL Blue Cross MedicareRx Value (PDP) | 3,483 | 3,502 | -19 | 128,963 |

| NJ Horizon Medicare Blue Rx Enhanced (PDP) | 3,483 | 3,502 | -19 | 14,520 |

| AZ Banner Medicare Classic Rx and Premier Rx plans | 3,178 | 3,499 | -321 | 2,945 |

| FL BlueMedicare Complete Rx (PDP) | 3,534 | 3,486 | 48 | 6,693 |

| NC Blue Medicare Rx Enhanced (PDP) | 3,483 | 3,454 | 29 | 27,149 |

| FL Wellcare Medicare Rx Value Plus (PDP) | 3,419 | 3,449 | -30 | 490,760 |

As in past years, although many of the largest 2022 drug plan formularies shown in the table above are offered by "Blue" plans, several of the 2023 Medicare Part D plans with the smallest formularies are also Blue plans.

Important note about the size of a formulary: A “larger” or “smaller” formulary does not necessarily reflect on the quality or coverage of the Medicare drug plan. Your goal when choosing a Medicare drug plan for next year is to find a Medicare plan that offers the most affordable coverage for your specific 2023 health and prescription needs.

| 2023 Medicare Part D Plans with the Smallest Formularies |

||||

| Plan Name | 2023 Formulary Size |

2022 Formulary Size | Change in Size |

Members Affected |

| MI Prescription Blue Select (PDP) | 2,845 | 2,768 | 77 | 3,470 |

| AZ Amerivantage Rx Basic (PDP) | 2,912 | 2,930 | -18 | 470 |

| CA Anthem Blue Cross MediBlue Rx Standard (PDP) | 2,912 | 2,930 | -18 | 37,177 |

| CO Anthem MediBlue Rx Standard (PDP) | 2,912 | 2,930 | -18 | 41,782 |

| KS Blue MedicareRx Value (PDP) | 2,912 | 2,930 | -18 | 11,289 |

| NY Blue Rx Standard (PDP) | 2,912 | 2,930 | -18 | 630 |

| OR WA Asuris Medicare Script Basic (PDP) | 2,939 | 2,806 | 133 | 2,578 |

| IL Blue Cross MedicareRx Basic (PDP) | 2,939 | 2,837 | 102 | 57,707 |

| NC Blue Medicare Rx Standard (PDP) | 2,939 | 2,720 | 219 | 7,595 |

| FL BlueMedicare Premier Rx (PDP) | 2,939 | 2,720 | 219 | 46,386 |

| AR BlueMedicare Value Rx (PDP) | 2,939 | 2,732 | 207 | 14,507 |

| NJ Horizon Medicare Blue Rx Standard (PDP) | 2,939 | 2,720 | 219 | 5,902 |

| IA MN MT NE ND SD WY MedicareBlue Rx Standard (PDP) | 2,939 | 3,068 | -129 | 115,950 |

How to see how your current formulary is changing in 2023?

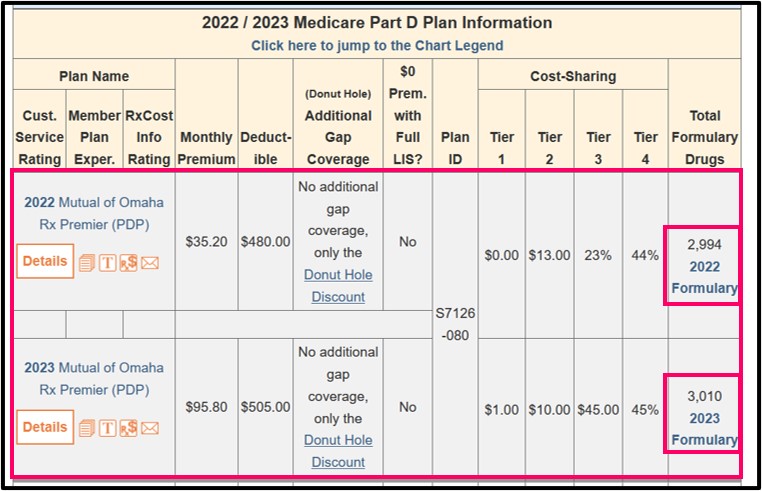

Our PDP-Compare and MA-Compare tools highlight coverage changes for each stand-alone Medicare Part D prescription drug (PDP) and Medicare Advantage (MA or MAPD) plan and include 2022 / 2023 changes in plan features such as premium, deductible, cost-sharing and formulary size changes.

You can click on the "2022 Formulary" or "2023 Formulary" link in the PDP-Compare or MA-Compare to review the plan's actual formulary.

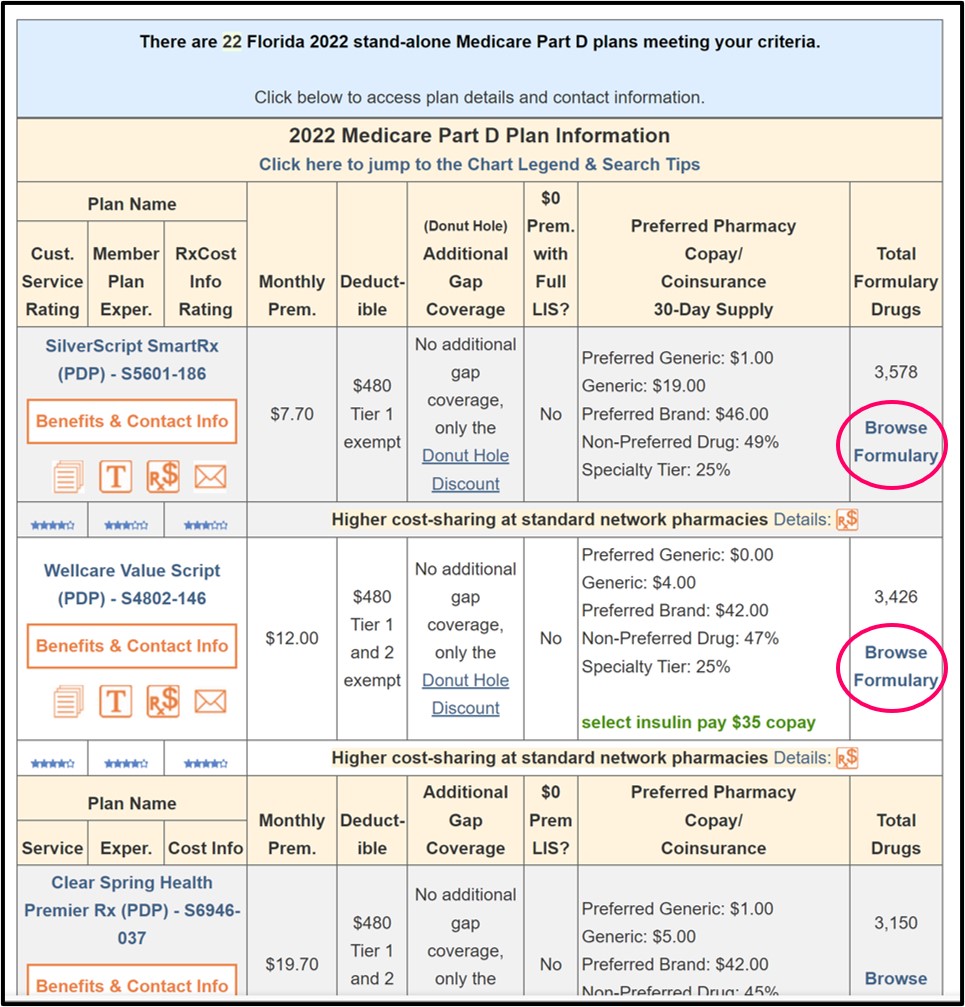

Browsing any Medicare plan’s formulary

Our Formulary Browser for both stand-alone Medicare Part D plans and Medicare Advantage plans (MAPDs) can be found at Formulary-Browser.com/2023. Using the Formulary Browser, you can browse by letter though each plan’s entire formulary to review cost-sharing and the details of the drug’s utilization management restrictions such as quantity limits, prior authorization, and step therapy. Quantity limits are displayed as Q:30/90days meaning that this drug has a quantity limit of 30 units (such as “tablets”) for a 90-day period.

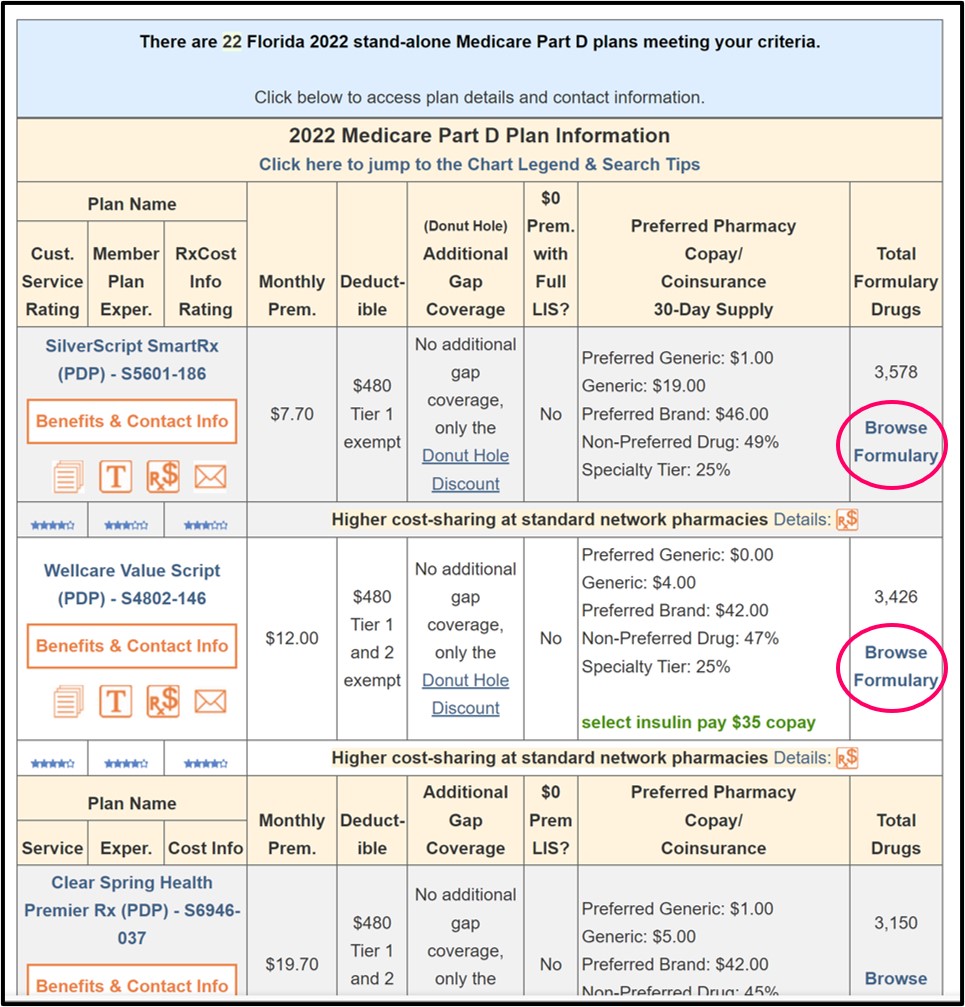

You can also find the "Browse Formulary" link on the results list within our Medicare Part D Plan Finder (PDP-Finder.com/CA) or the Medicare Advantage Plan Finder (MA-Finder.com/90210).

Comparing drug costs across Medicare plans

Our Drug Finder is available at Q1Rx.com/2023. Similar to our Formulary Browser, our Drug Finder displays the cost-sharing and details of the utilization management restrictions, but in the Drug Finder, this information is shown for a particular drug across all plans in your chosen service area.

As an example, click here to see the 50 Medicare Advantage plans available in Allegheny County, PA (ZIP: 15228) that cover Advair Diskus MIS 250/50 in 2023.

Once you are on the Drug Finder page, you can change the ZIP code to your ZIP and change the drug to your medication.

For a stand-alone Medicare prescription drug plan example, click here to review the 21 Medicare Part D drug plans available in Pennsylvania that cover Advair Diskus MIS 250/50. Again, change the state to your state once you are on the Drug Finder page.

Need help finding the Medicare plan with the most affordable coverage?

Medicare beneficiaries can telephone Medicare at 1-800-633-4227, speak with a Medicare representative, and learn more about 2023 Medicare Part D and Medicare Advantage plans that most affordably meet their health and prescription needs.

Our Formulary Browser for both stand-alone Medicare Part D plans and Medicare Advantage plans (MAPDs) can be found at Formulary-Browser.com/2023. Using the Formulary Browser, you can browse by letter though each plan’s entire formulary to review cost-sharing and the details of the drug’s utilization management restrictions such as quantity limits, prior authorization, and step therapy. Quantity limits are displayed as Q:30/90days meaning that this drug has a quantity limit of 30 units (such as “tablets”) for a 90-day period.

You can also find the "Browse Formulary" link on the results list within our Medicare Part D Plan Finder (PDP-Finder.com/CA) or the Medicare Advantage Plan Finder (MA-Finder.com/90210).

Comparing drug costs across Medicare plans

Our Drug Finder is available at Q1Rx.com/2023. Similar to our Formulary Browser, our Drug Finder displays the cost-sharing and details of the utilization management restrictions, but in the Drug Finder, this information is shown for a particular drug across all plans in your chosen service area.

As an example, click here to see the 50 Medicare Advantage plans available in Allegheny County, PA (ZIP: 15228) that cover Advair Diskus MIS 250/50 in 2023.

Once you are on the Drug Finder page, you can change the ZIP code to your ZIP and change the drug to your medication.

For a stand-alone Medicare prescription drug plan example, click here to review the 21 Medicare Part D drug plans available in Pennsylvania that cover Advair Diskus MIS 250/50. Again, change the state to your state once you are on the Drug Finder page.

Need help finding the Medicare plan with the most affordable coverage?

Medicare beneficiaries can telephone Medicare at 1-800-633-4227, speak with a Medicare representative, and learn more about 2023 Medicare Part D and Medicare Advantage plans that most affordably meet their health and prescription needs.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service