Almost 3 million people are currently enrolled in non-renewing 2022 Medicare plans and 1.4 million people will lose their 2023 Medicare plan coverage

Is your 2022 Medicare Part D prescription drug plan or Medicare Advantage plan still being offered in 2023?

Almost 3 million people are currently enrolled in a 2022 Medicare Advantage plan (MA and MAPD) or Medicare Part D plan (PDP) that will no longer be offered in 2023 - and half of these people will be automatically moved to a different 2023 Medicare plan, leaving over 1.4 million people losing their 2023 Medicare plan coverage - unless they enroll into another Medicare plan.

What are non-renewing Medicare plans?

Each year, Medicare Part D and Medicare Advantage plans have the option of not renewing the plan's contract with Medicare. When this happens, the Medicare plan can be discontinued across the entire country or discontinued in a specific service area (such as a single state, county, or ZIP code area).

How many 2022 plan members will lose their coverage in 2023 due to non-renewing Medicare plans?

When a 2022 plan is no longer being offered in 2023, existing Medicare plan members will be notified in their Annual Notice of Change (ANOC) letter about the plan termination or plan consolidation - and plan members will be given the option to join another plan during the annual Open Enrollment Period (AEP).

Again, if current plan members do not join another Medicare plan, they may find themselves without 2023 Medicare plan coverage on January 1.

Seeing annual plan change: Need a fast way to see how existing Medicare Part D or Medicare Advantage plans are changing next year?

Our PDP-Compare and MA-Compare tools allow you to compare annual 2022/2023 changes in all stand-alone Medicare Part D prescription drug plans (PDPs) or Medicare Advantage plans (MAs or MAPDs) across the country showing changes in monthly premiums and plan design changes, as well as changes in co-payments or co-insurance rates for different drug tiers along with the most recent Medicare quality star ratings.

Both the PDP-Compare and MA-Compare also show the Medicare Part D plans or Medicare Advantage plans that will be merged, discontinued, or added in 2023.

Almost 3 million people are currently enrolled in a 2022 Medicare Advantage plan (MA and MAPD) or Medicare Part D plan (PDP) that will no longer be offered in 2023 - and half of these people will be automatically moved to a different 2023 Medicare plan, leaving over 1.4 million people losing their 2023 Medicare plan coverage - unless they enroll into another Medicare plan.

What are non-renewing Medicare plans?

Each year, Medicare Part D and Medicare Advantage plans have the option of not renewing the plan's contract with Medicare. When this happens, the Medicare plan can be discontinued across the entire country or discontinued in a specific service area (such as a single state, county, or ZIP code area).

If a Medicare beneficiary is enrolled in a non-renewing 2022 Medicare plan that is

not automatically moving (or "crosswalking") their members to a different 2023 Medicare plan,

members of the 2022 plan will be without Medicare plan coverage starting January 1, 2023 - unless they enroll in a different Medicare plan during the annual

Open Enrollment Period (the AEP

runs from October 15th through December 7th) or these people have access to a Special Enrollment Period allowing them to join a Medicare plan outside of the AEP.

Important SAR-SEP: Remember, there is a Service Area Reduction Special Enrollment Period (SAR SEP) starting on December 8th and continuing through the end of February allowing people enrolled in a terminated Medicare plan the possibility of enrolling in a new 2023 Medicare plan after the December 7th close of the AEP.

Important SAR-SEP: Remember, there is a Service Area Reduction Special Enrollment Period (SAR SEP) starting on December 8th and continuing through the end of February allowing people enrolled in a terminated Medicare plan the possibility of enrolling in a new 2023 Medicare plan after the December 7th close of the AEP.

How many 2022 plan members will lose their coverage in 2023 due to non-renewing Medicare plans?

- Almost 1.45 million people are losing their Medicare plan coverage if they do not select a new Medicare plan.

Almost 1.4 million people are currently enrolled in 2022 Medicare Advantage plans that will be terminated in 2023 and an additional 48,000 people are enrolled in 7 non-renewing stand-alone Medicare prescription drug plans (PDPs). These plan members will NOT be crosswalked into another plan and will be without 2023 coverage if they do not actively enroll in a new Medicare Advantage or Medicare Part D plan during the AEP or the SAR-SEP. (See the county-specific chart below for more Medicare Advantage plan termination details.)

- Over 1.47 million people are being automatically assigned (or "crosswalked") to another 2023 Medicare plan.

Over 1.47 million people, 1.26 million enrolled in 2022 Medicare Advantage plan and an additional 200,000 people enrolled in a 2022 stand-alone Medicare Part D plan, will be automatically “crosswalked” or merged into a different 2023 Medicare plan -- with changes to their plan cost and coverage.

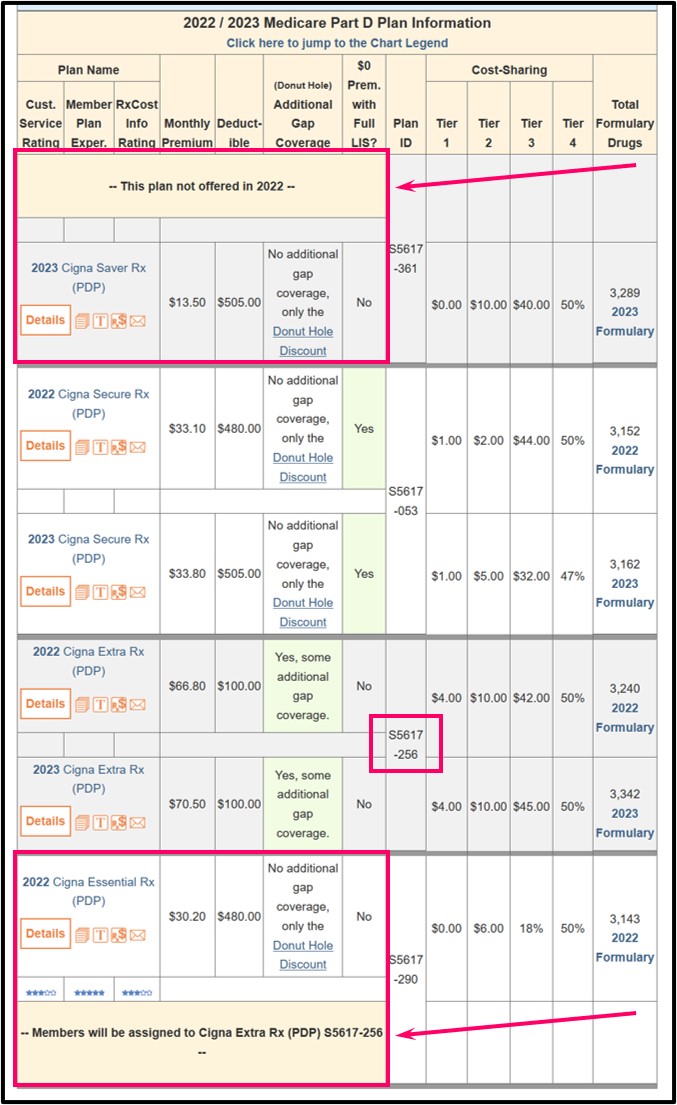

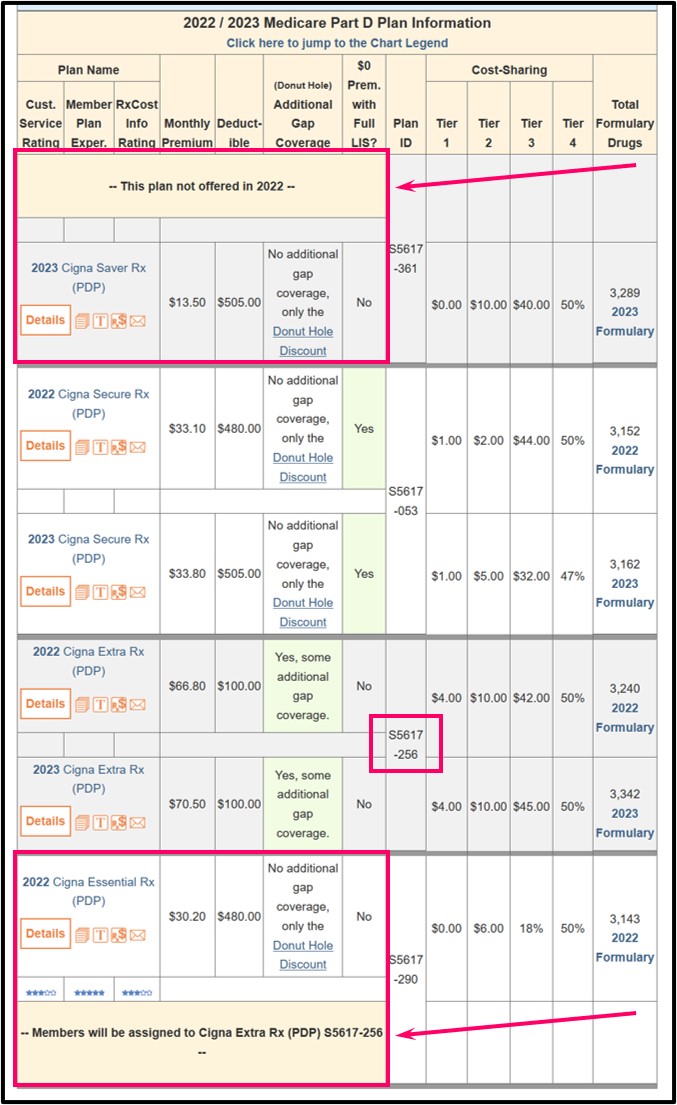

For example, 196,000 members of the 2022 Cigna Essential Rx (PDP) will be automatically reassigned to the 2023 Cigna Extra Rx (PDP).

Remember 2023 plans may not be the same as 2022 plans: If you are crosswalked to another Medicare plan next year, your new 2023 Medicare plan can be significantly different from your current 2022 Medicare plan.

For example, members in the Texas Wellcare No Premium (HMO-POS) will be crosswalked to the 2023 Wellcare TexanPlus No Premium (HMO) and will no longer have a more-flexible POS (point-of-service) feature in their HMO plan coverage.

Bottom line: It is always important to compare the changes in your Medicare plan coverage for the up-coming plan year.

When a 2022 plan is no longer being offered in 2023, existing Medicare plan members will be notified in their Annual Notice of Change (ANOC) letter about the plan termination or plan consolidation - and plan members will be given the option to join another plan during the annual Open Enrollment Period (AEP).

Again, if current plan members do not join another Medicare plan, they may find themselves without 2023 Medicare plan coverage on January 1.

Seeing annual plan change: Need a fast way to see how existing Medicare Part D or Medicare Advantage plans are changing next year?

Our PDP-Compare and MA-Compare tools allow you to compare annual 2022/2023 changes in all stand-alone Medicare Part D prescription drug plans (PDPs) or Medicare Advantage plans (MAs or MAPDs) across the country showing changes in monthly premiums and plan design changes, as well as changes in co-payments or co-insurance rates for different drug tiers along with the most recent Medicare quality star ratings.

Both the PDP-Compare and MA-Compare also show the Medicare Part D plans or Medicare Advantage plans that will be merged, discontinued, or added in 2023.

More about the 2023 Medicare Advantage plan (MA and MAPD) plan terminations

The chart below highlights counties with the highest number of non-renewing Medicare Advantage plans.

|

Counties

with Largest Number of Non-Renewing Medicare Advantage Plans |

|

| County | Number of Non-Renewing Plans* |

| Los Angeles County, CA | 37 |

| Orange County, CA | 30 |

| Riverside County, CA | 28 |

| San Bernardino County, CA | 28 |

| San Diego County, CA | 26 |

| Santa Clara County, CA | 19 |

| Pima County, AZ | 19 |

| Maricopa County, AZ | 17 |

| New York County, NY | 16 |

| Queens County, NY | 16 |

| Miami-Dade County, FL | 15 |

| Kings County, NY | 14 |

| Cook County, IL | 14 |

| Bexar County, TX | 14 |

| Bronx County, NY | 13 |

| Sumter County, FL | 13 |

| San Joaquin County, CA | 13 |

| Broward County, FL | 13 |

Need Help? Not sure where to begin with all this information?

Medicare beneficiaries can telephone Medicare at 1-800-633-4227, speak with a Medicare representative, and learn more about their 2023 Medicare Part D and Medicare Advantage plan options.

News Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service