Medicare Part D plan changes: Examples of how 2023 Medicare Part D plans change formulary cost-sharing.

As in past years, some 2022 Medicare Part D plans are changing their

cost-sharing designs for 2023 prescription drug purchases - and such changes will affect what you pay when purchasing formulary drugs at a network pharmacy.

Cost-sharing is what you will pay for your Medicare Part D formulary drugs and can be either a fixed-copay (Tier 3 drugs are a $47 co-pay) or cost-sharing can be a percentage of the drug's retail cost (25% of the retail drug price).

Adding to or changing your Medicare Part D plan's formulary drug tiers

Each year, Medicare drug plans can also change the structure of the plan's formulary or drug list and add (as in the example below) - or take away - formulary tiers - or the plan can move drugs from one Tier to another.

As an example, the 2023 Wellcare Value Script plan will change from a five (5) drug tier formulary to a six (6) tier cost-sharing structure in all states, as shown in the chart below.

Cost-sharing is what you will pay for your Medicare Part D formulary drugs and can be either a fixed-copay (Tier 3 drugs are a $47 co-pay) or cost-sharing can be a percentage of the drug's retail cost (25% of the retail drug price).

Adding to or changing your Medicare Part D plan's formulary drug tiers

Each year, Medicare drug plans can also change the structure of the plan's formulary or drug list and add (as in the example below) - or take away - formulary tiers - or the plan can move drugs from one Tier to another.

As an example, the 2023 Wellcare Value Script plan will change from a five (5) drug tier formulary to a six (6) tier cost-sharing structure in all states, as shown in the chart below.

|

California Wellcare Value Script (PDP) 2022 and 2023 Medicare Part D plan Cost-sharing Comparison |

||||||||

| 2022 | 2023 | |||||||

| Monthly Premium | $10.90 | $8.30 | ||||||

| Initial Deductible | $480 (Tier 1 and 2 excluded from the deductible.) | $505 (Tier 1 and 2 excluded from the deductible.) | ||||||

| Gap Coverage | No Gap Coverage | No Gap Coverage | ||||||

Tier |

2022 Cost-Sharing |

Drugs on Tier |

Tier |

2023 Cost-Sharing |

Drugs on Tier |

|||

| 1 | Preferred Generic | $0 | 342 | 1 | Preferred Generic | $0 | 322 | |

| 2 | Generic | $4 | 438 | 2 | Generic | $5 | 402 | |

| 3 | Preferred Brand | $42 | 1,037 | 3 | Preferred Brand | $44 | 1,005 | |

| 4 | Non-Preferred Drug | 47% | 962 | 4 | Non-Preferred Drug | 47% | 999 | |

| 5 | Specialty Tier | 25% | 693 | 5 | Specialty Tier | 25% | 637 |

|

| - | - | - | - | 6 | Select Diabetic Drugs | $11 | 43 |

|

| Total Formulary Drugs |

Browse 2022 Formulary |

3,472 | Browse 2023 Formulary |

3,408 | ||||

Question: What do these 2022 / 2023 plan changes mean to you?

- There are fewer drugs that will be excluded from the deductible (fewer drugs on Tier 1 and Tier 2).

- Tier 2 generics will be slightly more expensive in 2023.

- The cost of Tier 3 preferred brand drugs will be slightly more expensive in 2023 - and this tier has the largest number of drugs.

- The cost-sharing for Tier 4 and Tier 5 drugs will remain the same (but, the 2023 formulary can have your drugs on different tiers as compared to 2022 - or possibly no longer cover your higher-tier drugs).

- Select Diabetic Drugs will have an $11 copay.

- You can also see from the chart that the number of drugs being covered by this plan is decreasing by 64 - and you will want to review the formulary (FormularyBrowser.com) or contact your 2022 plan to ensure that your medications are still covered by the 2023 plan.

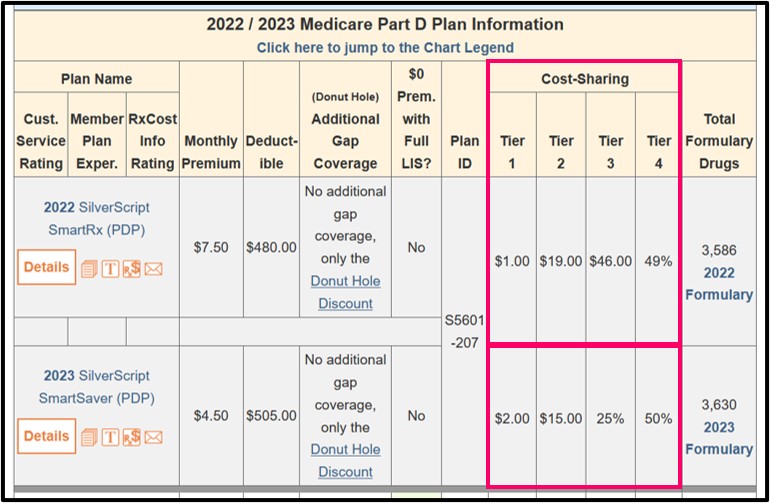

Changing the cost-sharing for a formulary tier

In another example, the 2022 California SilverScript SmartRx (PDP) plan formulary covers 799 medications as Tier 3 "Preferred Brand" medications (with a $46 copay). In 2023, the SilverScript SmartRx will become the SilverScript SmartSaver and Tier 3 "Preferred Brand" will have a 25% coinsurance.

|

California SilverScript SmartSaver (PDP) 2022 and 2023 Medicare Part D plan Cost-sharing Comparison |

||||||||

| 2022 | 2023 | |||||||

| Monthly Premium | $7.50 | $4.50 | ||||||

| Initial Deductible | $480 (Tier 1 excluded from the deductible.) | $505 (Tier 1 excluded from the deductible.) | ||||||

| Gap Coverage | No Gap Coverage | No Gap Coverage | ||||||

Tier |

2022 Cost-Sharing |

Drugs on Tier |

Tier |

2023 Cost-Sharing |

Drugs on Tier |

|||

| 1 | Preferred Generic | $1 | 250 | 1 | Preferred Generic | $2 | 250 | |

| 2 | Generic | $19 | 611 | 2 | Generic | $15 | 1,173 | |

| 3 | Preferred Brand | $46 | 799 | 3 | Preferred Brand | 25% | 225 | |

| 4 | Non-Preferred Drug | 49% | 1,370 | 4 | Non-Preferred Drug | 50% | 1,394 | |

| 5 | Specialty Tier | 25% | 599 | 5 | Specialty Tier | 25% | 588 | |

| Total Formulary Drugs |

Browse 2022 Formulary |

3,629 | Browse 2023 Formulary |

3,630 | ||||

Question: What do these 2022 / 2023 plan changes mean to you?

- Your Tier 1 medications will be slightly more expensive.

- Your Tier 2 medications will be less expensive

- The change from a $46 co-pay to a 25% of retail cost-sharing means

that you will pay less for your Tier 3 medications that have a retail price of under $184, but you will pay more for your Tier 3 medications that have a retail costs over $185 - and Tier 3 contains the largest number of formulary drugs.

- You will pay slightly less for your Tier 4 medications in 2023.

There are approximately 1,455,393 members in the 2022 SilverScript SmartRx (PDP) who will see similar changes in their plan coverage.

In total, 2.4 million members of various stand-alone Medicare Part D plans will see one or more of the drug tiers change cost-sharing from either coinsurance (such as 15%) to copay (such as $35) or copay to coinsurance.

To compare annual changes in Medicare plans, our PDP-Compare and MA-Compare tools show the 2023 stand-alone Medicare Part D prescription drug plans (PDPs) and Medicare Advantage plans (MAs or MAPDs) across the country and include changes in plan features such as premium, deductible, cost-sharing and formulary size changes. Our compare tools also highlight plans that will be merged or discontinued and new plans being added in 2023.

Not sure where to begin with choosing your Medicare Part D plan?

Medicare beneficiaries can telephone Medicare at 1-800-633-4227, speak with a Medicare representative, and learn more about their 2023 Medicare Part D or Medicare Advantage plan options.

News Categories

Pets are Family Too!

Use your drug discount card to save on medications for the entire family ‐ including your pets.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service