Changes are coming for 2019 Medicare Part D plans: A few highlights from the 2019 final CMS Call Letter and Final Rule

Seniors, Medicare plan providers, and caregivers can expect a few changes in the 2019 Medicare Part D program. Below are a few highlights from the final

2019 Call Letter and a 1,156

page Medicare Part D (unpublished) Final Rule released on April 02, 2018 by the Centers for Medicare and Medicaid Services (CMS).

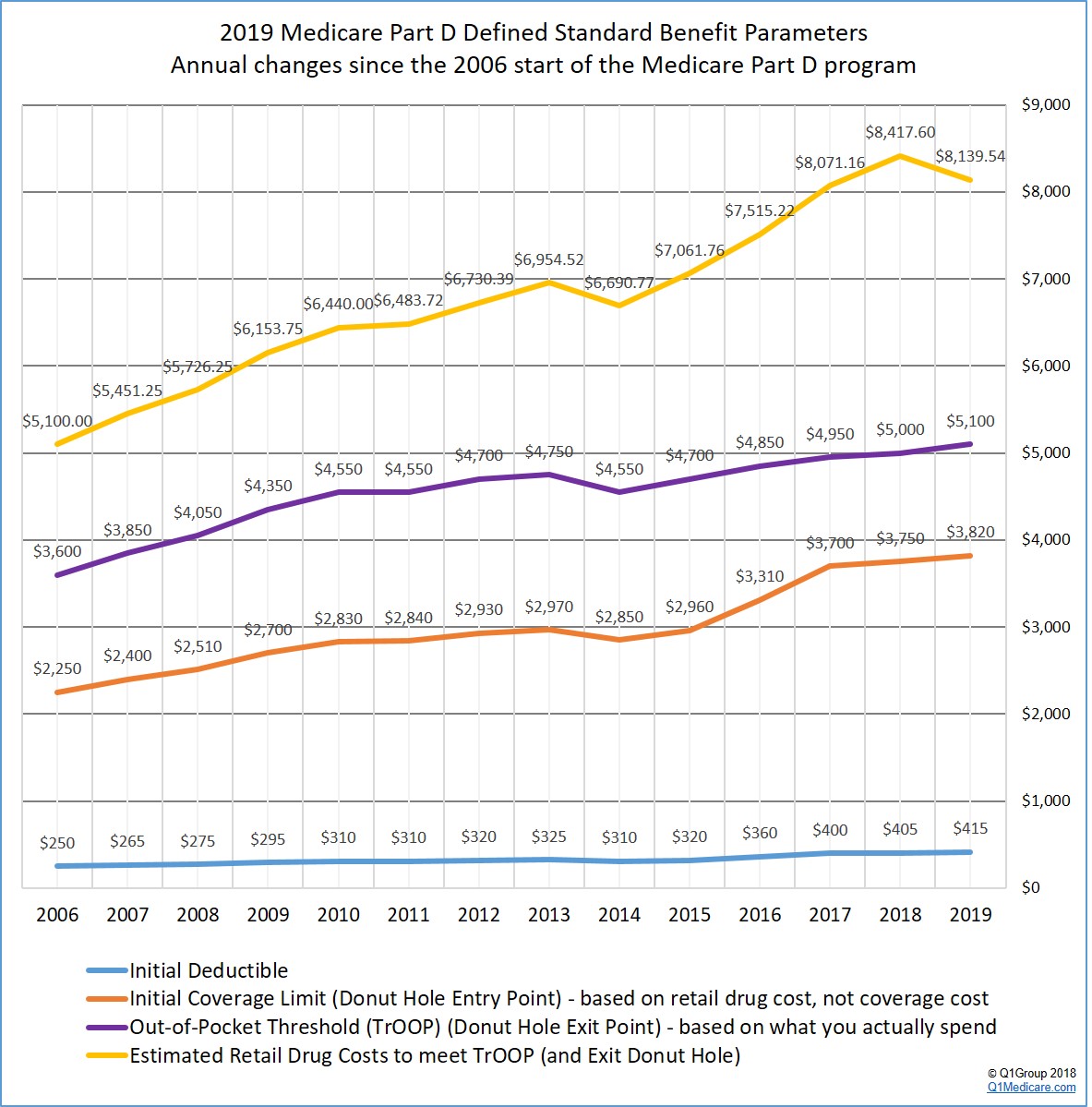

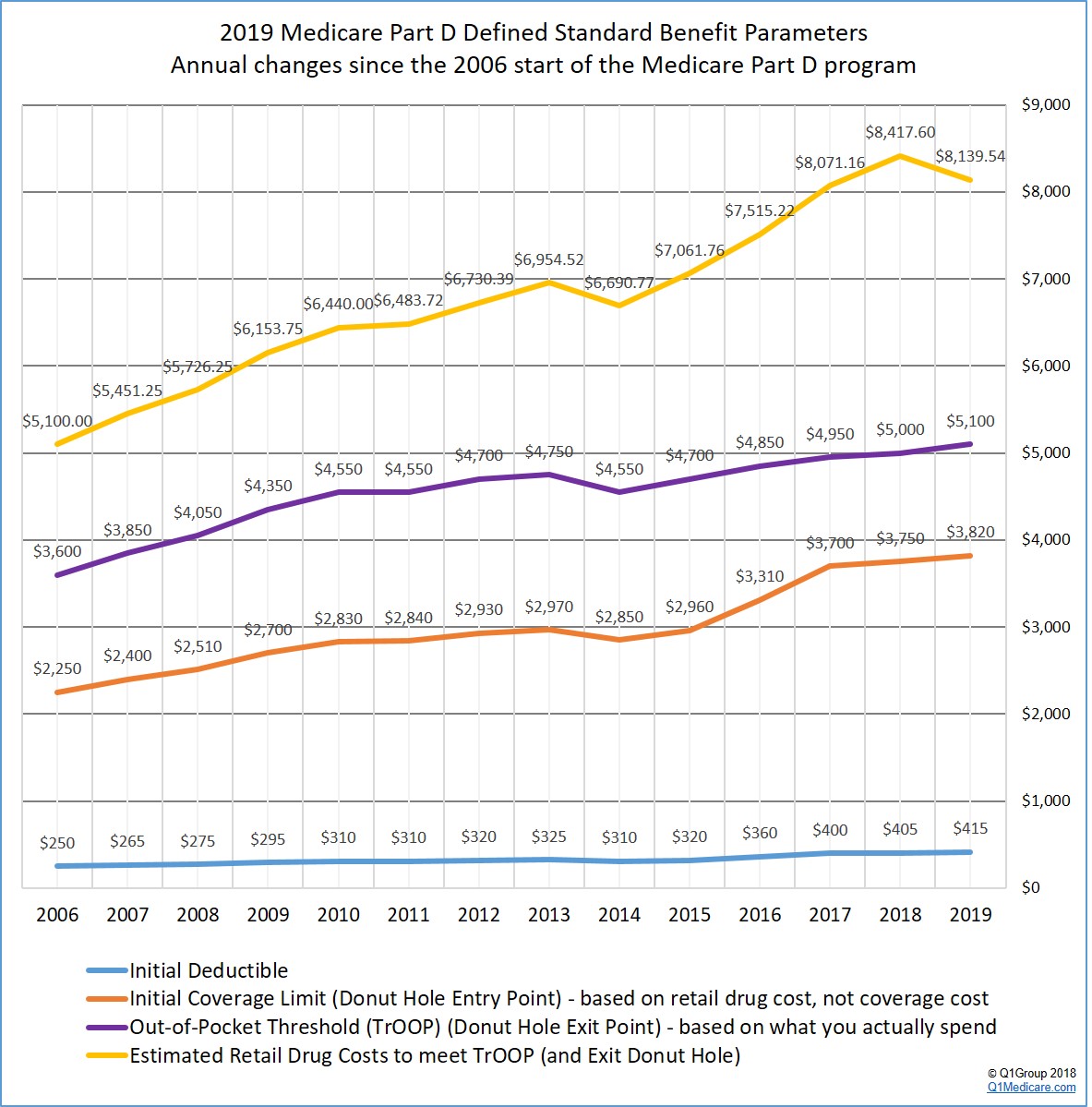

(1) The finalized standard 2019 Medicare Part D plan parameters increase slightly over 2018 Medicare Part D plan coverage (except for the total estimated retail drug spending needed to exit the Donut Hole).

CMS published the finalized defined standard Medicare Part D plan parameters that will form the basis of the 2019 Medicare drug plans. You can click here to see our analysis of the 2019 standard defined plan changes and how Medicare Part D coverage has changed over the years.

One key point of the CMS Call Letter is that, based on the Bipartisan Budget Act of 2018 (BBA) enacted February 2018, the brand-name Donut Hole discount will increase to 75% in 2019 - and the pharmaceutical industry will be responsible for 70% of this 75% Donut Hole discount, with your Medicare Part D plan covering the remaining 5%.

So if your monthly retail drug costs are over $318, you will reach the 2019 Donut Hole, pay 25% of retail brand-name drug prices, and get 95% of the brand-name retail drug cost credited to your out-of-pocket spending limit (or TrOOP). And this means: You may exit the 2019 Donut Hole faster than you expected and enter Catastrophic Coverage. Based on historical drug purchasing, CMS estimates that if you have monthly retail drug costs over $678, you will exit the 2019 Donut Hole.

(3) The 2019 generic drug Donut Hole discount has not changed.

As a reminder, the generic Donut Hole discount was not affected or “closed” by the Bipartisan Budget Act of 2018. The 2019 generic Donut Hole discount is 63% of retail – you will pay 37% of the generic drug cost and the amount you spend will count toward exiting the Donut Hole. In 2020, the generic Donut Hole discount will increase to 75%.

(4) You will not receive your 2019 ANOC letter and your Medicare Part D plan’s Evidence of Coverage at the same time.

In late-September or early October, your Medicare plan will send you a 2019 Annual Notice of Change letter (ANOC) detailing how your current 2018 Medicare plan is changing in 2019. However, CMS is separating the delivery of the ANOC letter and the delivery of your Evidence of Coverage (EOC) document so that the two documents arrive at different times.

You may recall that your ANOC is a relatively short, 10+ page document that summarizes upcoming plan changes and your EOC document is a rather long, 140+ page document that details your 2019 Medicare plan coverage. As noted by CMS, the “ANOC must be delivered 15 days prior to the [Annual Election Period (AEP)] and will be received by enrollees ahead of the EOC, thus allowing enrollees to focus on materials that drive decision-making during the AEP.” You should expect your 2019 EOC to be delivered on the first day of the Annual Election Period (October 15th) .

(5) Your 2019 Medicare Part D plan will actively fight opioid addiction.

In 2019, your Medicare Part D plan will implement a drug management program to monitor and limit at-risk Medicare beneficiaries’ access to frequently abused drugs (such as opioids and benzodiazepines). Medicare Part D plans will be permitted to have a “lock-in” feature “to limit an at-risk beneficiary’s access to frequently abused drugs to a selected prescriber(s) and/or pharmacy(ies).”

CMS will also limit “the availability of the special enrollment period (SEP) for dually or other low income subsidy (LIS) eligible beneficiaries who are identified as at-risk or potentially at-risk for prescription drug abuse under such drug management programs. At-risk determinations, which include prescriber and pharmacy lock-in, will be subject to the existing beneficiary appeals process.” [emphasis added]

(6) Starting in 2019, the Special Enrollment Period (SEP) for Dual-Eligible and Extra Help recipients will be limited to one plan change per quarter during the first 9 months of the year.

In 2019, Medicare beneficiaries who are dual-eligible (Medicare/Medicaid) or eligible for the Medicare Part D Extra Help program will no longer have a continuous month-to-month Special Enrollment Period (SEP). Instead, the Dual-Eligible or Extra Help SEP “ may be used only once per calendar quarter during the first nine months of the year.” [emphasis added]

(7) The Medicare Advantage Open Enrollment Period returns in 2019.

In 2019, we will no longer have the Medicare Advantage Disenrollment Period (MADP) that started January 1st and continued through February 14th. Instead, we will return to the Medicare Advantage Open Enrollment Period (OEP) starting on January 1st and continuing through March 31st.

The OEP will allow people “enrolled in an MA plan, including newly MA-eligible individuals, to make a one-time election to go to another [Medicare Advantage] plan” - or to leave their Medicare Advantage plan, join a stand-alone Medicare Part D plan, and return to Original Medicare Part A and Part B. "For example, an individual enrolled in an MA-PD plan may use the OEP to switch to: (1) another MA-PD plan; (2) an MA-only plan; or (3) Original Medicare with or without a PDP. The OEP will also allow an individual enrolled in an MA-only plan to switch to-- (1) another MA-only plan; (2) an MA-PD plan; or (3) Original Medicare with or without a PDP. However, this enrollment period does not allow for Part D changes for individuals enrolled in Original Medicare, including those with enrollment in stand-alone PDPs."

CMS expects approximately 558,000 Medicare beneficiaries will use the OEP to make an enrollment change.

You can read more about the 2019 Medicare Part D plan year outlook at: Q1Medicare.com/2019.

You can also sign-up for our Medicare Part D Reminder Service and we will send an email as information becomes available on the 2019 Medicare Part D program and plans. Your email will not be shared with anyone and you can unsubscribe at any time.

(1) The finalized standard 2019 Medicare Part D plan parameters increase slightly over 2018 Medicare Part D plan coverage (except for the total estimated retail drug spending needed to exit the Donut Hole).

CMS published the finalized defined standard Medicare Part D plan parameters that will form the basis of the 2019 Medicare drug plans. You can click here to see our analysis of the 2019 standard defined plan changes and how Medicare Part D coverage has changed over the years.

(2) You may exit the 2019 Donut Hole faster than you expected.

One key point of the CMS Call Letter is that, based on the Bipartisan Budget Act of 2018 (BBA) enacted February 2018, the brand-name Donut Hole discount will increase to 75% in 2019 - and the pharmaceutical industry will be responsible for 70% of this 75% Donut Hole discount, with your Medicare Part D plan covering the remaining 5%.

So if your monthly retail drug costs are over $318, you will reach the 2019 Donut Hole, pay 25% of retail brand-name drug prices, and get 95% of the brand-name retail drug cost credited to your out-of-pocket spending limit (or TrOOP). And this means: You may exit the 2019 Donut Hole faster than you expected and enter Catastrophic Coverage. Based on historical drug purchasing, CMS estimates that if you have monthly retail drug costs over $678, you will exit the 2019 Donut Hole.

(3) The 2019 generic drug Donut Hole discount has not changed.

As a reminder, the generic Donut Hole discount was not affected or “closed” by the Bipartisan Budget Act of 2018. The 2019 generic Donut Hole discount is 63% of retail – you will pay 37% of the generic drug cost and the amount you spend will count toward exiting the Donut Hole. In 2020, the generic Donut Hole discount will increase to 75%.

(4) You will not receive your 2019 ANOC letter and your Medicare Part D plan’s Evidence of Coverage at the same time.

In late-September or early October, your Medicare plan will send you a 2019 Annual Notice of Change letter (ANOC) detailing how your current 2018 Medicare plan is changing in 2019. However, CMS is separating the delivery of the ANOC letter and the delivery of your Evidence of Coverage (EOC) document so that the two documents arrive at different times.

You may recall that your ANOC is a relatively short, 10+ page document that summarizes upcoming plan changes and your EOC document is a rather long, 140+ page document that details your 2019 Medicare plan coverage. As noted by CMS, the “ANOC must be delivered 15 days prior to the [Annual Election Period (AEP)] and will be received by enrollees ahead of the EOC, thus allowing enrollees to focus on materials that drive decision-making during the AEP.” You should expect your 2019 EOC to be delivered on the first day of the Annual Election Period (October 15th) .

(5) Your 2019 Medicare Part D plan will actively fight opioid addiction.

In 2019, your Medicare Part D plan will implement a drug management program to monitor and limit at-risk Medicare beneficiaries’ access to frequently abused drugs (such as opioids and benzodiazepines). Medicare Part D plans will be permitted to have a “lock-in” feature “to limit an at-risk beneficiary’s access to frequently abused drugs to a selected prescriber(s) and/or pharmacy(ies).”

CMS will also limit “the availability of the special enrollment period (SEP) for dually or other low income subsidy (LIS) eligible beneficiaries who are identified as at-risk or potentially at-risk for prescription drug abuse under such drug management programs. At-risk determinations, which include prescriber and pharmacy lock-in, will be subject to the existing beneficiary appeals process.” [emphasis added]

(6) Starting in 2019, the Special Enrollment Period (SEP) for Dual-Eligible and Extra Help recipients will be limited to one plan change per quarter during the first 9 months of the year.

In 2019, Medicare beneficiaries who are dual-eligible (Medicare/Medicaid) or eligible for the Medicare Part D Extra Help program will no longer have a continuous month-to-month Special Enrollment Period (SEP). Instead, the Dual-Eligible or Extra Help SEP “ may be used only once per calendar quarter during the first nine months of the year.” [emphasis added]

(7) The Medicare Advantage Open Enrollment Period returns in 2019.

In 2019, we will no longer have the Medicare Advantage Disenrollment Period (MADP) that started January 1st and continued through February 14th. Instead, we will return to the Medicare Advantage Open Enrollment Period (OEP) starting on January 1st and continuing through March 31st.

The OEP will allow people “enrolled in an MA plan, including newly MA-eligible individuals, to make a one-time election to go to another [Medicare Advantage] plan” - or to leave their Medicare Advantage plan, join a stand-alone Medicare Part D plan, and return to Original Medicare Part A and Part B. "For example, an individual enrolled in an MA-PD plan may use the OEP to switch to: (1) another MA-PD plan; (2) an MA-only plan; or (3) Original Medicare with or without a PDP. The OEP will also allow an individual enrolled in an MA-only plan to switch to-- (1) another MA-only plan; (2) an MA-PD plan; or (3) Original Medicare with or without a PDP. However, this enrollment period does not allow for Part D changes for individuals enrolled in Original Medicare, including those with enrollment in stand-alone PDPs."

CMS expects approximately 558,000 Medicare beneficiaries will use the OEP to make an enrollment change.

You can read more about the 2019 Medicare Part D plan year outlook at: Q1Medicare.com/2019.

You can also sign-up for our Medicare Part D Reminder Service and we will send an email as information becomes available on the 2019 Medicare Part D program and plans. Your email will not be shared with anyone and you can unsubscribe at any time.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service