Will preferred pharmacy pricing save you money in 2023?

Yes. In general, preferred network pharmacies have lower cost-sharing for formulary medications as compared to standard

network pharmacies — meaning, you probably will pay less for your Medicare Part D plan's prescriptions at a

preferred pharmacy as compared to a standard pharmacy

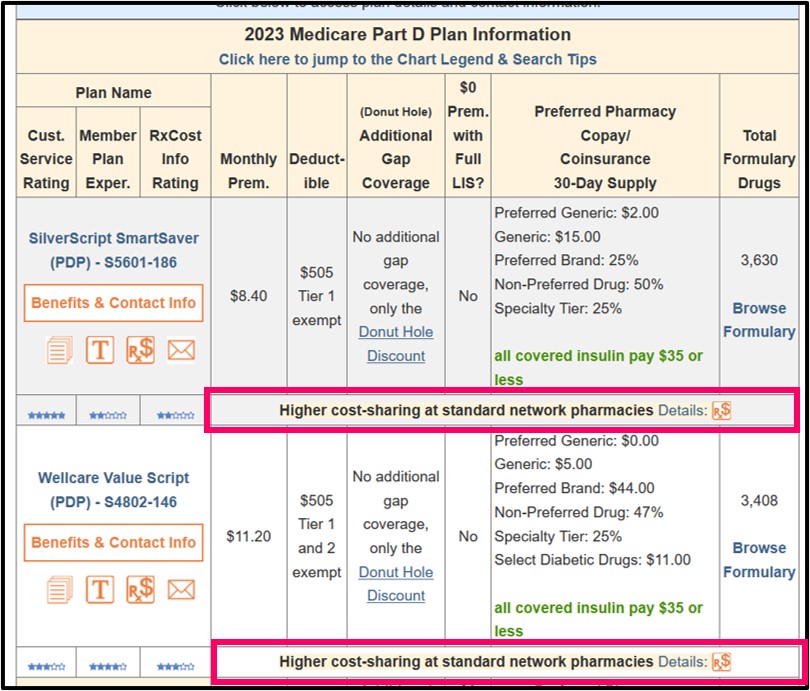

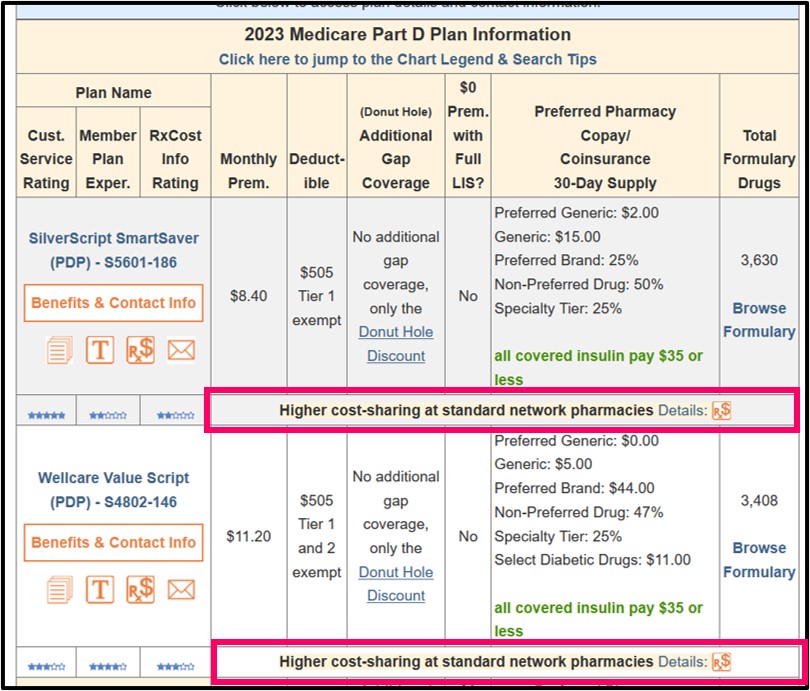

(you can see the actual 2023 Medicare Part D plan examples below).

As background, each Medicare Part D prescription drug plan has a national pharmacy network that includes 50,000 to 65,000+ pharmacies where you can purchase your formulary medications - and both "preferred" and "standard" pharmacies can be included in a Medicare prescription drug plan’s pharmacy network.

In 2023, about 98% of all stand-alone Medicare prescription drug plans (PDPs) will use different cost-sharing for preferred vs. standard network pharmacies (as compared to 97% of all PDPs in 2022). More specifically, 793 stand-alone 2023 Medicare prescription drug plans will offer additional cost-sharing savings if you shop at one of their preferred network pharmacies.

Question: How do I know if my Medicare Part D plan uses preferred pharmacy pricing?

Both our PDP-Finder and MA-Finder show the note: "Higher cost-sharing at standard network pharmacies" if a drug plan uses preferred network pharmacy pricing – and again, this means the cost-sharing you pay is different depending on whether you purchase your medications from a preferred network pharmacy or a standard network pharmacy. You can also see an "Rx$" icon after this note and a "Details" link showing you more information about preferred vs. standard cost-sharing for the chosen Medicare Part D plan.

Question: Which 2022 Medicare Part D plans will change their preferred pharmacy pricing strategy in 2023?

The BlueMedicare Complete Rx (PDP) in Florida is the only stand-alone Medicare prescription drug plan "removing" preferred pharmacy pricing for their 6,700 plan members. All other 2023 Medicare PDPs will continue with their 2022 preferred pharmacy pricing.

Question: How do preferred and standard pharmacy co-payments compare?

Usually, you will pay less for your formulary drugs when you are using one of your plan's preferred network pharmacies (as compared to a standard network pharmacy). As an example of different cost-sharing between network pharmacies, the chart below shows the variation between preferred and standard network pharmacies for the 2023 California SilverScript Choice (PDP) plan.

Note: The preferred and standard network pharmacy cost-sharing shown above can vary by state.

You can use our Rx$ icon on our PDP-Finder or MA-Finder to see the cost-sharing details for all tiers and pharmacies for any Medicare Part D or Medicare Advantage plan with prescription drug coverage.

As a second example, the chart below shows the variation between preferred and standard network pharmacies for the 2023 WellCare Classic plan.

Note: Again, the preferred and standard network pharmacy cost-sharing shown above can vary by state.

You can use our Rx$ icon on our PDP-Finder or MA-Finder to see the cost-sharing details for all tiers and pharmacies for any Medicare Part D or Medicare Advantage plan with prescription drug coverage.

As background, each Medicare Part D prescription drug plan has a national pharmacy network that includes 50,000 to 65,000+ pharmacies where you can purchase your formulary medications - and both "preferred" and "standard" pharmacies can be included in a Medicare prescription drug plan’s pharmacy network.

In 2023, about 98% of all stand-alone Medicare prescription drug plans (PDPs) will use different cost-sharing for preferred vs. standard network pharmacies (as compared to 97% of all PDPs in 2022). More specifically, 793 stand-alone 2023 Medicare prescription drug plans will offer additional cost-sharing savings if you shop at one of their preferred network pharmacies.

Question: How do I know if my Medicare Part D plan uses preferred pharmacy pricing?

Both our PDP-Finder and MA-Finder show the note: "Higher cost-sharing at standard network pharmacies" if a drug plan uses preferred network pharmacy pricing – and again, this means the cost-sharing you pay is different depending on whether you purchase your medications from a preferred network pharmacy or a standard network pharmacy. You can also see an "Rx$" icon after this note and a "Details" link showing you more information about preferred vs. standard cost-sharing for the chosen Medicare Part D plan.

Question: Which 2022 Medicare Part D plans will change their preferred pharmacy pricing strategy in 2023?

The BlueMedicare Complete Rx (PDP) in Florida is the only stand-alone Medicare prescription drug plan "removing" preferred pharmacy pricing for their 6,700 plan members. All other 2023 Medicare PDPs will continue with their 2022 preferred pharmacy pricing.

Question: How do preferred and standard pharmacy co-payments compare?

Usually, you will pay less for your formulary drugs when you are using one of your plan's preferred network pharmacies (as compared to a standard network pharmacy). As an example of different cost-sharing between network pharmacies, the chart below shows the variation between preferred and standard network pharmacies for the 2023 California SilverScript Choice (PDP) plan.

| California SilverScript Choice (S5601-064) | ||||||

| 30-Day Supply Cost-Sharing | 90-Day Supply Cost-Sharing | |||||

| Preferred Pharmacy | Standard Pharmacy |

Preferred Mail-Order |

Preferred Pharmacy | Standard Pharmacy |

Preferred Mail-Order |

|

| Initial Coverage Phase Cost-Sharing (before Donut Hole) |

||||||

| Tier 1 - Preferred Generic: | $2.00 | $6.00 | $2.00 | $6.00 | $18.00 | $6.00 |

| Tier 2 - Generic: | $7.00 | $13.00 | $7.00 | $21.00 | $39.00 | $21.00 |

| Tier 3 - Preferred Brand: | 17% | 17% | 17% | 17% | 17% | 17% |

| Tier 4 - Non-Preferred Brand: | 35% | 35% | 35% | 35% | 35% | 35% |

| Tier 5 - Specialty Tier: | 25% | 25% | 25% | n/a | n/a | n/a |

Note: The preferred and standard network pharmacy cost-sharing shown above can vary by state.

You can use our Rx$ icon on our PDP-Finder or MA-Finder to see the cost-sharing details for all tiers and pharmacies for any Medicare Part D or Medicare Advantage plan with prescription drug coverage.

As a second example, the chart below shows the variation between preferred and standard network pharmacies for the 2023 WellCare Classic plan.

| Texas WellCare Classic (PDP) (S4802-013) | ||||||

| 30-Day Supply Cost-Sharing | 90-Day Supply Cost-Sharing | |||||

| Preferred Pharmacy | Standard Pharmacy |

Preferred Mail-Order |

Preferred Pharmacy | Standard Pharmacy |

Preferred Mail-Order |

|

| Initial Coverage Phase Cost-Sharing | ||||||

| Tier 1 - Preferred Generic: | $0.00 | $3.00 | $0.00 | $0.00 | $9.00 | $0.00 |

| Tier 2 - Generic: | $5.00 | $8.00 | $5.00 | $15.00 | $24.00 | $15.00 |

| Tier 3 - Preferred Brand: | $37.00 | $43.00 | $37.00 | $111.00 | $129.00 | $111.00 |

| Tier 4 - Non-Preferred Brand: | 41% | 42% | 41% | 41% | 42% | 41% |

| Tier 5 - Specialty Tier: | 25% | 25% | 25% | n/a | n/a | n/a |

Note: Again, the preferred and standard network pharmacy cost-sharing shown above can vary by state.

You can use our Rx$ icon on our PDP-Finder or MA-Finder to see the cost-sharing details for all tiers and pharmacies for any Medicare Part D or Medicare Advantage plan with prescription drug coverage.

Question: How about an actual example of how cost sharing can vary between preferred and standard pharmacies?

As an example of how the different cost-sharing could affect your prescription drug spending, the chart below shows how the total prescription costs for three medications (Atorvastatin, Clopidogrel, and Esomeprazole Magnesium) can vary between network pharmacies (such as CVS, Walmart, or Walgreens), depending on your Medicare Part D plan.

Spoiler Alert: You may pay more for your medications at a standard network pharmacy (but not always!) — and you may pay a whole lot more for medications at a non-network pharmacy.

| 2023 Medicare Part D Drug Costs Only Without including plan premium |

||||

| 2023 Medicare Part D Plan Name | Annual Cost at CVS* | Annual Cost at Walmart* | Annual Cost at Walgreens* | Annual Cost Preferred Mail Order* |

| Cigna Saver Rx (PDP) | $487.80 (S) | $204.60 (P) | $202.92 (P) | $194.40 (P) |

| Humana Walmart Value Rx Plan (PDP) | $219.60 (S) | $150 (P) | $250.20 (S) | $145.20 (P) |

| AARP MedicareRx Walgreens (PDP) | $459.60 (S) | $459.60 (S) | $281.52 (P) | $382.48 (P) |

| SilverScript Plus | $0.00 (P) | $0.00 (P) | $288.00 (S) | $0.00 (P) |

| WellCare Value Script | $657.30 (P) | $879.82 (S) | $657.30 (P) | $655.05 (P) |

| Mutual of Omaha Rx Essential | $670.28 (P) | $671.00 (P) | $973.03 (S) | $615.68 (P) |

*Annual Drug Cost Estimates from Medicare.gov Plan Finder 10/22/2022.

(P) Preferred network pharmacy pricing for the designated Medicare Part D plan

(S) Standard network pharmacy pricing for the designated Medicare Part D plan

| 2023 Medicare Part D Drug Costs With plan premium included in drug costs |

||||

| 2023 Medicare Part D Plan Name | Annual Cost at CVS** | Annual Cost at Walmart** | Annual Cost at Walgreens** | Annual Cost Preferred Mail Order** |

| Cigna Saver Rx (PDP) | $633.00 (S) | $349.80 (P) | $348.12 (P) | $339.60 (P) |

| Humana Walmart Value Rx Plan (PDP) | $585.60 (S) | $516.00 (P) | $616.20 (S) | $511.20 (P) |

| AARP MedicareRx Walgreens (PDP) | $798.00 (S) | $798.00 (S) | $619.92 (P) | $720.88 (P) |

| SilverScript Plus | $883.20 (P) | $883.20 (P) | $1,171.20 (S) | $883.20 (P) |

| WellCare Value Script | $791.70 (P) | $1,014.22 (S) | $791.70 (P) | $789.45 (P) |

| Mutual of Omaha Rx Essential | $889.88 (P) | $890.60 (P) | $1,192.63 (S) | $835.28 (P) |

(P) Preferred network pharmacy pricing for the designated Medicare Part D plan

(S) Standard network pharmacy pricing for the designated Medicare Part D plan

Bottom Line: If you want to lower your prescription drug costs, make sure you are using one of your plan’s preferred network pharmacies (or preferred mail order option). HOWEVER, as noted in the charts above, it can happen that the retail prices at a standard network pharmacy may be lower and your plan's co-insurance is not significantly different between preferred and standard network pharmacies. And, you must consider both the coverage cost of your prescriptions at a network pharmacy and the cost of the plan's monthly premium to determine which Medicare Part D plan provides the most economical coverage.

Question: How do I know which specific pharmacies have preferred or standard cost-sharing for our drug plan?

Your Medicare Part D plan documentation (Summary of Benefits and Evidence of Coverage) should tell you whether your Medicare Part D plan has preferred cost-sharing. Look for text in your Evidence of Coverage document such as:

"The Pharmacy Directory will also tell you which of the pharmacies in our network have preferred cost-sharing, which may be lower than the standard cost-sharing offered by other network pharmacies."You might have also received a printed Pharmacy Directory that will tell you more about preferred / standard pharmacies in your area. If you do not have a printed copy of the pharmacy directory, you can download an electronic version of the pharmacy document from your plan's website.

Medicare Part D plans also usually have an easily accessible online pharmacy search tool that allows you to search for network pharmacies in your area and then indicates which pharmacies are preferred or standard.

If you cannot find your plan's online pharmacy search, you can call your Medicare plan's Member Services toll-free number (found on enrollment information, printed plan information, and your Member ID card) and ask a Member Services representative to help you find a preferred pharmacy in your area or to send you a Pharmacy Directory.

News Categories

Have a Medication Not Covered by Your Plan?

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service