More 2023 Medicare Advantage plans with a Medicare Part B premium Giveback feature

Our preliminary review of the 2023 Medicare Advantage plan landscape data released in late-September by the Centers for

Medicare and Medicaid Services (CMS) shows, as in past years, over 90% of 2023 Medicare Advantage plans will include

prescription drug coverage (MAPDs) - and forty

percent (40%) of these 2023 MAPDs will have a $0 premium and $0 initial drug

deductible (up from 30% of MAPDs in 2021) - and, in 2023 more $0/$0 MAPDs will also return or "Give Back" all or a portion of your Medicare Part B premium.

Question: How can a Medicare plan give back a portion or all of a Medicare Part B premium?

The federal government provides each Medicare Advantage plan with money for each Medicare plan beneficiary compensating the plan for implementing the person's Medicare Part A and Part B coverage. And because of lower-than-expected Medicare plan expenses (the plan members do not use as much coverage as expected), some Medicare plans can reduce the plan's premium to $0 per month - and, again, based on healthy plan members, some $0 premium Medicare Advantage plans are able to rebate or give-back all or a portion of the member's Medicare Part B premium (returned with the monthly Social Security check) - up to $170.10 in 2023 and $148.50 in 2022). Sometimes these $0 premium Medicare Advantage plans are called "Giveback", "Give Back", "Dividend", or "Rebate" plans.

Question: So, with a give-back plan, we pay no monthly premium for our Medicare plan coverage and get money refunded back for our Part B premium?

Yes. One requirement for joining a Medicare Advantage plan is that you must be enrolled in both Medicare Part A and Medicare Part B. Most people receive Medicare Part A coverage without premium cost based on past employment. However, these same people pay a monthly Medicare Part B premium for their Medicare "out-patient" care.

With a $0/$0 Part B Giveback MAPD plan - you receive a portion of your Part B premium returned to you (up to $170.10) - while your monthly Medicare Advantage plan premium is $0, and you will have a $0 prescription drug deductible - meaning you will actually have more money at the end of the month with the MAPD plan coverage.

$0 Premium / $0 Deductible MAPD with a Part B premium Giveback: Is this most economical Medicare Advantage plan option?

Finding a $0 premium Medicare Advantage plan with a $0 prescription drug deductible that includes a generous drug list (formulary), cost-sharing, supplemental benefits, healthcare network, and an acceptable maximum out-of-pocket spending limit (MOOP) is certainly hard to ignore when contemplating Medicare Advantage plan options.

However, even better may be finding that, in your county, there are the same type of $0 premium/$0 deductible 2023 MAPD plans that also return a portion of your Medicare Part B premium - or provide a "Giveback", "Dividend", or "Rebate" feature to plan members.

Important: Look beyond the $0 Rx deductible, the $0 premium, and Part B give-back. Yes, Medicare Advantage Part B Giveback plans do provide very economic Medicare coverage for many people, but ... please ensure that your prescription drugs are also economically covered by your chosen MAPD plan and your doctors (healthcare providers) are included in the MAPD network and the Medicare Advantage plan has an acceptable MOOP limit and that you receive the Supplemental Benefits you desire.

More Part B premium Giveback $0/$0 Medicare Advantage (MAPD) plans in 2023 - but "Giveback" plans are not available everywhere.

In 2023, over 3,008 counties (or ZIP Code areas) include at least one Medicare Advantage plan with a Part B premium “Giveback” - and 1,283 counties offer at least one $0/$0 Medicare Advantage (MAPD) plan with a Part B premium “Giveback” -- with the amount of the give-backs ranging from $2 up to $170.10 (this may decrease with the recently released 2023 Part B premium of $164.90).

Please remember, the availability of Medicare Advantage plans (MA or MAPD) with Part B premium Givebacks will depend on where you live (County, ZIP Code area or partial-ZIP) - and, the amount of your Medicare Part B premium that you receive as a "Giveback" will also depend on your Medicare Advantage plan and the area of the country where you are located.

Question: How can a Medicare plan give back a portion or all of a Medicare Part B premium?

The federal government provides each Medicare Advantage plan with money for each Medicare plan beneficiary compensating the plan for implementing the person's Medicare Part A and Part B coverage. And because of lower-than-expected Medicare plan expenses (the plan members do not use as much coverage as expected), some Medicare plans can reduce the plan's premium to $0 per month - and, again, based on healthy plan members, some $0 premium Medicare Advantage plans are able to rebate or give-back all or a portion of the member's Medicare Part B premium (returned with the monthly Social Security check) - up to $170.10 in 2023 and $148.50 in 2022). Sometimes these $0 premium Medicare Advantage plans are called "Giveback", "Give Back", "Dividend", or "Rebate" plans.

Question: So, with a give-back plan, we pay no monthly premium for our Medicare plan coverage and get money refunded back for our Part B premium?

Yes. One requirement for joining a Medicare Advantage plan is that you must be enrolled in both Medicare Part A and Medicare Part B. Most people receive Medicare Part A coverage without premium cost based on past employment. However, these same people pay a monthly Medicare Part B premium for their Medicare "out-patient" care.

With a $0/$0 Part B Giveback MAPD plan - you receive a portion of your Part B premium returned to you (up to $170.10) - while your monthly Medicare Advantage plan premium is $0, and you will have a $0 prescription drug deductible - meaning you will actually have more money at the end of the month with the MAPD plan coverage.

$0 Premium / $0 Deductible MAPD with a Part B premium Giveback: Is this most economical Medicare Advantage plan option?

Finding a $0 premium Medicare Advantage plan with a $0 prescription drug deductible that includes a generous drug list (formulary), cost-sharing, supplemental benefits, healthcare network, and an acceptable maximum out-of-pocket spending limit (MOOP) is certainly hard to ignore when contemplating Medicare Advantage plan options.

However, even better may be finding that, in your county, there are the same type of $0 premium/$0 deductible 2023 MAPD plans that also return a portion of your Medicare Part B premium - or provide a "Giveback", "Dividend", or "Rebate" feature to plan members.

Important: Look beyond the $0 Rx deductible, the $0 premium, and Part B give-back. Yes, Medicare Advantage Part B Giveback plans do provide very economic Medicare coverage for many people, but ... please ensure that your prescription drugs are also economically covered by your chosen MAPD plan and your doctors (healthcare providers) are included in the MAPD network and the Medicare Advantage plan has an acceptable MOOP limit and that you receive the Supplemental Benefits you desire.

More Part B premium Giveback $0/$0 Medicare Advantage (MAPD) plans in 2023 - but "Giveback" plans are not available everywhere.

In 2023, over 3,008 counties (or ZIP Code areas) include at least one Medicare Advantage plan with a Part B premium “Giveback” - and 1,283 counties offer at least one $0/$0 Medicare Advantage (MAPD) plan with a Part B premium “Giveback” -- with the amount of the give-backs ranging from $2 up to $170.10 (this may decrease with the recently released 2023 Part B premium of $164.90).

Please remember, the availability of Medicare Advantage plans (MA or MAPD) with Part B premium Givebacks will depend on where you live (County, ZIP Code area or partial-ZIP) - and, the amount of your Medicare Part B premium that you receive as a "Giveback" will also depend on your Medicare Advantage plan and the area of the country where you are located.

How can you find Medicare Advantage (MAPDs) in your area with a Part B premium Giveback?

We include the Part B premium Giveback information in our Medicare Advantage Plan Finder (MA-Finder.com/32084) - and the quickest way to see all giveback plans is to use a quick link such as MA-Finder.com/giveback/32084. You can change the ZIP code to your zip to see all plans that offer a Part B premium Giveback.

As an online example, here is a link to all counties in New York state and a total of the number of 2023 Medicare Advantage plans in each county: MA-Finder.com/2023/NY

And here is an “example” link to all 95 of the 2023 Medicare Advantage plans in Queens County, New York:

https://q1medicare.com/mafinder/2023/?state=NY&countyCode=36081&showCounty=Queens

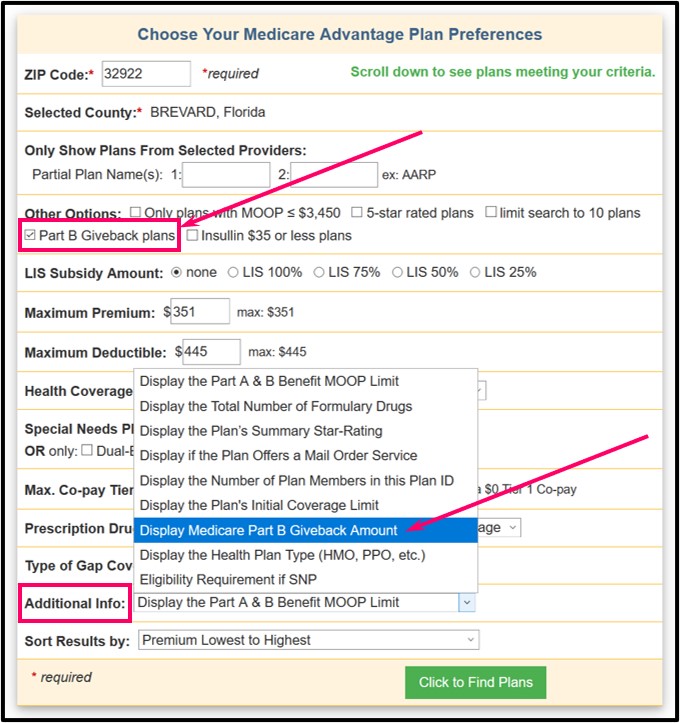

You will notice that Q1Medicare has a search “filter” for Medicare Part B Give-Back or rebate plans found at the top of our Q1Medicare Medicare Advantage Plan Finder (MA-Finder.com).

You can now "select" the Giveback filter and then also "select" the "Display Medicare Part B Giveback Amount" from the Additional Info box drop-down box, - after you click the green "Click to Find Plans" button, you can see the "Giveback Amount" in the right column.

You can change the ZIP Code from Queens County, New York to where you live to see plans in your area.

Below is a graphic showing an older example of search results for both Medicare Advantage plans with drug coverage (MAPDs) and Medicare Advantage plans without drug coverage (MAs) in Brevard County, Florida. The MAPDs have a $0 premium and a $0 prescription drug deductible ($0/$0 plans) and Medicare Part B premium Giveback of $60 to $95. The MAs (no drug coverage) have a $0 premium and a Part B premium Giveback of $75 to $144.

For more information, instructions for using the filter, and screen shots please see our Frequently Asked Question:

“Do any Medicare Advantage plans refund or give back a portion of my Medicare Part B premium?”: Q1FAQ.com/741.

As always, you can also call the plans for more Give-Back information (the telephone number for Member Services is available when you click on the plan name).

Need additional help finding a Medicare plan?

If you are unsure about your Medicare Advantage or Medicare Part D plan options, please contact a Medicare representative at 1-800-633-4227 (1-800-Medicare).

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service