CMS projects a 1.8% decrease in 2023 Medicare prescription drug plan premiums

The Centers for Medicare and Medicaid Services (CMS)

recently announced

in their press release entitled, "CMS Releases 2023 Projected Medicare Basic Part D Average Premium", that the average basic monthly Medicare Part D plan premium is expected to decrease in 2023.

Based on the 2023 Medicare Part D plan bids and current Medicare drug plan (PDP and MAPD) enrollment, the 2023 average weighted basic monthly premium is projected to be approximately $31.50 per month - a decrease of $1.50 from the $33.00 per month premium projected for 2022.

Question: Does the projected decrease in the estimated average Medicare Part D premiums mean you will pay less for your 2023 Medicare Part D plan?

Not exactly. The average monthly Medicare Part D premium figure released by CMS may not reflect the actual changes you see in your 2023 Medicare Part D prescription drug plan premiums - or overall coverage.

The CMS projected 2023 average premium of $31.50 suggests that you should be able to shop around during the annual Open Enrollment Period (AEP) and find a stand-alone 2023 Medicare prescription drug plan (PDP) with about the same monthly premium as you currently have now, or you may want to consider changing enrollment to a low-premium (or $0 premium) Medicare Advantage plan that includes prescription drug coverage (MAPD) - or even an MAPD that offers a Part B premium Give-Back feature (the plan rebates a portion of your Medicare Part B premium).

Our analysis (see below) shows that average stand-alone Medicare Part D plan premiums (not weighted by plan enrollment) and the average annual stand-alone Medicare Part D (PDP-only) premiums weighted by plan enrollment remain higher than the CMS basic premium (combined PDP and MAPD weighted by enrollment) indicating the affect of low-premium MAPD enrollment.

Question: When can I see the 2023 Medicare Part D and Medicare Advantage plans?

Starting in October, people with Medicare Part D can begin to research their Medicare health and prescription plan options. During the annual Open Enrollment Period (AEP) that begins October 15th and ends December 7, 2022, beneficiaries can switch Medicare plans by enrolling in their newly selected plan. If you are not sure where to begin with the annual plan review process, you can start by calling a Medicare representative at 1-800-MEDICARE for more information.

Question: Will my 2022 Medicare Part D plan inform me about 2023 plan changes?

Yes. Everyone with a Medicare Part D or Medicare Advantage plan should review their Medicare plan's Annual Notice of Change letter (ANOC) that will be mailed in late-September. Even if your Medicare Part D plan premium remains stable (or decrease) – this does not mean that your 2023 Medicare plan’s drug coverage costs will decrease. Your Medicare drug plan's prescription coverage - which drugs are covered and at what cost - usually changes every year, even if your monthly Medicare plan premium remains the same or decreases slightly.

Finally, Medicare Part D plan members should review their Medicare plan's 2023 Evidence of Coverage (EOC) document mailed to them in early-October - or made available electronically for download. The EOC is a 200+ page document that includes detailed information about the Medicare plan's coverage.

Bottom Line: Medicare Part D plans change each year, so please be prepared to review your 2023 Medicare plan options starting in early October.

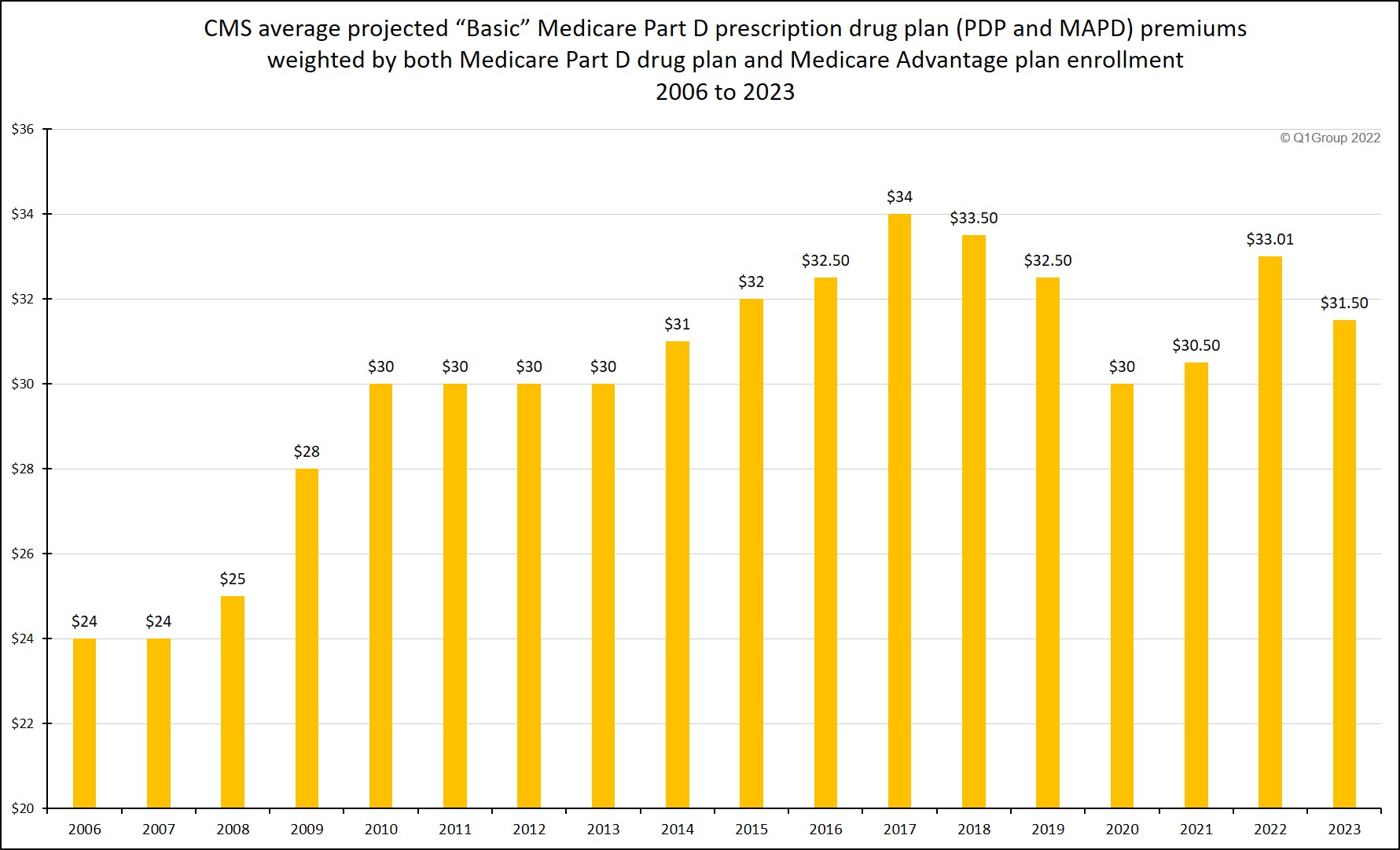

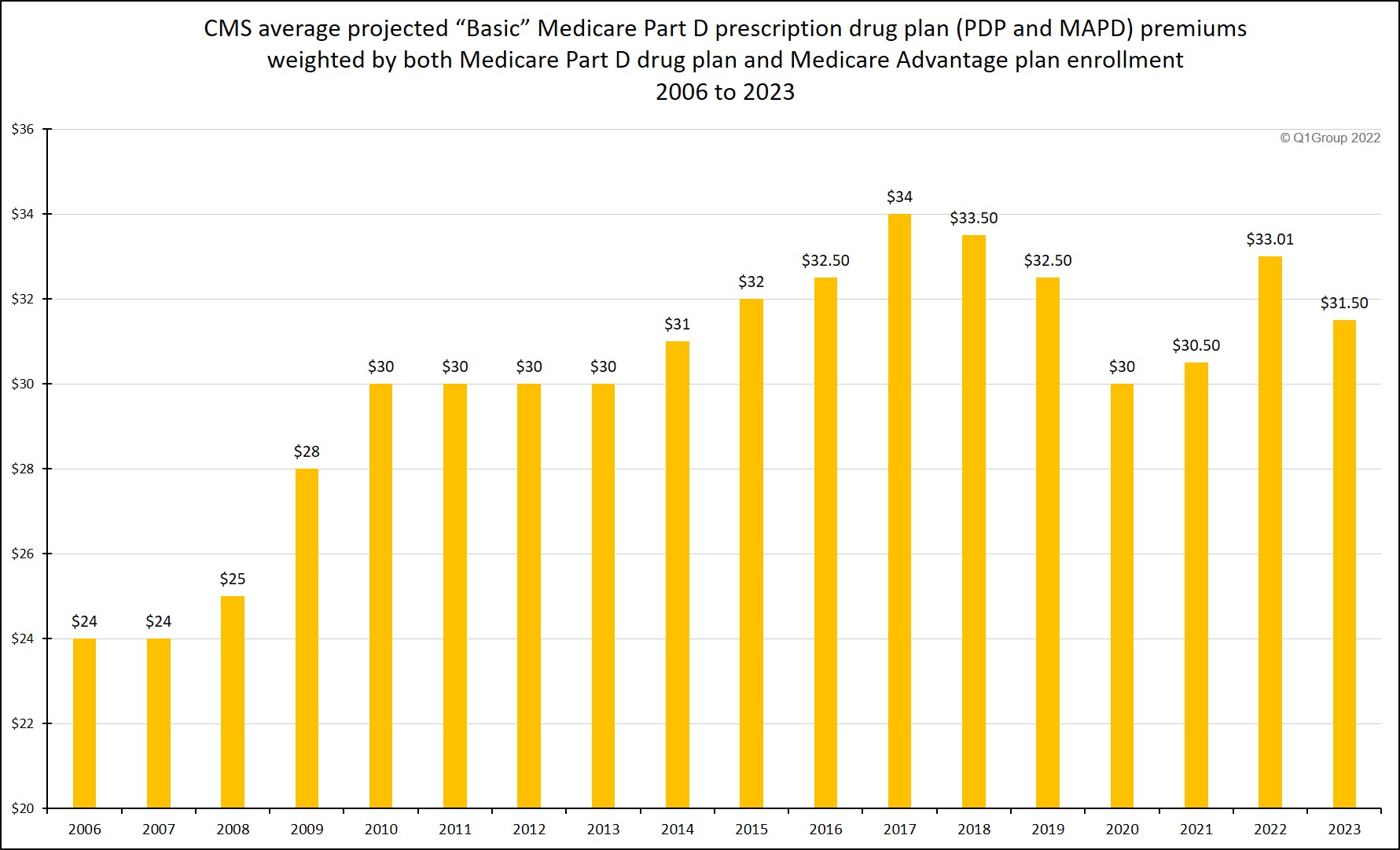

Question: How have projected Medicare Part D premiums changed over time?

The following are Medicare's annual projected basic Medicare Part D premiums weighted by enrollment. The actual annual average Medicare Part D premium reported by Medicare may be slightly higher or lower than the projected premium depending on actual Medicare plan enrollment for the year (for example, the actual 2022 average premium was $32.08 as compared to the projected average Part D premium of $33.00).

Question: How does the CMS estimated average weighted Medicare Part D premium compare to actual stand-alone Medicare Part D (PDP) premiums?

The projected average basic Medicare Part D premiums reported by CMS include both stand-alone Medicare Part D plans (PDPs) and Medicare Advantage plans that include drug coverage (MAPDs) - and are usually much lower than the actual average Medicare Part D premiums we report each year in our PDP landscape analysis or PDP-Facts section.

The difference between the CMS average premium projection and our Q1Medicare analysis is because we only consider stand-alone Medicare Part D prescription drug plans (PDPs) in our premium calculations (or calculations showing average premiums weighted by plan enrollment).

Unlike CMS, we do not include the premiums for Medicare Advantage plans offering prescription drug coverage (MAPDs) with stand-alone Medicare Part D plans (PDPs) for several reasons:

The following chart shows variations or trends in CMS projected basic Medicare Part D plan premiums (PDP and MAPD) as compared to our calculated average stand-alone Medicare Part D plan (PDP-only) premiums and stand-alone Medicare Part D plan (PDP-only) premiums weighted by plan enrollment.

Average Premiums weighted by enrollment as compared to Average Unweighted Premiums

Over time we have seen trends of increasing and then stabilizing of average stand-alone Medicare Part D (PDP) premiums - with PDP premiums weighted by plan enrollment remaining more consistent or stable - with the exception of the 2022 average weighted premium increase. From this chart, we might conclude that people are staying with their moderately priced PDPs - or moving to lower-premium PDPs when their premium increases - or moving to lower-premium ($0 premium) MAPDs as stand-alone PDP premiums increase.

Based on the 2023 Medicare Part D plan bids and current Medicare drug plan (PDP and MAPD) enrollment, the 2023 average weighted basic monthly premium is projected to be approximately $31.50 per month - a decrease of $1.50 from the $33.00 per month premium projected for 2022.

Question: Does the projected decrease in the estimated average Medicare Part D premiums mean you will pay less for your 2023 Medicare Part D plan?

Not exactly. The average monthly Medicare Part D premium figure released by CMS may not reflect the actual changes you see in your 2023 Medicare Part D prescription drug plan premiums - or overall coverage.

The CMS projected 2023 average premium of $31.50 suggests that you should be able to shop around during the annual Open Enrollment Period (AEP) and find a stand-alone 2023 Medicare prescription drug plan (PDP) with about the same monthly premium as you currently have now, or you may want to consider changing enrollment to a low-premium (or $0 premium) Medicare Advantage plan that includes prescription drug coverage (MAPD) - or even an MAPD that offers a Part B premium Give-Back feature (the plan rebates a portion of your Medicare Part B premium).

Our analysis (see below) shows that average stand-alone Medicare Part D plan premiums (not weighted by plan enrollment) and the average annual stand-alone Medicare Part D (PDP-only) premiums weighted by plan enrollment remain higher than the CMS basic premium (combined PDP and MAPD weighted by enrollment) indicating the affect of low-premium MAPD enrollment.

Question: When can I see the 2023 Medicare Part D and Medicare Advantage plans?

Starting in October, people with Medicare Part D can begin to research their Medicare health and prescription plan options. During the annual Open Enrollment Period (AEP) that begins October 15th and ends December 7, 2022, beneficiaries can switch Medicare plans by enrolling in their newly selected plan. If you are not sure where to begin with the annual plan review process, you can start by calling a Medicare representative at 1-800-MEDICARE for more information.

Question: Will my 2022 Medicare Part D plan inform me about 2023 plan changes?

Yes. Everyone with a Medicare Part D or Medicare Advantage plan should review their Medicare plan's Annual Notice of Change letter (ANOC) that will be mailed in late-September. Even if your Medicare Part D plan premium remains stable (or decrease) – this does not mean that your 2023 Medicare plan’s drug coverage costs will decrease. Your Medicare drug plan's prescription coverage - which drugs are covered and at what cost - usually changes every year, even if your monthly Medicare plan premium remains the same or decreases slightly.

Finally, Medicare Part D plan members should review their Medicare plan's 2023 Evidence of Coverage (EOC) document mailed to them in early-October - or made available electronically for download. The EOC is a 200+ page document that includes detailed information about the Medicare plan's coverage.

Bottom Line: Medicare Part D plans change each year, so please be prepared to review your 2023 Medicare plan options starting in early October.

Question: How have projected Medicare Part D premiums changed over time?

The following are Medicare's annual projected basic Medicare Part D premiums weighted by enrollment. The actual annual average Medicare Part D premium reported by Medicare may be slightly higher or lower than the projected premium depending on actual Medicare plan enrollment for the year (for example, the actual 2022 average premium was $32.08 as compared to the projected average Part D premium of $33.00).

Projected basic stand-alone Medicare Part D premiums 2006 to 2023 weighted by Medicare plan enrollment.

Question: How does the CMS estimated average weighted Medicare Part D premium compare to actual stand-alone Medicare Part D (PDP) premiums?

The projected average basic Medicare Part D premiums reported by CMS include both stand-alone Medicare Part D plans (PDPs) and Medicare Advantage plans that include drug coverage (MAPDs) - and are usually much lower than the actual average Medicare Part D premiums we report each year in our PDP landscape analysis or PDP-Facts section.

The difference between the CMS average premium projection and our Q1Medicare analysis is because we only consider stand-alone Medicare Part D prescription drug plans (PDPs) in our premium calculations (or calculations showing average premiums weighted by plan enrollment).

Unlike CMS, we do not include the premiums for Medicare Advantage plans offering prescription drug coverage (MAPDs) with stand-alone Medicare Part D plans (PDPs) for several reasons:

-

First, Medicare Part D plans (PDPs) are offered on a statewide (or multi-state regional) basis and Medicare Advantage prescription drug plans (MAPDs) are offered within much smaller service areas (ZIP code, partial-ZIP, or county basis) - and more MAPDs are available in densely populated areas where Medicare plans can easily establish healthcare networks as compared to rural areas. So low-premium MAPDs may not be widely available to all Medicare beneficiaries in a state.

- In addition, many popular MAPDs have a low or $0 premium and these low premiums tend to skew the average weighted monthly premium for prescription drug coverage toward lower values that are not reflective of the stand-alone Medicare Part D plan (PDP) landscape. In short, a national average of combined PDP and MAPD premiums weighted by enrollment may not reflect the actual stand-alone Medicare Part D plan premiums available to all seniors.

The following chart shows variations or trends in CMS projected basic Medicare Part D plan premiums (PDP and MAPD) as compared to our calculated average stand-alone Medicare Part D plan (PDP-only) premiums and stand-alone Medicare Part D plan (PDP-only) premiums weighted by plan enrollment.

Average Premiums weighted by enrollment as compared to Average Unweighted Premiums

Over time we have seen trends of increasing and then stabilizing of average stand-alone Medicare Part D (PDP) premiums - with PDP premiums weighted by plan enrollment remaining more consistent or stable - with the exception of the 2022 average weighted premium increase. From this chart, we might conclude that people are staying with their moderately priced PDPs - or moving to lower-premium PDPs when their premium increases - or moving to lower-premium ($0 premium) MAPDs as stand-alone PDP premiums increase.

CMS estimated average basic Medicare Part D

premiums vs. actual weighted (and unweighted) stand-alone Medicare Part D

premiums from 2007 to 2023

Here is a summary of our average-weighted PDP premiums over the past years:

- We calculated the 2023 average and weighted average monthly premiums across all

stand-alone Medicare Part D plans (not considering Medicare Advantage

plans offering prescription drug coverage or MAPDs) to be $48.97 - or $42.62 when weighted by stand-alone Medicare Part D plan enrollment (updated 09/30/2022). You can find these values and others statistics at PDP-Facts.com/2023.

- We calculated the 2022 average and weighted average monthly premiums across all

stand-alone Medicare Part D plans (not considering Medicare Advantage

plans offering prescription drug coverage or MAPDs) to be $47.55 - or $43.19 when weighted by stand-alone Medicare Part D plan enrollment (updated 09/30/2021). You can find these values and others statistics at PDP-Facts.com/2022.

- We calculated the 2021 average and weighted average monthly premiums across all

stand-alone Medicare Part D plans (not considering Medicare Advantage

plans offering prescription drug coverage or MAPDs) to be $41.38 - or $40.70 when weighted by stand-alone Medicare Part D plan enrollment (updated 09/25/2020) (adjusted to $37.54 on 09/30/2021 due to enrollment changes). You can find these values and others statistics at PDP-Facts.com/2021.

- We calculated the 2020 average monthly premium across all

stand-alone Medicare Part D plans (not considering Medicare Advantage

plans offering prescription drug coverage or MAPDs) to be $40.90 - or $41.40 (adjusted to $37.72 on 09/25/2020) when weighted by stand-alone Medicare Part D plan enrollment. (updated 09/26/2019 and again on 09/25/2020)

- We calculated the 2019 average monthly premium across all stand-alone Medicare Part D plans (not considering Medicare Advantage plans offering prescription drug coverage or MAPDs) to be $47.21 - or $41.29 when weighted by stand-alone Medicare Part D plan enrollment. (updated 08/04/2019)

- We calculated the 2018 average monthly premium across all

stand-alone Medicare Part D plans (not considering Medicare Advantage

plans offering prescription drug coverage or MAPDs) to be $52.69 - or $43.69

when weighted by stand-alone Medicare Part D plan enrollment. Please

note that "enrollment weighting" can change throughout the plan year as

Medicare plans are sanctioned (and plan members leave the plan) or CMS

lifts Medicare plan sanctions and the plan resumes enrollment or plan

members use a Special Enrollment Period (SEP) to change Medicare plans mid-year. (updated 09/29/2017)

- We calculated the 2017 average monthly premium across all

stand-alone Medicare Part D plans (not considering Medicare Advantage

plans offering prescription drug coverage or MAPDs) to be $51.96 or $42.70

when weighted by stand-alone Medicare Part D plan enrollment.

Please note that "enrollment weighting" can change throughout the plan

year as Medicare plans are sanctioned or removed from sanctions.

(updated 08/02/2017)

- We calculated the 2016 average monthly premium across all stand-alone Medicare Part D plans (not considering Medicare Advantage plans offering prescription drug coverage or MAPDs) to be $53.83 or $39.08 when weighted by stand-alone Medicare Part D plan enrollment

(note: the "enrollment weighting" can change throughout the plan year as Medicare plans are sanctioned or removed from sanctions).

- We calculated the 2015 average monthly premium across all stand-alone Medicare Part D plans (not considering Medicare Advantage plans offering prescription drug coverage or MAPDs) to be $53.14 or $36.75 when weighted by stand-alone Medicare Part D plan enrollment.

- We calculated the 2014 average monthly premium across all stand-alone Medicare Part D plans (not considering Medicare Advantage plans offering prescription drug coverage or MAPDs) to be $53.80 or $41.23 when weighted by stand-alone Medicare Part D plan enrollment.

- We calculated the 2013 average monthly premium across all stand-alone Medicare Part D plans to be $53.26 or $40.63 when weighted by all stand-alone Medicare Part D plan enrollment.

- We calculated the 2012 average premium across all stand-alone Medicare Part D plans to be $53.99 or $39.62 when weighted by plan enrollment.

- In 2011, we calculated the average monthly premium across all stand-alone Medicare Part D plans as $53.77 -- or $41.05 when weighted by Medicare Part D plan enrollment.

The full text of the July 29, 2022 CMS Press Release is included below:

CMS Releases 2023 Projected Medicare Basic Part D Average Premium

The Centers for Medicare & Medicaid Services (CMS) today [July 29, 2022] announced that the average basic monthly premium for standard Medicare Part D coverage is projected to be approximately $31.50 in 2023. This expected amount is a decrease of 1.8% from $32.08 in 2022.

CMS releases the projected average basic monthly Part D premium—calculated based on plan bids submitted to CMS—annually to help beneficiaries understand overall Part D premium trends before Medicare Open Enrollment, when they can select from plan options for the upcoming benefit year.

The Medicare Part D program helps people with Medicare pay for both brand-name and generic prescription drugs. Part D remains one of Medicare’s most popular programs, with more than 49 million Medicare beneficiaries enrolled for prescription drug coverage. CMS continues to analyze changes to the Part D program carefully, and engages with stakeholders to identify opportunities for improvements, particularly for reducing costs.

CMS is also releasing additional information—such as the Part D national average monthly bid amount—to help Part D plan sponsors finalize their premiums and prepare for Medicare Open Enrollment. Medicare Open Enrollment for coverage beginning January 1, 2023 will run from October 15 to December 7, 2022. CMS anticipates releasing the 2023 premium and cost-sharing information for 2023 Medicare Advantage and Part D plans in September 2022.

For more information on the Part D national average monthly bid amount, the Part D regional low-income premium subsidy amounts, the de minimis amount, the Medicare Advantage employer group waiver plan regional payment rates, and the Medicare Advantage regional preferred provider organization benchmarks, visit: https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Ratebooks-and-Supporting-Data.html.

###

[Emphasis and Highlighting added]

www.cms.gov/newsroom/news-alert/cms-releases-2023-projected-medicare-basic-part-d-average-premium.

- 2024 PY CMS Press Release: Q1News.com/1007

- 2023 PY CMS Press Release: Q1News.com/981

- 2022 PY CMS Press Release: Q1News.com/887

- 2021 PY CMS Press Release: Q1News.com/833

- 2020 PY CMS Press Release: Q1News.com/780

- 2019 PY CMS Press Release: Q1News.com/718

- 2018 PY CMS Press Release: Q1News.com/639

- 2017 PY CMS Press Release: Q1News.com/581

- 2016 PY CMS Press Release: Q1News.com/481

- 2015 PY CMS Press Release: Q1News.com/360

- 2014 PY CMS Press Release: Q1News.com/300

- 2013 PY CMS Press Release: Q1News.com/224

- 2012 PY CMS Press Release: Q1News.com/163

- 2011 PY CMS Press Release: Q1News.com/149

- 2010 PY CMS Press Release: Q1News.com/131

- 2009 PY CMS Press Release: Q1News.com/93

- 2008 PY CMS Press Release: Q1News.com/34

- 2007 PY CMS Press Release: Q1News.com/164

News Categories

Pets are Family Too!

Use your drug discount card to save on medications for the entire family ‐ including your pets.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service