More $0 premium 2023 Medicare Advantage plans that include prescription drug coverage (MAPDs) with a $0 initial deductible

As noted in a September CMS press release,

the average Medicare Advantage plan premium is expected to decline in 2023. Our analysis of 2023 Medicare Advantage plan premiums shows 88% of all 2023

Medicare Advantage plans having a monthly premium

under $50 per month.

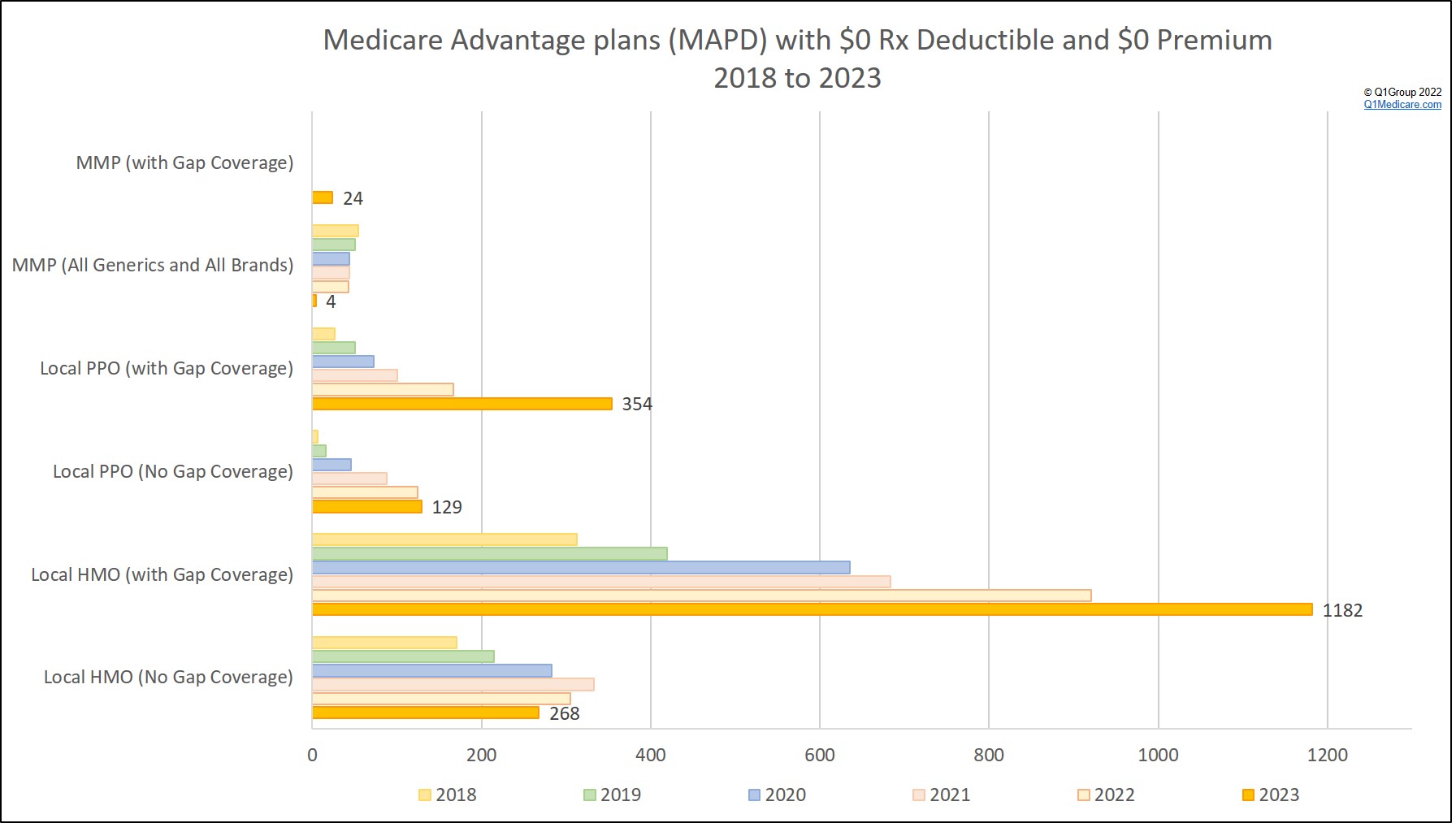

And in addition to overall lower-premium 2023 Medicare Advantage plans, our analysis found forty percent (40%) of all 2023 Medicare Advantage plans that include prescription drug coverage (MAPDs) will have a $0 premium and $0 initial drug deductible (up from 34% in 2022).

As shown in the table below, in 2023, there will be 1,961 Medicare Advantage plans with prescription drug coverage (MAPDs) having a $0 Part D initial drug deductible and a $0 monthly premium ($0/$0 plans) - as compared to 1,560 $0/$0 plans available in 2022.

As might be expected, the highest concentration of $0/$0 Medicare Advantage plans are located in Florida and California. However, 50 different states plus Puerto Rico will have one or more counties where Medicare beneficiaries will have access to at least one Medicare Advantage plan that includes prescription drug coverage with a $0 deductible and has a $0 monthly premium plan.

As an example, Miami-Dade County, Florida offers 50 Medicare Advantage plans (MAPDs) with a $0 deductible and $0 monthly premium, 48 of these plans have some Gap (or Donut Hole) Coverage and 32 of those Medicare Advantage plans have a MOOP of $3,450 or less.

And in addition to overall lower-premium 2023 Medicare Advantage plans, our analysis found forty percent (40%) of all 2023 Medicare Advantage plans that include prescription drug coverage (MAPDs) will have a $0 premium and $0 initial drug deductible (up from 34% in 2022).

As shown in the table below, in 2023, there will be 1,961 Medicare Advantage plans with prescription drug coverage (MAPDs) having a $0 Part D initial drug deductible and a $0 monthly premium ($0/$0 plans) - as compared to 1,560 $0/$0 plans available in 2022.

As might be expected, the highest concentration of $0/$0 Medicare Advantage plans are located in Florida and California. However, 50 different states plus Puerto Rico will have one or more counties where Medicare beneficiaries will have access to at least one Medicare Advantage plan that includes prescription drug coverage with a $0 deductible and has a $0 monthly premium plan.

As an example, Miami-Dade County, Florida offers 50 Medicare Advantage plans (MAPDs) with a $0 deductible and $0 monthly premium, 48 of these plans have some Gap (or Donut Hole) Coverage and 32 of those Medicare Advantage plans have a MOOP of $3,450 or less.

| 2023 Medicare

Advantage plans (MAPDs) with No Initial Deductible ($0) and No Monthly Premium ($0) |

||||||

| Medicare Advantage Plan Type (MAPD) | Gap (Donut Hole) Coverage | 2023 Plans | 2022 Plans | Change '22 to '23 | 2021 Plans | 2020 Plans |

| Local HMO | No Gap Coverage | 268 | 305 | -37 | 333 | 283 |

| Local HMO | Yes | 1,182 | 921 | 261 | 683 | 536 |

| Local PPO | No Gap Coverage | 129 | 124 | 5 | 88 | 46 |

| Local PPO | Yes | 354 | 167 | 187 | 100 | 73 |

| Medicare-Medicaid Plan | All Generics and All Brands | 4 | 43 | -39 | 44 | 44 |

| Medicare-Medicaid Plan | Yes | 24 | 24 | |||

| Total Plans | 1,961 | 1,560 | 401 | 1,248 | 982 | |

As a reminder: Be sure to look beyond the $0 premium and $0 deductible!

As you review your 2023 Medicare plan options, be sure the Medicare Advantage plan you are considering also:

- has an acceptable annual Medicare Part

A and Part B Maximum

Out-of-Pocket limit (or MOOP),

- has a healthcare network including the

physicians or health care providers that you can visit (with acceptable limits

on out-of-network healthcare), and

- provides a formulary (drug list) most affordably covering your prescription drugs (and includes your local pharmacies in their network).

Because of lower-than-expected plan expenses, some $0 premium Medicare Advantage plans are able to rebate or give-back all or a portion of your Medicare Part B premium (as part of your monthly Social Security check - up to $170.10 in 2023 and $148.50 in 2022).

Sometimes these Medicare Advantage plans are called a "Giveback", "Give Back", "Dividend", or "Rebate" plans.

The number of Part B Giveback plans has increased over time and in 2023, 235 Medicare Advantage plans with a $0 premium and $0 deductible ($0/$0 plans) will return a portion of your Medicare Part B premium -- the number of plans is up from 190 Giveback plans in 2022. In more detail, over 2,362 counties include at least one 2023 Medicare Advantage plan with a Part B premium “Giveback” or refund (equating to about 8,783 unique plan/county combinations of different 2023 Medicare Advantage plans).

Naturally, the availability of Medicare Advantage plans with Part B premium Givebacks will depend on where you live (County, Zip Code area or partial-ZIP) - and the amount of your Medicare Part B premium that you receive as a "Giveback" will depend on your chosen Medicare Advantage plan and the area of the country where you are located - with the amount of the Part B premium givebacks ranging from $2 up to $170.10.

You can search for Medicare Advantage Giveback plans by using the Q1Medicare MA-Finder search tool and checking the box for Part B Giveback plans (MA-Finder.com/2023).

When you check the “Part B Giveback plans” box at the top of the page (look within the search criteria fields), you may also want to change the “Additional Info” box to “Display Medicare Part B Giveback Amount”, you can see the Part B premium Giveback amount in the right column.

For more information, instructions for using the MA-Finder Giveback filter, and screen shots please see our Frequently Asked Question:

“Do any Medicare Advantage plans refund or give back a portion of my Medicare Part B premium?”: Q1FAQ.com/741.

As always, you can also call the plans for more Giveback information (the telephone number for Member Services is available when you click on the Medicare Advantage plan name).

Need additional help finding a plan?

If you are unsure about your Medicare Advantage plan options, contact a Medicare representative at 1-800-633-4227.

You can also use our MA-Finder to preview all $0 Premium 2023 Medicare Advantage plans with prescription drug coverage available in your area (just enter your ZIP code after clicking on the link or go to MA-Finder.com to start.)

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service