Understanding the 2019 Medicare Part D Coverage Gap or Donut Hole

The Donut Hole or Coverage Gap is a

term used to describe a gap or pause in your Medicare Part D prescription drug plan

or Medicare Advantage plan coverage where, prior to 2011, you were 100% responsible for the cost of your prescription drugs -

unless your Medicare plan provided some brand-name or generic

drug coverage through the Donut Hole.

However, starting in 2011, Medicare Part D prescription drug plans and the pharmaceutical drug manufacturers began to share a portion of your medication expenses while you are in the Donut Hole (giving you what we now call the Donut Hole discount). So if you reach the Donut Hole, you are no longer responsible for paying 100% of the retail drug price, and instead, you pay a discounted price.

Reminder: The Donut Hole is actually the third part or phase of your Medicare Part D prescription drug coverage and you only reach this phase and enter the Donut Hole when your drug spending exceeds a certain point (your Initial Coverage Limit) - you will leave the Donut Hole after spending a certain amount of money out-of-pocket (your TrOOP) - or your Donut Hole ends when you reach December 31st. And on January 1st, your drug coverage starts over again from the beginning. You can read the next sections below for more information about entering - and exiting the Donut Hole.

Will you enter the 2019 Donut Hole?

If your formulary medications have a total retail value over $3,820 or you have retail drug costs over $319 per month, you will enter the 2019 Donut Hole and receive a discount on your Medicare Part D prescriptions (the $3,820 is not what you spend out-of-pocket, but the actual retail value of the medications you use). If you are receiving Medicare Part D Extra Help, you never have a Donut Hole in your coverage. Read more in our article: Will I enter the 2019 Medicare Part D Coverage Gap or Donut Hole?

What happens if you enter the Donut Hole?

If you enter the Donut Hole, you will receive a discount on all generic and brand-name formulary drugs that you purchase. And here are the discounts:

A quick review of how the Donut Hole fits into your Medicare Part D coverage

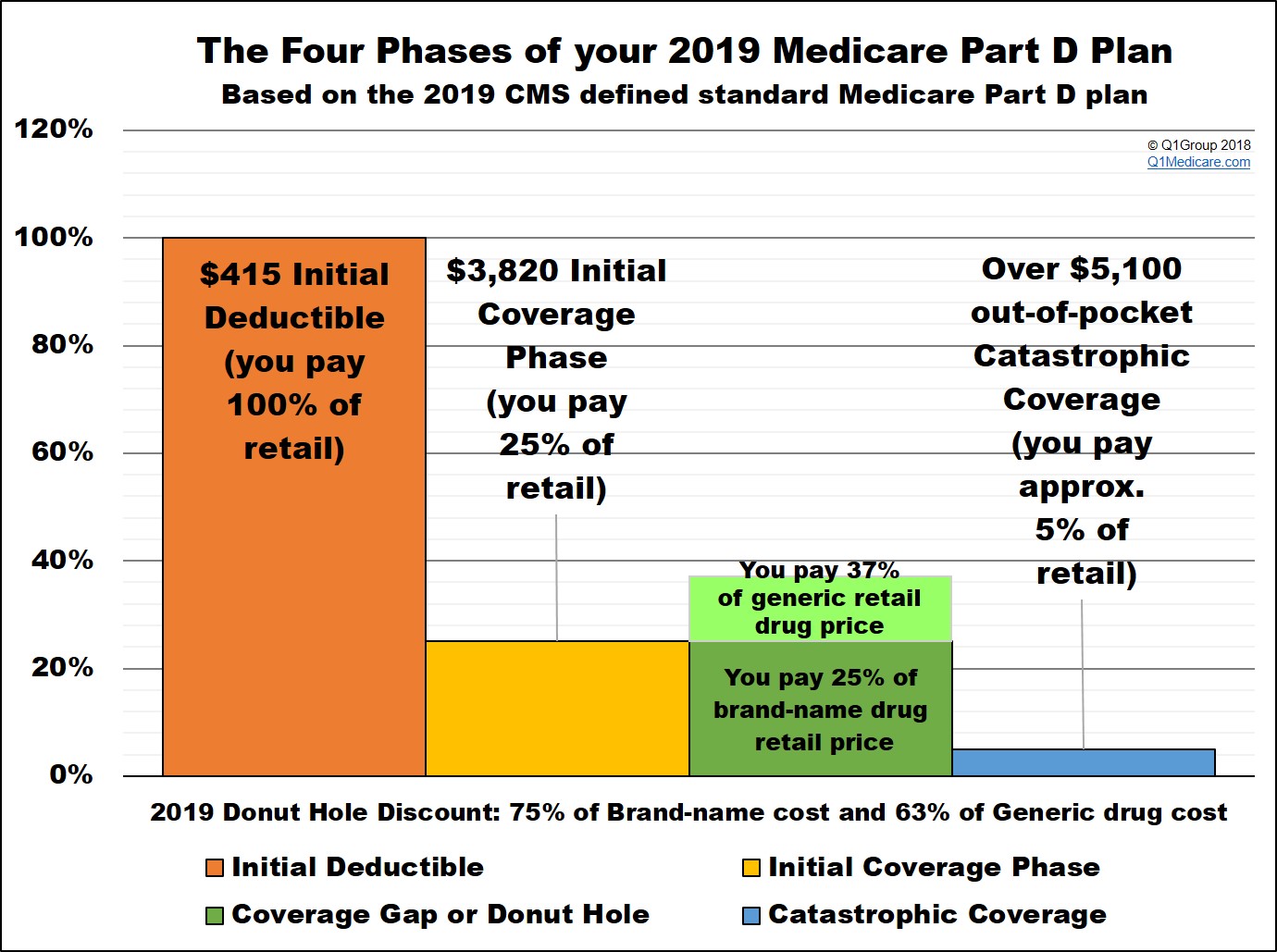

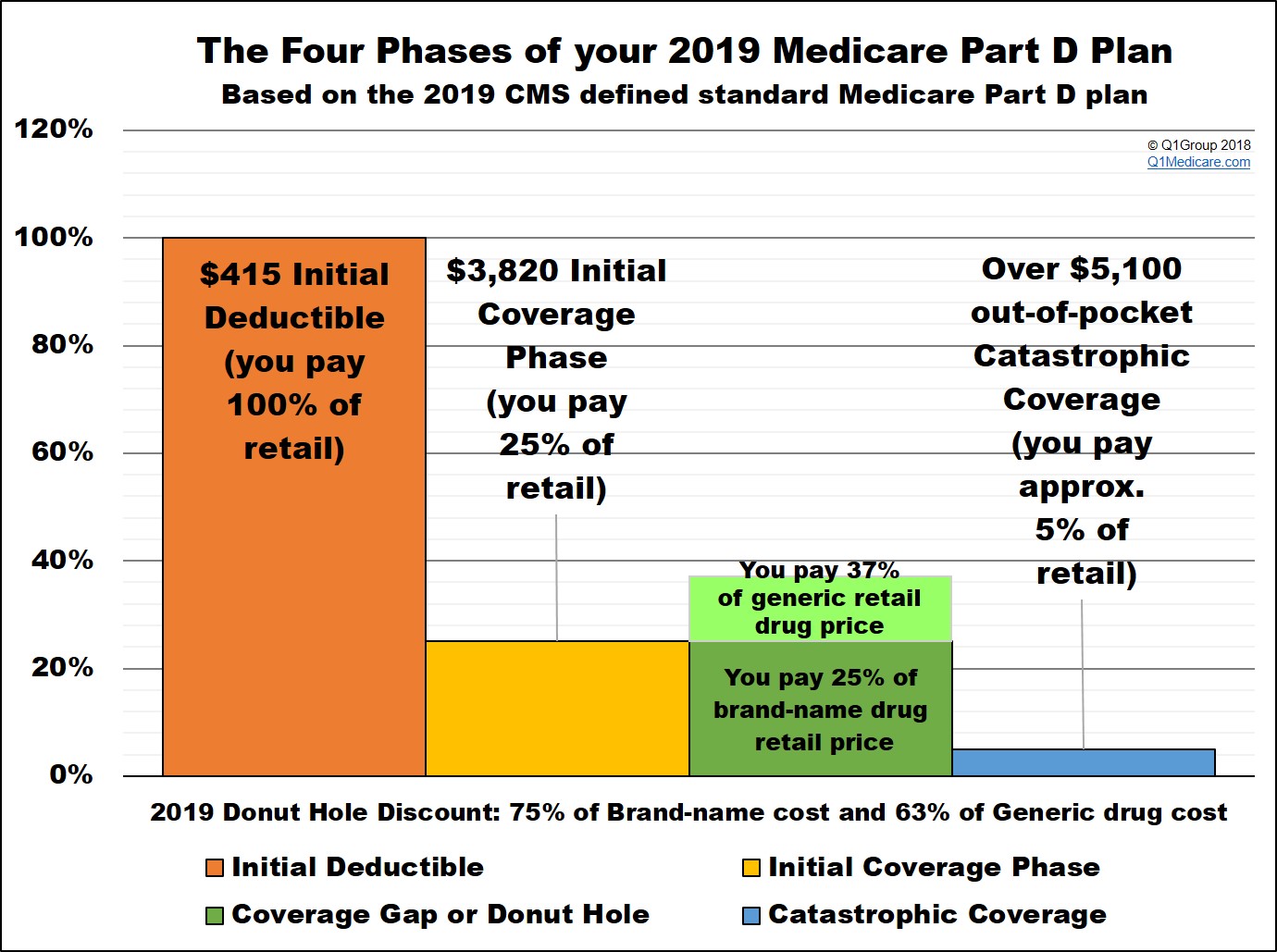

As a reminder, your Medicare Part D plan coverage has four separate parts or phases. However, if your Medicare Part D plan has a $0 initial deductible, you will skip the first or deductible phase and begin coverage directly in the Initial Coverage Phase.

Part 1 of your drug coverage

The Initial Deductible Phase (unless your plan has a $0 deductible and you skip directly to the Initial Coverage Phase): If your Medicare Part D plan has an Initial Deductible, you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole. However, some Medicare Part D prescription drug plans with an Initial Deductible are now covering some lower-costing medications in the Initial Deductible. So, whether you or your plan pays for your medications in the Initial Deductible, the retail value of your medications counts toward your Initial Coverage Limit (see next section) and determines when you enter into the Donut Hole or Coverage Gap.

The standard Initial Deductible can change each year. In 2019, the Initial Deductible is $415. In 2018, the Initial Deductible was $405.

Part 2 of your drug coverage

The Initial Coverage Phase: After the Initial Deductible (if any), you will continue into your Initial Coverage Phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance). You will leave your Initial Coverage Phase and enter the Donut Hole or Coverage Gap when your retail medication costs reach a certain amount (not the amount of what you paid for your drugs, but the retail value of the medications you purchased - for instance, if you buy a medication with a retail value of $100 for a $30 co-payment, the $100 retail value counts toward your Initial Coverage Limit).

The Initial Coverage Limit can change each year. In 2019, the Initial Coverage Limit or Donut Hole entry point begins when your retail drug costs exceed $3,820 - in 2018, the Initial Coverage Limit or Donut Hole entry point is when retail drug costs exceed $3,750.

Bottom Line: If the retail cost of your medications is over $319 per month, you will enter the 2019 Donut Hole.

A note on using high-cost medications:

If you use a single medication with a retail cost of over $3,820, you will enter the Donut Hole with your first purchase. If you use an expensive medication on an infrequent basis, you may find that one large drug purchase (or multiple drug purchases in a single month) can actually move you from the Initial Coverage Phase (or Initial Deductible) into the Donut Hole, so the only way to know exactly when you will enter or leave the doughnut hole is by watching your monthly Medicare Part D plan's Explanation of Benefits statement carefully (you received this printed form in the mail) or you can contact your Medicare Part D plan and ask the Member Services representative where you are relative to the plan's Coverage Gap.

Part 3 of your drug coverage

The Coverage Gap or Donut Hole: You will leave the Initial Coverage Phase and enter the Donut Hole when your total retail drug cost (what you spent plus what your Medicare drug plan spent) exceeds the Initial Coverage Limit. As mentioned, this is the portion of your Medicare Part D coverage where you traditionally paid a larger percentage of the retail drug cost. From 2006 through 2010, you were responsible for 100% of your drug costs, unless your Medicare plan included some Donut Hole coverage. Since 2011, you receive some discount on your Medicare Part D plan purchases while in the Donut Hole.

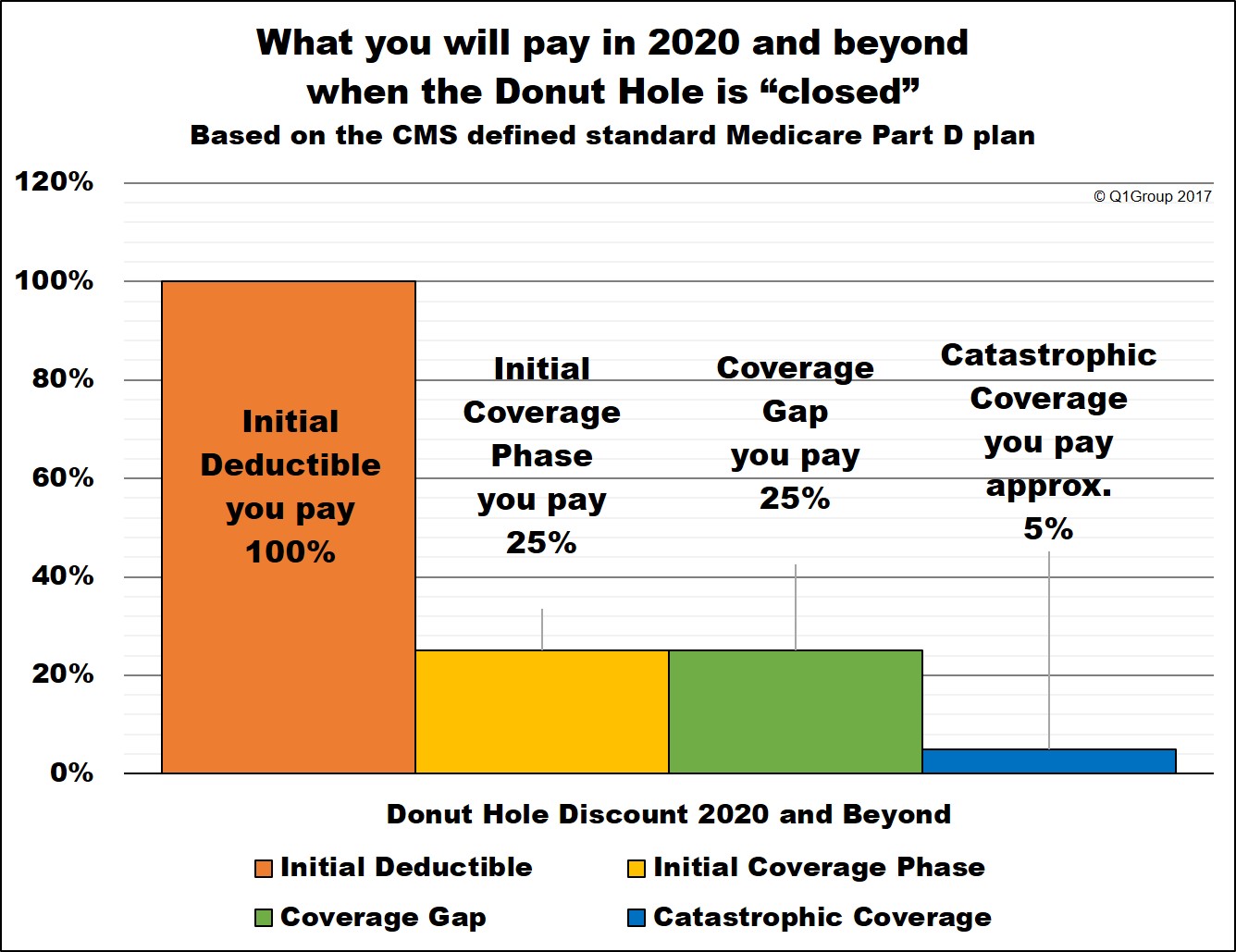

The 2019 Donut Hole discount is 75% for brand-name drugs (you pay 25%) and 63% for generic drugs (you pay 37%). For more information about the Donut Hole discount, you can click here to see how the Donut Hole discount has increased over the years. In 2020, the Donut Hole discount will be 75% for all formulary drugs and the Donut Hole is considered “closed”.

Part 4 of your drug coverage

The Catastrophic Coverage Phase: You will stay in the Coverage Gap or Donut Hole phase until your out-of-pocket costs (called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2019 is $5,100. So if you have spent $5,100 on Medicare Part D drugs (not including monthly Medicare plan premiums), you will exit the Donut Hole and enter the Catastrophic Coverage phase.

Your TrOOP limit can change every year: the TrOOP in 2016 was $4,850 - TrOOP in 2017 was $4,950 - TrOOP in 2018 was $5,000.

A note on TrOOP vs. Retail Cost: Without considering your Donut Hole discount, your 2019 TrOOP (true or total out-of-pocket costs) should equate to about $7,654 in retail drug costs. But with the Donut Hole discount, Medicare estimates that your retail drug cost should be around $8,139.54 before exiting the 2019 Donut Hole. The estimate is based on historic brand-name and generic drug purchases while in the Donut Hole.

Bottom Line: If your monthly retail drug costs are somewhere around $743, you probably will spend your way through the 2019 Donut Hole and enter your Medicare Part D plan's 2019 Catastrophic Coverage phase.

Once you enter the 2019 Catastrophic Coverage portion of your Medicare Part D plan, you pay the greater of 5% or $3.40 for generic drugs (and preferred drugs that are multi-source drugs) or the greater of 5% or $8.50 for all other drugs (such as brand-name medications).

For example, if you purchase a brand-name medication in the 2019 Catastrophic Coverage phase that has a retail cost of $100, you will pay $8.50 (since this fixed cost of $8.50 is higher than $5.00 ($100 * 5%).

Reminder: No matter where you are at the end of the plan year, your Medicare Part D plan coverage ends on December 31st and the whole process begins again on January 1st of the next year.

* 25% coinsurance or cost-sharing

** 75% Brand-name Discount

*** 63% Generic Discount

**** you pay 5% of retail or $8.50 for brand drugs whatever is higher or 5% of retail or $3.40 for generic or multi-source drugs whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

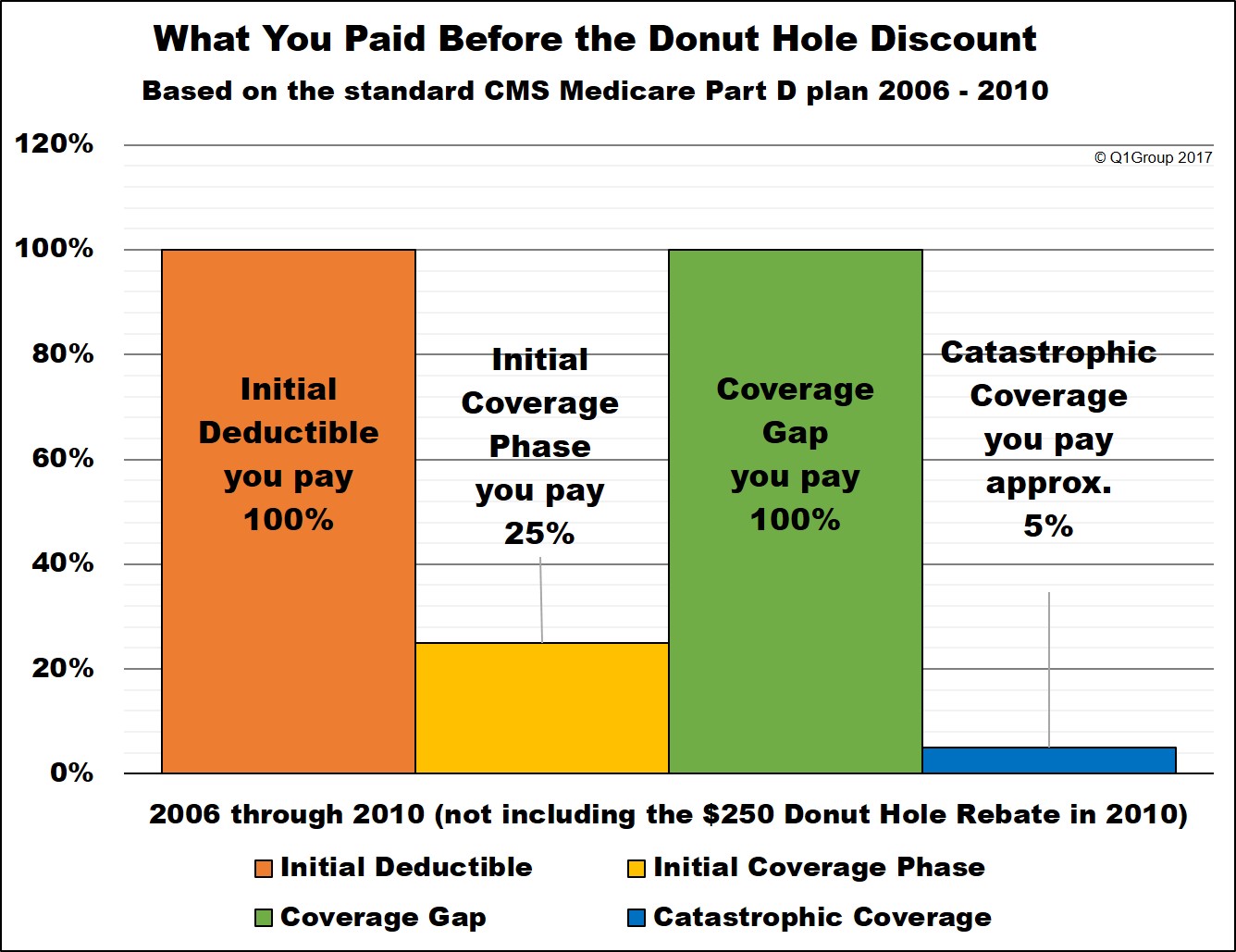

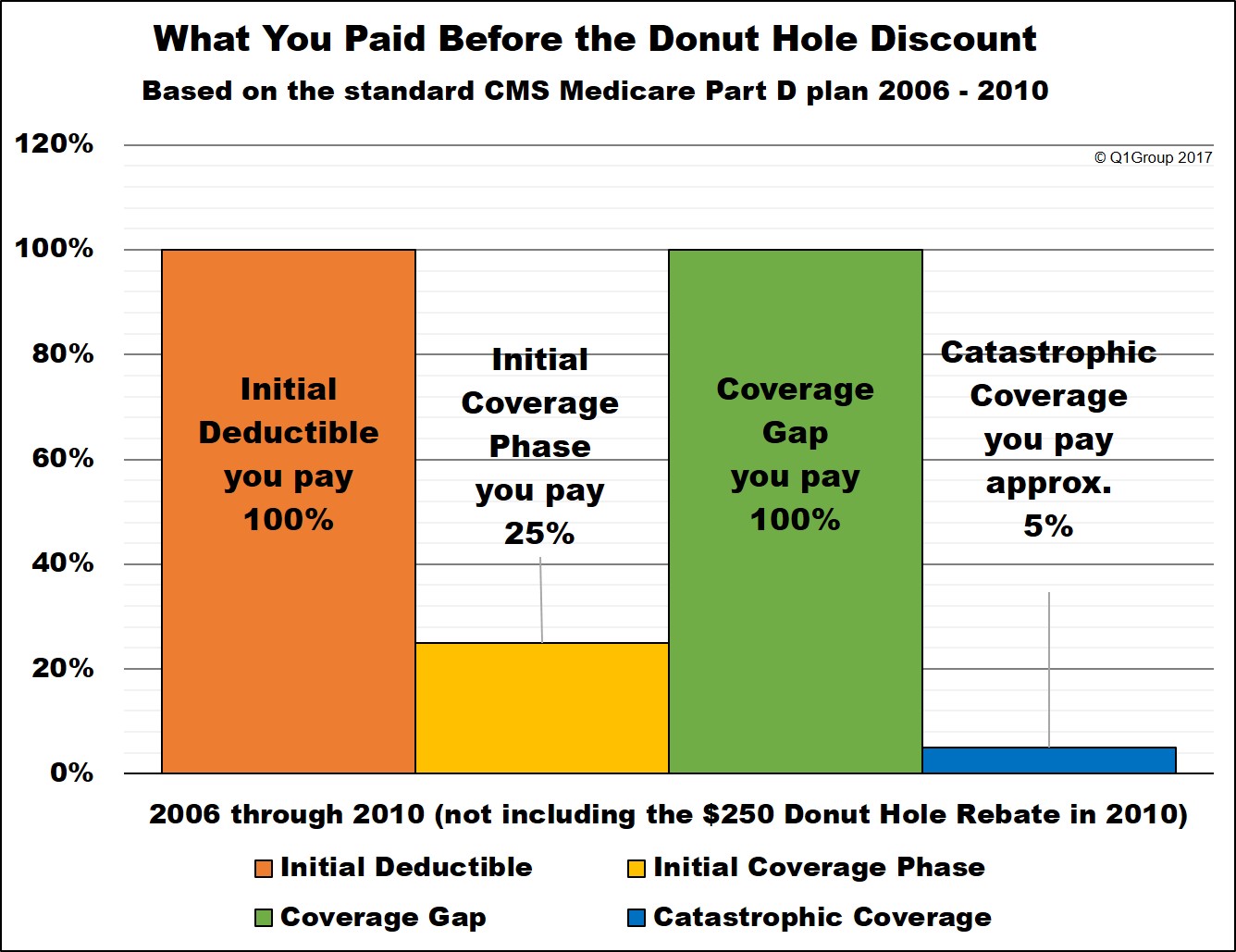

A bit of Coverage Gap history: The Donut Hole 2006 to 2010

Before 2011, the Medicare Part D Coverage Gap or Donut Hole was actually similar to a second deductible in an insurance policy where, after receiving a certain level of coverage, you were, once again, responsible for paying your own drug coverage until you reached the Catastrophic Coverage portion of your Medicare Part D plan or Medicare Advantage plan that included drug coverage (MAPD).

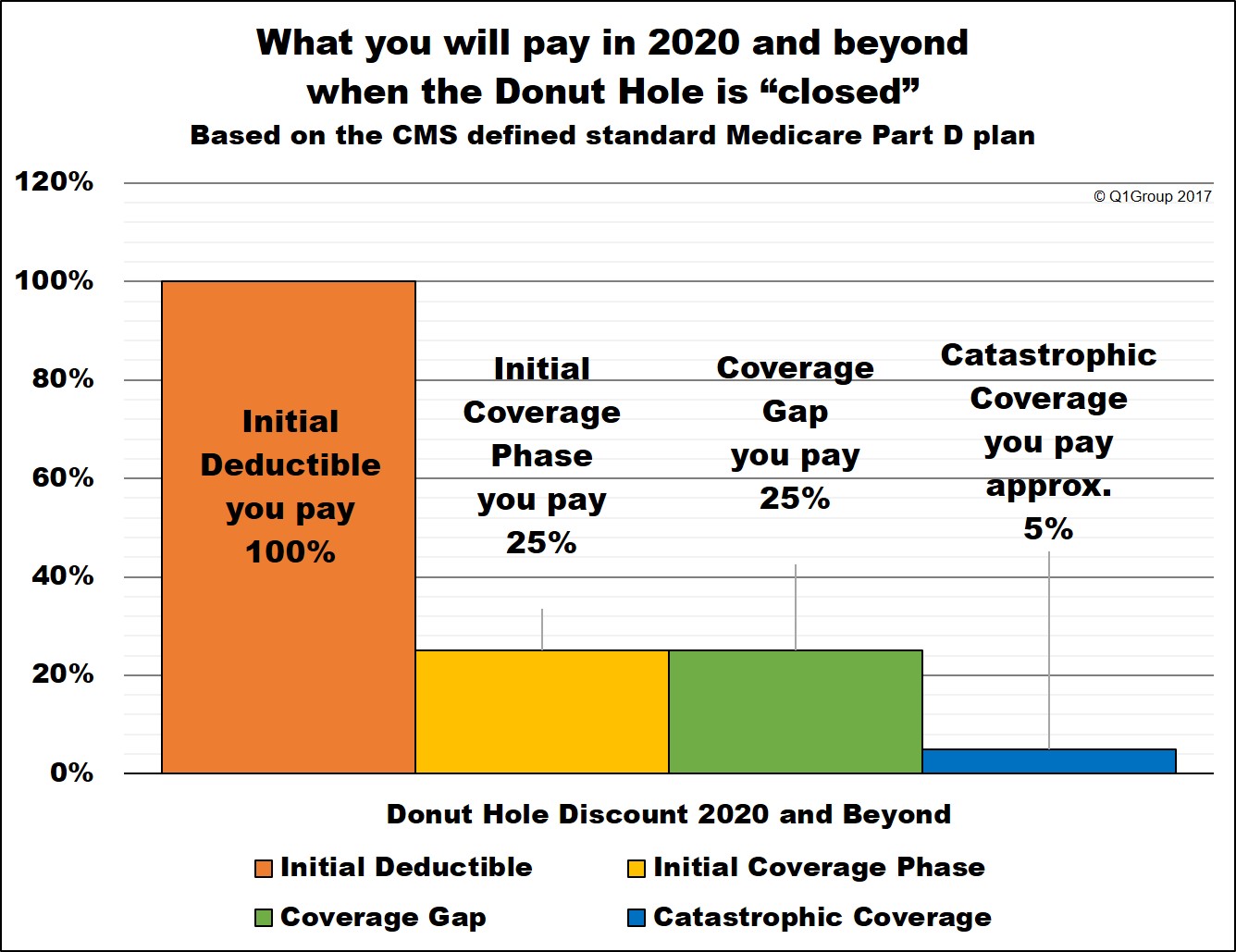

A view into the future and the closing of the Donut Hole

In 2020, the Coverage Gap will be considered "closed" when both generic and brand-name drugs will cost Medicare Part D plan members 25% of the retail drug price (so you will pay $250 for a medication with a $1,000 retail cost) until reaching Catastrophic Coverage.

*Update 02/12/18: President Trump signed the Bipartisan Budget Act of 2019 (Pub.L. 115-123) on Friday, February 9, 2018 that effectively "closes" the Coverage Gap for brand-name drugs, with the brand-name Donut Hole discount increasing to 75% in 2019. The Coverage Gap for generic drugs will not "close" until 2020.

Help with planning for your 2019 Donut Hole

To help you visualize the phases of your Medicare Part D prescription drug plan coverage, we have a Donut Hole Calculator or 2019 PDP-Planner online illustrating the changes in your monthly estimated costs based on the established 2019 standard Medicare Part D plan limits mentioned above.

We also have several examples online to help you get started with our 2019 PDP-Planner tool. You can click here for an example of a Medicare beneficiary with relatively high monthly prescription drug costs of $800 per month that result in annual out-of-pocket costs estimated at $2,362.36 - you can then change the monthly drug cost to whatever you wish to estimate your 2019 out-of-pocket cost.

However, starting in 2011, Medicare Part D prescription drug plans and the pharmaceutical drug manufacturers began to share a portion of your medication expenses while you are in the Donut Hole (giving you what we now call the Donut Hole discount). So if you reach the Donut Hole, you are no longer responsible for paying 100% of the retail drug price, and instead, you pay a discounted price.

Reminder: The Donut Hole is actually the third part or phase of your Medicare Part D prescription drug coverage and you only reach this phase and enter the Donut Hole when your drug spending exceeds a certain point (your Initial Coverage Limit) - you will leave the Donut Hole after spending a certain amount of money out-of-pocket (your TrOOP) - or your Donut Hole ends when you reach December 31st. And on January 1st, your drug coverage starts over again from the beginning. You can read the next sections below for more information about entering - and exiting the Donut Hole.

Will you enter the 2019 Donut Hole?

If your formulary medications have a total retail value over $3,820 or you have retail drug costs over $319 per month, you will enter the 2019 Donut Hole and receive a discount on your Medicare Part D prescriptions (the $3,820 is not what you spend out-of-pocket, but the actual retail value of the medications you use). If you are receiving Medicare Part D Extra Help, you never have a Donut Hole in your coverage. Read more in our article: Will I enter the 2019 Medicare Part D Coverage Gap or Donut Hole?

What happens if you enter the Donut Hole?

If you enter the Donut Hole, you will receive a discount on all generic and brand-name formulary drugs that you purchase. And here are the discounts:

- The 2019 Donut Hole generic drug discount will increase from 56% (2018) to 63%.

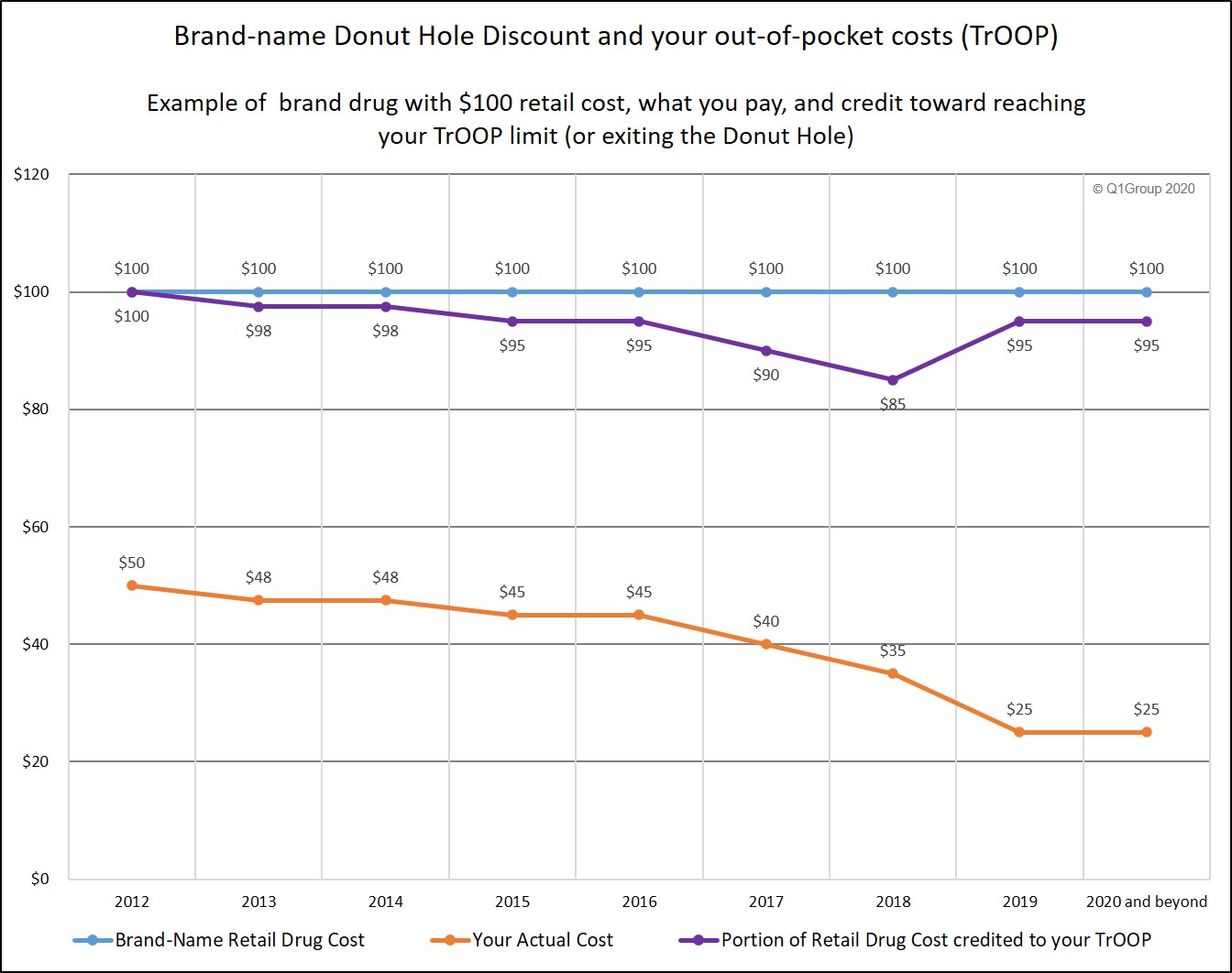

- The 2019 Donut Hole discount for brand-name drugs will increase to 75% and you will receive credit for 95% of the retail drug cost toward meeting your 2019 total out-of-pocket maximum (TrOOP) or Donut Hole exit point (the 25% you spend plus the 70% drug manufacturer discount).

A quick review of how the Donut Hole fits into your Medicare Part D coverage

As a reminder, your Medicare Part D plan coverage has four separate parts or phases. However, if your Medicare Part D plan has a $0 initial deductible, you will skip the first or deductible phase and begin coverage directly in the Initial Coverage Phase.

Part 1 of your drug coverage

The Initial Deductible Phase (unless your plan has a $0 deductible and you skip directly to the Initial Coverage Phase): If your Medicare Part D plan has an Initial Deductible, you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole. However, some Medicare Part D prescription drug plans with an Initial Deductible are now covering some lower-costing medications in the Initial Deductible. So, whether you or your plan pays for your medications in the Initial Deductible, the retail value of your medications counts toward your Initial Coverage Limit (see next section) and determines when you enter into the Donut Hole or Coverage Gap.

The standard Initial Deductible can change each year. In 2019, the Initial Deductible is $415. In 2018, the Initial Deductible was $405.

Part 2 of your drug coverage

The Initial Coverage Phase: After the Initial Deductible (if any), you will continue into your Initial Coverage Phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance). You will leave your Initial Coverage Phase and enter the Donut Hole or Coverage Gap when your retail medication costs reach a certain amount (not the amount of what you paid for your drugs, but the retail value of the medications you purchased - for instance, if you buy a medication with a retail value of $100 for a $30 co-payment, the $100 retail value counts toward your Initial Coverage Limit).

The Initial Coverage Limit can change each year. In 2019, the Initial Coverage Limit or Donut Hole entry point begins when your retail drug costs exceed $3,820 - in 2018, the Initial Coverage Limit or Donut Hole entry point is when retail drug costs exceed $3,750.

Bottom Line: If the retail cost of your medications is over $319 per month, you will enter the 2019 Donut Hole.

A note on using high-cost medications:

If you use a single medication with a retail cost of over $3,820, you will enter the Donut Hole with your first purchase. If you use an expensive medication on an infrequent basis, you may find that one large drug purchase (or multiple drug purchases in a single month) can actually move you from the Initial Coverage Phase (or Initial Deductible) into the Donut Hole, so the only way to know exactly when you will enter or leave the doughnut hole is by watching your monthly Medicare Part D plan's Explanation of Benefits statement carefully (you received this printed form in the mail) or you can contact your Medicare Part D plan and ask the Member Services representative where you are relative to the plan's Coverage Gap.

Part 3 of your drug coverage

The Coverage Gap or Donut Hole: You will leave the Initial Coverage Phase and enter the Donut Hole when your total retail drug cost (what you spent plus what your Medicare drug plan spent) exceeds the Initial Coverage Limit. As mentioned, this is the portion of your Medicare Part D coverage where you traditionally paid a larger percentage of the retail drug cost. From 2006 through 2010, you were responsible for 100% of your drug costs, unless your Medicare plan included some Donut Hole coverage. Since 2011, you receive some discount on your Medicare Part D plan purchases while in the Donut Hole.

The 2019 Donut Hole discount is 75% for brand-name drugs (you pay 25%) and 63% for generic drugs (you pay 37%). For more information about the Donut Hole discount, you can click here to see how the Donut Hole discount has increased over the years. In 2020, the Donut Hole discount will be 75% for all formulary drugs and the Donut Hole is considered “closed”.

Part 4 of your drug coverage

The Catastrophic Coverage Phase: You will stay in the Coverage Gap or Donut Hole phase until your out-of-pocket costs (called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2019 is $5,100. So if you have spent $5,100 on Medicare Part D drugs (not including monthly Medicare plan premiums), you will exit the Donut Hole and enter the Catastrophic Coverage phase.

TrOOP is the total of what you pay

- during the Initial Deductible (if you have one) plus

- what you personally pay in the Initial Coverage Phase, before the Donut Hole, plus

- what you pay in the Donut Hole (and plus you get credit for the 70% brand-name discount paid by the drug manufacturer in the donut hole - for instance, if in the 2019 Donut Hole you buy a brand-name drug with a $100 retail value, you pay the $25 discounted price, but actually get credit for $95 toward meeting your TrOOP limit).

A note on TrOOP vs. Retail Cost: Without considering your Donut Hole discount, your 2019 TrOOP (true or total out-of-pocket costs) should equate to about $7,654 in retail drug costs. But with the Donut Hole discount, Medicare estimates that your retail drug cost should be around $8,139.54 before exiting the 2019 Donut Hole. The estimate is based on historic brand-name and generic drug purchases while in the Donut Hole.

Bottom Line: If your monthly retail drug costs are somewhere around $743, you probably will spend your way through the 2019 Donut Hole and enter your Medicare Part D plan's 2019 Catastrophic Coverage phase.

Once you enter the 2019 Catastrophic Coverage portion of your Medicare Part D plan, you pay the greater of 5% or $3.40 for generic drugs (and preferred drugs that are multi-source drugs) or the greater of 5% or $8.50 for all other drugs (such as brand-name medications).

Reminder: No matter where you are at the end of the plan year, your Medicare Part D plan coverage ends on December 31st and the whole process begins again on January 1st of the next year.

Here is how example formulary drug purchases are calculated throughout your 2019 Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide).

|

When you purchase a formulary medication with a $100 ($200) retail cost in 2019 |

||||||

| Retail Cost | You Pay | Medicare Plan Pays | Pharma Mfgr Pays | Gov. Pays | Amount toward your TrOOP | |

| Initial Deductible | $100 | $100 | $0 | $0 | $0 | $100 |

| Initial Coverage Phase * | $100 | $25 | $75 | $0 | $0 | $25 |

| Coverage Gap - brand-name ** | $100 | $25 | $5 | $70 | $0 | $95 |

| Coverage Gap - generic *** | $100 | $37 | $63 | $0 | $0 | $37 |

| Catastrophic Coverage (brand drug) **** | $200 | $10 | $30 | $0 | $160 | n/a |

| Catastrophic Coverage (generic drug) **** | $100 | $5 | $15 | $0 | $80 | n/a |

* 25% coinsurance or cost-sharing

** 75% Brand-name Discount

*** 63% Generic Discount

**** you pay 5% of retail or $8.50 for brand drugs whatever is higher or 5% of retail or $3.40 for generic or multi-source drugs whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

A bit of Coverage Gap history: The Donut Hole 2006 to 2010

Before 2011, the Medicare Part D Coverage Gap or Donut Hole was actually similar to a second deductible in an insurance policy where, after receiving a certain level of coverage, you were, once again, responsible for paying your own drug coverage until you reached the Catastrophic Coverage portion of your Medicare Part D plan or Medicare Advantage plan that included drug coverage (MAPD).

However, with the introduction of the Donut Hole discount in 2011, you are now responsible for only a portion of your own drug coverage in the Donut Hole.

A view into the future and the closing of the Donut Hole

In 2020, the Coverage Gap will be considered "closed" when both generic and brand-name drugs will cost Medicare Part D plan members 25% of the retail drug price (so you will pay $250 for a medication with a $1,000 retail cost) until reaching Catastrophic Coverage.

*Update 02/12/18: President Trump signed the Bipartisan Budget Act of 2019 (Pub.L. 115-123) on Friday, February 9, 2018 that effectively "closes" the Coverage Gap for brand-name drugs, with the brand-name Donut Hole discount increasing to 75% in 2019. The Coverage Gap for generic drugs will not "close" until 2020.

Help with planning for your 2019 Donut Hole

To help you visualize the phases of your Medicare Part D prescription drug plan coverage, we have a Donut Hole Calculator or 2019 PDP-Planner online illustrating the changes in your monthly estimated costs based on the established 2019 standard Medicare Part D plan limits mentioned above.

We also have several examples online to help you get started with our 2019 PDP-Planner tool. You can click here for an example of a Medicare beneficiary with relatively high monthly prescription drug costs of $800 per month that result in annual out-of-pocket costs estimated at $2,362.36 - you can then change the monthly drug cost to whatever you wish to estimate your 2019 out-of-pocket cost.

News Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2025 Medicare Part D plan Facts & Figures

- 2025 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2024/2025 Medicare Part D plan changes

- 2025 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2024 to 2025

- Drug Finder: 2025 Medicare Part D drug search

- Formulary Browser: View any 2025 Medicare plan's drug list

- 2025 Browse Drugs By Letter

- Guide to Consumer Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2026 Medicare Part D Reminder Service